Five Essential Investment Perspectives for Late 2025

Five Essential Investment Perspectives for Late 2025

At first glance, the initial months of 2025 presented significant hurdles for market participants. Between trade tensions, market volatility, escalating conflicts in the Middle East, and mounting concerns about federal debt levels, investors might perceive financial markets as lurching between crises. Media coverage frequently emphasizes negative developments, potentially amplifying concerns beyond their actual impact.

Nevertheless, as wisdom suggests, challenging periods often harbor valuable opportunities. While this concept frequently appears in political discourse, it applies equally to investment strategy and wealth management. Looking beyond surface-level headlines frequently uncovers meaningful prospects for market participants. For example, despite corrections affecting the S&P 500 and Dow, plus a bear market in the Nasdaq during early 2025, markets also demonstrated remarkably swift recoveries.

This combination established conditions that favored investors who concentrated on portfolio allocation and maintained comprehensive viewpoints. Although uncertainty remains uncomfortable, risk and potential returns represent two aspects of the same fundamental relationship. Were it simple to remain invested while looking past immediate news cycles, universal participation would likely diminish future return potential.

These principles remain crucial as elevated uncertainty continues into the year's latter half. The following analysis presents five essential perspectives to help investors manage current market conditions and prepare portfolios for emerging opportunities, independent of specific future headlines.

Market durability emerges as we transition into the second half

Market participants have grown familiar with volatility across recent years. This year continued that pattern, with many expressing concern about prolonged trade conflicts potentially triggering global economic contraction.

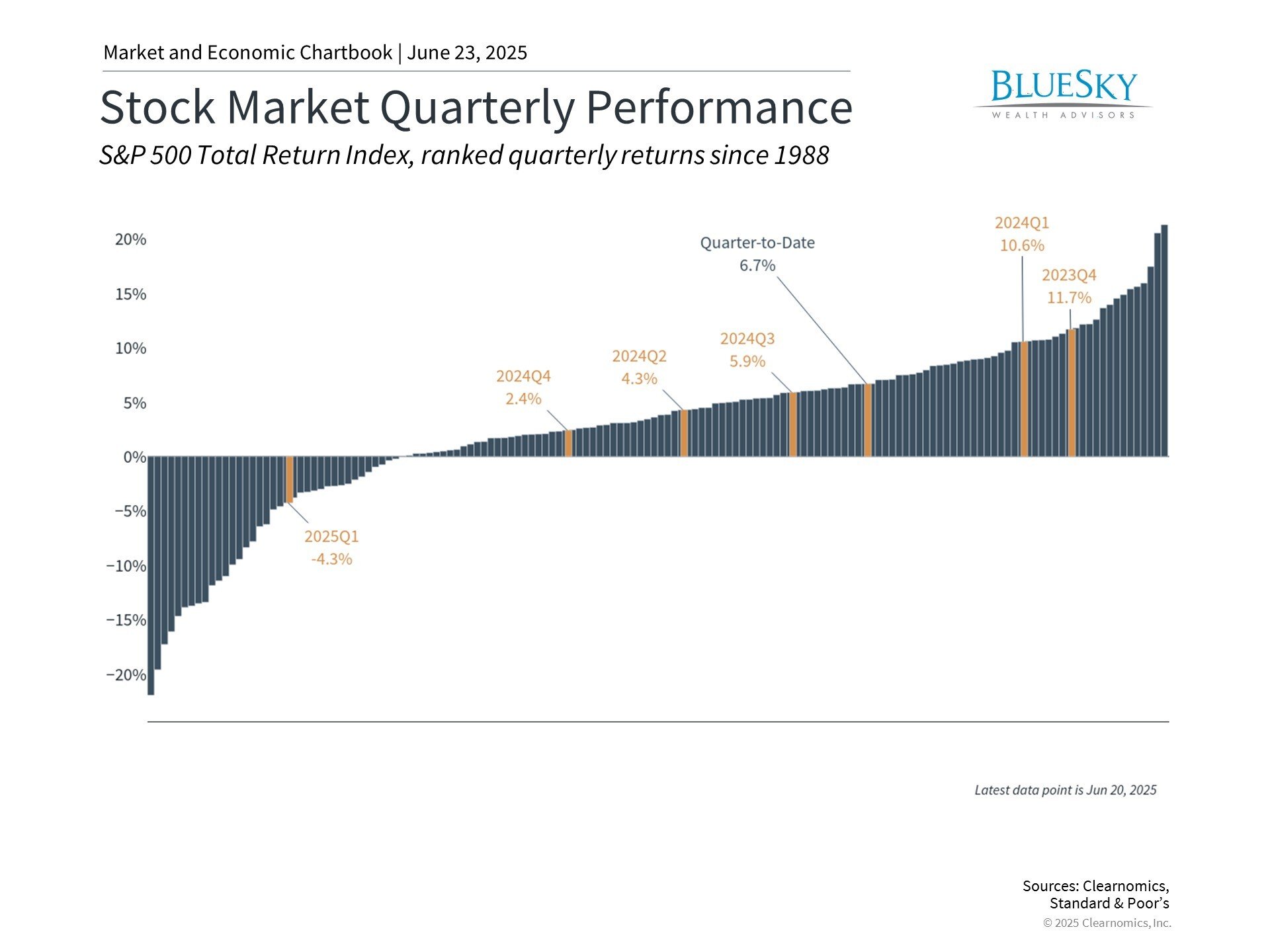

Although tariff concerns persist throughout the economy, recent trade negotiations have reduced the likelihood of worst-case scenarios. The accompanying visualization demonstrates how markets delivered substantially stronger performance during the second quarter compared to the first, reflecting these developments.

Moving ahead, markets will probably remain sensitive to upcoming trade negotiation phases. Most countries' 90-day suspension periods conclude in July, while the reported Chinese agreement hasn't fully materialized. The current administration has demonstrated its commitment to securing new agreements, similar to its 2018 and 2019 efforts. Whatever the specific results, average tariff levels on imports have increased meaningfully this year, potentially affecting consumer prices and corporate profitability.

Market participants should consider these factors throughout the year's remaining months. While rapid market recovery never comes with guarantees, the essential approach involves focusing on fundamental trends. Markets look forward and demonstrate capacity for adjusting to evolving circumstances.

International tensions currently dominate news coverage

International political risks have heightened, especially with the Israel-Iran situation escalating to include U.S. military involvement. This understandably concerns some investors, as these developments differ from typical business and economic reporting. Fortunately, historical analysis offers valuable insights into how markets generally respond to political conflicts.

The accompanying data demonstrates that markets have typically rebounded from political disruptions over time, frequently within months of initial disturbances. Even major events like wars showed limited lasting effects on diversified investment portfolios. This observation doesn't diminish the human and social consequences of conflicts, but serves as guidance that dramatic portfolio adjustments based on political developments are seldom beneficial.

Rather, market and economic fundamentals proved more significant during these historical episodes. The Gulf War occurred during the extended 1990s bull market powered by technology advancement. Conversely, the Afghanistan war began following the dot-com collapse and spanned multiple economic cycles.

Looking further back, the American economy remained weakened by the Great Depression when World War II commenced. Military production revived industrial activity and drove markets higher. The Vietnam conflict, however, coincided with difficult stagflation conditions.

Current market concerns regarding the Iran situation focus on potential oil supply interruptions. The Strait of Hormuz, located south of Iran, serves as a vital passage for over one-fifth of global petroleum transport. Any disruption to production or essential supply routes could trigger oil price increases, potentially stoking inflation.

Nevertheless, petroleum prices have remained relatively stable despite conflict escalation. Brent crude pricing has only returned to January levels. Therefore, while circumstances continue developing, maintaining perspective on political impacts remains important.

Economic conditions appear robust

The U.S. economy's durability over recent years represents perhaps the most encouraging development. What has most surprised market observers is employment market strength even as inflation has declined toward more typical historical ranges. The accompanying chart illustrates that most inflation measurements remain at or below 3%.

Recent GDP data indicated a 0.2% economic contraction during the year's first quarter. However, detailed analysis reveals this primarily resulted from trade effects as businesses accumulated imported goods before potential tariff implementation. Consumer expenditure, representing the largest growth component, maintained steady expansion, supporting overall economic activity. Excluding trade disruptions, GDP growth would probably have remained positive.

One concern likely to resurface during the year's second half involves expanding federal debt due to continued government expenditure and deficits. This prompted Moody's to downgrade U.S. debt in May, following similar actions from other agencies including Standard & Poor's in 2011 and Fitch in 2023. This issue will regain prominence as Congress considers the next budget legislation, including Tax Cuts and Jobs Act extension provisions.

Federal debt creates substantial long-term economic challenges, particularly given the apparent absence of comprehensive solutions. However, avoiding portfolio overreactions remains crucial. History demonstrates that making investment decisions based on Washington fiscal policy would have proven counterproductive. Instead, these periods frequently create opportunities across equity and fixed income markets.

Investment categories beyond domestic equities have delivered strong results

The primary challenge accompanying market recovery involves elevated U.S. equity valuations. However, this expensive valuation environment has generated opportunities elsewhere in markets. International equities, smaller companies, and value-focused sectors frequently trade at more reasonable multiples, offering potential opportunities for patient investors. Fixed income markets also present attractive possibilities, with yields staying above long-term averages across most sectors.

International equity performance represents one of 2025's most notable developments, with developed and emerging markets achieving double-digit returns based on MSCI EAFE and MSCI EM indices. This partly reflects U.S. dollar weakness. When the dollar declines, foreign currency-denominated assets gain value.

This reinforces an important lesson for the year's remaining months: market leadership shifts over time. Maintaining exposure across different regions can enhance portfolio results while potentially reducing risk through diversification. While historical performance doesn't ensure future outcomes, current conditions demonstrate why investors often benefit from patient, long-term strategies that capture global market opportunities.

Advantages of sustaining long-term investment perspectives

Early 2025 patterns reflect challenges investors have encountered throughout market history. They demonstrate how extending investment timeframes can enhance portfolio results, even during the most difficult market environments.

The accompanying visualization shows that while annual returns can fluctuate dramatically - with equities ranging from substantial losses to significant gains within single years - this volatility has historically moderated over extended periods. Across 10-year and longer horizons, outcome ranges narrow considerably, explaining why stocks and bonds have traditionally formed the foundation of long-term investment strategies.

This historical context emphasizes the importance of maintaining commitment to well-designed portfolios despite short-term uncertainties. This approach will prove even more valuable as new developments challenge markets in upcoming months.

The bottom line? Early 2025 experiences highlight the critical importance of maintaining long-term focus. Investors who preserve discipline and emphasize enduring principles are optimally positioned for the year's second half and achieving their financial objectives.