Understanding Dividend Income in a Rate-Cutting Environment

Understanding Dividend Income in a Rate-Cutting Environment

Jack Bogle, the legendary founder of Vanguard, once noted that "successful investing is about owning businesses and reaping the huge rewards provided by the dividends and earnings growth of our nation's—and, for that matter, the world's—corporations." This perspective remains highly applicable today, as equity ownership benefits extend beyond capturing price appreciation to include the dividend income that corporations distribute to shareholders as their earnings expand.

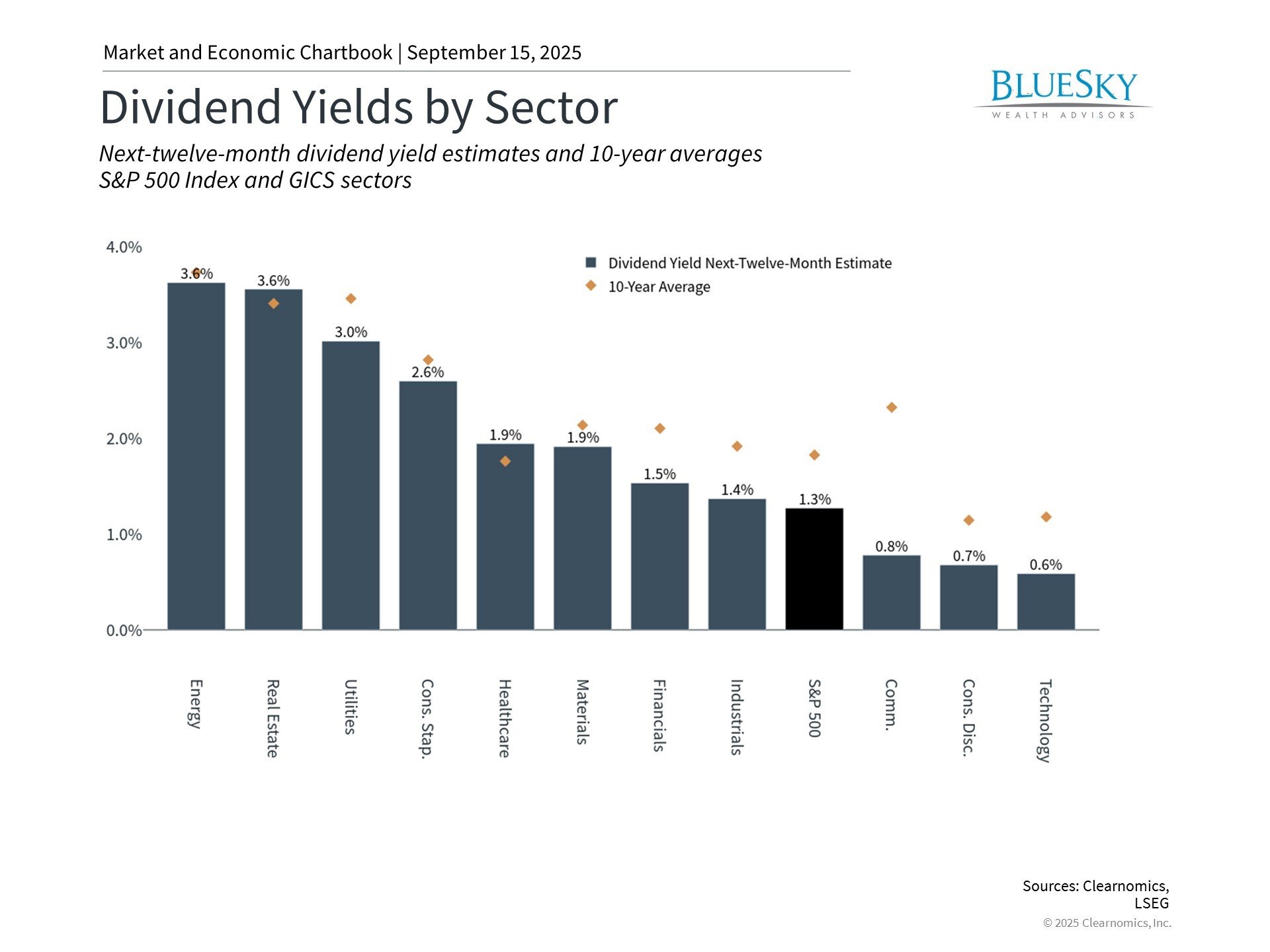

Currently, equity markets trade near record levels while dividend yields sit at historically modest levels, with the S&P 500 expected to yield approximately 1.3% over the coming year. Such low dividend yields last occurred in 2000 during the technology bubble. Federal Reserve policy shifts and evolving interest rate conditions further influence how investors might structure their portfolios for income generation.

Although dividend-paying investments may appear less exciting than rapidly appreciating growth stocks that capture headlines and investor enthusiasm, their portfolio significance deserves attention. Dividend distributions compound through time and deliver consistent income streams, particularly valuable when equity prices experience volatility. Enterprises that deliver both regular dividend payments and sustained price growth over extended periods can potentially provide investors with dual benefits: ongoing cash flows combined with long-term wealth accumulation.

Current market conditions reflect multi-decade changes in corporate capital allocation strategies and investor preferences. How might investors effectively balance price returns with dividend income in today's environment?

Investor perspectives on dividend income have transformed across decades

Dividend investing's importance has shifted significantly throughout the past century. During much of the 1900s, dividend income represented a major component of equity market returns, with yields frequently surpassing 5% to 7%. Investors approached stock purchases similarly to how they might consider bonds currently – primarily seeking the income these investments produced. Corporations faced expectations to maintain and increase their dividend distributions as evidence of financial strength, with stock price gains often viewed as secondary to dividend income.

This approach evolved as investors increasingly emphasized technology-focused enterprises and expansion. The dot-com period of the 1990s diminished dividend focus further as high-growth technology firms not only reinvested their capital internally, but were frequently expected to

avoid

dividend payments. Share repurchase programs also gained popularity as a more tax-advantaged method of returning capital to shareholders compared to dividends.

Current low yields demonstrate this transformation. The accompanying chart illustrates that technology-oriented sectors including Information Technology, Consumer Discretionary, and Communication Services provide the lowest dividend yields at 0.6%, 0.7%, and 0.8% respectively. These sectors encompass the Magnificent 7 stocks which typically distribute minimal dividends or none whatsoever.

Conversely, sectors like Real Estate, Energy, and Utilities that have historically emphasized income production offer yields exceeding 3%, indicating that higher dividend opportunities exist by examining various market segments and individual holdings.

This broader market pattern of reduced dividend yields doesn't necessarily present concerns since it reflects varying market conditions and business approaches that can benefit investors in distinct ways. Nevertheless, it emphasizes the significance of comprehending dividend purposes for corporations, investors, and within portfolios.

Business strategies and monetary policy influence dividend appeal

From a corporate standpoint, earnings can be deployed in two primary ways: reinvestment in business operations or cash distribution to shareholders via dividends. Theoretically, companies should return capital to investors when they possess sufficient funds for compelling investment opportunities or when their business models specifically focus on generating shareholder income, such as REITs (real estate investment trusts).

Nevertheless, dividends fulfill broader functions beyond merely distributing surplus cash. Many corporations maintain consistent dividend payments to attract investors and communicate financial stability, especially when they can show steady growth in these distributions over time. This dividend expansion functions as a measure of corporate wellness and management's confidence in future profitability, extending beyond income considerations alone.

Interest rates and Federal Reserve monetary policy also influence dividend-paying stock attractiveness. When Treasury yields surpass dividend yields, they diminish the relative appeal of these equities. Presently, with 10-year Treasury yields near 4.1%, government bonds provide considerably higher income than the overall equity market. As the Fed proceeds with policy rate reductions, this relationship could evolve.

The accompanying chart displays a related measure called the "earnings yield," occasionally termed the "equity risk premium." This gauges stock attractiveness relative to Treasurys. The recent years' declining trend results from equities reaching new peaks alongside elevated interest rates. Interest rates remaining within a range recently explains why the relative earnings yield has stabilized this year.

Dividend income represents a crucial investor consideration

For investors, dividends constitute an essential component of portfolio total returns. According to Standard and Poor's research, dividends have generated 31% of S&P 500 total returns since 1926, while price appreciation contributed 69%.1

Today, individual investors appear to concentrate primarily on stock prices except when portfolio income becomes necessary, such as for those approaching or experiencing retirement.

The accompanying chart demonstrates that $1 invested in equities in 1926 expanded to roughly $18,000 by 2025, illustrating compound growth's strength across extended timeframes. This expansion resulted from both dividends and price appreciation, though the specific combination varied across different periods. During certain decades, dividends supplied most returns. In others, stock price gains dominated. The consistent factor was the importance of maintaining investment positions through various market cycles, regardless of return drivers.

For investors nearing or in retirement, emphasis naturally transitions toward generating current income. However, this doesn't necessarily require concentrating exclusively on high-dividend equities. The danger of "yield chasing" – focusing solely on highest-yielding investments – involves potential poor diversification, concentration in unsustainable companies and sectors, and reduced growth potential for today's extended retirements.

Therefore, investors should establish appropriate dividend and growth balance for their financial objectives. This "total return" strategy helps ensure portfolios can produce suitable returns across various market conditions, whether through dividends, capital appreciation, or both.

The bottom line? Although dividend yields remain near historical lows, they maintain significant portfolio importance. Investors should emphasize both price appreciation and dividend income while pursuing their financial objectives.

- https://www.spglobal.com/spdji/en/documents/research/research-sp500-dividend-aristocrats.pdf

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.