John Staton, MBA, CFP®

Associate Wealth Advisor John joined us in our New Bern, NC headquarters in 2024 after honorably retiring from the US military...

Watch Our Latest Webinar: "Who Pays the Tax? Modeling IRA Distributions in a Post-SECURE Act Environment" WATCH NOW

Associate Wealth Advisor John joined us in our New Bern, NC headquarters in 2024 after honorably retiring from the US military...

Senior Wealth Advisor, Partner Madeline is a firm believer in fee-only advising and its ability to deliver objective and prudent...

Senior Wealth Advisor, Partner Christie actively formulates and implements personalized financial planning strategies and manages...

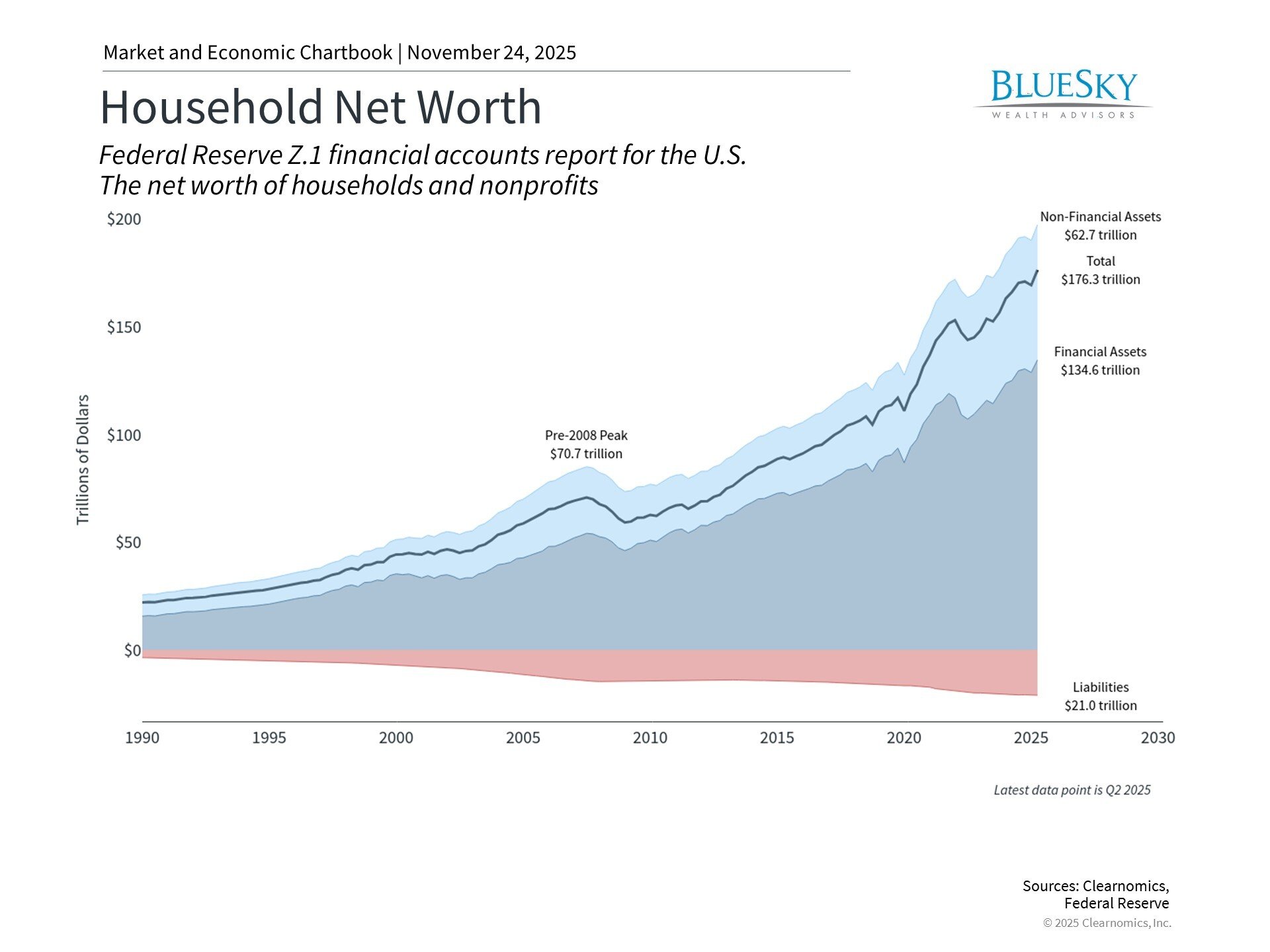

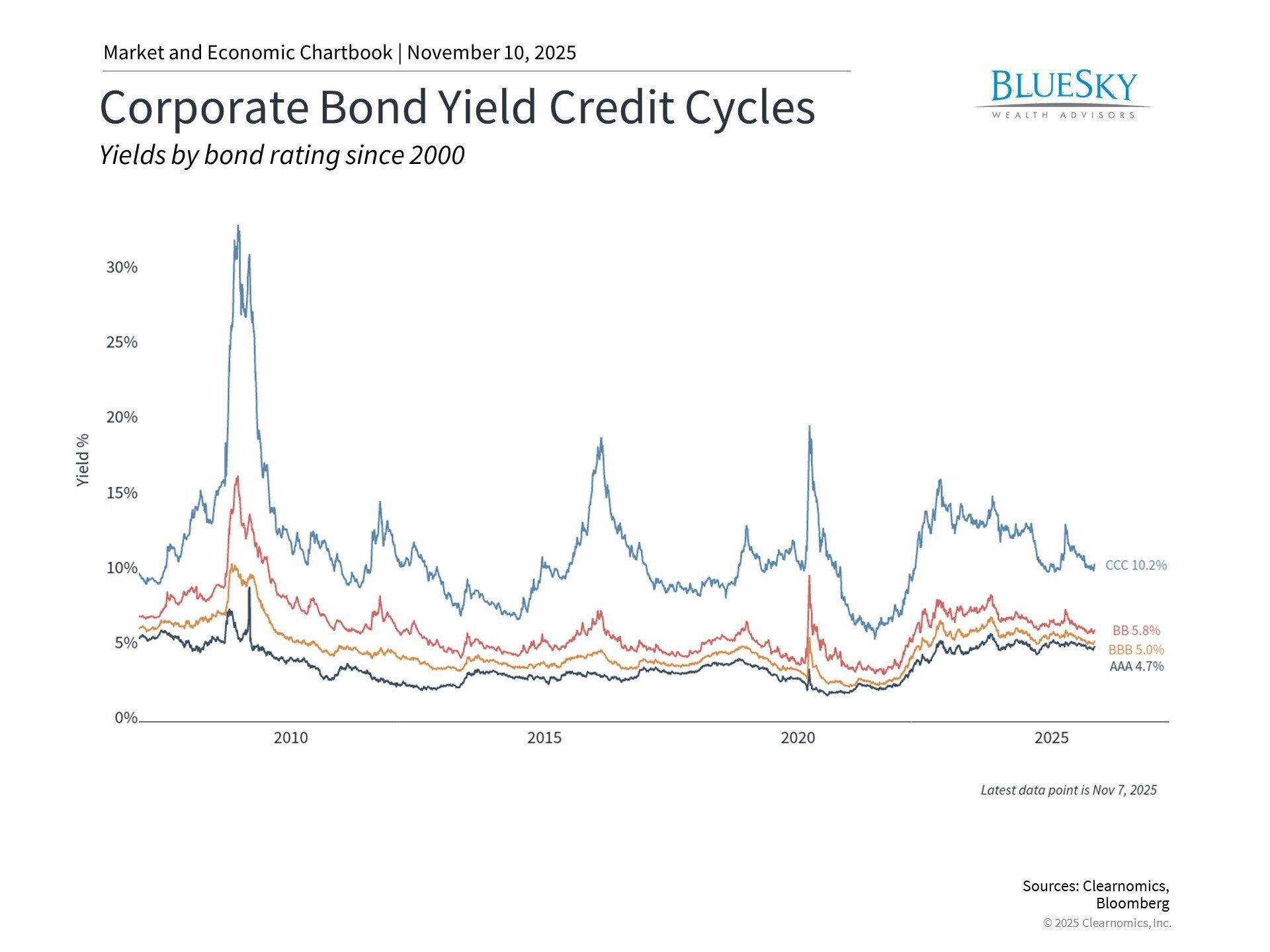

The Federal Reserve serves as a cornerstone institution for long-term investors, providing crucial support to both the economy...

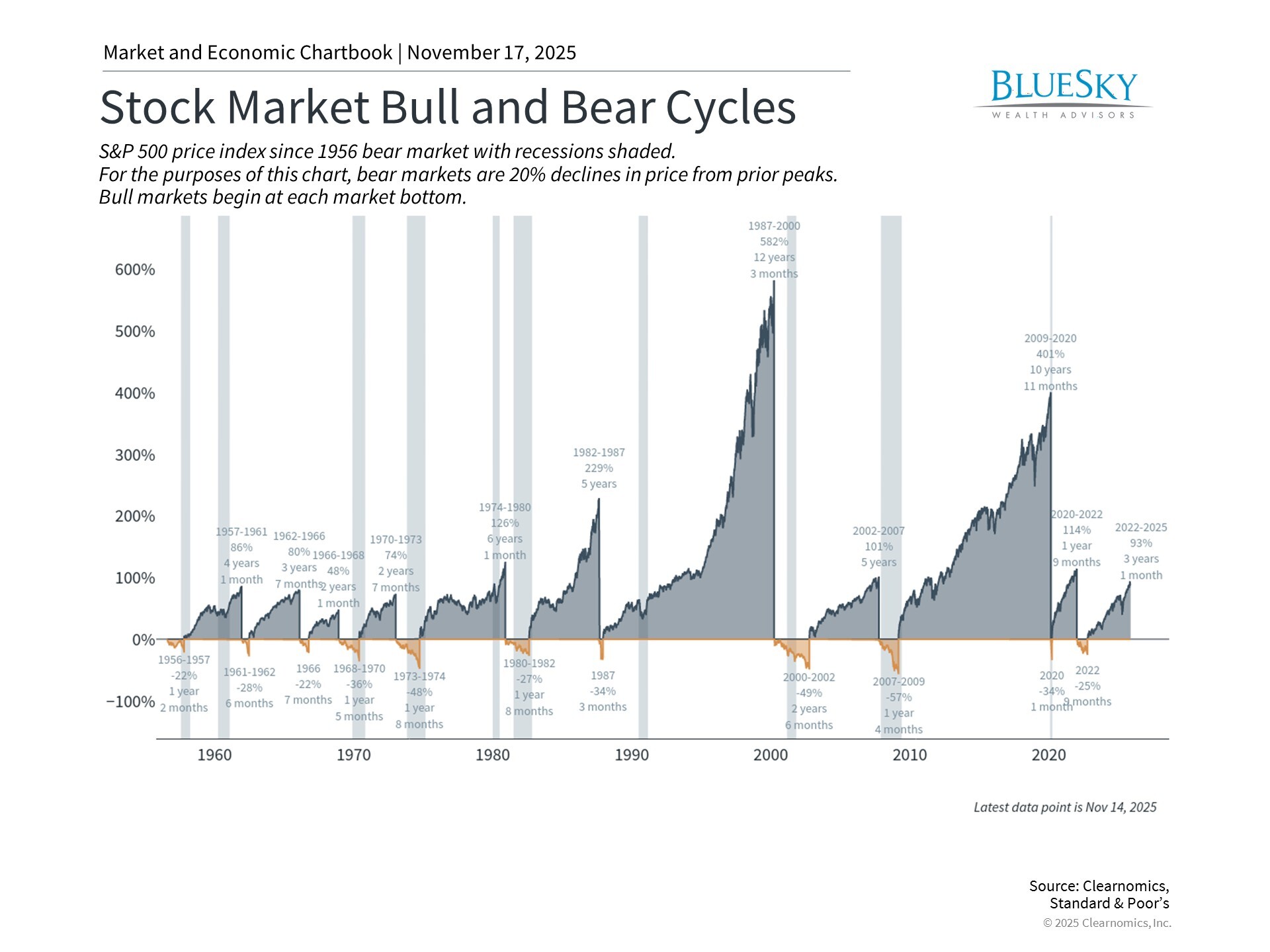

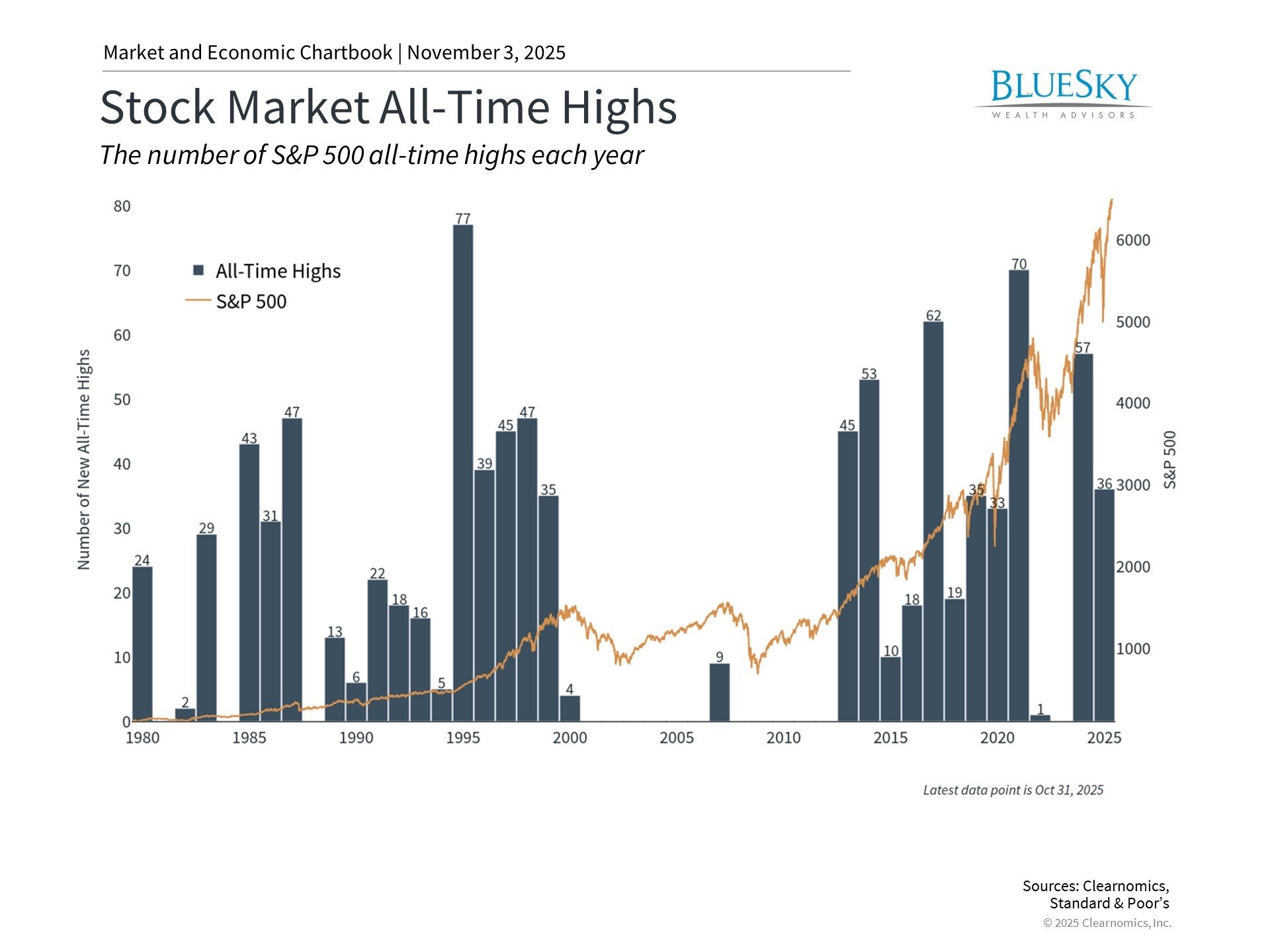

Stock markets are poised to finish with double-digit gains for the sixth time in seven years. The sole interruption came in 2022...

November brought a wave of market turbulence that touched numerous asset classes. Although major indices have posted impressive...

Winston Churchill is often credited with saying that "it is more agreeable to have the power to give than to receive." As the...

The arrival of the holiday season offers an opportune moment to reflect on achievements in both personal and financial spheres....

An old adage suggests that criminals target banks because that's where the money is. Yet in the modern financial landscape,...

Major equity indices posted solid gains in October, with many reaching fresh record highs despite headwinds from a government...