Understanding Credit Market Concerns and What They Mean for Investors

Understanding Credit Market Concerns and What They Mean for Investors

An old adage suggests that criminals target banks because that's where the money is. Yet in the modern financial landscape, capital flows through a diverse array of financial institutions beyond traditional banks. Following the global financial crisis, policymakers aimed to decrease banking sector vulnerabilities, but this shift has introduced new complexities. As recent bankruptcies spark concerns about potential weaknesses in credit markets, it's essential for investors with long-term horizons to understand the broader implications.

Following 2008, substantial lending operations migrated toward "non-depository financial institutions" (NDFIs) including private credit funds, mortgage providers, insurance carriers, digital lending platforms, and others. These entities differ from traditional banks primarily because they don't accept customer deposits and therefore operate outside conventional banking oversight. Nevertheless, banks remain intertwined with these activities—lending from banks to NDFIs has expanded to $1.2 trillion.1 This configuration introduces additional layers of complexity to the financial system, earning it the nickname "shadow banking."

What has brought this topic into current headlines? Recent months have seen several instances of suspected fraud among certain borrowers. Tricolor, a subprime auto lender, failed in September following allegations of pledging identical vehicles as collateral for multiple loans. Around that same period, auto parts provider First Brands entered bankruptcy proceedings amid questions regarding undisclosed debt obligations.2 Most recently, fraud accusations have emerged against related entities Broadband Telecom and Bridgevoice, involving fabricated invoices used in asset-based financing arrangements.3

Perhaps the most attention-grabbing remark came from JPMorgan CEO Jamie Dimon, who recently stated that "when you see one cockroach, there are probably more." Though these specific situations are troubling and have triggered temporary market volatility, the central question is whether they signal systemic credit market difficulties that merit comparisons to the 2008 financial crisis or the 2023 banking turmoil. For investors focused on long-term objectives, recognizing this distinction matters greatly, as effective risk management involves maintaining portfolios positioned to weather uncertain periods rather than reacting to individual news items.

Historical context helps frame today's credit concerns

When credit challenges surface, comparisons to 2008 or 2023 naturally arise. During the 2008 financial crisis, while certain fraud cases were uncovered, the systemic nature stemmed not from these incidents or the housing collapse alone, but from excessive financial leverage concentrated among major institutions. Frequently, these leveraged exposures exceeded the equity capital held by these firms, creating widespread financial system disruption.

The 2023 banking crisis offers perhaps a more applicable comparison, when multiple regional banks collapsed in rapid succession. That episode exposed a distinct vulnerability: the disparity between bank assets and liabilities amid sharply rising interest rates. These institutions had concentrated depositor bases, including technology startups for Silicon Valley Bank and cryptocurrency firms for Signature Bank and Silvergate. This concentration left them exposed to industry-specific shocks.

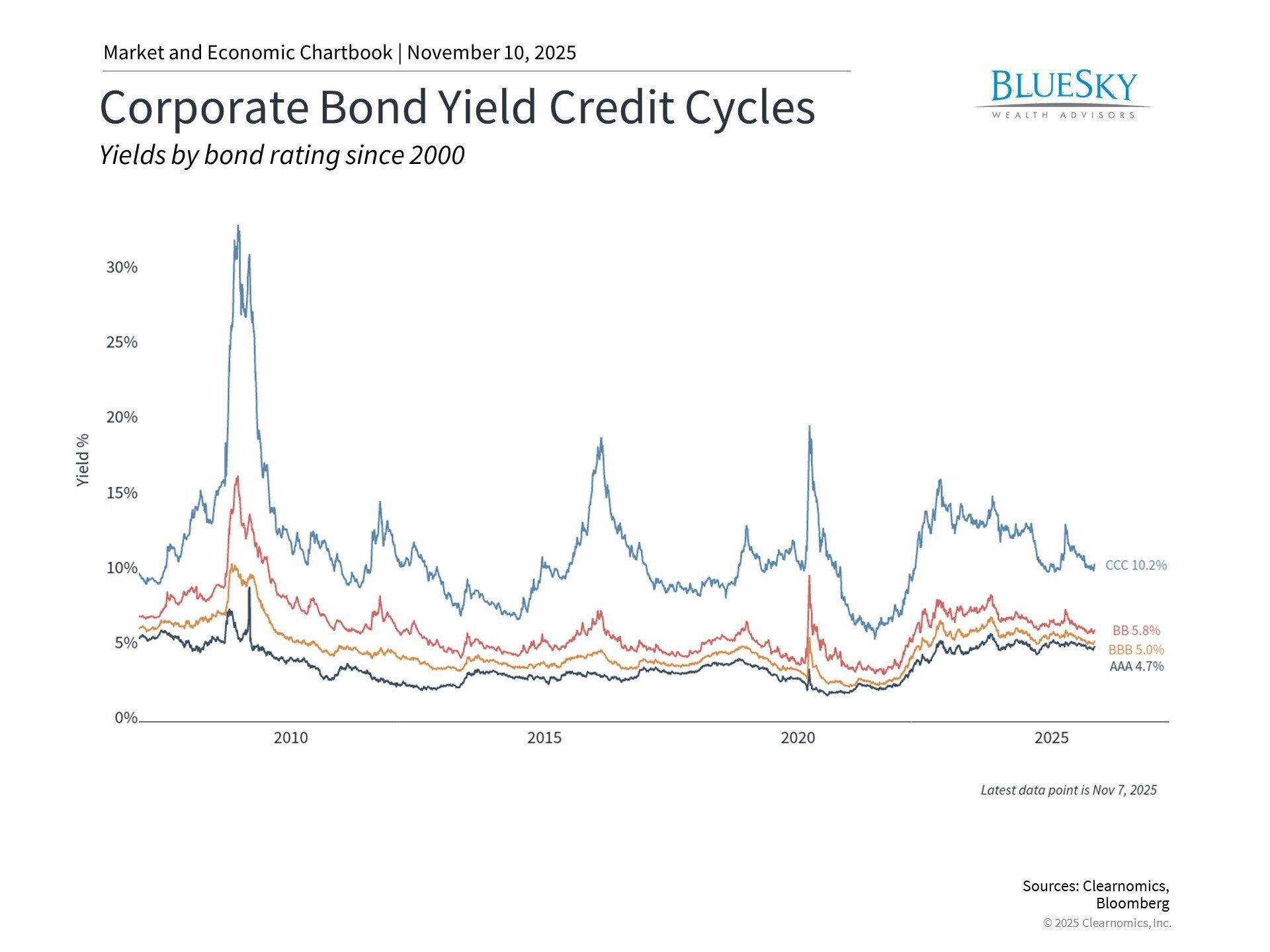

Despite initial worries, this situation did not evolve into a wider economic recession. Nevertheless, the 2023 episode illustrates how swiftly confidence can dissipate in contemporary financial markets before recovering again. These historical examples underscore the value of measured responses to headlines rather than knee-jerk reactions. The accompanying chart displays both past credit disruptions and the current stability in bond yields and spreads.

Credit cycles play a central role in economic fluctuations

Across history, credit and debt cycles have frequently driven the most substantial economic booms and busts. During periods of ample financial system liquidity, credit extension to businesses and consumers typically increases. This recurring pattern of lending and borrowing during growth phases has manifested across various historical periods, from nineteenth-century railroad expansion, through the 1920s boom, to the mid-2000s housing surge.

That said, distinguishing between the viewpoint of major banks and that of long-term investors proves important. For large financial institutions, individual loans carry weight and can lead to write-downs impacting quarterly results. For investors, the critical consideration is whether these problems are "systemic," meaning they threaten the broader economy and diversified investment portfolios.

The circumstances continue to develop and additional fraud cases and problematic loans may emerge. That said, markets have stabilized following the initial bankruptcy announcements, and several important factors deserve consideration.

First, while the dollar amounts are meaningful for affected institutions, they constitute a modest portion of the total financial system. Second, major banks generally maintain strong capital positions and diversification across numerous lending sectors, limiting their exposure to difficulties in any particular segment. Third, unlike previous crises, no evidence currently suggests a wider economic challenge that would trigger extensive credit problems. The chart above illustrates that the banking system has demonstrated greater stability throughout the past two years.

Financial markets have demonstrated resilience

Stock and bond markets have experienced short-lived uncertainty in recent months, influenced by tariffs, the government shutdown, financial sector concerns, and questions surrounding AI companies. Despite these factors, major equity indices have continued achieving new all-time highs during this timeframe, while bond performance has also contributed positively to balanced portfolios.

For investors with long-term perspectives, the essential takeaway is that recent headlines concerning financial fraud and bankruptcies represent a normal feature of credit cycles and market operations. While specific cases warrant attention, the question of whether they threaten the broader financial system remains separate. Regardless, adjustments among lenders, particularly non-bank entities, will clearly be necessary.

The bottom line? Recent credit challenges involving private lenders have sparked concern, yet markets have also stabilized in recent weeks. For long-term investors, these developments underscore the importance of risk management strategies that align portfolios with long-term objectives.

References

- https://www.fitchratings.com/research/non-bank-financial-institutions/us-bank-lending-to-non-banks-continues-to-outpace-all-other-types-15-05-2025

- https://www.bloomberg.com/news/articles/2025-10-31/is-a-private-credit-crisis-brewing-tricolor-first-brands-shake-wall-street

- https://www.wsj.com/finance/blackrock-stung-by-loans-to-businesses-accused-of-breathtaking-fraud-6de5c3a7

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.