Strategic Year-End Charitable Giving: Maximizing Impact and Tax Efficiency

Strategic Year-End Charitable Giving: Maximizing Impact and Tax Efficiency

Winston Churchill is often credited with saying that "it is more agreeable to have the power to give than to receive." As the year draws to a close, many individuals reflect on their philanthropic contributions and how charitable giving fits into their broader financial strategy. Strategic charitable planning serves dual purposes: advancing philanthropic objectives while enhancing tax efficiency. The key consideration extends beyond simply making donations—it involves structuring gifts to optimize both the benefit to chosen causes and the advantages within your comprehensive financial plan.

This year offers distinctive opportunities for charitable strategy. Recent legislative changes through the One Big Beautiful Bill Act (OBBBA) have introduced provisions affecting these decisions. Furthermore, with the December 31 deadline for current tax year contributions approaching, now is an ideal time to evaluate your giving approach. Properly structuring charitable contributions can elevate generosity from a standalone act to an integral component of your overall planning framework.

Record levels of household wealth create new opportunities

According to the National Philanthropic Trust, charitable contributions in America totaled $593 billion during 2024, representing a 6.3% rise from the previous year.1

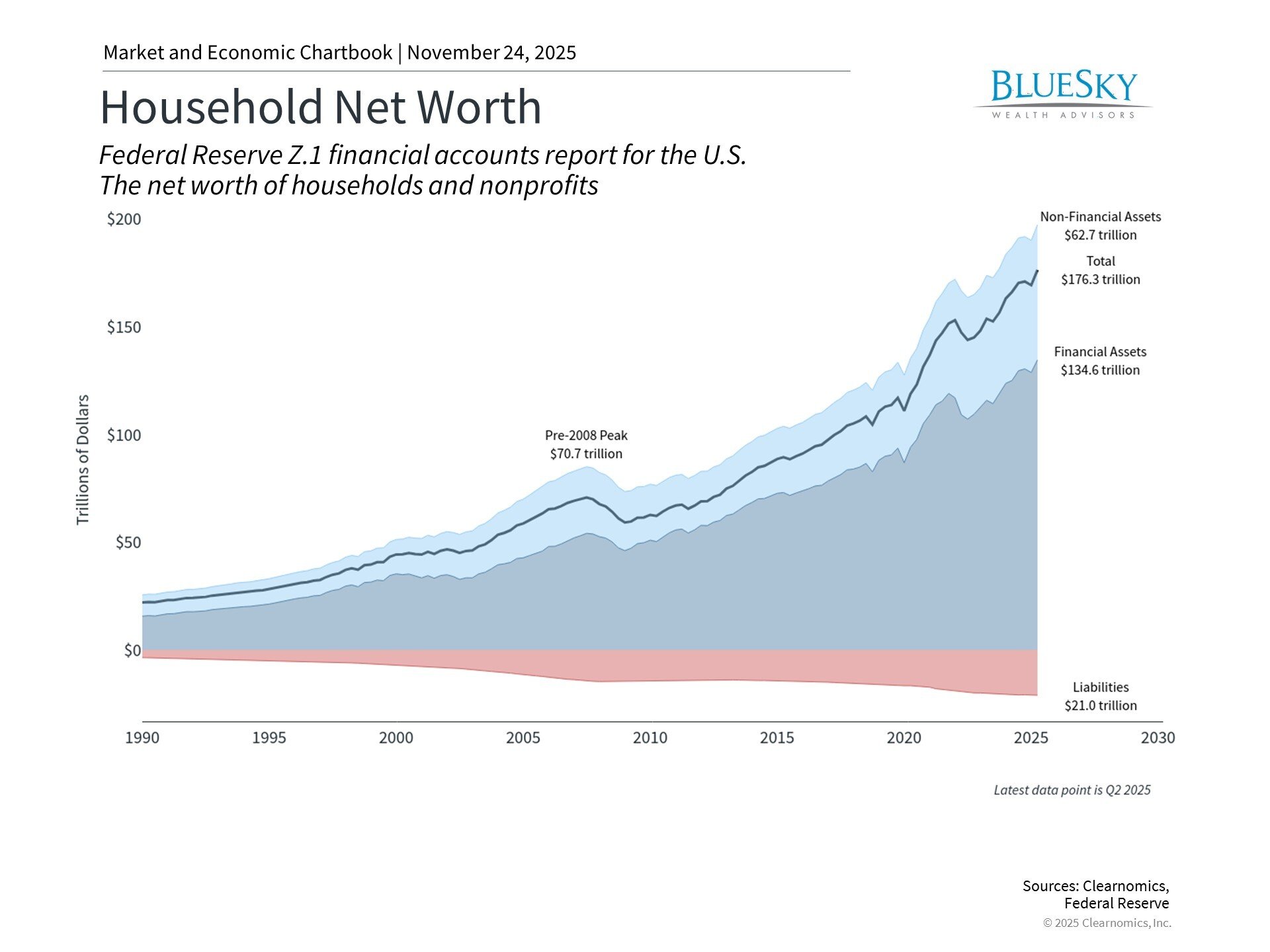

This demonstrates that philanthropy continues to hold significance for numerous families, despite a declining percentage of Americans making donations in recent years. The chart shown illustrates how household wealth has grown consistently alongside stock market gains and economic expansion. Rising income levels and accumulated wealth, combined with tax code modifications, have established fresh incentives for charitable contributions.

Philanthropy also serves a vital function in estate planning strategies. Charitable bequests avoid estate taxation, making them an effective method for decreasing estate tax obligations while advancing meaningful causes. When estates reach taxable thresholds, combining lifetime donations with charitable bequests can substantially minimize the tax burden transferred to beneficiaries.

Beyond financial considerations, charitable giving helps establish an enduring legacy, strengthens family principles across generations, and reduces lifetime tax obligations. For numerous families, philanthropy provides opportunities to engage younger generations in substantive conversations about principles and responsible stewardship. The complexity for investors lies not in the intent to give, but in determining the most effective approach, which demands careful planning.

Legislative changes elevate the importance of timing and structure

The OBBBA has introduced significant modifications affecting charitable contributions. The most substantial change involves expanding the population eligible to itemize tax returns through raising the state and local tax (SALT) deduction limit from $10,000 to $40,000. Given that charitable deductions require itemization, this development amplifies their significance in contemporary tax planning.

Furthermore, a limited window exists from 2025 through 2029 to optimize gift timing and structure. Beginning in 2026, the OBBBA establishes a threshold for charitable deductions at 0.5% of adjusted gross income (AGI) for those who itemize. This means only contributions exceeding 0.5% of AGI will qualify for deduction. For instance, an individual with $200,000 in AGI could only deduct donations surpassing $1,000 (0.5% of $200,000).

A strategy employed by some investors to address this limitation involves "bunching," which consolidates multiple years' worth of charitable contributions into one tax year to surpass the deduction threshold. This technique has gained traction since the 2017 Tax Cuts and Jobs Act substantially increased the standard deduction, thereby reducing the proportion of households that itemize.

Selecting appropriate assets for donation represents another critical factor. Donating significantly appreciated securities provides three distinct tax advantages: bypassing capital gains taxes from direct sales, eliminating future appreciation from the taxable estate, and generating ordinary income deductions. For ordinary income deduction purposes, factors include whether the receiving organization qualifies as a public or private charity and the donor's projected AGI. This "triple benefit" proves particularly valuable during years with substantial capital gains, such as when equity compensation becomes available or following business sales, especially when offsetting losses are unavailable.

Incorporating charitable giving into portfolio rebalancing strategies can further improve efficiency. Some investors prioritize donating appreciated holdings from taxable accounts, then replace those positions through purchases in tax-advantaged accounts. This method preserves target asset allocation while optimizing tax advantages.

Common structures for charitable contributions

Various charitable giving mechanisms serve distinct objectives, and choosing the appropriate option depends on individual circumstances and objectives. The following represents several prevalent examples, though not a comprehensive inventory:

Donor-advised funds (DAFs) have experienced substantial growth, with total assets surpassing $250 billion.1

DAFs operate similarly to charitable investment vehicles: contributions generate immediate tax deductions, and donors subsequently recommend grants to charities over time. Contributed funds can be invested and appreciate tax-free while donors determine distribution timing and recipients. DAFs prove especially beneficial during years when maximizing deductions holds particular importance.

Under current tax regulations, donors can structure DAF contributions to exceed the 0.5% AGI threshold mentioned previously. DAFs also offer greater simplicity compared to alternative options, broadening accessibility to more donors.

Qualified charitable distributions (QCDs) provide another avenue for individuals aged 70½ or older holding traditional IRAs. QCDs permit direct transfers up to $108,000 for tax year 2025 from IRAs to charitable organizations. This satisfies required minimum distribution (RMD) obligations while excluding transferred amounts from taxable income. QCDs deliver tax benefits independent of itemization status, making them valuable during years when itemized deductions offer less advantage.

Charitable remainder trusts (CRTs) offer an additional mechanism for supporting philanthropic objectives within estate planning frameworks. CRTs involve transferring assets into trusts that distribute income to beneficiaries for specified periods, with remaining assets directed to charity. This proves particularly useful for highly appreciated assets, as trusts can liquidate them without triggering immediate capital gains taxes for donors.

As with other trust instruments, careful attention to structure is essential. For instance, certain retained powers might trigger asset inclusion in the grantor's taxable estate. Additionally, designating beneficiaries other than the grantor or spouse could initiate gift tax consequences.

For individuals with substantial resources and long-term philanthropic aspirations, additional considerations might include:

- Private foundations, offering maximum control and family governance frameworks but requiring higher administrative oversight, minimum distribution obligations, and excise taxes on investment earnings

- Charitable lead trusts, providing income to charitable organizations for specified periods before transferring assets to heirs

- Supporting organizations, collaborating closely with particular public charities

- Pooled income funds provided by certain charitable institutions

These examples represent commonly utilized charitable giving structures, though additional options and modifications may suit specific circumstances. Consulting with a trusted advisor can help identify which approach best aligns with individual objectives.

Integrating philanthropy into comprehensive financial planning

Optimal charitable planning incorporates giving into broader financial strategies rather than treating it as isolated from other financial decisions. This comprehensive perspective considers how philanthropy intersects with investment management, tax planning, retirement income strategies, and estate planning.

Most significantly, engaging children and grandchildren in philanthropic decision-making generates opportunities for discussing family priorities, rationales for supporting particular causes, and methods for assessing nonprofit effectiveness. These discussions often become the most valuable elements of wealth planning, helping ensure your family's principles and stewardship ethic endure across generations.

The bottom line? As year-end approaches and recent tax legislation creates both opportunities and complexities, optimizing the timing, structure, and mechanisms for charitable contributions becomes increasingly important. This optimization can enhance both philanthropic impact and achievement of financial objectives.

- https://www.nptrust.org/philanthropic-resources/charitable-giving-statistics/

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.