Geopolitical Tensions and Market Impact: Lessons for Investors

Geopolitical Tensions and Market Impact: Lessons for Investors

Global attention has focused on escalating tensions between Israel and Iran, creating waves of uncertainty across financial markets. Iranian military installations and nuclear facilities faced Israeli strikes beginning June 13, prompting swift retaliation. Reports now suggest Iran may consider ceasing hostilities and returning to nuclear negotiations, even as the Gaza conflict persists alongside other regional disputes worldwide.

While humanitarian concerns rightfully take precedence, investors must grasp how such developments affect market dynamics. The primary worry centers on whether these incidents might spiral into broader global warfare. Historical evidence suggests otherwise - even significant conflicts like Ukraine's invasion by Russia and the Hamas assault on Israel remained localized, generating only temporary market turbulence.

This observation doesn't minimize the gravity of these situations, but rather emphasizes how portfolio overreactions can prove detrimental. During such periods, maintaining perspective becomes crucial, along with focusing on historical lessons and long-term market patterns. How can investors remain disciplined amid this challenging environment?

Regional tensions have intensified significantly

Recent events represent a notable escalation in Israel-Iran relations. Israeli operations struck Iranian nuclear installations and military command structures, with reports confirming damage to uranium processing facilities. Iran countered with missile and drone assaults, some penetrating Israeli airspace. Both nations suffered infrastructure damage, including energy facilities and petroleum refineries.

Historians typically examine each event as distinct, with unique narratives and outcomes. Economists seek patterns and parallels to form broader conclusions. Investors benefit from both viewpoints to understand applicable lessons. As commonly noted, while history may not repeat exactly, it frequently echoes similar themes.

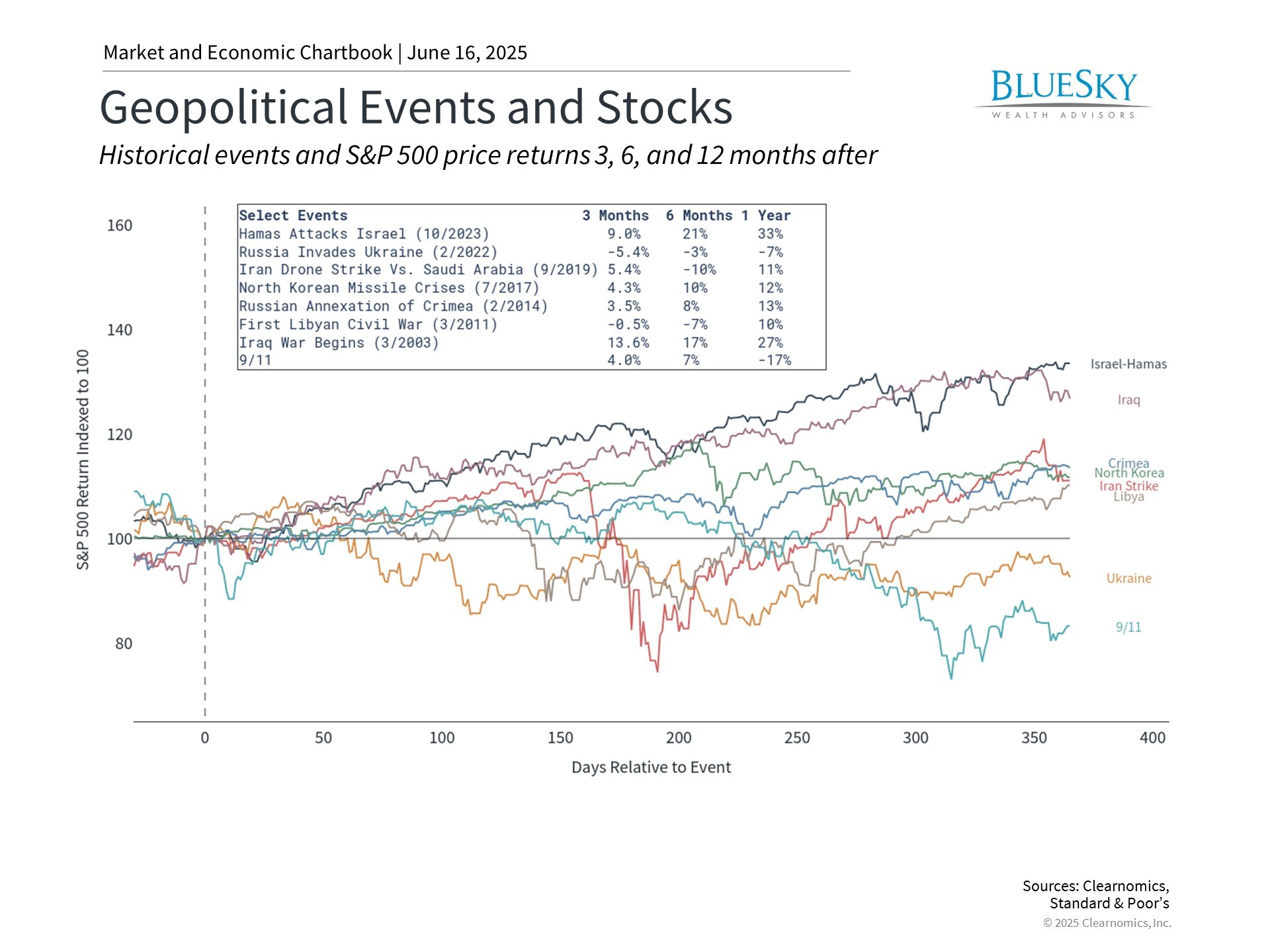

The referenced chart offers historical context for geopolitical events spanning 25 years. This encompasses Middle Eastern conflicts affecting oil markets, such as Iran's 2019 drone attacks on Saudi Arabia. These episodes demonstrate that despite short-term market fluctuations, markets typically rebound from geopolitical disruptions, often within weeks or months. Underlying business cycle trends proved more significant during these intervals.

Energy markets have experienced significant swings

Oil prices serve as a primary channel through which regional conflicts influence global markets. Market responses to recent tensions centered on energy sectors, pushing Brent crude above $74 per barrel. Prices remain unstable but retreated toward $70 amid potential de-escalation possibilities.

Energy costs impact the global economy as they represent major inputs across all goods and services. Elevated oil prices translate to higher gasoline and shipping expenses, increasing costs for consumers and businesses alike. Concerns amplify with potential disruptions to vital shipping routes, particularly the Strait of Hormuz in the Persian Gulf. This waterway facilitates passage for roughly one-third of global oil supplies.

Nevertheless, maintaining perspective on current pricing levels remains important. Though recent fluctuations are noteworthy, prices stay well beneath 2022 peaks during early Russia-Ukraine conflict stages, when oil surpassed $120 per barrel. Current levels around $70 fall within recent years' typical range. This year alone has seen oil fluctuate between $60 and $82 per barrel.

America's growing energy independence over two decades deserves recognition. U.S. oil production now surpasses 13.5 million barrels daily. Many might be surprised that America leads global production in both oil and natural gas. While the U.S. still imports foreign oil and responds to global price movements, substantial domestic supply helps shield the American economy and markets.

Conflict effects on investments depend on economic cycles

Investors concerned about worldwide conflict escalation can gain perspective through broader historical analysis. From World War II through the Iraq War, markets may have responded to conflicts short-term, but long-term performance reflected investment fundamentals.

World War II, for instance, revitalized industrial production following the Great Depression and transformed labor markets with women joining the workforce. These developments propelled economic growth throughout the remaining century. The Gulf War impacted oil markets but coincided with the 1990s Information Technology boom. Conversely, the post-Vietnam decade aligned with elevated oil prices and stagflation, producing weak market results.

Again, this analysis doesn't diminish the human and societal costs of warfare. For current circumstances, outcomes largely depend on whether conflict expands or begins subsiding. Major power involvement and threats to critical supply chains add complexity, yet history indicates even substantial regional conflicts typically exert limited long-term effects on global financial markets.

The bottom line? Although Middle Eastern tensions have generated temporary market volatility, investors should preserve perspective and resist headline-driven reactions. Portfolios aligned with long-term financial objectives remain the optimal strategy for navigating geopolitical uncertainty periods.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.