July Market Review: Record Highs During a Turbulent Month

July Market Review: Record Highs During a Turbulent Month

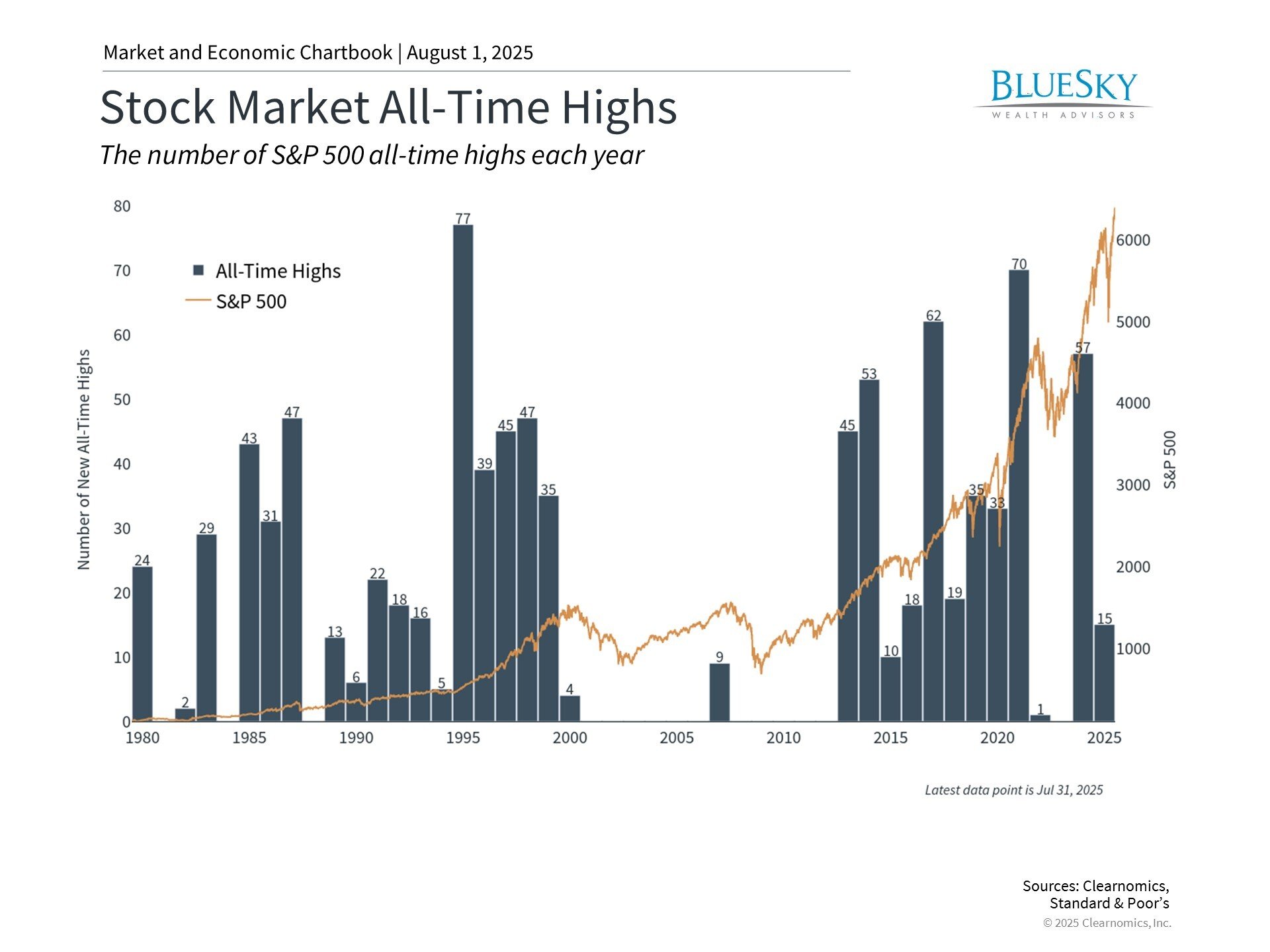

July witnessed the S&P 500 achieving ten fresh record highs, driven by robust earnings reports, steady economic indicators, and successful trade negotiations completed before the tariff implementation date. The index closed at record levels for six straight sessions during the month's latter half, contributing to a 7.8% year-to-date advance for the S&P 500.

Nevertheless, market volatility and economic uncertainties emerged as July concluded. The July 31 tariff rate announcement sparked worries about potential consumer price increases. Moreover, employment data from July indicated that job market conditions had been significantly weaker during the prior three-month period than initially reported.

Given these circumstances, investors should maintain composure while markets digest fresh trade policy developments and economic information. Recent months demonstrate how rapidly conditions can shift, reinforcing that maintaining long-term investment focus remains the most effective approach for reaching financial objectives.

Primary Market and Economic Factors

- July performance showed the S&P 500 advancing 2.2%, the Dow Jones Industrial Average climbing 0.1%, and the Nasdaq increasing 3.7%. For the year, the S&P 500 has risen 7.8%, the Dow has gained 3.7%, and the Nasdaq has advanced 9.4%.

- Bond markets saw the Bloomberg U.S. Aggregate Bond Index fall 0.3% during July. The 10-year Treasury yield increased modestly to close the month at 4.38%.

- Global equity markets showed mixed results with the MSCI EAFE developed markets index falling 1.5% while the MSCI EM emerging markets index advanced 1.7%.

- Second quarter GDP expanded at a 3.0% annualized pace, primarily attributed to improved business investment patterns and import dynamics related to tariff policies.

- The U.S. dollar index recovered from June's close of 96.88 to finish July at 99.97, though it remains substantially lower for the year.

- Bitcoin reached an all-time high of $120,198 mid-month before closing July at $116,491.

- Gold prices maintained strength but remained below recent peaks, finishing the month at $3,293.

- Copper prices hit record highs due to selective tariffs before experiencing a dramatic 22% single-day decline.

- The Consumer Price Index increased 2.7% year-over-year in June, matching economist forecasts.

- Employment growth totaled just 73,000 jobs in July. Major downward adjustments to May and June data revealed the economy performed much weaker than initially indicated. The unemployment rate held steady at 4.2%.

Equity markets achieved fresh record levels

The second quarter earnings reporting period that began in July has continued delivering upbeat results, propelling markets to new heights. Although numerous companies have cited tariff-related impacts, these effects have not been uniformly detrimental. Among S&P 500 companies that have reported, over one-third have done so, with 80% delivering earnings-per-share beats. The combined earnings growth rate now stands at 6.4% annually, below recent quarters but exceeding Wall Street projections.1

Artificial intelligence optimism bolstered multiple Magnificent 7 companies. Microsoft and Meta both delivered stronger-than-anticipated earnings while making substantial AI infrastructure investments. Consequently, Microsoft became the second company ever to achieve a market capitalization exceeding $4 trillion, joining NVIDIA. Conversely, Tesla's disappointing second quarter results weighed on its share price.

Despite technology stocks experiencing mixed performance in 2025, the Information Technology sector has gained over 13% year-to-date, trailing only Industrials which has returned more than 15% this year. Health Care and Consumer Discretionary sectors have underperformed and posted negative returns.

Fixed income markets experienced relatively quiet conditions, with bonds declining modestly overall. The Federal Reserve maintained rates in the 4.25% to 4.50% range for the fifth consecutive meeting, balancing tariff-induced inflation concerns against economic growth considerations. Notably, two Fed governors dissented for the first time since 1993, favoring a quarter-point reduction. This follows continued public disagreement between President Trump and Fed Chair Powell as the administration pressures the Fed for lower rates.

Post-meeting employment data revealed July hiring deceleration, with 73,000 jobs created during the month. Earlier reports underwent downward revisions, indicating 258,000 fewer jobs were added in May and June than originally stated. The three-month average now totals only 35,000 monthly job additions, well below historical norms. This development suggests the Fed may need to emphasize the employment component of its dual mandate, raising the likelihood of rate reductions potentially starting in September.

Market participants monitor trade agreement progress and tariff developments

Throughout July, the administration announced multiple trade agreements with the European Union, Japan, and South Korea. Negotiations with China continue. These agreements prevented the most severe outcomes many investors anticipated in April, though numerous other nations still face potentially elevated rates as negotiation deadlines approach. On July 31, President Trump signed an executive order establishing new tariff rates for various trading partners, effective August 7 (extending the previous August 1 deadline), as illustrated in the accompanying chart.

According to Yale Budget Lab estimates as of July 23, consumers now face an overall effective tariff rate of 20.2%, the highest level since 1911. To date, companies appear to have absorbed much of these additional costs rather than transferring them to consumers. Whether this pattern continues depends on final tariff levels and corporate adaptation strategies.

Congress enacted significant tax and cryptocurrency legislation

Bitcoin achieved new peaks in July as lawmakers deliberated cryptocurrency regulation legislation. The administration's perceived support for broader cryptocurrency adoption has contributed to Bitcoin's 2025 gains. Additionally, the enacted GENIUS Act addresses stablecoins, which are typically linked to the U.S. dollar.

On July 4, President Trump signed comprehensive tax and spending legislation that permanently extended numerous Tax Cuts and Jobs Act provisions, including existing tax rates and brackets. The bill enhances investor certainty by preserving the current low-tax framework while raising questions about national debt sustainability.

The Congressional Budget Office projects the legislation will increase national debt by over $3 trillion during the next decade. Although the bill included spending reductions for major programs, these were exceeded by tax revenue decreases.

Making these tax changes permanent eliminates uncertainty that has impacted long-term financial planning, as many TCJA provisions were set to expire this year. This development could bolster business investment and consumer spending in the immediate term.

The bottom line? Markets established numerous records during a volatile month characterized by tariff uncertainty, new tax legislation, and earnings reports. Moving into August, trade developments and corporate earnings will likely continue capturing investor attention.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.