Understanding the "One Big Beautiful Bill" and Its Investment Implications

Understanding the "One Big Beautiful Bill" and Its Investment Implications

Following extensive deliberations, Congress has enacted and President Trump has signed comprehensive tax and spending legislation on July 4. This expansive budget encompasses numerous provisions, including the permanent extension of various Tax Cuts and Jobs Act components, increased state and local tax deduction limits, continued estate tax exemption levels, and additional measures. The legislation seeks to balance these benefits through targeted spending reductions, particularly in Medicaid programs.

This legislation holds significance because, despite trade policy dominating recent headlines, fiscal policy uncertainty in Washington has mounted over multiple years. Although political divisions exist regarding this budget's direction, it eliminates the looming "tax cliff" scenario - where dramatic tax policy shifts could have occurred if current provisions had expired at year-end.

For individuals, taxation directly influences numerous financial planning considerations, and this bill's specific elements carry immediate consequences for household budgets. From an economic standpoint, many investors express concern about government expenditure levels, expanding national debt, and related factors that have influenced markets over the past two decades.

Consequently, this recently enacted budget can be analyzed from multiple perspectives. What should investors understand regarding their personal financial strategies and the implications for markets moving forward?

Tax Cuts and Jobs Act provisions become permanent fixtures

The recent tax legislation, termed the "One Big Beautiful Bill" by the current administration, perpetuates and broadens several crucial elements from the 2017 Tax Cuts and Jobs Act (TCJA) that faced expiration. Additionally, it incorporates new provisions offering taxpayer benefits, which spending cuts in select areas only partially counterbalance. Below are significant provisions potentially impacting households:

- Existing TCJA tax rates and brackets receive permanent status.

These were initially scheduled to sunset at 2025's conclusion. - Standard deduction amounts rise

to $15,750 for individual filers and $31,500 for married couples filing jointly in 2025. - An additional $6,000 deduction becomes available for eligible seniors

(often called a "senior bonus") with phaseouts beginning at $75,000 gross income. This provision concludes in 2028. - Alternative minimum tax exemption achieves permanent status.

Phaseout thresholds also increase to $500,000 for individual filers, with future inflation indexing. - Child tax credit expands from $2,000 to $2,200 per qualifying child,

with subsequent inflation adjustments to preserve value over time. - State and local tax (SALT) deduction ceiling rises to $40,000

from the previous $10,000 limitation, including annual 1% increases through 2029. The limit returns to $10,000 in 2030. - Tip income deduction up to $25,000 annually

for workers earning under $150,000, effective until 2028. - Certain green energy tax incentives face elimination,

including electric vehicle and residential energy efficiency credits. - Federal debt ceiling increases by $5 trillion.

This prevents congressional debt limit debates and approvals for an extended period, diminishing political uncertainty. - Business provisions expand tax incentives

aimed at promoting domestic investment and employment opportunities.

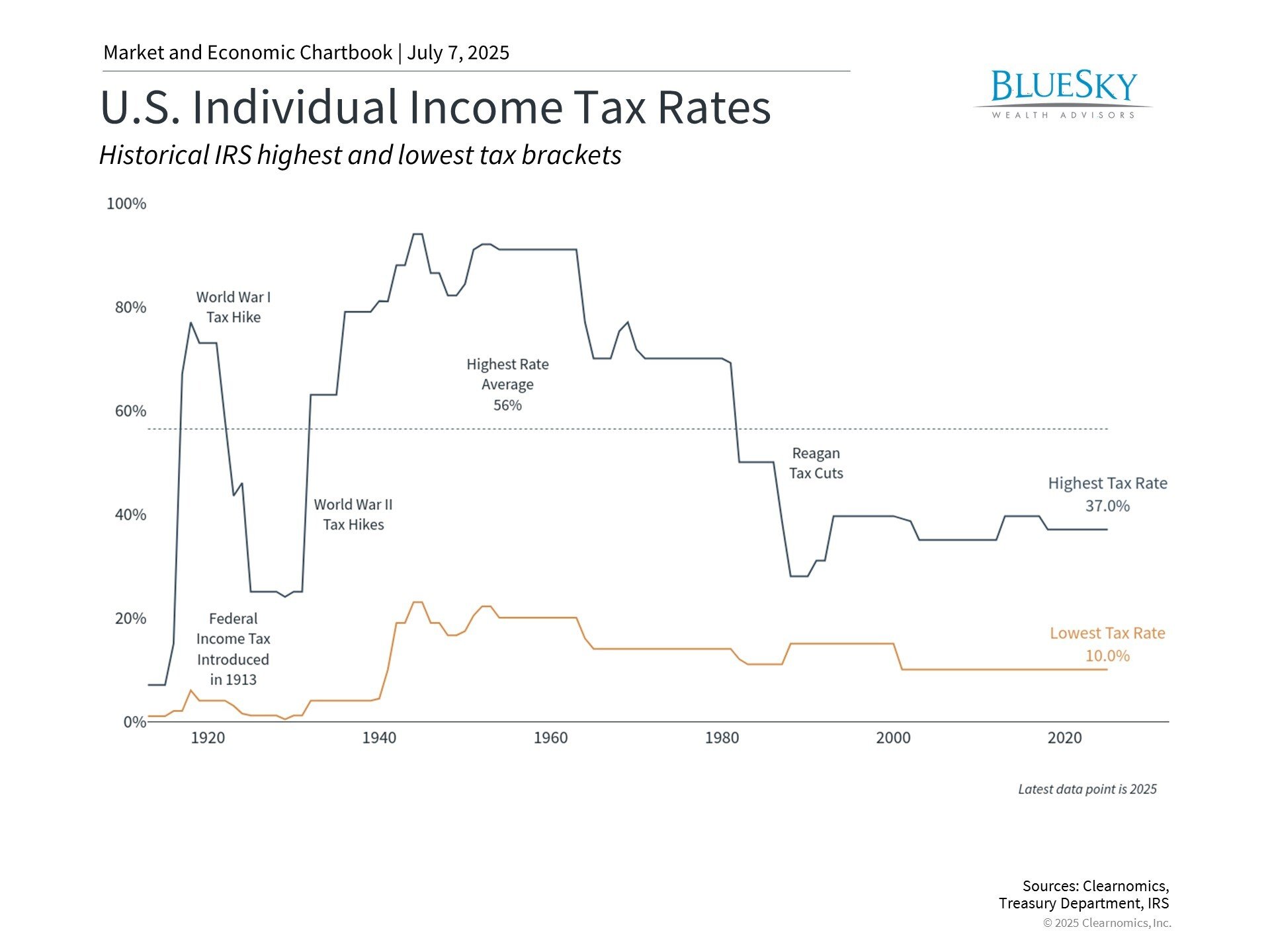

These modifications, along with numerous others, preserve the comparatively low-tax climate that has defined recent decades. The accompanying chart demonstrates that present tax rates remain substantially below historical peaks experienced throughout much of the 20th century, when top marginal rates surpassed 70% and occasionally exceeded 90% during wartime.

Mounting fiscal deficit concerns

Tax policy and government deficits represent interconnected issues. Tax reductions decrease government revenues, requiring compensation through reduced expenditures or increased borrowing. Nevertheless, most government spending supports entitlement and defense programs that prove politically challenging to modify. Treasury Department data indicates that in 2025, Social Security accounts for 21% of government spending, Medicare represents 14%, National Defense comprises 13%, and interest payments on existing national debt constitute 14%.

Consequently, government borrowing has grown consistently over the past century and will likely continue this trajectory. The Congressional Budget Office, a nonpartisan congressional support agency, projects this new tax and spending legislation will contribute $3.4 trillion to national debt over the coming decade. This occurs against a federal debt backdrop already exceeding 120% of GDP, totaling $36.2 trillion, equivalent to approximately $106,000 per American.

Regrettably, straightforward solutions remain elusive, particularly given the contentious political nature of this issue. Tax reductions can potentially stimulate economic growth, possibly offsetting revenue losses through enhanced economic activity. Conversely, Washington demonstrates a poor record of budget balancing even during strong economic periods. The most recent balanced budgets occurred 25 years ago under the Clinton administration, with the previous instance occurring 56 years earlier during the Johnson presidency.

It's crucial to remember that income taxation hasn't always existed in the United States. The contemporary income tax system originated with the 16th Amendment in 1913, initially applying modest rates to relatively few Americans. The system expanded dramatically during the Great Depression and World War II, with top rates reaching 94% by 1944. The post-war era brought various reforms, including President Reagan's Tax Reform Act of 1986, which simplified the tax code and reduced rates.

The situation has transformed significantly in subsequent years. As the accompanying chart illustrates, individual income taxes now constitute the primary federal revenue source. Social insurance taxes, or payroll taxes, are deducted from wages and fund Social Security, Medicare, unemployment insurance, and similar programs. Other revenue sources remain proportionally smaller, including corporate taxes reduced by the TCJA, and excise taxes such as tariffs.

For investors, tax policies certainly carry direct implications for financial plans and portfolios. From a macroeconomic perspective, however, fiscal implications have more constrained effects. Over extended periods, elevated debt levels can influence interest rates and inflation expectations. While these factors have been relatively high recently, many worst-case scenarios have not materialized. The key for long-term investors involves maintaining diversified portfolios capable of performing across various fiscal and economic environments, rather than reacting solely to policy changes.

Enhanced estate tax exemption limits continue

Among the provisions that would have been central to a tax cliff scenario are estate tax exemptions. The TCJA doubled these limits, which were scheduled to return to previous levels this year. However, the new tax bill's passage makes these elevated exemptions permanent, further raising the threshold to $15 million for individuals and $30 million for couples in 2026.

While estate taxes may appear to affect only higher net worth households, the reality is that all families must consider asset transfer to future generations. This requires a comprehensive approach integrating estate planning, tax efficiency, philanthropy, and long-term family wealth preservation objectives. It's also important to remember that individual states may impose estate taxes with exemption thresholds less favorable than federal levels.

The bottom line? The new tax and spending legislation perpetuates and expands the current low-tax climate. For investors, a well-structured financial plan incorporates these tax provisions. Regarding expanding deficits and national debt, it's crucial to avoid portfolio overreactions and maintain a long-term investment perspective.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.