Navigating Alternative Assets: Bitcoin, Metals, and Long-Term Portfolio Strategy

Navigating Alternative Assets: Bitcoin, Metals, and Long-Term Portfolio Strategy

Investors often struggle to maintain focus on long-term objectives while navigating short-term market volatility. This challenge persists whether markets are climbing or declining. Recent attention on cryptocurrencies, commodities, and alternative investments can create urgency to react to daily news cycles, potentially triggering concerns about missing opportunities.

Seasoned investors who have weathered multiple market cycles understand that sustainable returns require disciplined approaches. Traditional assets like stocks and bonds continue to serve as portfolio cornerstones because they offer the risk-return balance necessary for achieving financial objectives. Meanwhile, market enthusiasm for specific assets, whether technology stocks or digital currencies, can shift rapidly and unexpectedly.

Successful investing centers on building portfolios that harness diverse asset characteristics while staying aligned with long-term financial plans. What matters most isn't holding the trending investment of the moment, but ensuring your portfolio supports retirement security, family provisions, homeownership goals, or philanthropic aspirations.

Recent surges in Bitcoin to record heights, copper hitting new peaks, and rising precious metals present investors with complex allocation decisions. These rallies stem from both broad market improvements and specific policy shifts in Washington, alongside growing institutional participation. How can investors evaluate these assets through a portfolio lens rather than as isolated opportunities?

Bitcoin demonstrates significant volatility patterns

Bitcoin has reached unprecedented levels amid Congressional consideration of cryptocurrency legislation during "Crypto Week." The House is examining the GENIUS Act for stablecoin regulation, digital currencies typically pegged to the U.S. dollar. Additional proposals include the CLARITY Act for clearer cryptocurrency frameworks and the Anti-CBDC Surveillance State Act, which would prevent Federal Reserve digital currency creation.

Cryptocurrencies like Bitcoin draw attention through dramatic price movements, expanding institutional adoption, new investment vehicles including ETFs, and monetary policy concerns. These factors involve considerable complexity and speculation. For long-term investors, the crucial question becomes whether digital currencies serve meaningful portfolio functions.

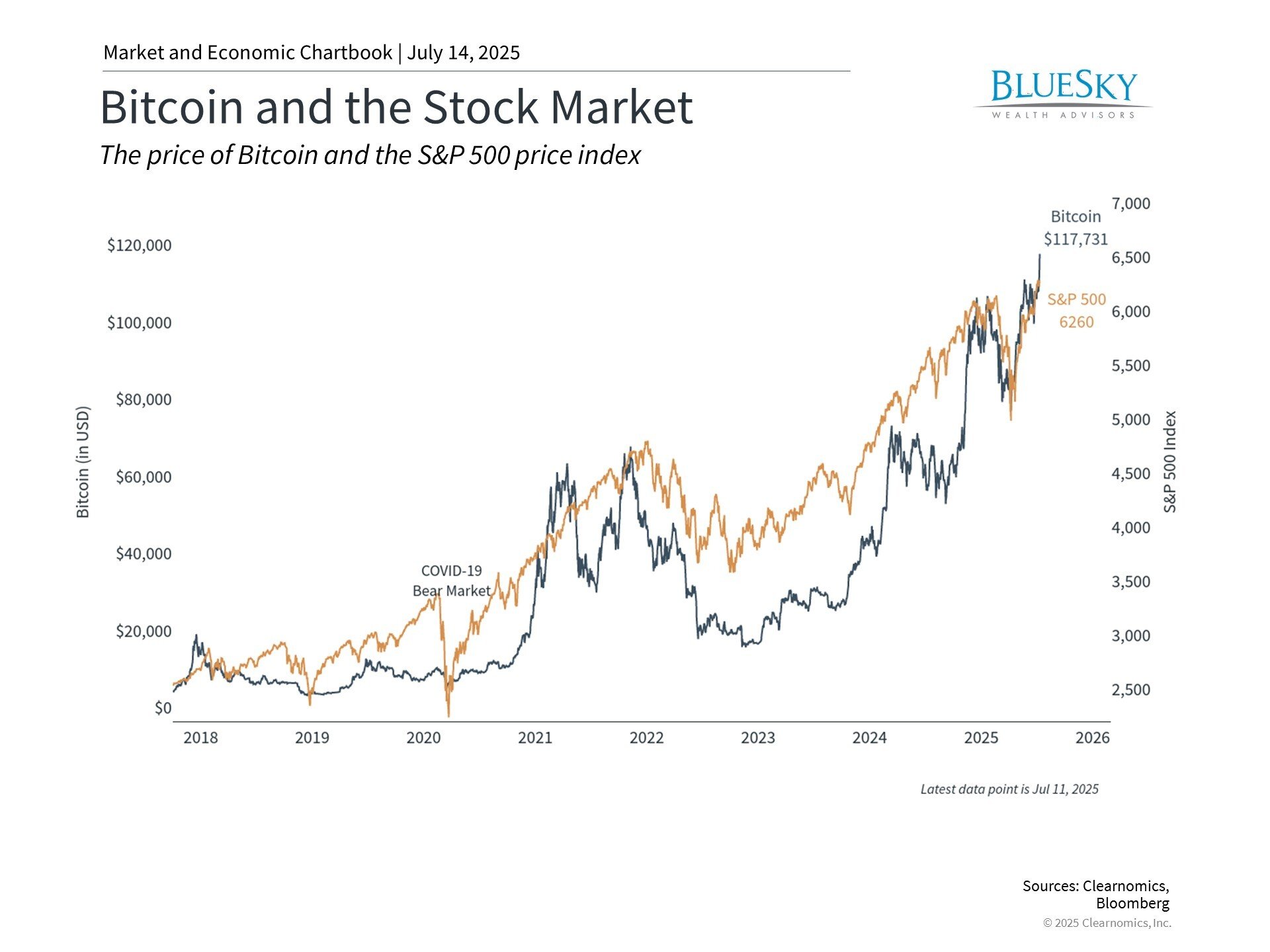

Bitcoin's portfolio suitability depends on individual objectives and risk capacity. Bitcoin exhibits price swings multiple times larger than equity markets. The 2022 bear market saw Bitcoin decline over 75% while the S&P 500 fell approximately 25%, illustrating how digital assets can magnify portfolio risk during market downturns. While Bitcoin recovered more dramatically, the chart demonstrates similar performance patterns to the S&P 500 since 2018, despite different trajectories.

Not all cryptocurrencies mirror Bitcoin's performance. Ethereum, another prominent digital currency, shows negative returns this year and has dropped roughly 25% from December highs. Numerous other cryptocurrencies and "meme coins" have followed distinct paths. Careful portfolio-context evaluation remains essential rather than headline-driven reactions.

Copper's surge reflects economic growth and trade policy

Copper has captured media attention by reaching record levels following White House announcements of 50% import tariffs.

As an industrial metal crucial for construction, electrical systems, electronics, and renewable energy infrastructure, copper plays a vital economic role. Market participants often view copper as "Dr. Copper," an economic indicator whose price movements can signal broader economic trends.

The United States imports 45% of its copper consumption, mainly from Chile, Canada, Mexico, and Peru. While tariff policies may encourage domestic production over time, they create immediate pricing and supply chain impacts. China's significant copper demand also makes the metal sensitive to global economic conditions and trade dynamics.

For investors, distinguishing between sharp price changes and portfolio fit remains crucial, similar to Bitcoin and other volatile assets. Attempting to forecast copper's direction resembles predicting precise economic and trade policy outcomes. Instead, investors should evaluate whether copper and similar assets enhance portfolio characteristics alongside other economically-sensitive holdings like equities.

Gold and silver present unique investment considerations

Gold and silver have gained recently, benefiting from traditional roles as potential hedges against currency movements, inflation pressures, geopolitical risks, and central bank accumulation. Theoretically, these precious metals can preserve value during economic uncertainty, though they face limitations including lack of income generation.

The chart illustrates gold's value increases during events like the global financial crisis. However, over extended periods, equity markets have surpassed gold performance, even after recent gains. Throughout the 2010s, many anticipated continued gold appreciation as the Fed maintained low rates. This expectation's failure highlights the difficulty and counterintuitive nature of predicting gold's direction.

For long-term investors, overall portfolio alignment with financial objectives should take precedence. Assets including Bitcoin, copper, gold, and silver highlight both potential advantages and the importance of thoughtful allocation choices. These assets should enhance, not substitute for, diversified positions in stocks, bonds, and other fundamental asset classes.

The bottom line? While various assets gain attention through recent performance, investors should resist chasing short-term gains. Understanding each asset's distinct characteristics provides the foundation for aligning portfolios with long-term financial objectives.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.