November Market Review: Navigating Volatility in Uncertain Times

November Market Review: Navigating Volatility in Uncertain Times

November brought a wave of market turbulence that touched numerous asset classes. Although major indices have posted impressive gains year-to-date spanning equities, fixed income, and global markets, concerns persist regarding artificial intelligence sector valuations and the Federal Reserve's monetary policy trajectory. Additionally, the government shutdown postponed critical economic data releases, complicating efforts to assess the economy's health.

Even with this period of instability, numerous asset classes found their footing and recovered as the month concluded. For those investing with a long-term horizon, this reinforces why maintaining a well-balanced portfolio capable of weathering market fluctuations is essential. Effective investing demands concentration on enduring objectives rather than pursuing near-term gains or responding to news cycles.

What factors influenced November's market behavior and how should investors stay grounded as the year draws to a close?

November's Primary Market and Economic Developments

- The S&P 500 edged up 0.1% during November, while the Dow Jones Industrial Average advanced 0.3%, and the Nasdaq slipped 1.5%. For the year through November, the S&P 500 has climbed 16.4%, the Dow has risen 12.2%, and the Nasdaq has surged 21.0%.

- The VIX, which tracks equity market volatility expectations, closed at 16.35 after spiking to 26.42 during the month.

- The Bloomberg U.S. Aggregate Bond Index increased 0.6% in November and has gained 7.5% year-to-date. The 10-year Treasury yield concluded November at 4.02%, having temporarily dipped below the 4% threshold.

- International developed markets, as measured by the MSCI EAFE Index, rose 0.5% in U.S. dollar terms, whereas emerging markets declined 2.5% according to the MSCI EM Index. Year-to-date results show the MSCI EAFE Index up 24.3% and the MSCI EM Index up 27.1%.

- The U.S. dollar index finished at 99.46, momentarily surpassing the 100 mark.

- Bitcoin underwent a substantial pullback of approximately 17% during November, closing at $91,176.

- Gold prices finished November higher at $4,218, though remaining beneath October's record high of $4,336.

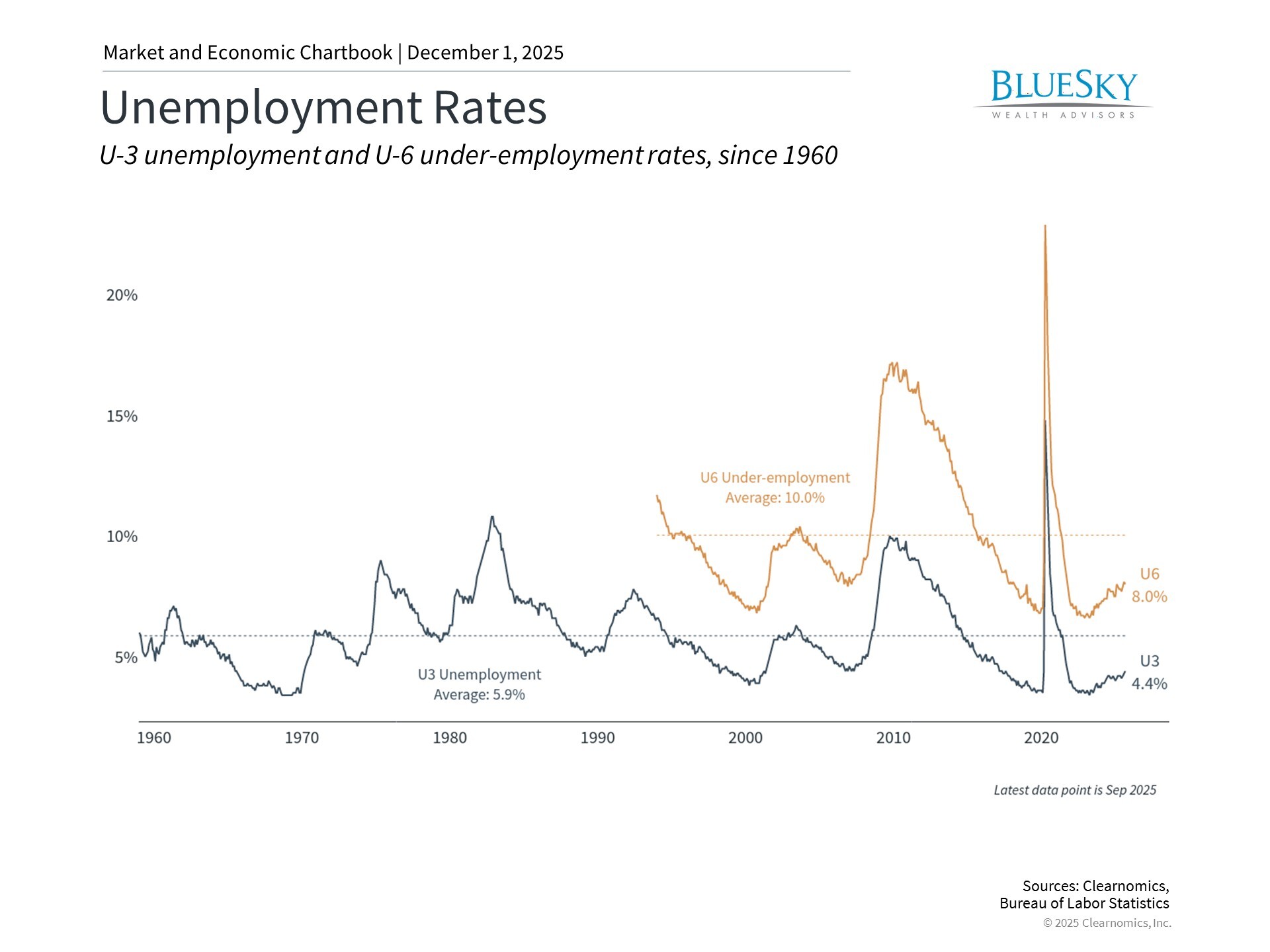

- The September employment report, delayed by the government shutdown, revealed 119,000 new jobs were created and the unemployment rate increased to 4.4% that month. No October employment report will be released.

A temporary shift away from risk assets occurred in markets

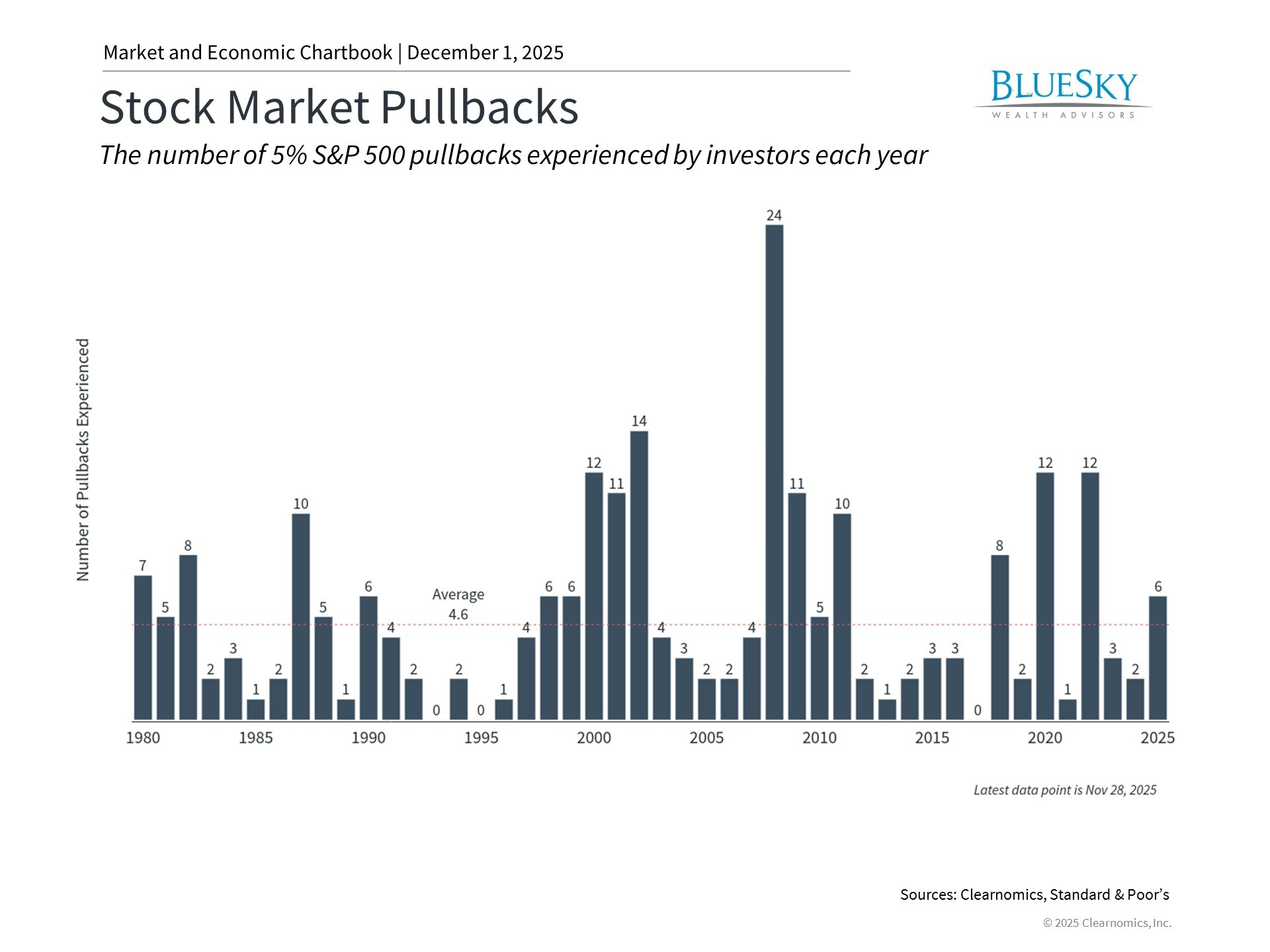

Throughout November, market participants temporarily reduced exposure to risk-oriented investments including technology equities, high-yield bonds, cryptocurrencies, and similar holdings. The primary catalysts were doubts about the viability of AI-related investments and recalibrated expectations regarding future Fed rate reductions. Six separate declines of 5% or greater for the S&P 500 have occurred this year, representing the highest count since 2022 yet remaining near historical norms. Several key asset classes recovered during the month's closing days, with the S&P 500 finishing marginally positive.

AI-focused technology stocks encountered their most challenging week since April during this period. Apprehension about capital expenditures and leverage levels, profitability metrics, and speculation regarding overvaluation contributed to price swings. Nevertheless, underlying fundamentals stayed robust, with companies like Nvidia delivering solid revenue and earnings growth for the third quarter. Certain equities, including members of the Magnificent 7, rallied following these announcements.

Cryptocurrencies underwent a pronounced correction amid this risk-averse environment. Bitcoin tumbled more than 30% from its early October peaks above $125,000, momentarily trading under $85,000 and eliminating its year-to-date appreciation. Although cryptocurrency adoption among investors has expanded, such episodes illustrate that these and comparable assets remain highly speculative and vulnerable to dramatic cycles. Consequently, continuous risk management and adherence to appropriate asset allocation remain critical.

The fixed income market advanced in November, supported partly by declining long-term interest rates as the 10-year Treasury yield again dipped below 4%. This movement reflected revised expectations surrounding government policy that could produce lower rates over time. Year-to-date, the Bloomberg U.S. Aggregate Bond Index has returned 7.5%, marking the strongest performance since 2020. This has contributed important balance to diversified portfolios.

The government shutdown concluded but economic ambiguity persists

Following 43 days, the longest government shutdown on record concluded, yet federal funding extends only through January 2026. This indicates political uncertainty will resurface in headlines within just a few months. Despite this, markets largely managed to navigate through the shutdown, even with heightened challenges stemming from missing economic data.

The Bureau of Labor Statistics published the delayed September employment report, initially slated for October release. This report indicated job creation surpassed projections that month, recovering from summer softness. Nevertheless, revised data reveal that 4,000 jobs were eliminated in August, marking the second month of negative employment growth this year. The unemployment rate ticked up to 4.4% in September, representing its peak level since October 2021, though this figure remains modest by historical comparison.

A complete October employment report will not be issued since household and business surveys were not administered during that month, although some data will appear with November's report on a deferred schedule.

Expectations for the Fed's next rate decision have evolved

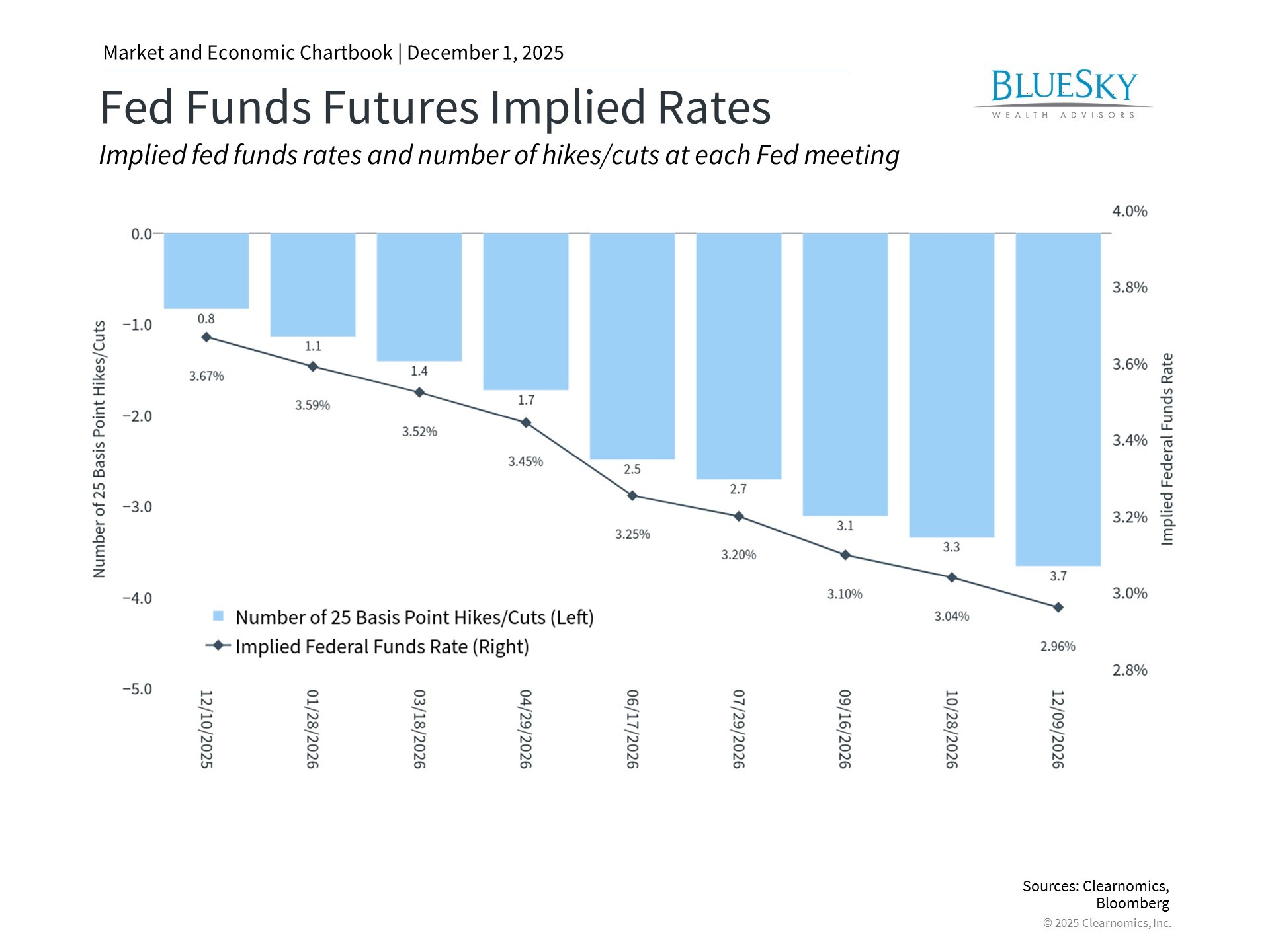

These information gaps mean the Federal Reserve will approach its mid-December meeting lacking comprehensive economic visibility. Expectations regarding a rate reduction at the upcoming Fed meeting have fluctuated significantly, with probabilities falling during mid-November before rising again. Currently, market-derived expectations indicate the Fed will reduce rates in December and subsequently in April or June 2026.

Additional economic indicators, including consumer confidence measures, have also deteriorated. The University of Michigan's Index of Consumer Sentiment preliminary reading decreased from 53.6 to 50.3 in November. This captures continuing concerns among Americans regarding employment stability, elevated prices, and general financial circumstances. While numerous households face financial pressures, weak sentiment throughout recent years has not resulted in diminished spending or corporate revenue declines.

The bottom line? November's market fluctuations and persistent economic uncertainty serve as reminders that stock market swings represent normal occurrences. Investors should keep a wider perspective as year-end approaches.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.