The Dollar's Decline and Its Impact on Long-Term Investment Strategies

The Dollar's Decline and Its Impact on Long-Term Investment Strategies

Many Americans view the strength of the U.S. dollar as a reflection of national economic power and global standing. Yet recent months have witnessed the dollar weakening against major international currencies amid growing trade tensions and economic uncertainties, reaching its weakest position in three years. This decline has reignited debates about whether the dollar might eventually lose its dominant position in international finance.

For portfolio managers and long-term investors, grasping how currency fluctuations influence global markets remains crucial for effective asset allocation. What underlying forces are creating these recent exchange rate movements, and what implications might they hold for the dollar's future trajectory?

The dollar's historical dominance in perspective

Since surpassing the British pound following World War I, the U.S. dollar has functioned as the world's dominant reserve currency for nearly a century. Some market participants express concern that geopolitical shifts, mounting fiscal pressures including rising national debt, evolving trade relationships, or alternative currencies like the renminbi and digital assets might eventually challenge this supremacy.

Although these represent legitimate considerations, such apprehensions have emerged repeatedly throughout different periods of economic turbulence. During the 1980s, Japan's remarkable economic expansion generated speculation about the yen potentially displacing the dollar. The euro's launch in the 2000s, combined with China's rapid growth, triggered comparable forecasts. Most recently, cryptocurrency developments have raised questions about conventional currencies including the dollar.

Nevertheless, throughout numerous economic cycles, the dollar has preserved its fundamental position in international finance. This durability stems from the breadth and accessibility of U.S. capital markets, the comparative steadiness of American financial institutions, and the dollar's ongoing utilization in global commerce and investment. Generally, the dollar remains regarded as a refuge during periods of worldwide economic stress.

From a consumer perspective, it seems intuitive that dollar strength always benefits Americans. For households, a robust dollar reduces overseas travel expenses and decreases imported product costs, potentially moderating consumer price inflation. Therefore, when purchasing foreign merchandise and services, currency strength provides advantages.

Nevertheless, dollar strength also presents drawbacks, particularly regarding export competitiveness. A powerful dollar can undermine U.S. business competitiveness by making American products costlier for international purchasers, potentially damaging domestic manufacturers and agricultural producers. This explains why numerous nations face accusations of artificially suppressing their currencies to enhance export performance.

Clearly, optimal currency levels require balancing multiple considerations rather than simply pursuing maximum strength or weakness.

Multiple influences shape dollar valuation

Nations employ various approaches to currency management. Some, including the United States and United Kingdom, permit free-floating currencies with exchange rates determined largely by market dynamics. Others maintain fixed rates by linking their currency to major currencies like the U.S. dollar or euro, or constraining values within specific ranges. This requires central bank action and proves challenging to sustain.

International commerce significantly influences currency valuations. When overseas investors buy American goods and services, they must convert their currencies into dollars. Generally speaking, this demand creates upward pressure on the currency, increasing its value. Conversely, when Americans import more than they export, dollars are exchanged for foreign currencies.

Therefore, sustained trade deficits would typically weaken a currency. During the past twelve months, U.S. imports exceeded exports by $1 trillion, as illustrated in the accompanying chart. This trade imbalance has continued for many years, partially because central banks and international businesses maintain substantial dollar demand.

Notably, recent tariffs have not strengthened the dollar. Economic theory would typically suggest that U.S. tariffs on foreign products would decrease imports, creating upward currency pressure. However, many businesses accumulated foreign goods before these tariffs took effect, while additional factors including capital movements and political uncertainty also influence exchange rates.

Trade constitutes just one element of the comprehensive currency framework. Capital movements, interest rates, central bank strategies, and international lending all contribute to worldwide dollar demand. The intricacy of these relationships explains why currency fluctuations often appear unrelated to straightforward economic measures.

For instance, interest rate differentials rank among the most significant currency influences. When the Federal Reserve establishes rates above other major central banks, it generally generates dollar demand, as investors might relocate assets to higher-yielding Treasuries. Financial markets refer to this as a "carry trade."

Furthermore, fiscal policy concerns may also pressure the dollar. With national debt approaching 120% of GDP and ongoing budget shortfalls, some investors question the long-term viability of U.S. fiscal management. While these concerns haven't reached crisis proportions, they introduce additional complexity to dollar valuation.

The dollar retains its international prominence

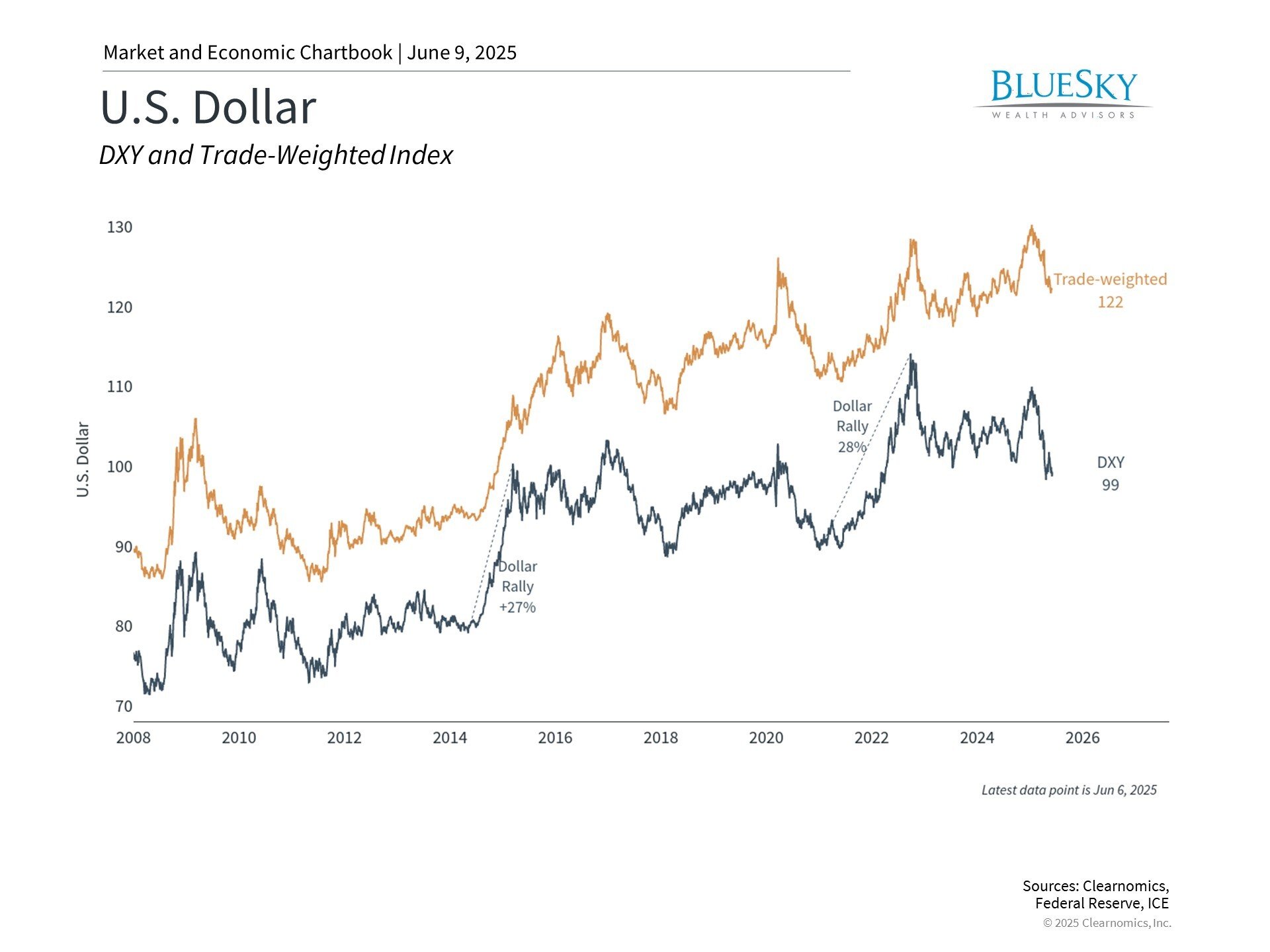

Considering the numerous factors affecting its value, current dollar levels require proper context. Although the dollar has fallen to three-year lows, a longer-term view reveals these levels remain near their strongest over the past two decades. As usual, maintaining broader perspective and avoiding overreaction to recent movements proves important.

For investors, modest dollar weakness has benefited diversified portfolios this year. A declining dollar means international investments gain additional value when converted back from local currencies, enhancing returns. The accompanying chart demonstrates that the MSCI EAFE index of developed market equities and the MSCI EM index of emerging market stocks have surpassed S&P 500 performance this year.

The bottom line? Despite various valid concerns, the dollar maintains its role as the world's primary reserve currency. More significantly for investors, it has enhanced diversified portfolio performance this year. Market participants should preserve a long-term outlook regarding dollar movements.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.