Understanding Business Cycles and Their Impact on Your Financial Strategy

Understanding Business Cycles and Their Impact on Your Financial Strategy

Financial success often depends on understanding what elements we can and cannot influence. While market movements and economic policy decisions lie beyond our control, we maintain authority over our financial choices, planning decisions, and strategic adjustments. This perspective helps us concentrate on areas where our actions have meaningful impact.

Given current market volatility and widespread economic concerns, now presents an ideal opportunity to examine how business cycles function and their implications for financial planning.

Understanding the economic cycle

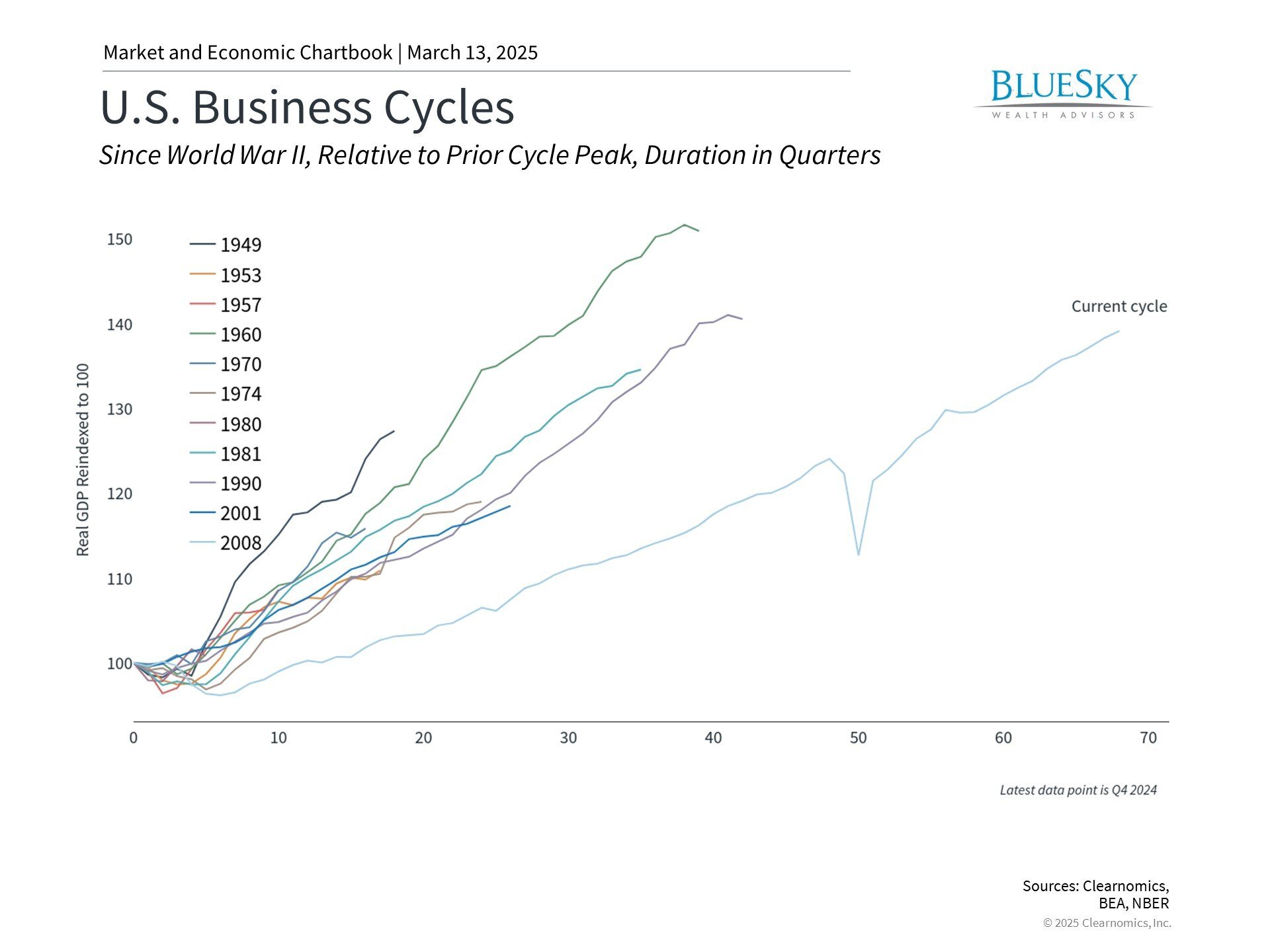

The business cycle describes how economies fluctuate between growth and contraction phases, tracked through various indicators including GDP, employment levels, and industrial output. These cycles typically span 5-10 years, though their length can vary considerably.

Since World War II, the NBER has identified twelve recessionary periods. Three significant downturns have occurred in recent decades: the pandemic-induced recession of 2020, the 2008 financial crisis, and the 2001 technology sector collapse. Many more recession concerns have arisen during this time, even when downturns did not materialize.

Economic cycles have lengthened since the high-inflation era of the 1970s and early 1980s. The period through 2008, dubbed "The Great Moderation," saw sustained growth, controlled inflation, low unemployment, and cycles averaging nine years.

The four economic cycle stages

While each cycle has unique characteristics, they generally progress through four distinct phases:

- Expansion - Economic growth accelerates, unemployment decreases, consumer sentiment improves, and business activity rises. GDP grows positively as businesses expand operations.

- Peak - Growth reaches its apex, with the economy operating at maximum capacity. Inflation pressures may emerge alongside signs of economic overheating.

- Contraction - Economic activity declines, employment opportunities decrease, and GDP growth turns negative or slows significantly. Consumer spending typically reduces during this stage.

- Trough - The cycle's bottom point, marked by peak unemployment and low business confidence, before recovery begins.

These phases often vary in duration, with some cycles extending beyond expectations while others end unexpectedly.

The 1995 slowdown demonstrates how the economy can decelerate without entering recession, as the Federal Reserve achieved reduced inflation without hampering growth.

Conversely, the 2008 financial sector crisis and the 2020 pandemic shutdown illustrate how external shocks can trigger rapid economic contractions.

While precise cycle timing remains challenging - contributing to economics' reputation as "the dismal science" - understanding these general patterns can enhance financial decision-making.

Market cycles versus economic cycles

Financial markets experience more frequent fluctuations than the broader economy. Multiple market corrections can occur within a single economic cycle, including regular short-term declines, influenced by investor psychology, market liquidity, and various external factors.

Markets often anticipate future conditions while economic indicators reflect past performance. Though economic data influences markets, they also respond to news, sentiment, and numerous other factors, sometimes resulting in exaggerated short-term reactions.

Navigating economic cycles

Instead of attempting to time markets, consider these strategies to maintain progress toward financial objectives throughout various cycles:

- Focus on long-term outcomes - Brief market movements often appear insignificant over extended timeframes and may not accurately reflect economic conditions, as demonstrated by the 2022 market decline.

- Regular portfolio adjustments - Systematic rebalancing helps maintain desired asset allocations while capitalizing on market movements, removing emotion from investment decisions.

- Align expectations with cycle position - Late-cycle periods often suggest moderating return expectations rather than pursuing higher yields through increased risk.

- Maintain emergency savings - A 6-12 month expense buffer provides flexibility during economic contractions, particularly when employment becomes uncertain.

Building resilient portfolios

Portfolio construction remains essential for navigating economic cycles. Different investments respond uniquely to economic conditions - stocks typically benefit from expansion but face challenges during contraction, while bonds can provide both income and stability across different phases.

Individual circumstances, including time horizon, risk tolerance, and financial objectives, should determine portfolio composition. While diversification may not capture maximum returns during specific cycles, it helps protect against severe losses that could compromise long-term financial plans.

The bottom line? Economic and market cycles are inherent to investing. Success comes not from predicting cycle shifts but from maintaining a balanced portfolio designed to perform across all market conditions.