October Market Review: Navigating Shutdowns, Trade Tensions, and Retirement Challenges

October Market Review: Navigating Shutdowns, Trade Tensions, and Retirement Challenges

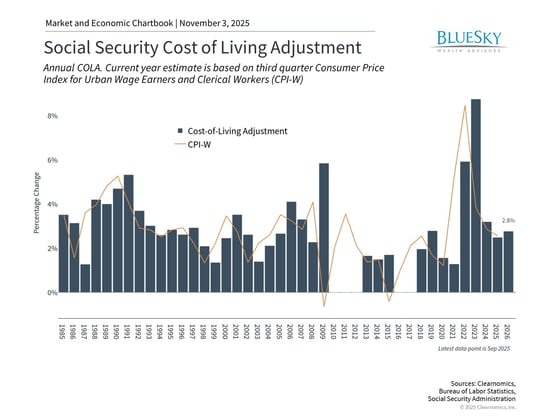

Major equity indices posted solid gains in October, with many reaching fresh record highs despite headwinds from a government shutdown and heightened trade friction with China early in the month. The market experienced a temporary bout of volatility but demonstrated resilience by quickly recovering. Fixed income investments also delivered positive returns as yields fell, supported in part by the Federal Reserve's decision to cut rates for the second consecutive meeting.

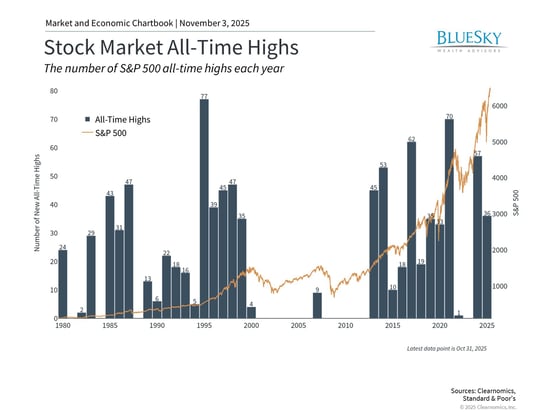

While returns were positive, investors faced notable challenges throughout the month. The government shutdown dominated news coverage and sparked concerns about economic growth, while tensions over rare earth metals triggered the steepest single-day market drop since April. Markets rebounded swiftly from these setbacks, highlighting the risk of making portfolio decisions based on short-term headlines. These events also drove gold prices to unprecedented levels before a late-month retreat.

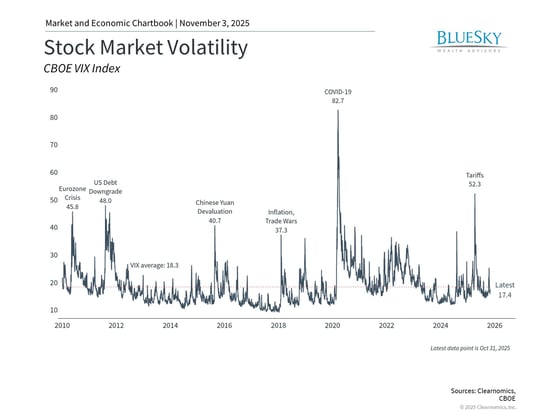

In retirement news, the Social Security Administration revealed a 2.8% cost-of-living adjustment for 2026, representing a more subdued increase relative to prior years and potentially insufficient to match the actual expense increases many retirees encounter. When combined with declining yields on cash investments, this development emphasizes the need for diversified portfolios that deliver both income generation and capital appreciation.

Through these fluctuations, October's results demonstrate that staying committed to a portfolio strategy designed for long-term objectives remains the most effective way to manage uncertain conditions.

Key Market and Economic Drivers

- The S&P 500 advanced 2.3% in October, while the Dow Jones Industrial Average rose 2.5% and the Nasdaq climbed 4.7%. For the year through October, the S&P 500 has gained 16.3%, the Dow has increased 11.8%, and the Nasdaq has surged 22.9%.

- The Bloomberg U.S. Aggregate Bond Index posted a 0.6% gain in October. The 10-year Treasury yield concluded the month at 4.08%, down from prior levels.

- International developed markets increased 1.1% in U.S. dollar terms as measured by the MSCI EAFE index, while emerging markets rallied 4.1% according to the MSCI EM index. Year-to-date, the MSCI EAFE index has returned 23.7% and the MSCI EM index 30.3%.

- The U.S. dollar index held relatively steady, ending slightly higher at 99.8.

- Bitcoin declined modestly in October, finishing the month at $109,428.

- Gold prices closed the month at $3,997, retreating from an all-time high of $4,336 reached earlier in October.

- The Consumer Price Index report was delayed by the government shutdown but ultimately showed that prices increased 3.0% year-over-year in September. This figure determines the Social Security cost-of-living adjustment (COLA), which will be 2.8% in 2026.

- Additional economic data, including the monthly jobs report, has been postponed due to the government shutdown.

The government shutdown had minimal impact on market performance

October opened with a government shutdown that is now nearing the longest duration in history. Such shutdowns occur when Congress cannot reach agreement on a new budget or extension of existing funding. Numerous agencies, including those responsible for releasing timely economic data, have been functioning with skeleton crews since the shutdown began.

Although the shutdown creates genuine hardships for federal employees and their families, it's essential to maintain context regarding portfolio implications. Historical evidence shows that government shutdowns typically have not produced lasting impacts on financial markets, as government expenditures are generally delayed rather than eliminated. During the previous record shutdown of 35 days spanning 2018 to 2019, the S&P 500 subsequently returned 31.5% in 2019. While past performance doesn't guarantee future results, this history suggests markets frequently move beyond such disruptions.

Concerns have also emerged regarding government workforce reductions through reductions in force. From a macroeconomic standpoint, federal government employment accounts for only 1.8% of total workforce participation, and recent reduction-in-force announcements represent merely 0.002% of total U.S. employment. Though the shutdown presents real challenges for impacted workers and disrupts government operations, its broader economic effect remains constrained.

Trade tensions sparked short-lived volatility

Markets experienced their steepest single-day drop since April amid escalating U.S.-China tensions regarding rare earth metals and potential 100% tariffs on Chinese imports. Rare earth metals represent a critical area where China maintains substantial leverage in trade negotiations. China accounts for roughly 70% of worldwide rare earth production and approximately 90% of global processing capacity, resulting in considerable supply chain vulnerability.

Following the initial selloff, markets rebounded quickly after more measured communications from the White House. Late in the month, Presidents Trump and Xi held discussions that led to reduced tensions and a 10% reduction in tariffs previously imposed on China.

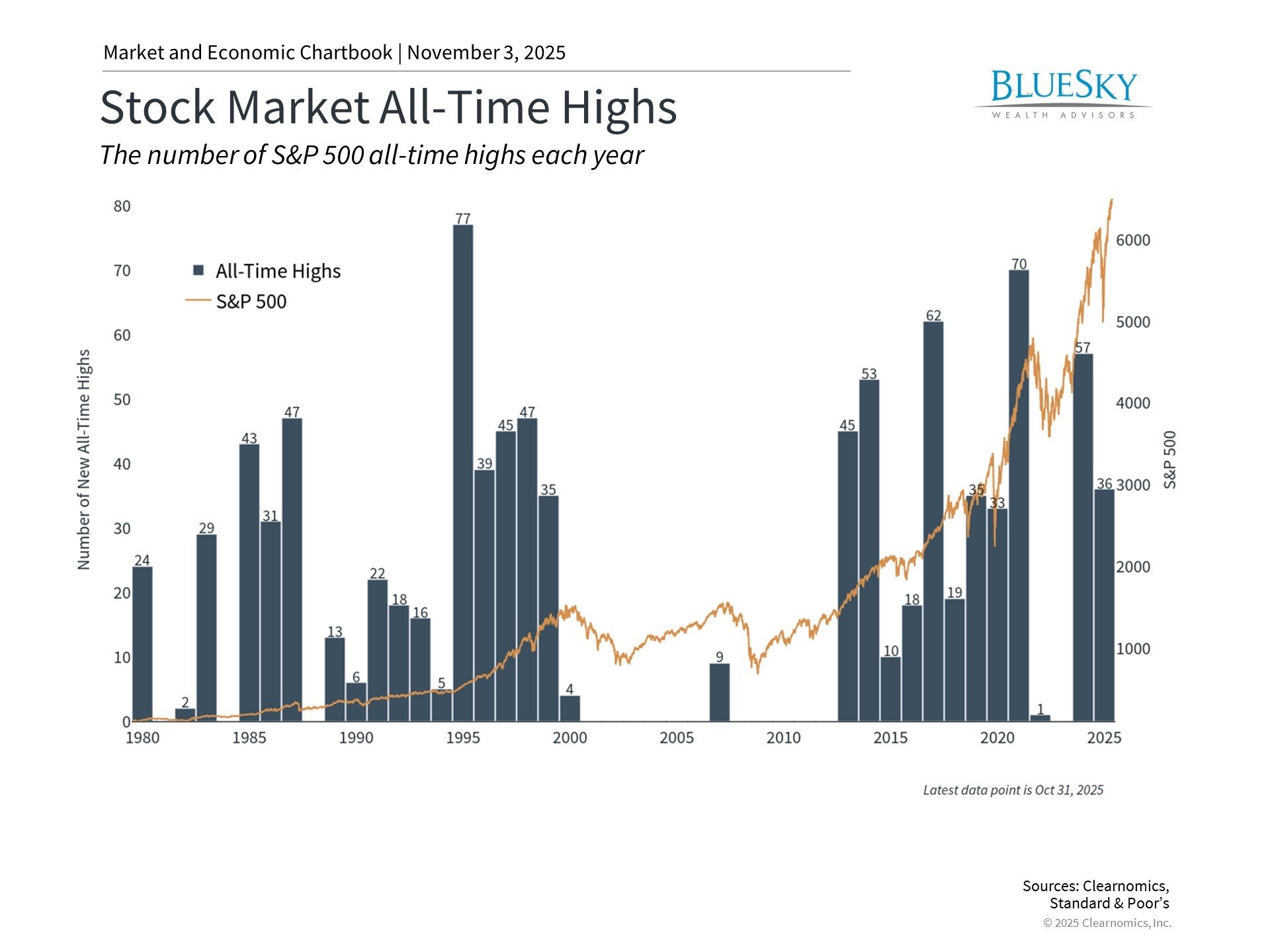

This cycle of trade-related concerns triggering temporary declines followed by recoveries has been a recurring theme throughout the year. The S&P 500 has climbed 37% from its April trough and established 36 new record highs through October. Since markets inevitably experience ups and downs rather than linear gains, these episodes serve as useful reminders that brief periods of volatility are both normal and anticipated.

The Fed maintains its accommodative policy shift

At its October gathering, the Federal Reserve reduced interest rates by 0.25% to a target range of 3.75% to 4.00%, representing its second straight rate reduction. This move demonstrates the Fed's commitment to fostering economic expansion while balancing inflation concerns and softening labor market conditions. In its accompanying statement, the Fed acknowledged that "uncertainty about the economic outlook remains elevated" and that "downside risks to employment rose in recent months."

Current market pricing indicates another rate reduction is probable by January, with one or two further cuts possible in 2026. In addition to policy rate adjustments, the Fed revealed plans to cease balance sheet reduction in December. This decision means continued bond purchases, effectively preserving accommodative monetary conditions. Throughout the previous three years, the Fed tightened policy by shrinking its balance sheet by $2.2 trillion, making the conclusion of this process an additional form of economic stimulus. For investors, falling interest rates and supportive monetary policy have historically generated favorable conditions across multiple asset classes.

Retirees confront pressures from modest COLA increases and falling yields

The Social Security Administration unveiled a 2.8% cost-of-living adjustment (COLA) for 2026, indicating persistent but decelerating inflation. For typical Social Security recipients, monthly benefits will reach approximately $2,064, representing an increase of just $56. Although any enhancement provides some relief, this moderate adjustment appears modest when compared to the 8.7% increase in 2023, which marked the largest since 1981.

A significant concern for retirees involves the methodology used to calculate the COLA, which may not accurately capture the inflation they actually face. Healthcare expenses, housing costs, and other categories that comprise substantial portions of retiree budgets have frequently increased faster than the broader index. For instance, medical care services grew 3.9% over the past year, health insurance expanded 4.2%, and home insurance jumped 7.5%. Food prices increased 3.1%, though meat, poultry, and fish climbed 6.0%.

Given that life expectancies continue to extend—with many retirees living into their 90s—preparing for multi-decade retirement horizons necessitates portfolios capable of delivering both income and growth. Determining how to construct portfolios for these prolonged timeframes, while managing distribution rates and adjusting to evolving market environments, highlights the importance of thorough financial planning.

The bottom line? Markets delivered solid performance in October despite government shutdowns, trade tensions, and other sources of uncertainty. Staying committed to a well-designed portfolio remains the most prudent approach as year-end approaches.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.