Understanding Market Volatility in an Era of Trade Tensions

Understanding Market Volatility in an Era of Trade Tensions

In recent market developments, the implementation of new tariffs has created ripples across financial markets. Following President Trump's confirmation of tariffs on multiple trading partners including Canada, Mexico, and China, market sentiment has turned cautious. The prospect of additional tariffs, including retaliatory measures from affected nations, has heightened market uncertainty.

These trade policy developments have triggered concerns about potential economic impacts, particularly regarding consumer prices and business costs. This has contributed to recent market declines across various sectors.

Understanding the market impact of trade policies

During periods of market uncertainty, diversified investment portfolios demonstrate their true value. Similar market reactions occurred during previous trade tensions in 2017 and 2018, and investors have remained vigilant since the recent presidential inauguration. Market history suggests these challenges can be overcome in the longer term, despite short-term volatility.

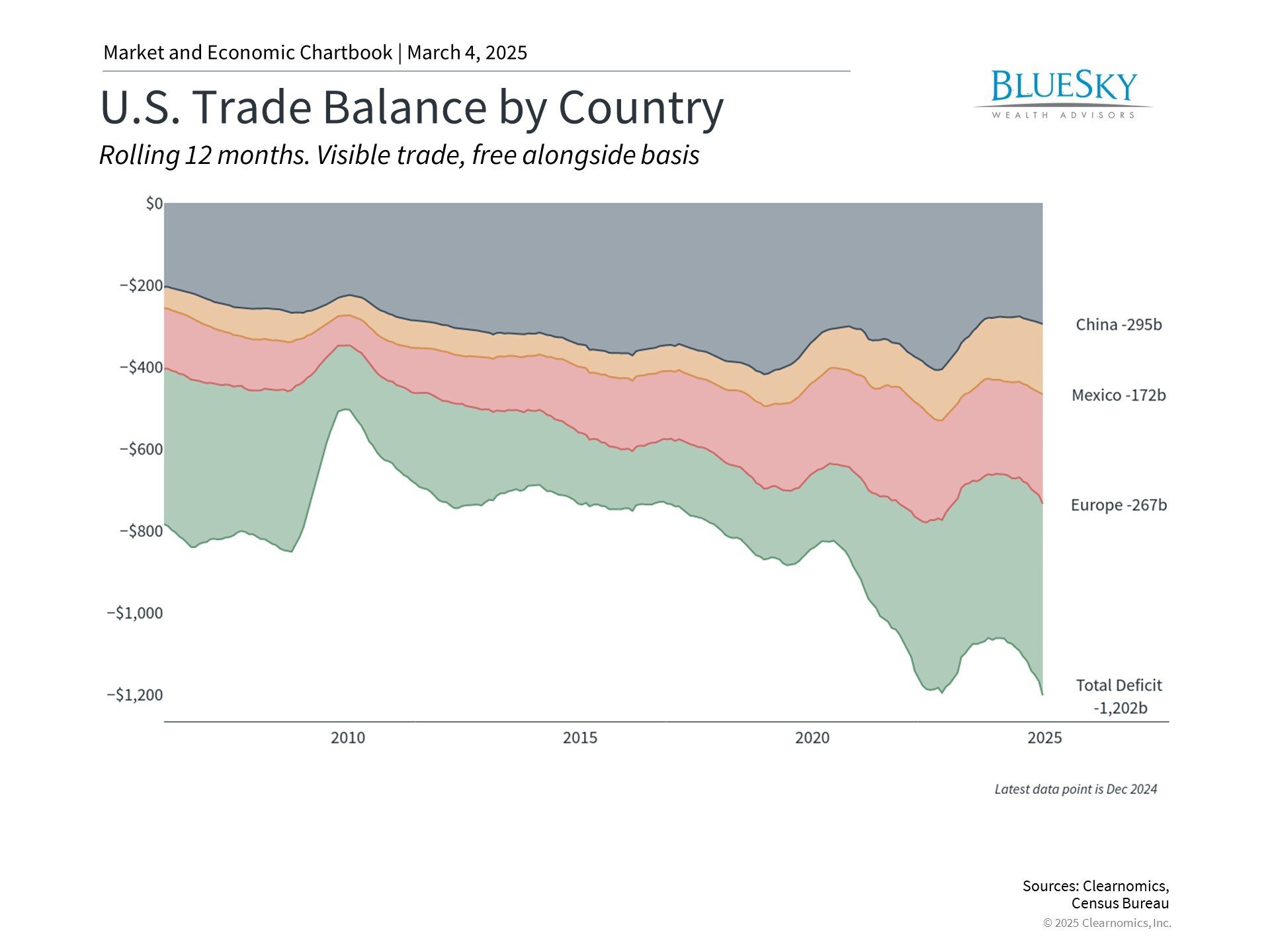

The primary concern surrounding tariffs stems from their nature as import taxes that could affect consumer prices. In the current inflationary environment, additional tariffs may put upward pressure on prices for essential goods. The situation becomes more complex when trading partners implement retaliatory measures. As illustrated in the accompanying chart, the U.S. maintains significant trade imbalances with key trading partners.

Context is crucial when evaluating current trade measures. The United States has frequently employed tariffs throughout its history, particularly during the Industrial Revolution and reaching peak usage during the Great Depression. Tariffs often serve to protect strategic domestic industries, particularly in technology and national security sectors.

During the previous administration, tariff implementation led to successful trade negotiations with various partners including Mexico and China. The current administration often employs tariffs as strategic tools to achieve broader policy objectives, including immigration control and drug enforcement.

Market responses to tariff announcements typically exceed their actual economic impact, especially when measures are temporary or lead to negotiated solutions. Despite trade-related market volatility from 2017 to 2019, overall market performance remained robust.

While current trade tensions present unique characteristics, they demonstrate how market concerns don't always materialize into lasting economic impacts.

Understanding market corrections in context

The current market correction of approximately 5% reflects normal market behavior. Similar or larger declines occurred multiple times in recent years, including twice in 2024, three instances in 2023, and numerous occasions during 2022's bear market.

Recent years of record-setting market performance may have created unrealistic expectations for continuous growth. While current year-to-date results may not match early optimism about pro-growth policies, numerous positive economic indicators persist.

Recent corporate earnings have shown robust growth. The unemployment rate remains favorable at 4.0%, wage growth continues, and productivity maintains steady progress. High yield credit spreads below pre-pandemic levels suggest bond markets maintain confidence in economic prospects.

Long-term investment success requires patience through market cycles

Recent months have demonstrated the benefits of diversification, with various sectors showing strength despite technology sector challenges. Different asset classes and geographic regions have provided portfolio balance. Bond performance has particularly helped offset equity market declines in diversified portfolios.

Historical evidence supports maintaining a long-term investment approach during market volatility. While short-term fluctuations can be concerning, consistent market participation has historically rewarded patient investors through compound returns.

While trade-related headlines will likely continue, successful investing requires a broader perspective beyond daily market movements. The focus should remain on long-term financial objectives over years and decades rather than short-term market dynamics.

The bottom line? Recent trade policy developments have contributed to market volatility, but historical patterns suggest maintaining a long-term investment perspective typically yields better outcomes than reacting to daily market movements.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.