Market Review: February 2025 Brings Mixed Performance Amid Policy Changes

Market Review: February 2025 Brings Mixed Performance Amid Policy Changes

Markets experienced heightened volatility in February as investors grappled with multiple challenges. The Magnificent 7 technology stocks declined 8.1% as the selloff that began in late December continued. The implementation of new policies by the Trump administration, combined with inflation concerns, created uncertainty around economic growth prospects. While corporate earnings remained robust, mixed economic signals led investors to seek refuge in defensive sectors. Fixed income investments, particularly long-term Treasury bonds, provided stability during market fluctuations.

Market Performance Overview

- The S&P 500 declined 1.4%, while the Nasdaq dropped 4.0% and the Dow Jones Industrial Average fell 1.6%. The S&P 500 maintains a 1.2% gain for the year, but the Nasdaq has reversed into negative territory with a 2.4% year-to-date loss.

- Bond markets showed strength with the Aggregate Bond index rising 2.2%. The 10-year Treasury yield closed at 4.2%, after touching 4.6% during the month.

- Inflation accelerated to 3.0% year-over-year, exceeding expectations and the previous 2.9% reading.

- Consumer spending weakened with retail sales falling 0.9%, including a 1.9% drop in nonstore retail. The savings rate edged up to 4.6%, though still below the 6.2% historical norm.

- Bitcoin experienced a significant correction, falling from $102,000 to approximately $84,000 during February.

Technology Sector Faces Headwinds

February brought considerable market turbulence driven by policy developments and renewed inflation worries. Despite reaching new record highs during the month, the S&P 500 ultimately ended lower. These market fluctuations, while challenging for investors, represent typical market behavior. The month highlighted the value of diversification as bond market gains helped offset equity losses. For those investing with a long-term perspective, maintaining focus on broader financial objectives remains crucial.

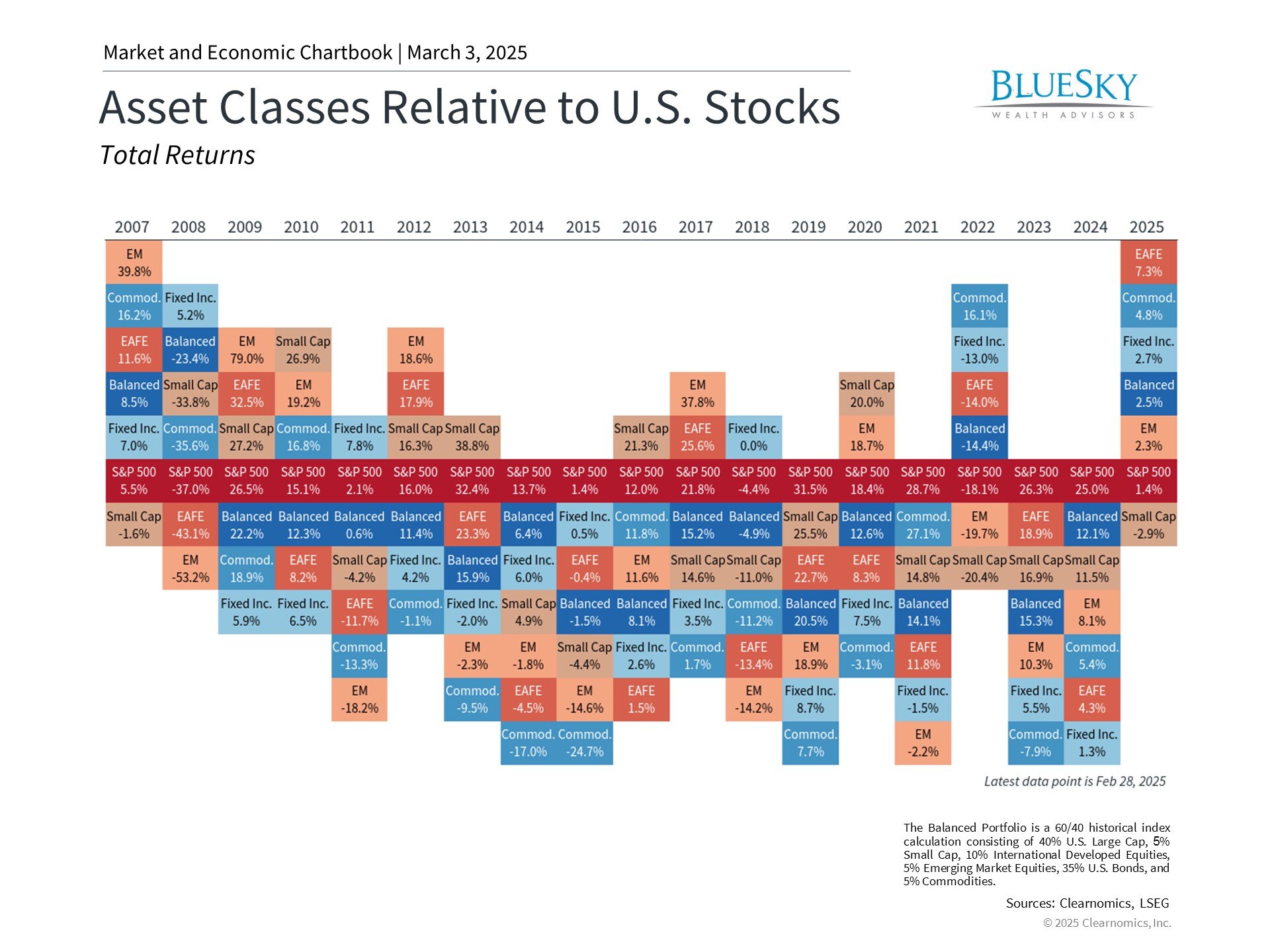

Chart: Diverse asset classes show positive returns in 2025

The technology sector, particularly the Magnificent 7, faced significant pressure despite positive developments in artificial intelligence investments and strong earnings from Nvidia. Concerns about growth prospects intensified as investors evaluated potential impacts of new tariff policies on production capabilities.

Technology and Communication Services continue to trade at premium valuations compared to historical levels, though recent declines have improved overall market valuations. Most S&P 500 sectors maintain positive year-to-date performance, with defensive sectors like Healthcare, Financials, and Consumer Staples leading the way.

The fixed income market provided portfolio support as yields declined. The 10-year Treasury yield's drop of over one-third percentage point during the month enhanced bond values, demonstrating the stabilizing effect of fixed income during equity market stress.

As illustrated above, both international investments and fixed income have outperformed U.S. stocks this year. February's market action emphasizes the importance of maintaining diversified exposure across various market segments to manage risk effectively.

Inflation Concerns Return to Center Stage

Inflation emerged as a key market catalyst in February, with the Consumer Price Index reaching 3% for the first time since mid-2024. Various inflation metrics suggested more persistent price pressures than economists had forecast.

Chart: Rising inflation expectations among consumers

Consumer sentiment reflects growing inflation concerns. The outlook for price increases has shifted significantly, with 12-month inflation expectations jumping to 4.3% from January's 3.3%. Looking further ahead, consumers anticipate inflation averaging 3.5% over the next five years.

These inflation trends have created market anxiety, particularly regarding monetary policy implications. Persistent inflation could necessitate extended periods of elevated interest rates from the Federal Reserve.

Earnings Show Underlying Economic Strength

Corporate performance remains robust amid broader economic uncertainties. Companies reported the strongest earnings growth since 2021 at 18.2% year-over-year. The earnings season demonstrated healthy economic conditions through broad-based sector growth and expanding profit margins. The proportion of companies beating earnings estimates matched the 10-year average at 75%, with larger-than-typical margins of outperformance.

Chart: Stock market performance reflects long-term earnings trends

Despite short-term market fluctuations and investor concerns, long-term market performance ultimately follows corporate earnings growth. Analysts project S&P 500 earnings-per-share of $266 for the year, implying 12% growth. While conditions may evolve, focusing on fundamental factors like earnings typically proves more valuable than reacting to daily news.

The bottom line? Market volatility reflects normal adjustment to policy changes, inflation, and technological developments. A balanced, long-term investment approach historically provides the best foundation for meeting financial goals.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.