Understanding Employment Trends and Economic Health Indicators

Understanding Employment Trends and Economic Health Indicators

Market participants frequently focus on historical data despite recognizing that future developments matter most. Current backward-looking indicators have raised concerns among some investors and officials about economic conditions, prompting questions about potential recession risks. Today's environment presents evidence of labor market deceleration and persistent inflation pressures, while unemployment stays relatively low and overall economic growth metrics show positive trends. For investors with long-term horizons, these conflicting indicators underscore the importance of maintaining an objective outlook.

Economic data interpretation presents inherent complexities, and understanding market dynamics requires careful analysis. During uncertain periods, focusing on economic fundamentals rather than sensational headlines proves most valuable. Consumer financial well-being serves as a logical starting point, given that household spending represents more than two-thirds of total economic activity and significantly influences corporate earnings and broader economic performance. What does current evidence reveal about consumer conditions in this intricate economic landscape?

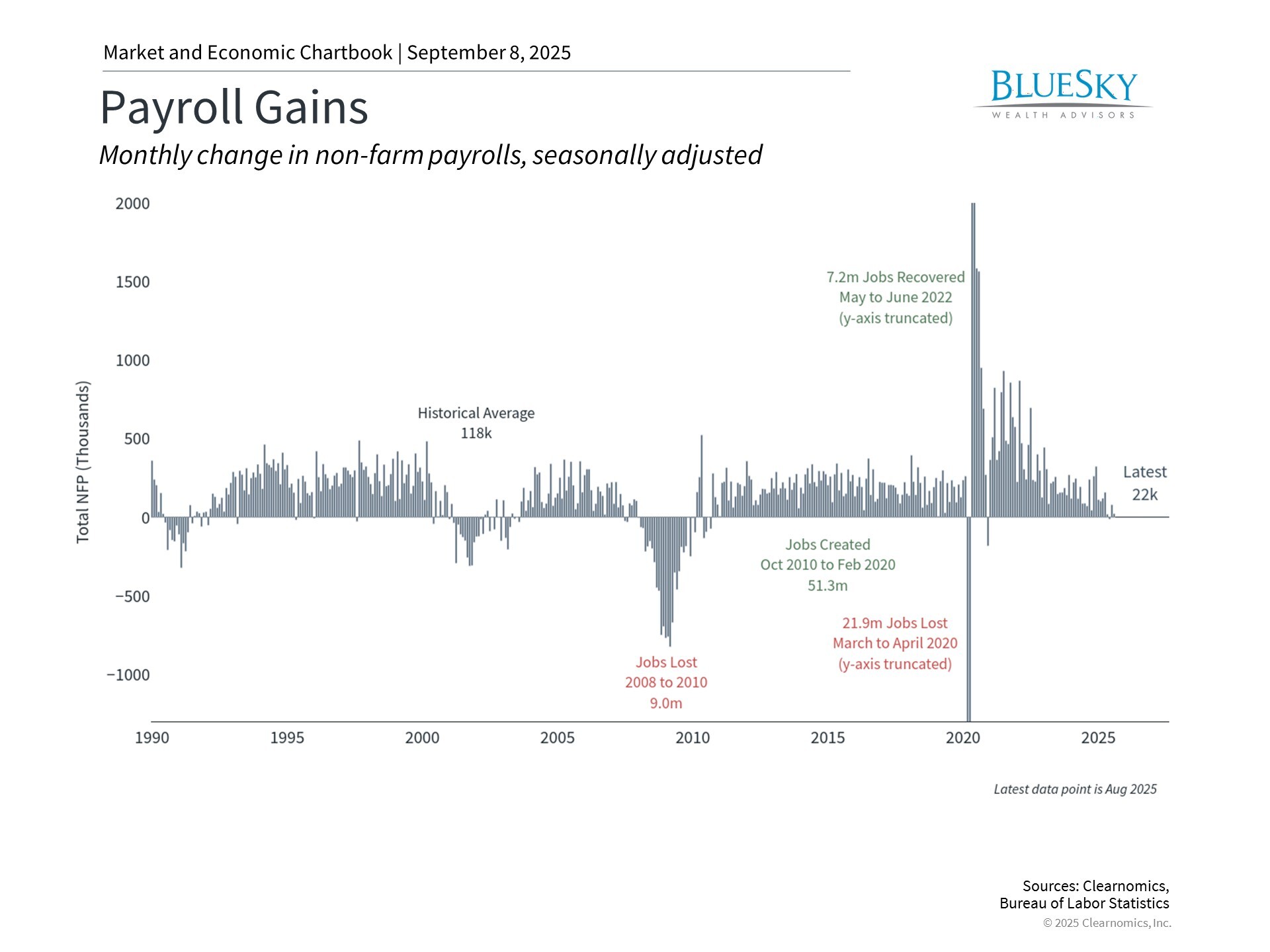

Employment conditions have deteriorated in recent periods

Examining employment trends provides insight into consumer financial stability. Recent employment data confirmed that workforce conditions are weakening beyond earlier projections. August employment figures showed only 22,000 new positions created according to official statistics, significantly below the anticipated 75,000 additions. The data also revealed major adjustments to prior monthly calculations, with June's employment numbers indicating a 13,000 job reduction, representing the first monthly decline since 2020.

Although these statistics receive considerable attention in financial publications, economic analysts examine broader patterns rather than focusing exclusively on monthly employment changes, which often fluctuate significantly. They evaluate what economists term "labor market slack," essentially measuring whether job seekers can successfully find employment opportunities.

Federal Reserve Chair Jerome Powell recently characterized current employment conditions as existing in "a curious kind of balance" because both worker availability and employer demand have simultaneously decreased.1

Notably, the 4.3% unemployment rate indicates that most individuals seeking employment can find positions. The broader "under-employment" measure, encompassing discouraged workers, remains historically low at 8.1%. Additional data indicates approximately one available position exists for each unemployed person nationwide. While this doesn't guarantee universal employment success, it demonstrates continued corporate hiring activity.

These factors, combined with employment statistics, suggest gradual labor market cooling rather than sudden collapse. The distinction matters because unemployment spikes have historically resulted from economic disruptions, including the 2008 financial crisis or 2020 pandemic events. Current conditions appear to reflect natural economic adjustments instead. For Federal Reserve officials, this employment pattern increases the likelihood of interest rate reductions starting in September.

Household financial conditions demonstrate stability amid pressures

Despite labor market softening, consumer financial health exhibits characteristics of a "two-speed economy" where circumstances differ based on income and wealth levels. Investment analysts have scrutinized these metrics because total household debt continues expanding across credit cards, vehicle financing, educational loans, and other categories. Increased household leverage can become problematic during economic downturns, a dynamic that contributed to the 2008 financial crisis.

Payment timeliness provides one method for identifying potential household financial stress. The accompanying data shows credit card and automobile loan delinquencies have risen over two years, partially due to increased consumer borrowing and recent interest rate increases. This delinquency growth has concentrated among borrowers with weaker credit profiles, supporting evidence of economic divergence.

However, the information also demonstrates that delinquency rates have stabilized recently and remain substantially below pre-2008 levels. While nationwide debt totals are elevated, household debt service payments have stayed constant in recent months. This indicates that although some families may experience financial pressure from loan payments, current levels haven't reached historically recessionary thresholds.

Total household wealth stays near historical peaks

Concentrating solely on consumer debt obligations can be misleading since problems often originate there. Nevertheless, asset holdings are equally significant, and American household net worth continues near record territory today. The chart illustrates this phenomenon clearly.

At $169 trillion, total wealth has grown over fifteen years through consistent economic expansion, increasing property values, and robust equity market performance. This again reflects economic divergence since households with recent borrowing increases may differ from those benefiting from asset appreciation. Nonetheless, this wealth effect, where rising asset values support consumer expenditures, can provide economic stability. This explains why various concerns over recent years haven't always translated into economic weakness.

This also reminds us what drives long-term wealth accumulation and why maintaining portfolios aligned with financial objectives remains crucial. Throughout this timeframe, investors frequently worried about recession possibilities. While markets may react to negative information or experience short-term declines, they often "climb the wall of worry" over extended periods. For patient investors, concentrating on long-term economic direction proves far more valuable than dwelling on past performance.

The bottom line? Although employment conditions have weakened, increasing September rate cut probabilities, this represents just one element of the complete economic assessment. During uncertain periods, investors should emphasize fundamental economic patterns to maintain portfolio balance.

- https://www.federalreserve.gov/newsevents/speech/powell20250822a.htm

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.