Understanding the Gold Rally and Currency Debasement Concerns

Understanding the Gold Rally and Currency Debasement Concerns

Gold has surged more than 60% this year, exceeding $4,300 per ounce, as numerous asset classes have hit record highs. This impressive rally has generated significant attention and left many investors questioning whether this episode differs from previous ones.

The term "debasement trade" has emerged to describe this phenomenon, reflecting the notion that governments may be incentivized to diminish their currency values through expansive fiscal spending and supportive monetary policies. Combined with a declining dollar, these factors have driven some investors toward assets such as gold, which are perceived as a "store of value," particularly as stock market turbulence has returned.

Although concerns regarding fiscal deficits are understandable, historical evidence demonstrates that forecasting gold price movements is challenging, and numerous factors beyond currencies and interest rates are contributing to the current market rally. For investors with long-term horizons, the key question is not whether to choose stocks and bonds over gold, but rather determining the appropriate allocation of each asset class within a well-balanced portfolio.

Most critically, investors must distinguish between short-term trading activity and long-term financial objectives such as generating income and achieving growth, particularly when an asset has already experienced a substantial rally.

The historical context of currency debasement

Although currency debasement is an ancient concept dating back thousands of years, it remains a recurring concern that emerges periodically. The traditional definition of "debasement" describes the practice of governments decreasing the precious metal content in their coinage. This historically enabled governments to produce additional coins from the same quantity of precious metal, though it simultaneously diminished the purchasing power of individual coins.

Today, most currencies are classified as "fiat currencies," meaning their value derives from confidence in the issuing governments rather than backing by gold or other precious metals. Consequently, contemporary debasement concerns focus on whether governments will tolerate elevated inflation levels and currency weakness, as this would facilitate the management of their outstanding debt obligations.

This concept relates closely to other ideas that gained attention following the 2008 financial crisis. Economists Reinhart and Rogoff, for example, described what they called "financial repression" - policy approaches that maintain artificially low interest rates to decrease the real burden of government debt. This strategy disadvantages savers because cash loses value when interest rates fail to match inflation. Given the ongoing expansion of national debt, it is understandable that some investors harbor concerns about these policies and consequently seek assets that can preserve their value.

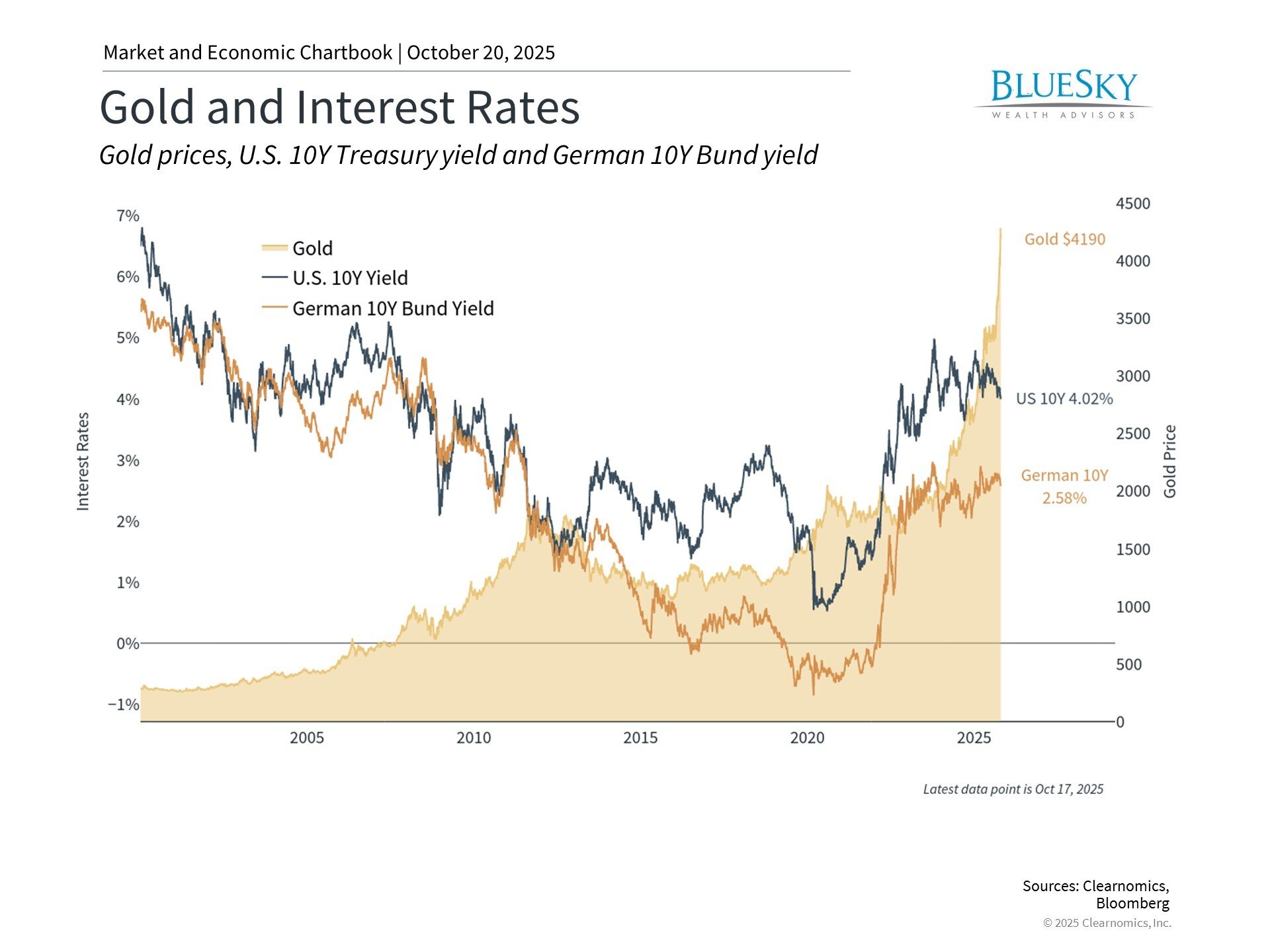

Despite these long-term considerations, current evidence regarding whether this is happening today remains mixed. First, inflation rates have proven persistent but are not at extreme levels. For example, the Consumer Price Index, the Personal Consumption Expenditures Index, and the Producer Price Index all register at 3% or below. Second, bond markets are not indicating expectations of high inflation. In fact, the 10-year Treasury yield has decreased in recent weeks to 4% or less, and the inflation rate suggested by Treasury Inflation-Protected Securities (TIPS) stands at only 2.3%.

Two additional factors merit consideration. First, central banks globally have been accumulating gold to strengthen their reserves. This trend has intensified amid geopolitical uncertainty and the weakening dollar. Second, although the dollar has declined approximately 10% this year, it remains near the upper end of its twenty-year range. From a long-term viewpoint, the dollar continues to demonstrate considerable strength relative to historical levels.

Forecasting gold rallies presents challenges

Given its nature as a speculative asset, gold naturally attracts investor attention. Throughout recent decades, gold has experienced dramatic rallies with varying outcomes. During the late 1970s, gold surged as investors grew concerned about stagflation and Federal Reserve independence. Its price reached a peak above $800 in 1980 - a threshold it would not attain again until 2007.

A comparable pattern emerged following the 2008 financial crisis when central banks injected substantial stimulus into the financial system. During that period, many investors understandably worried about uncontrolled inflation and dollar collapse, neither of which materialized. Gold doubled between 2009 and 2011, climbing to approximately $1,900 per ounce, before retreating toward $1,000 over subsequent years. This occurred despite the Fed not beginning to reduce stimulus until 2013, or raising rates from the zero lower bound until 2015.

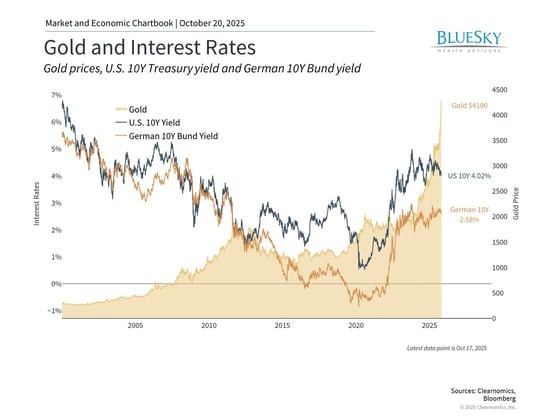

The accompanying chart illustrates gold's performance relative to the S&P 500 since the market peak in 2007. Although gold has delivered strong performance during certain periods that provide diversification advantages, the S&P 500 has nonetheless outperformed across the entire period. For investors preoccupied with daily stock market fluctuations, this reality may seem unexpected. This underscores the importance of evaluating all asset classes from a portfolio perspective.

Diverse asset classes have driven portfolio gains this year

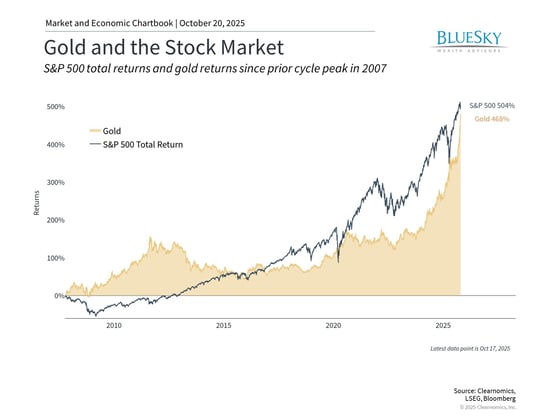

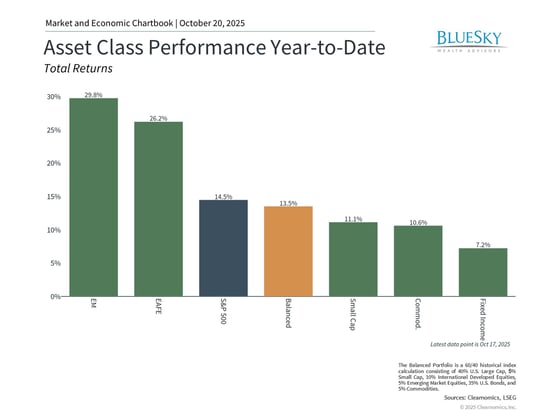

The present gold rally, which commenced in 2024, is connected to robust performance across numerous assets, including artificial intelligence stocks such as the Magnificent 7, international equities, bonds, and cryptocurrencies. The accompanying chart demonstrates that multiple asset classes have contributed to portfolio returns this year. While gold has certainly delivered impressive results, there will invariably be individual stocks and other assets that excel in any given year.

For many investors, gold serves a function as part of a wider commodities allocation, potentially linked to other alternative asset classes. The Bloomberg Commodity Index, for instance, started the year with a 14.3% target allocation in gold. Combined with other commodities including silver, industrial metals, energy, grains, and others, this index has advanced 10.6% year-to-date.

Additional rationale exists for maintaining diverse asset classes aligned with long-term financial objectives. One traditional limitation is that gold produces no income, unlike bonds or dividend-paying stocks. Therefore, a portfolio with excessive concentration in gold forfeits the longer-term growth potential of equities and the income generation of bonds.

The bottom line? While some investors are troubled by dollar debasement concerns, particularly as gold continues its rally, gold should be viewed as one element of a comprehensive portfolio aligned with long-term financial objectives.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.