Why Market Sentiment Often Conflicts with Investment Success

Why Market Sentiment Often Conflicts with Investment Success

In today's market environment, there's a notable disconnect between investor sentiment and market performance. The timeless wisdom of Warren Buffett to be "fearful when others are greedy and greedy when others are fearful" remains particularly relevant. Despite various economic and political uncertainties creating market tension, historical evidence supports the value of maintaining investment discipline for long-term success.

Current market conditions present a complex picture where investor concerns about economic factors, trade policies, and monetary policy contrast with underlying market fundamentals. The challenge for investors isn't about responding to market fluctuations, but rather maintaining a strategically designed portfolio that corresponds with their long-term objectives and risk preferences. How should investors interpret current market dynamics and maintain proper perspective?

Market sentiment reaches pessimistic levels despite positive performance

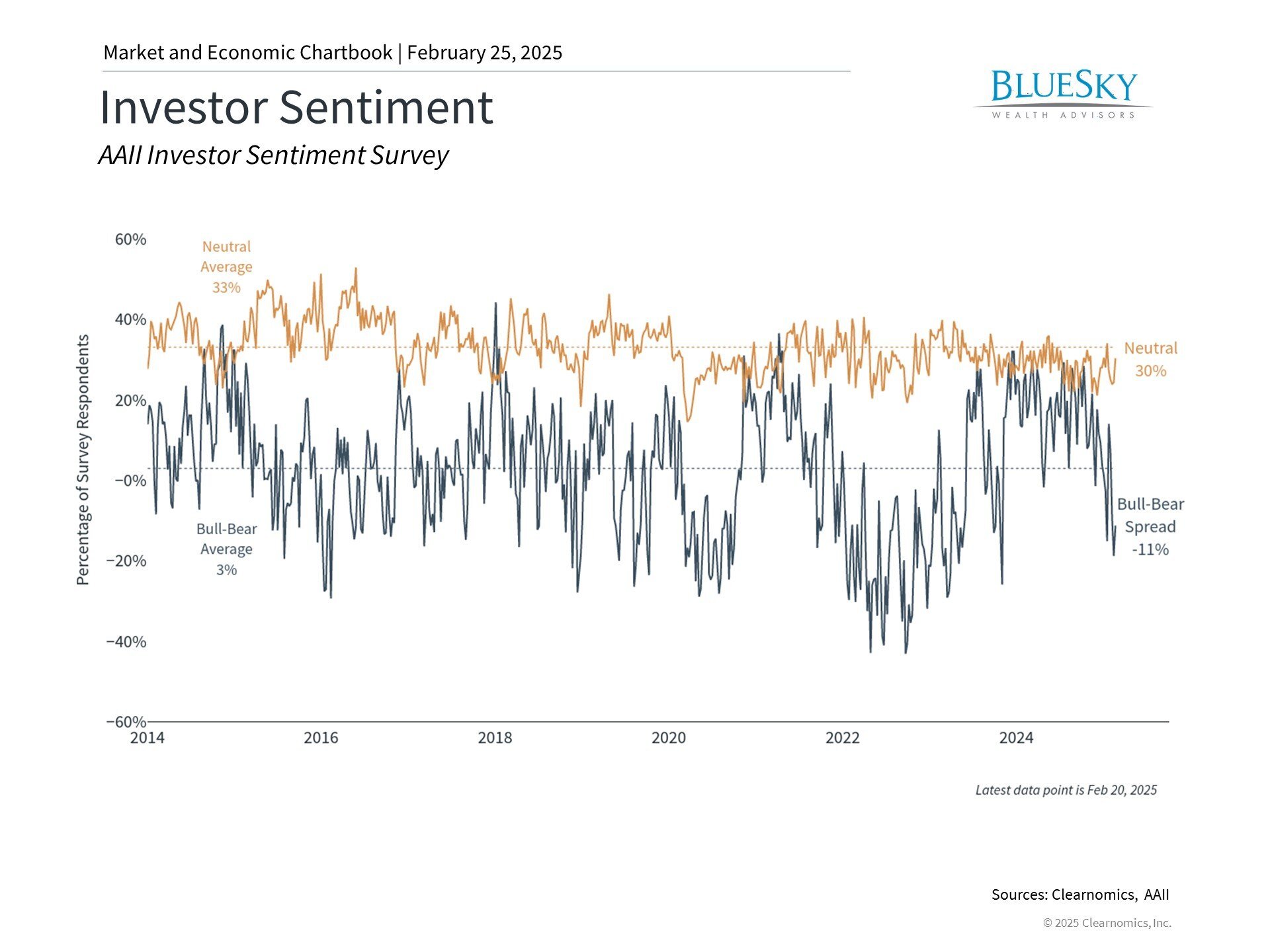

Recent data from the AAII Investor Sentiment Survey reveals a significant bearish tilt, with negative sentiment surpassing positive outlook by up to 19%. This marks the highest level of pessimism since the recession fears of late 2023. The data demonstrates how rapidly investor attitudes can shift.

A notable divergence exists between market perception and actual performance. Despite heightened market volatility and declining sentiment, major market indices have delivered positive returns in recent months. This pattern reinforces the concept that investor sentiment often serves as a contrary indicator. As Buffett's wisdom suggests, the best investment opportunities frequently emerge when investor anxiety peaks.

This phenomenon occurs because emotional responses can shift rapidly and may not accurately reflect future market drivers. Markets have demonstrated numerous instances of advancing despite widespread negativity, including the post-2008 financial crisis recovery, the 2017 trade dispute period, the post-pandemic rebound of 2020, the recovery following 2022's bear market, and various other occasions. Conversely, periods of extreme optimism often warrant additional caution.

Strategic portfolio design optimizes risk-reward balance

Understanding investor sentiment requires proper historical context, similar to how we should view our investment portfolios. Confidence comes from knowing our financial strategies are designed to endure various market conditions and align with long-term objectives, regardless of short-term market movements.

Current economic indicators show strength across several areas: unemployment remains at historic lows, manufacturing activity is rebounding for the first time since 2022, business leadership expresses confidence, and productivity metrics have improved year-over-year. However, stock market valuations are approaching historic highs, suggesting potential challenges for broad market returns in the future.

The appropriate response to mixed market signals and widespread pessimism isn't market timing or complete withdrawal. Instead, these conditions emphasize the importance of thoughtful portfolio construction. The chart illustrates the intrinsic connection between risk and reward in investment management. When valuations suggest increased risk in certain market segments, strategic allocation adjustments may be warranted.

Effective portfolio management involves balancing various asset classes while considering different market and economic scenarios, managing risk and return potential to maintain progress toward financial objectives. Market declines can create opportunities for rebalancing and acquiring quality investments at attractive prices. This disciplined approach highlights the value of working with a professional advisor in developing investment strategies.

Long-term investment success requires maintaining market exposure

Maintaining market exposure stands as a crucial principle for long-term investors. Historical evidence consistently demonstrates that staying invested through market cycles represents one of the most effective wealth-building strategies across years and decades. Despite various sources of short-term uncertainty, attempts at market timing often prove counterproductive.

The chart demonstrates that over the past 25 years, maintaining investments during market downturns proved more beneficial than temporary market exits. While past results don't guarantee future outcomes, the rapid nature of sentiment shifts explains why disciplined investors often achieve superior results.

The bottom line? While market volatility and negative headlines naturally create concern, historical evidence supports the benefits of maintaining well-structured portfolios. Investors who remain disciplined typically position themselves best for long-term financial success.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.