Who Pays the Tax? Modeling IRA Distributions in a Post-SECURE Act Environment

Join BlueSky Wealth Advisors for an insightful session that will equip you with the knowledge and strategies you need to navigate...

Register for Our Upcoming Webinar: "Who Pays the Tax? Modeling IRA Distributions in a Post-SECURE Act Environment" REGISTER NOW

Join BlueSky Wealth Advisors for an insightful session that will equip you with the knowledge and strategies you need to navigate...

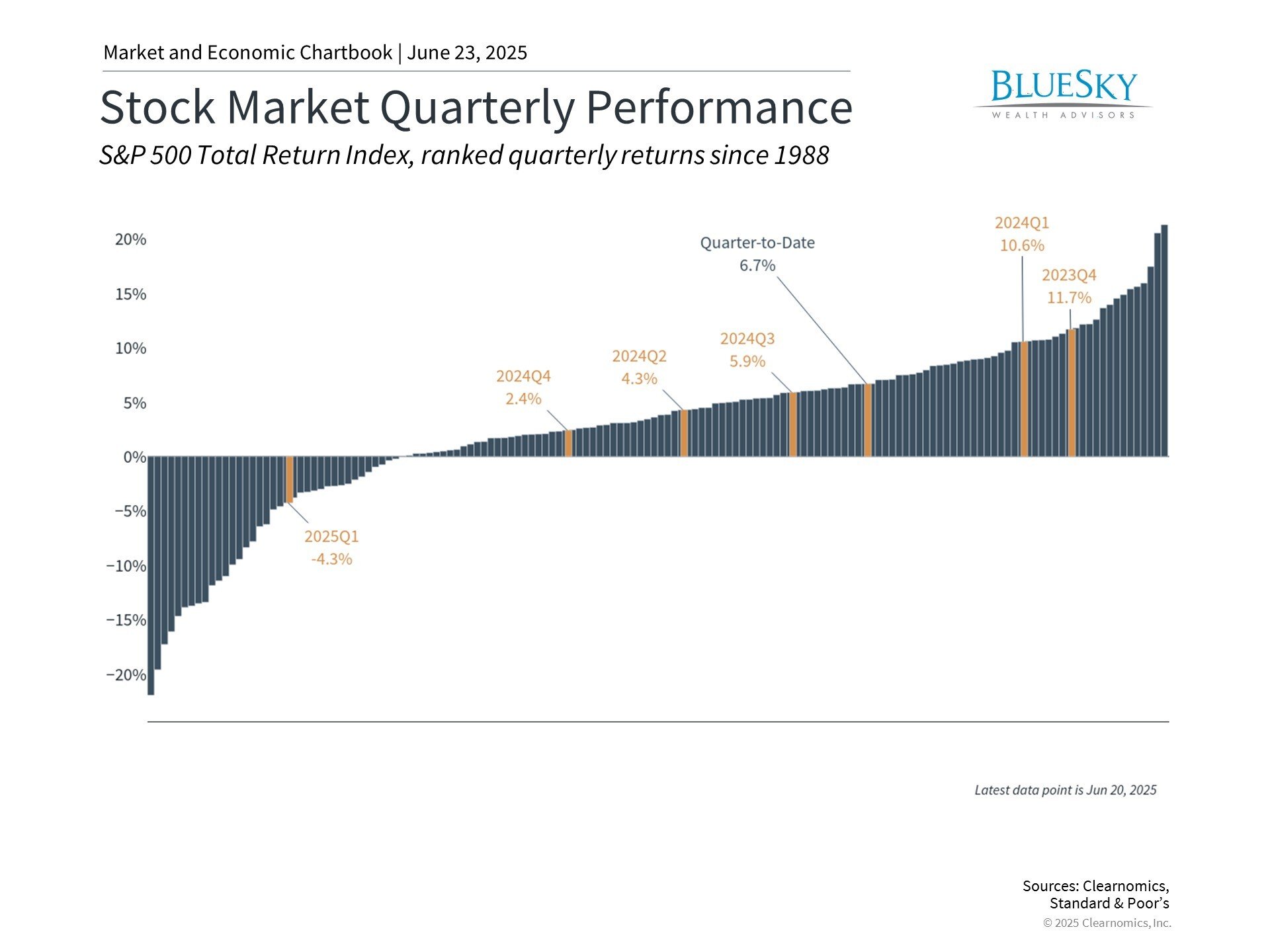

Investors often struggle to maintain focus on long-term objectives while navigating short-term market volatility. This challenge...

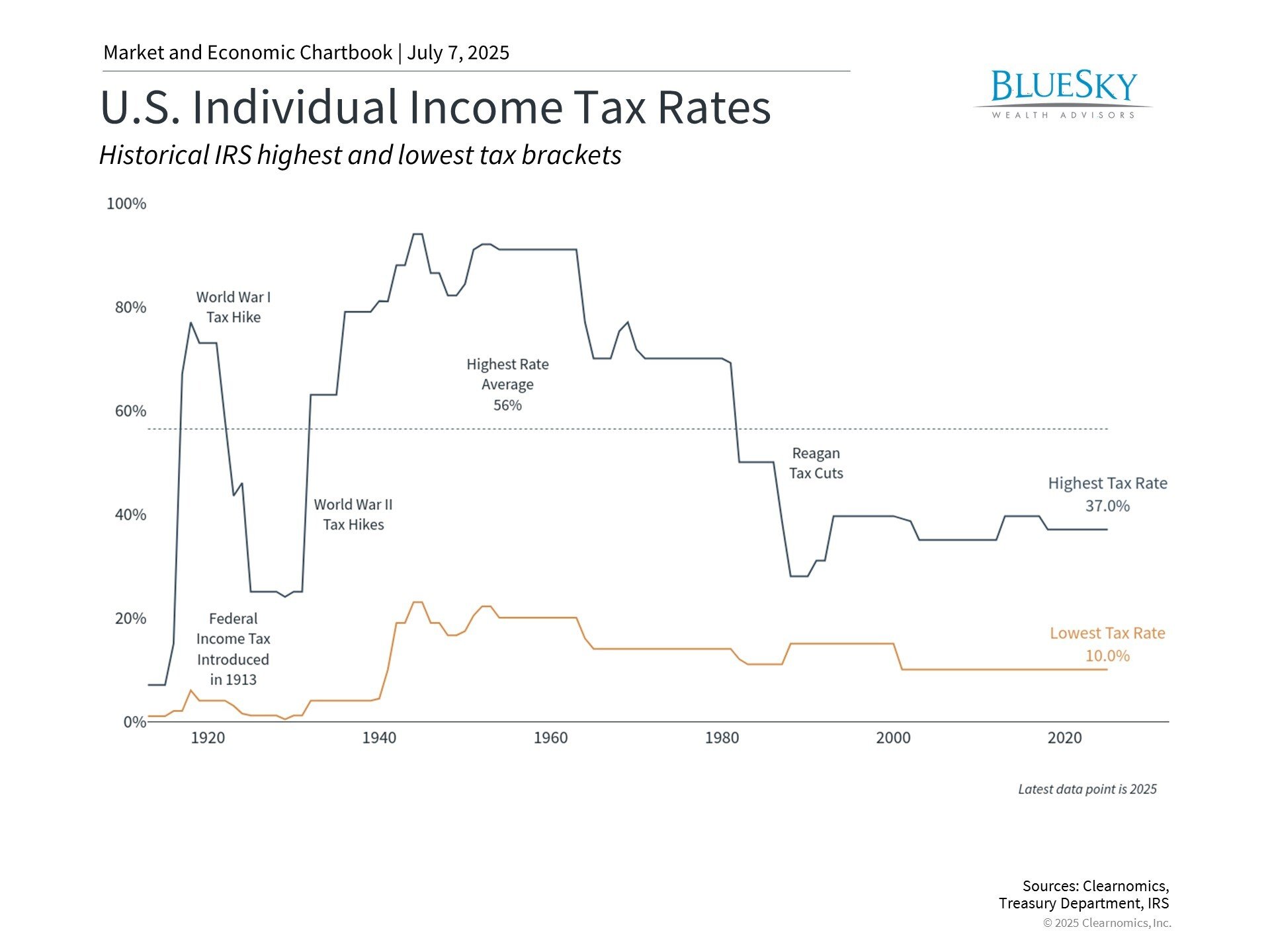

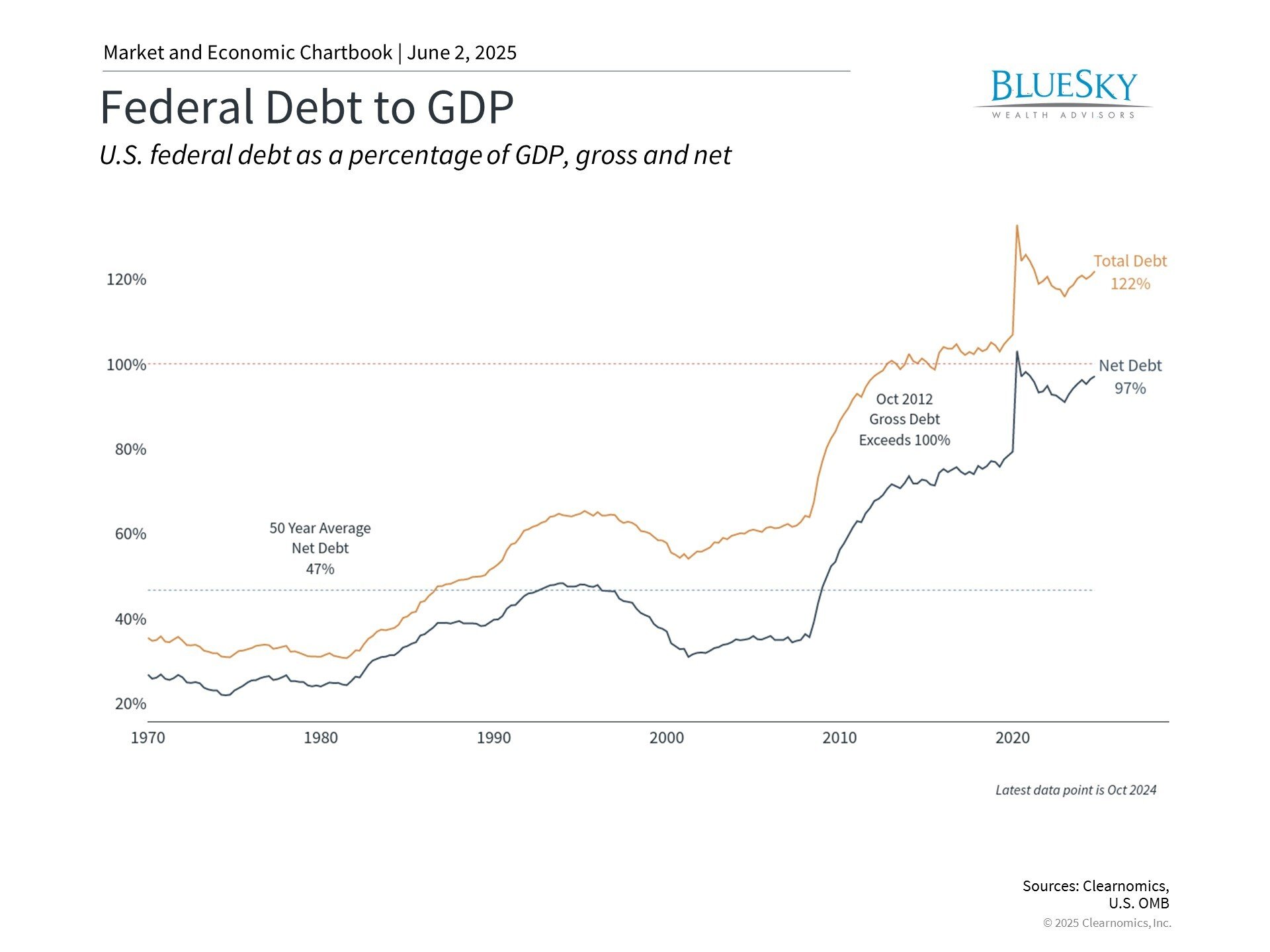

Following extensive deliberations, Congress has enacted and President Trump has signed comprehensive tax and spending legislation...

President Dwight Eisenhower famously observed that "what is important is seldom urgent and what is urgent is seldom important."...

Financial scams are on the rise, and they’re targeting individuals of all ages and backgrounds. Whether you're building your...

Retirement is not the end of a financial journey. It’s a transformation. For decades, you saved deliberately. Now, the focus...

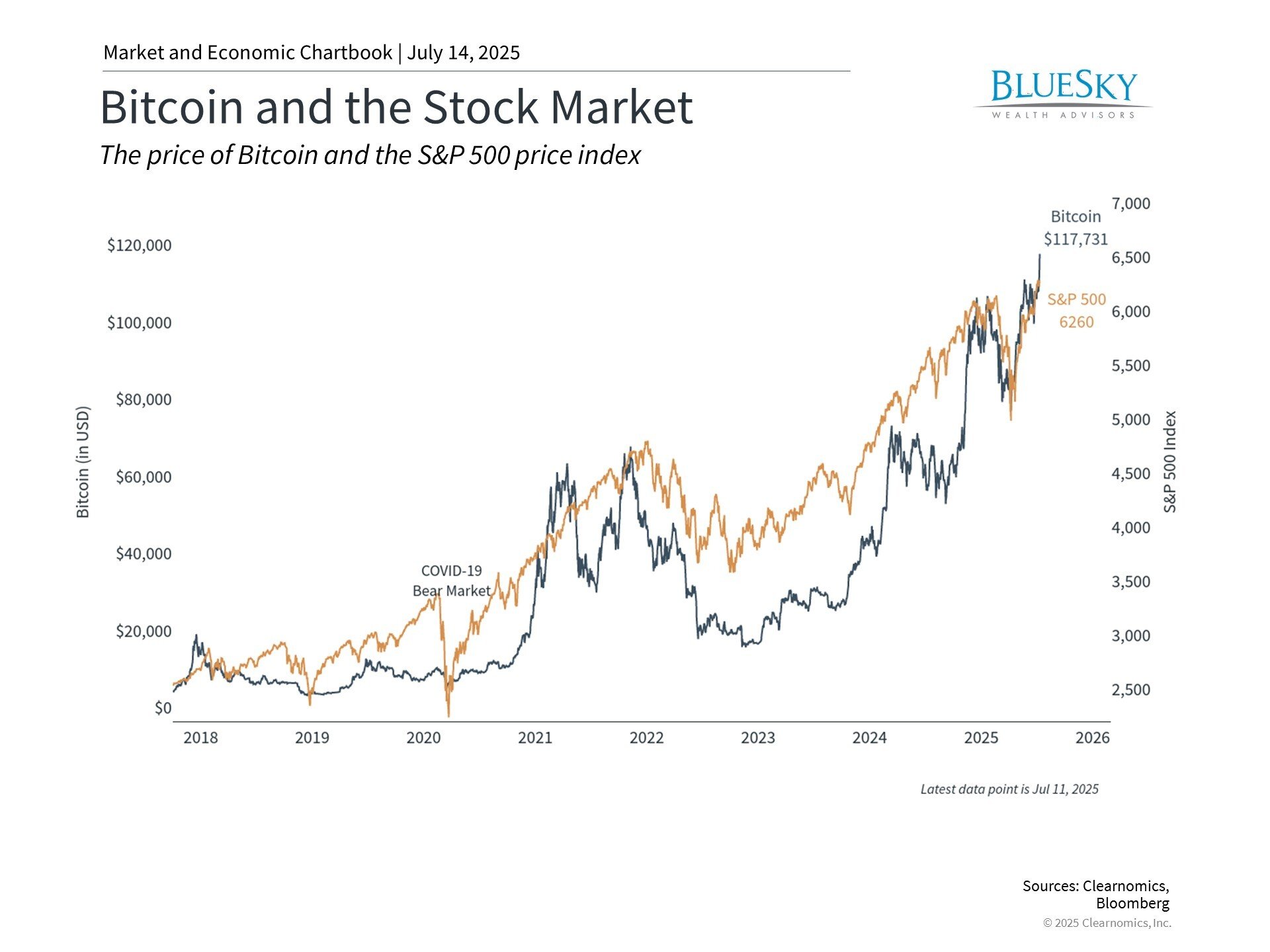

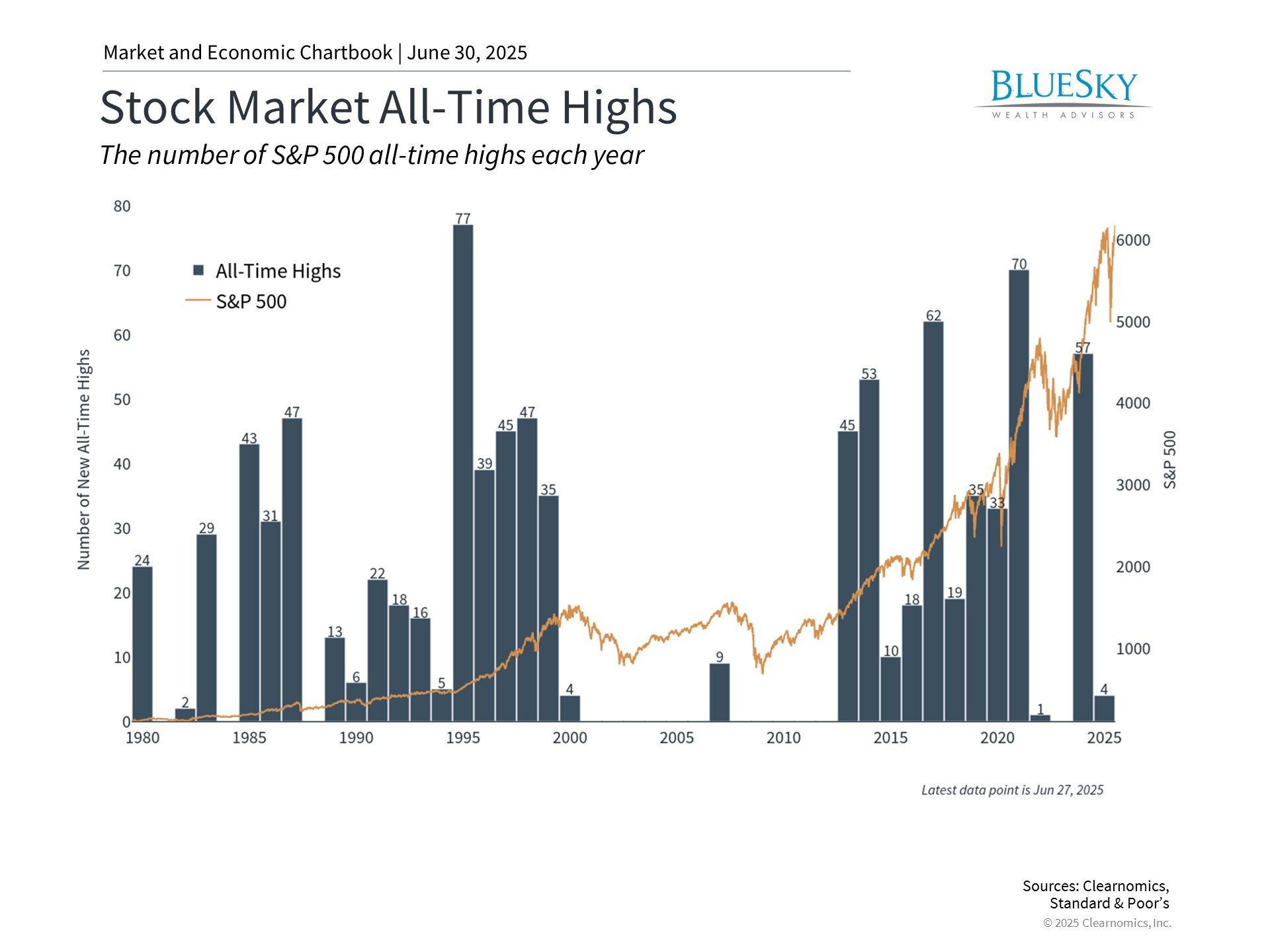

At first glance, the initial months of 2025 presented significant hurdles for market participants. Between trade tensions, market...

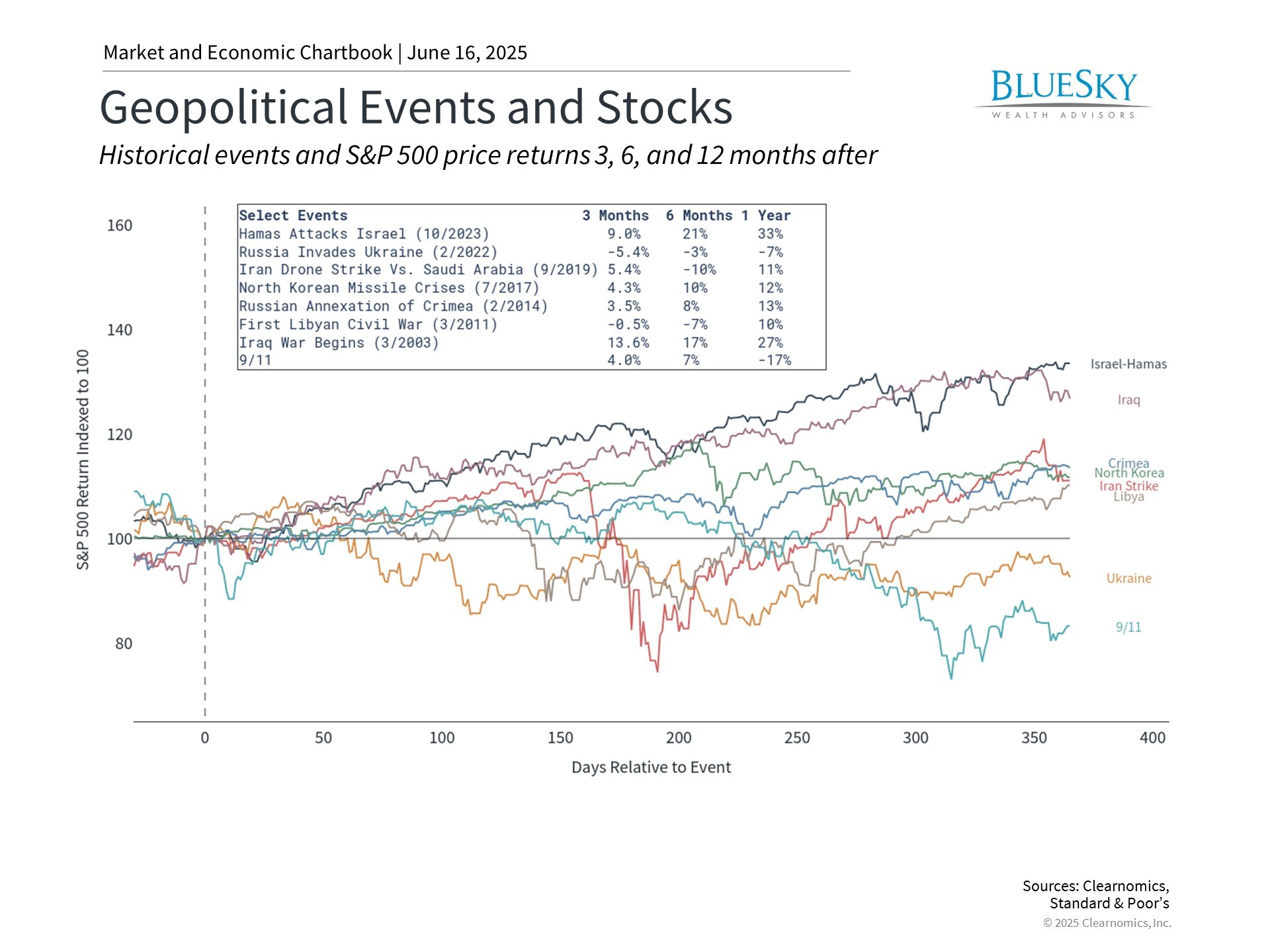

Global attention has focused on escalating tensions between Israel and Iran, creating waves of uncertainty across financial...

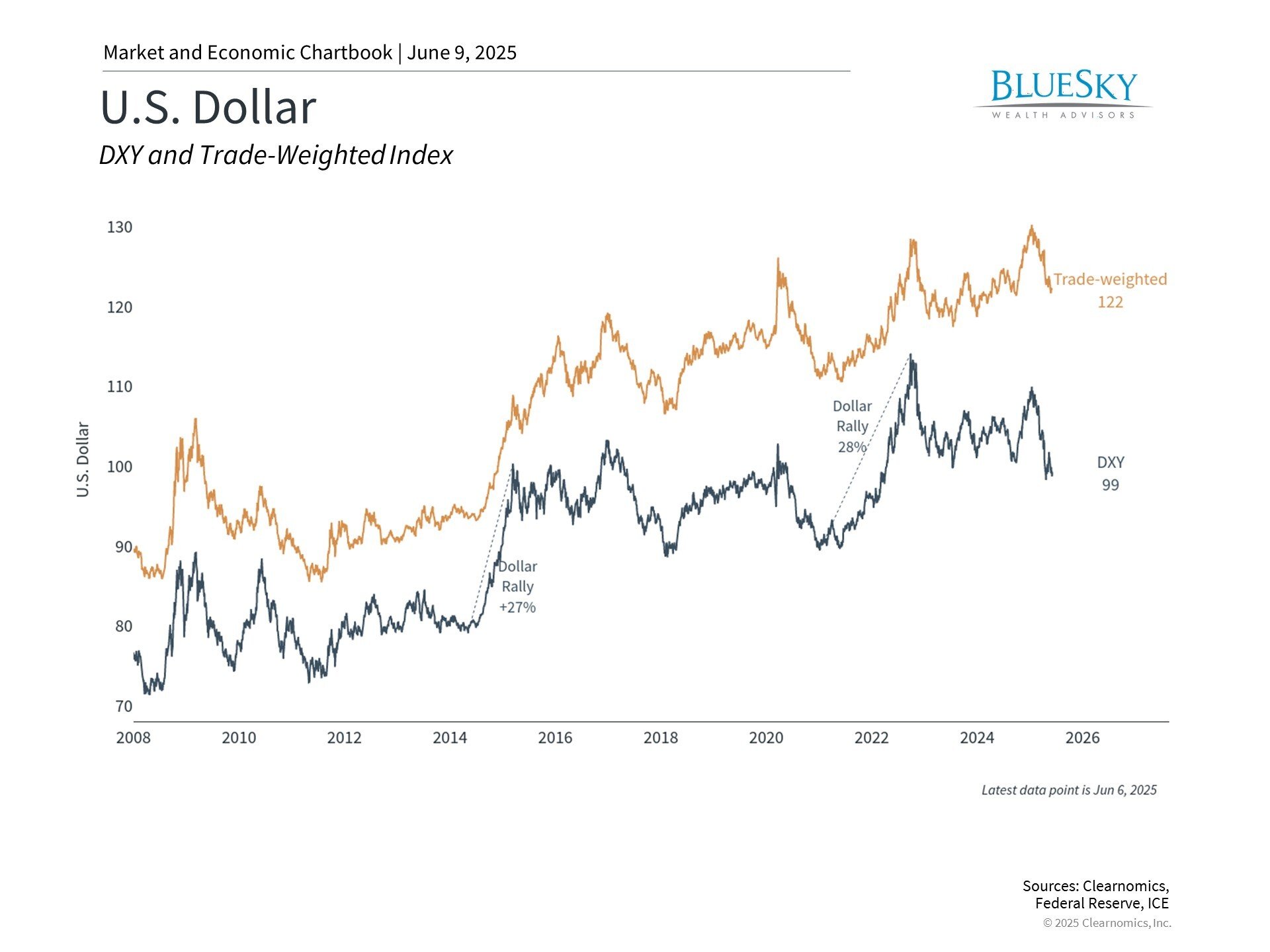

Many Americans view the strength of the U.S. dollar as a reflection of national economic power and global standing. Yet recent...

May brought renewed optimism to financial markets as the S&P 500 erased its year-to-date decline and returned to positive...