Planning Your Retirement: Beyond Standard Withdrawal Rules

Planning Your Retirement: Beyond Standard Withdrawal Rules

With a surge in retirements expected this year, many Americans are grappling with a crucial question: how to ensure their retirement savings will sustain them throughout their golden years. The current political and economic landscape adds complexity to this challenge, making it more important than ever to understand retirement planning fundamentals.

Two critical questions emerge for those approaching or already in retirement: determining the adequate savings amount for a comfortable retirement, and establishing a sustainable annual withdrawal rate that preserves those savings.

Historical data shows varying sustainable withdrawal rates

These questions require personalized answers based on three key variables: investment portfolio performance, evolving spending requirements, and anticipated retirement duration. Understanding these elements is crucial for effective retirement planning.

While daily market fluctuations and retirement timing relative to market cycles are beyond our control, historical trends demonstrate the market's long-term growth potential and ability to recover from downturns. The key is maintaining discipline and choosing an appropriate portfolio allocation strategy.

Retirement spending typically follows a "retirement smile" pattern - higher initial expenditures during active early retirement years, followed by reduced spending in middle retirement, before potentially increasing due to healthcare costs in later years. Understanding after-tax spending needs is crucial for optimal distribution planning.

Longevity risk - the possibility of outliving one's savings - presents a unique challenge in retirement planning. Given that running out of funds typically poses a greater concern than leaving an inheritance, accurate life expectancy projections are essential, particularly as life spans continue to increase.

Key concepts for determining your retirement savings target

After considering these factors, you can begin calculating your target retirement savings. Many start with the "4% rule" as a baseline guideline.

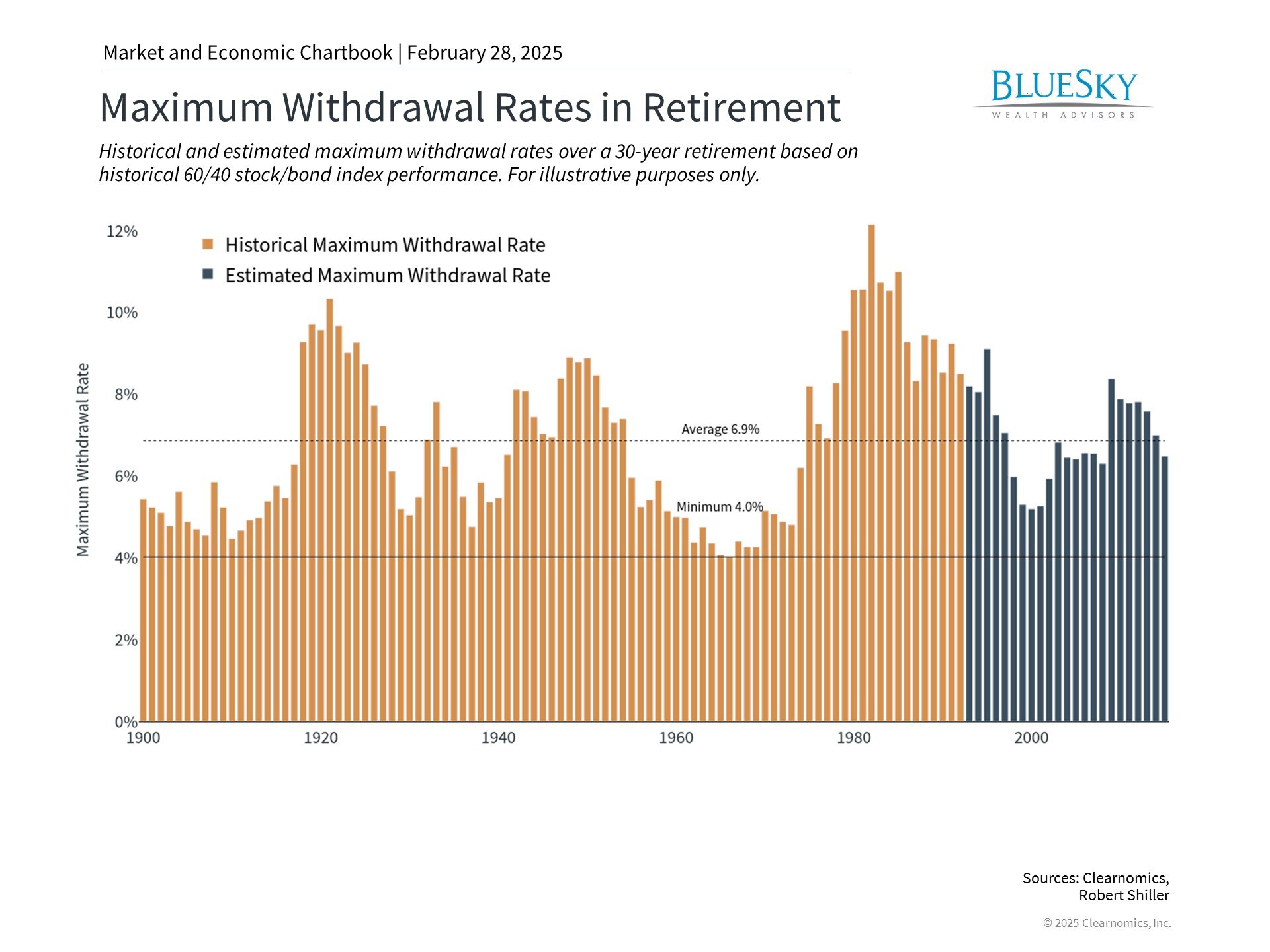

William Bengen developed the 4% rule after discovering that historically, retirees could withdraw 4% annually from their portfolio, adjusted for inflation, without depleting their savings over a 30-year retirement period.

However, individual experiences vary based on personal circumstances, market conditions, and retirement duration. Therefore, the 4% rule serves as a starting point rather than a definitive solution.

Interestingly, many retirees tend to withdraw too conservatively. Historical analysis suggests that average sustainable withdrawal rates could have reached 6.9% over the past century. Only during the 1960s did the maximum sustainable withdrawal rate drop to 4%.

Market return timing significantly affects retirement portfolio sustainability

Annual safe withdrawal rates can fluctuate significantly, reflecting market volatility. Sequence of returns risk - how the timing of market gains and losses affects a portfolio's value during retirement withdrawals - is particularly important. Current high market valuations and inflation levels suggest a cautious approach.

The 4% rule's limitations include its simplified assumptions about portfolio composition, risk tolerance, taxes, and fees. A more comprehensive approach considers individual investment strategies, risk preferences, spending patterns, and tax situations.

Success in retirement planning requires consistent adherence to an appropriate investment strategy. Emotional reactions to market downturns can prevent participation in subsequent recoveries, potentially compromising long-term withdrawal sustainability.

The bottom line? While the 4% rule provides a useful starting point, effective retirement planning requires personalized analysis of your specific circumstances and needs. Professional financial guidance can help develop a comprehensive strategy for a secure retirement.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.