Understanding Market Shifts: A Balanced Approach for 2025

Understanding Market Shifts: A Balanced Approach for 2025

As we begin 2025, financial markets have experienced increased turbulence amid shifting economic signals. The S&P 500 has declined 4.3% from its December 6 peak, while the 10-year Treasury yield has moved higher to 4.76% from 4.15%.

These market movements reflect evolving perspectives on monetary policy and economic conditions. A robust December employment report suggests the economy remains resilient, potentially reducing the need for aggressive Fed rate cuts. Currently, market expectations point to just one rate reduction in 2025, possibly marking the end of the easing cycle, though such projections remain fluid as demonstrated throughout 2024.

Recent market volatility follows an extended period of stability

Context is crucial when evaluating current market conditions. While early-year declines may cause concern, it's worth noting that we're only a few trading sessions into 2025. Similar patterns emerged at the start of 2024 before markets mounted a substantial rally. Though past performance doesn't guarantee future results, short-term market fluctuations often present opportunities for portfolio assessment and rebalancing.

The past two years have been characterized by relatively subdued volatility as major indices reached historic highs. The chart illustrates that 2024's deepest S&P 500 decline was just 8%, which is modest by historical measures.

Multiple market pullbacks occur in nearly every calendar year, but markets typically recover from these temporary setbacks. Attempting to time these movements often proves counterproductive. Long-term investors who maintained their positions through various challenges - including the pandemic, inflation surge, monetary tightening, and global conflicts - have generally been rewarded.

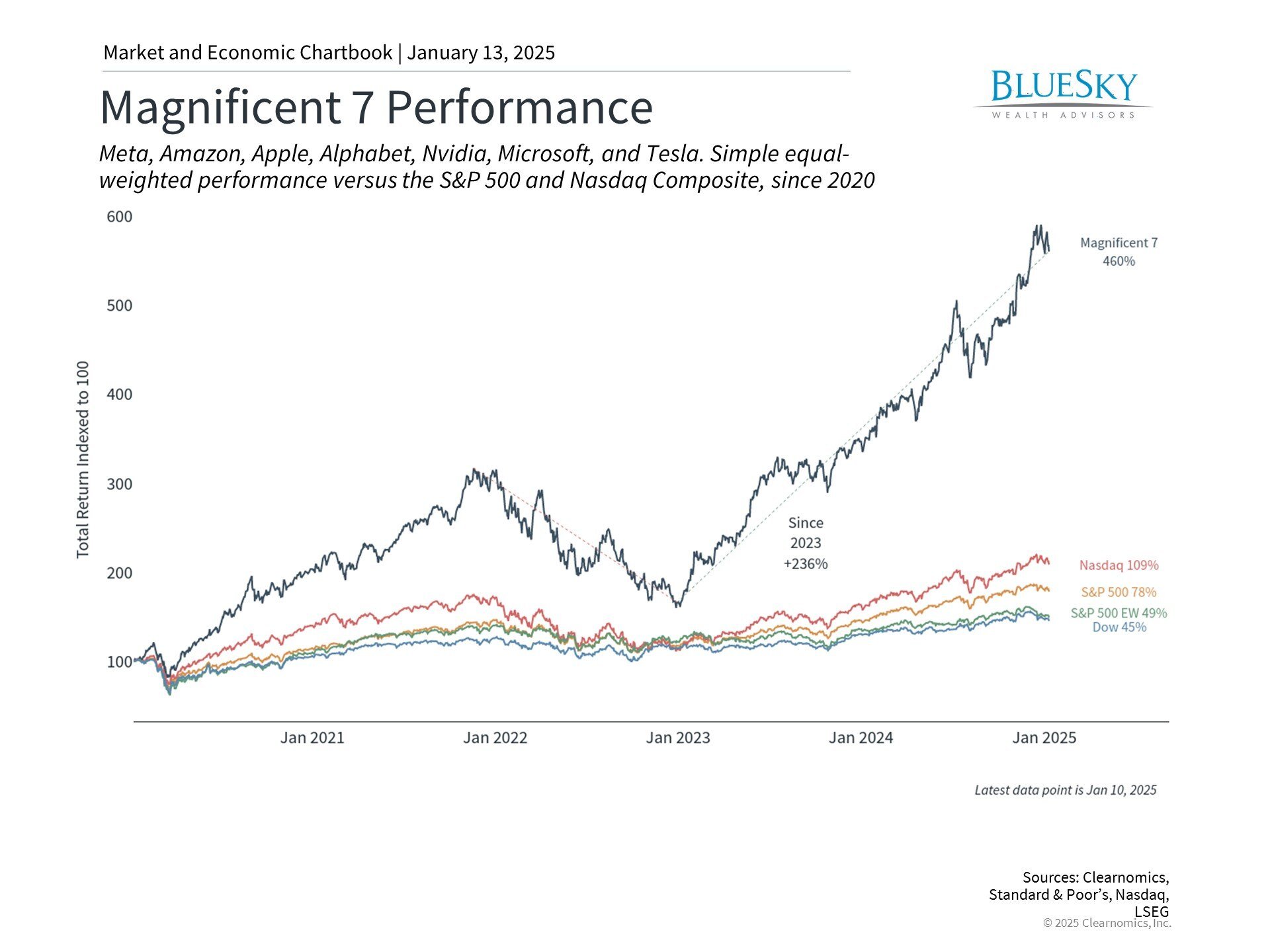

Technology leaders continue to drive market performance

The sustainability of the technology and AI-driven rally remains a key focus for market participants. The Magnificent 7 have been instrumental in broader market gains, delivering impressive returns of 250% since early 2023 and approximately 500% from 2020.

However, a broader perspective is warranted despite the Magnificent 7's remarkable performance and AI's ongoing significance. The 2022 rate-tightening cycle demonstrated technology and growth stocks' vulnerability to rising interest rates, as their valuations rely heavily on projected future earnings and cash flows.

The market-cap weighted structure of the S&P 500 means outperforming stocks can become disproportionately represented in portfolios. This may result in unintended concentration risk and heightened sensitivity to individual stock movements.

Rather than speculating on the Magnificent 7's future performance, investors should focus on building well-diversified portfolios aligned with their long-term objectives, preferably with professional guidance.

Current market valuations exceed historical averages

A distinctive feature of today's market environment is elevated valuations. The S&P 500's price-to-earnings ratio stands at 21.5x, approaching historic highs and nearing the 24.5x peak observed during the dot-com era. This has prompted discussions about potential market or AI stock bubbles.

Elevated price-to-earnings ratios indicate investors are paying premium prices for corporate earnings, potentially constraining future returns. The critical consideration is whether fundamental economic and market conditions support current valuations, unlike the scenarios in 2000 or 2008. Present indicators show continued economic growth, robust employment, and strong earnings from market leaders.

High valuations don't necessitate avoiding equities entirely. Instead, they underscore the importance of diversification across market segments that can excel in different environments. This includes considering sectors beyond technology, various investment styles, and other diversifying opportunities. The objective is to construct a portfolio that aligns with individual financial goals.

The bottom line? Recent market volatility should not prompt hasty portfolio changes. Success lies in maintaining diversified investments that can navigate short-term uncertainty while supporting long-term objectives.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.