Reasons for Investor Optimism During the Holiday Season

Reasons for Investor Optimism During the Holiday Season

The arrival of the holiday season offers an opportune moment to reflect on achievements in both personal and financial spheres. Investors often concentrate on potential risks rather than recognizing positive outcomes. With markets currently showing strength, reviewing the past year's developments provides valuable context as we approach new opportunities and challenges ahead.

Historical data shows that financial markets have consistently delivered solid returns, and the current year continues this trend. Year-to-date, the S&P 500 has risen more than 15% including dividends, while the Bloomberg U.S. Aggregate Bond Index has posted approximately 7% returns. For the first time in several years, international equities have surpassed U.S. stock performance. This widespread strength across multiple asset classes has enhanced many diversified investment portfolios. What considerations should guide investors as they look toward the upcoming year?

The bull market has reached its fourth year

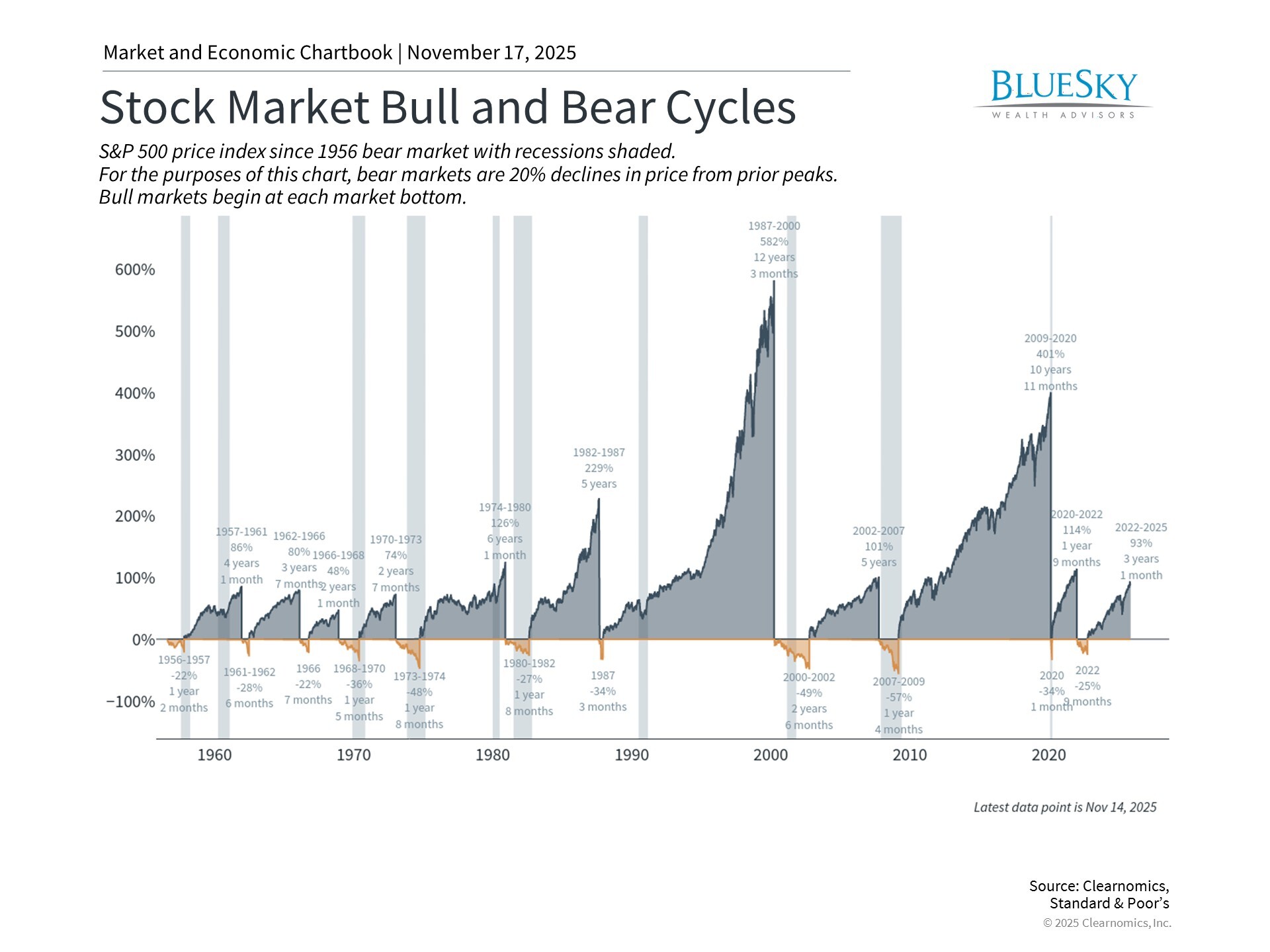

To begin, investors have reason to appreciate that markets have delivered positive results this year even amid volatility. The current bull market, which started following the October 2022 market low, is now in its fourth year of expansion.

Although historical performance doesn't guarantee future outcomes, data indicates that bull markets generally extend considerably longer than bear markets, frequently lasting five to ten years or beyond. Previous bull markets have generated total returns significantly higher than what this cycle has produced thus far, even when facing substantial obstacles. While legitimate questions exist regarding valuations and market concentration, successful long-term investing requires weathering various market environments.

The bond market's gains deserve particular attention following several difficult years of rising interest rates and elevated inflation. With rates stabilizing and the Federal Reserve resuming monetary easing, bond valuations have improved. This illustrates why maintaining exposure to both equities and fixed income remains essential for achieving portfolio balance and generating income.

This strength reinforces a fundamental concept: attempting to time markets based on near-term developments is not only challenging but potentially harmful when not aligned with comprehensive financial planning. This held true even during April when markets declined nearly to bear market territory following new tariff announcements. Markets recovered swiftly and reached fresh record highs. Disciplined investors benefited from staying invested, while those responding to news headlines may have forfeited gains and could remain underinvested.

The Federal Reserve is lowering rates as inflation moderates

Additionally, investors can appreciate that inflation has moderated, despite progress occurring more gradually than many anticipated. Consumer prices have increased roughly 3% during the past year, presenting ongoing difficulties for families and economic authorities. From an investment perspective, however, inflation has become considerably more predictable, with diminished concerns about accelerating price increases compared to previous periods.

This environment has enabled the Fed to initiate rate reductions after maintaining restrictive policy for much of the year. Supporting the labor market, which has shown signs of softening since summer, represents another policy objective. Lower rates have historically supported both equity and fixed income markets by decreasing financing costs for corporations and individuals while increasing the value of existing bonds with higher coupon rates. Therefore, although inflation and interest rate dynamics will continue influencing markets, anxieties about perpetually climbing inflation and rates seem to have subsided.

Proper asset allocation balances risk while pursuing returns

Lastly, investors should recognize the value of continuous risk oversight and appropriate asset allocation. The coming year will inevitably present fresh uncertainties, as each year does. These developments will naturally spark concerns about economic contractions, market downturns, and whether the expansion is concluding. Instead of responding to each market development, long-term investors benefit from maintaining suitable portfolios capable of performing through various market and economic phases.

We can also appreciate having access to diverse assets that help balance risk and potential returns. Risk management matters throughout an investor's timeline, particularly following a three-year market advance. The S&P 500's price-to-earnings ratio stands at 22.6x, above historical averages and gradually nearing the elevated levels seen during the dot-com era.

While valuations don't forecast short-term market direction and shouldn't preclude continued strong performance, they suggest that prospective returns might be more conservative, particularly relative to less expensive asset classes and sectors. Consequently, maintaining reasonable expectations and allocating to market segments with more favorable valuations remains prudent.

Discussions surrounding artificial intelligence will continue. Given the technology's transformative potential, uncertainty about its impact on equity prices is understandable. This parallels the difficulty of forecasting how the internet revolution would develop starting in the mid-1990s. Political uncertainty will likely remain elevated with evolving tariff policies, international tensions, increasing national debt, and other factors. Recent experience confirms that excessive reactions to these developments prove counterproductive and can compromise financial objectives.

The bottom line? The holiday period provides an excellent opportunity to acknowledge multiple positive developments and reassess portfolio positioning. Well-designed portfolios harmonize various asset classes with financial objectives. This approach continues to be essential for successfully managing both risks and opportunities in the months ahead.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.