Market Uncertainty: Navigating Economic Headwinds

Market Uncertainty: Navigating Economic Headwinds

Recent market declines in both the S&P 500 and Nasdaq have raised investor concerns.1

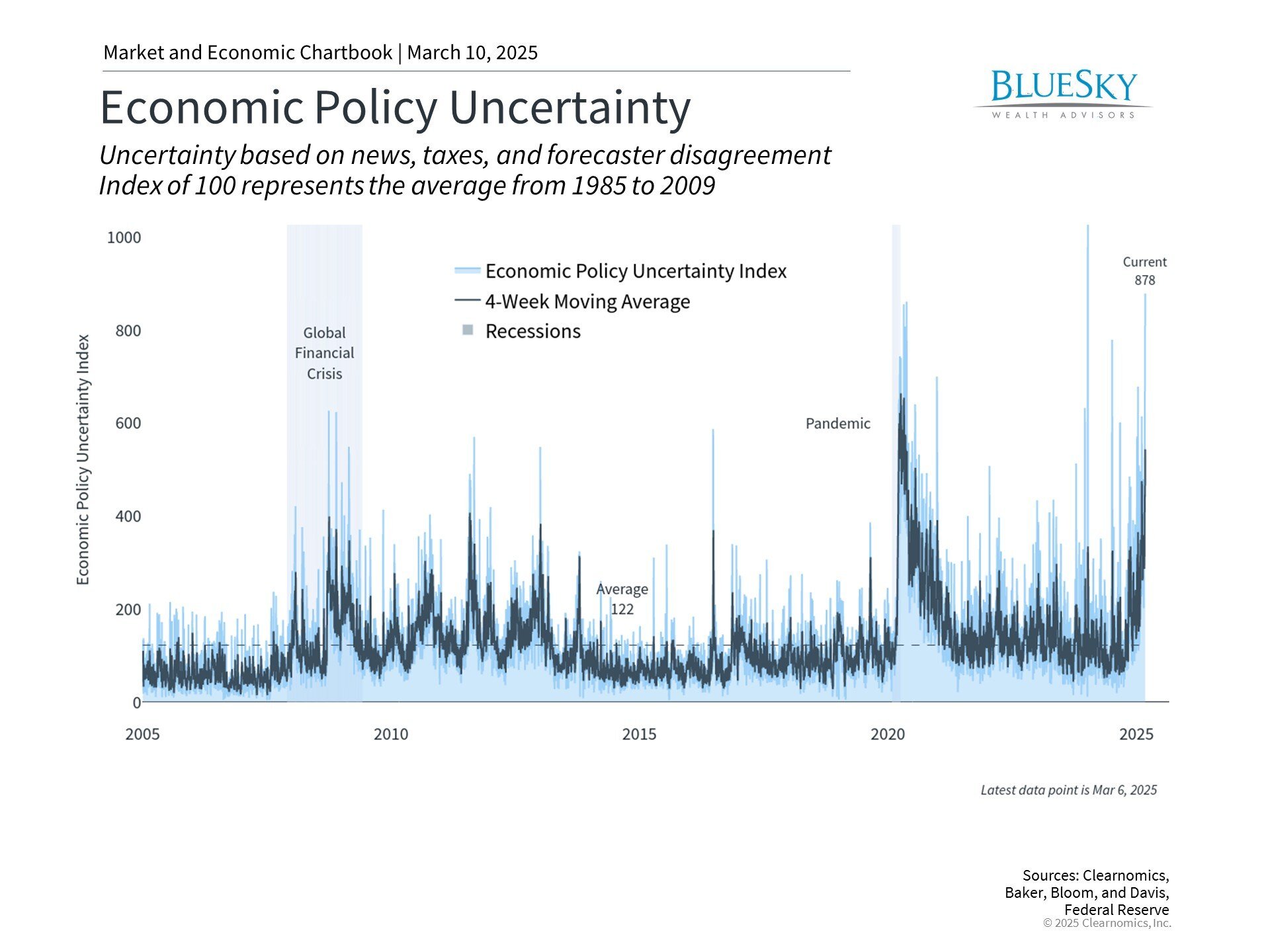

While trade tensions dominate headlines, other economic indicators including inflation trends, declining consumer sentiment, government workforce reductions, and mixed signals have contributed to market uncertainty. With President Trump acknowledging recession possibilities in recent statements, many investors are seeking guidance on maintaining perspective in this complex environment.

Economic policy uncertainty reaches elevated levels

Economic growth persists despite market concerns

Current economic indicators present a mixed picture. Inflation has unexpectedly increased above 3.0%, reaching levels not seen since last summer. The federal government workforce contracted by 10,000 in February, raising concerns about broader economic impacts despite overall job market resilience.

Consumer sentiment has deteriorated, with five-year inflation expectations reaching 3.5% - the highest since 1995. This has contributed to pessimistic outlooks regarding personal financial situations.

Interestingly, markets seem to have shifted focus from post-election optimism regarding potential pro-growth policies in manufacturing, energy, taxation, and regulation. Consumer spending has been a key economic driver, as illustrated above, while some economists anticipate potential business spending increases from policy initiatives including possible TCJA extension.

Market corrections are a normal part of long-term investing

Economic cycles naturally include periods of slower growth. Market predictions often miss the mark, and even accurate forecasts don't necessarily translate to expected market behavior. Recent examples from 2020 and 2022 demonstrate markets' capacity for rapid sentiment shifts and recovery.

Market pullbacks represent a normal aspect of investing, as shown in the chart. Despite regular corrections, the S&P 500 has demonstrated long-term growth potential, underlining the importance of maintaining perspective during periods of economic uncertainty.

The bottom line? While recession concerns have resurfaced amid mixed economic signals and trade tensions, maintaining a long-term investment perspective remains crucial. History demonstrates that staying invested through challenging periods typically supports long-term financial success.

1 Standard & Poor's and Nasdaq have declined 1.9% and 5.8%, respectively, as of March 7, 2025

2 S&P 500 price return from September 20, 2022 to March 7, 2025

3 Nasdaq Composite price return from December 22, 2022 to March 7, 2025

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.