Expanding Investment Horizons: Diversification Strategies Beyond Major Indices

Expanding Investment Horizons: Diversification Strategies Beyond Major Indices

Equity investments have long served as cornerstone assets in wealth-building strategies. As integral components of well-structured financial plans, equities have demonstrated their capacity to generate long-term returns and support investors in reaching their objectives. Yet this raises an important consideration: which specific equity categories deserve attention? Although market commentary and investor focus gravitate toward the largest corporations, numerous other segments offer valuable roles within diversified investment approaches.

Market performance discussions frequently center on major indices like the S&P 500 or Dow Jones Industrial Average. The S&P 500 represents an index monitoring 500 of the nation's largest publicly traded corporations, organized by market capitalization as a size measurement. Meanwhile, the Dow encompasses just 30 large, established enterprises. Both indices predominantly feature companies with U.S. incorporation and headquarters.

Given their construction methodology, these benchmarks concentrate exclusively on America's largest enterprises. This focus proves valuable for gauging broad market conditions and economic trends, as these major corporations typically influence such patterns. Nevertheless, when constructing investment portfolios, these indices might miss other promising opportunities. This consideration becomes particularly significant when a small number of "mega cap" companies, including members of the Magnificent 7, have predominantly influenced both gains and losses.

Within today's market landscape, how might investors expand their investment scope? Small-capitalization equities and global markets represent two segments that can deliver both opportunities and diversification benefits. These areas present unique attributes and potential advantages that may strengthen portfolio diversification, particularly during periods of market turbulence and economic unpredictability.

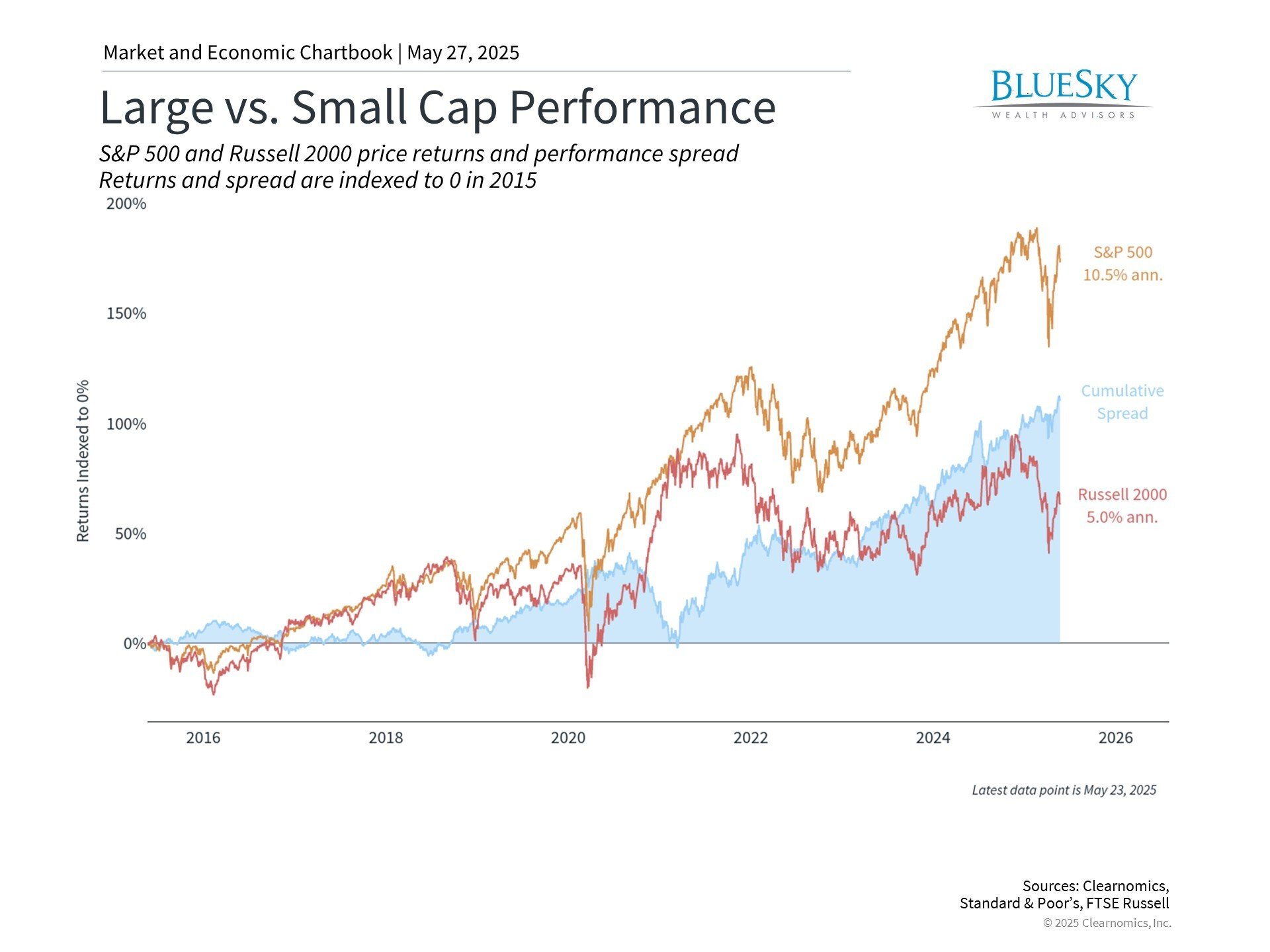

Small-cap equities trail performance but provide diversification advantages

Small-capitalization stocks encompass companies with market values generally spanning from several hundred million to approximately two billion dollars. This differs significantly from mid and large-cap enterprises ranging from tens to hundreds of billions, while mega caps now reach trillion-dollar valuations.

The Russell 2000 index, serving as a small-cap performance tracker, has delivered 5.0% annual returns over the recent decade versus 10.5% for the S&P 500, according to the accompanying data.

1

This performance differential has become especially notable in recent periods as market concentration among large and mega cap enterprises has grown, particularly within technology and artificial intelligence sectors. Small-cap enterprises generally maintain reduced technology sector exposure and generate greater revenue portions from domestic operations, creating sensitivity to U.S. economic policy and trade condition shifts.

Importantly, small caps have faced challenges during the current year amid continuing uncertainty regarding tariffs and economic expansion. Nevertheless, this situation has produced potentially appealing valuations. Small-cap equities currently trade at more reasonable price-to-earnings multiples relative to large-cap alternatives. The Russell 2000 presently shows a price-to-earnings ratio significantly below its 10-year average. Even more notable is the price-to-book value of roughly 0.8x, substantially below the historical 1.2x average. By contrast, numerous S&P 500 valuation measures exceed averages, with some approaching record levels.

Interest rate conditions represent another crucial distinction between large and small-cap companies. Small caps frequently depend more extensively on floating rate debt financing compared to their large-cap peers, creating greater interest rate sensitivity. While this generated difficulties during the rapid rate increases beginning in 2022, the subsequent stable environment could provide support. This becomes especially relevant if the Fed proceeds with additional rate reductions during the year.

These various indicators suggest that small-cap stocks present more attractive valuations than numerous other market segments. While large caps will maintain significant portfolio importance, this underscores the existence of opportunities across many additional market areas.

Global markets maintain appealing valuation levels

International equities represent another area featuring attractive valuations, commonly divided into two primary categories: developed markets (including Europe, Japan, and Australia) and emerging markets (encompassing nations like China, India, and Brazil). These distinctions reflect variations in economic development, market structure, regulatory environments, and additional factors.

While U.S. equities have dominated global markets throughout much of the recent decade, international stocks have demonstrated superior performance this year. The MSCI EAFE index, monitoring 21 major developed market nations, has achieved approximately 17.5% gains year-to-date in U.S. dollar terms. The MSCI EM index, tracking emerging markets, has advanced 10%.

2

This progress has occurred despite global trade-related uncertainties.

Beyond delivering stronger performance this year, significant valuation gaps persist. As the S&P 500 trades at elevated price-to-earnings levels, international markets present more compelling valuations, as illustrated in the above chart. This partially stems from political and economic difficulties across many regions over the past decade, some of which have started improving.

A fundamental difference between domestic and international investing involves currency fluctuation impacts on returns. Specifically, dollar weakness has established favorable conditions for U.S.-based investors. This occurs because foreign assets gain value when their denominating currencies strengthen, enabling conversion back to increased dollar amounts. This currency benefit has meaningfully contributed to international stocks' strong yearly performance, providing additional returns beyond underlying foreign company results.

Diversification across regions and market capitalizations remains crucial

Long-term investors benefit from maintaining exposure to segments including small-cap and international equities to construct more balanced portfolios. This becomes particularly relevant following the substantial large-cap stock performance driven by a limited number of the largest companies.

This perspective doesn't suggest that U.S. large caps will diminish in importance. This also doesn't advocate for dramatic modifications to well-designed portfolios. Rather, sustaining long-term portfolios involves maintaining appropriate asset allocation across these various investment types. Through including more attractively priced market segments, we may potentially enhance long-term risk-adjusted results while capitalizing on market opportunities. Although individual asset classes might underperform during specific timeframes, their distinct characteristics and return behaviors can deliver valuable diversification advantages over extended periods.

The bottom line? Although the S&P 500 and Dow continue serving as significant benchmarks, investors should evaluate diversification benefits across numerous other market segments, including smaller enterprises and international equities. Maintaining suitable long-term portfolios remains the optimal approach for achieving financial objectives.

- Russell 2000 and S&P 500, price returns, from January 2, 2015 to May 23, 2025

- MSCI EAFE and MSCI EM, total returns, January 1, 2025 to May 23, 2025

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.