How to Strengthen Your Financial Future: Key Resolutions for 2025

How to Strengthen Your Financial Future: Key Resolutions for 2025

As we embark on a new year, it's crucial to consider our financial health alongside our physical well-being. Following two years of robust market performance and evolving economic conditions, now is an opportune moment to assess and enhance our financial strategies.

Make investing a priority to achieve long-term financial success

Creating a comprehensive financial strategy is similar to developing a fitness regimen - it requires careful planning and consistent execution. A thorough evaluation of your current financial position, combined with concrete savings objectives and a well-structured investment approach, can provide direction throughout 2025. Particularly important is ensuring your portfolio's asset allocation aligns with both your desired returns and risk comfort level.

Whether you're focused on expanding your investment portfolio, establishing a safety net, minimizing debt, or building retirement savings, breaking down these objectives into smaller, actionable steps makes them more manageable. Here are three essential strategies to implement immediately.

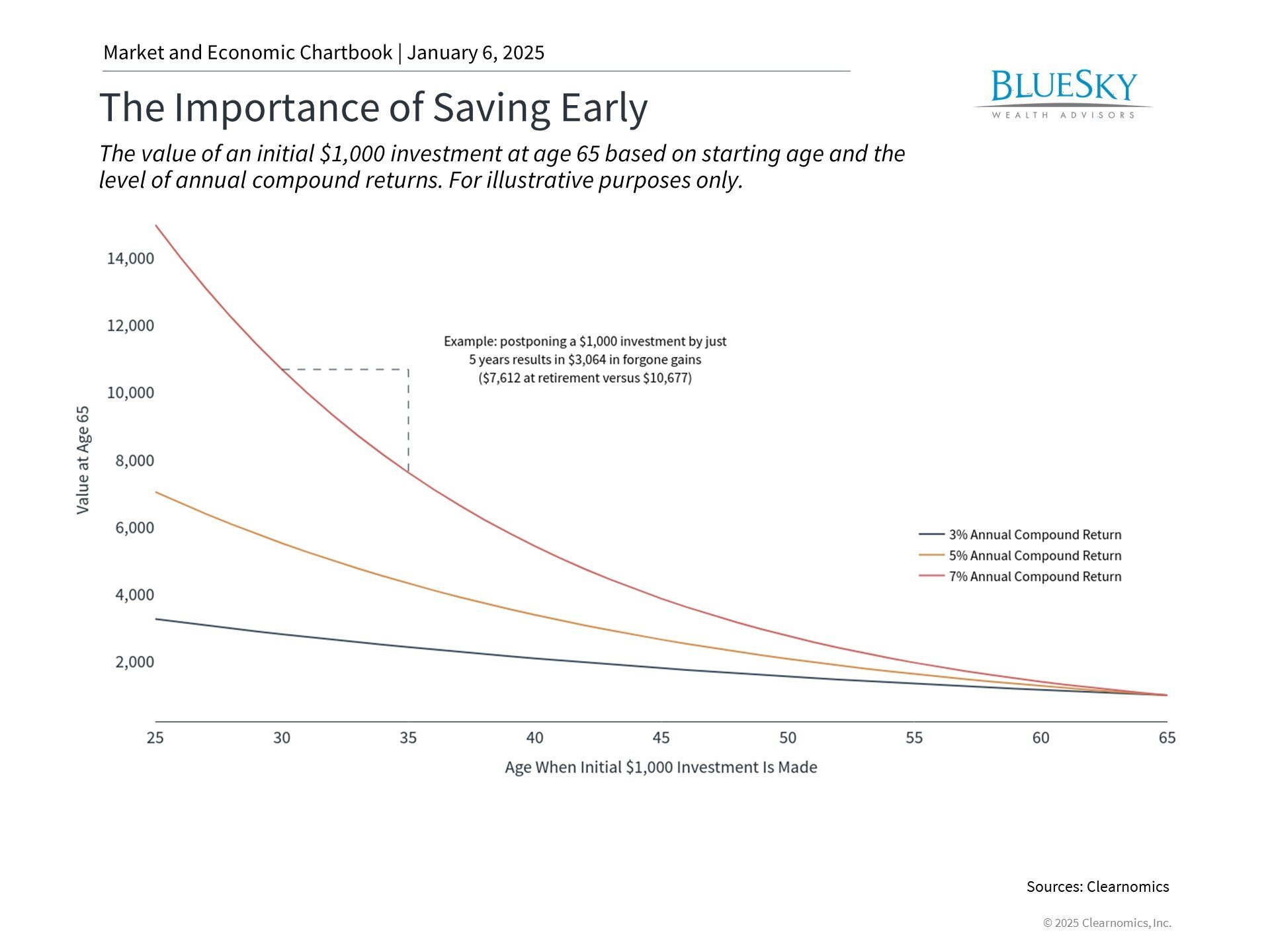

Consider the wisdom in the saying "the best time to plant a tree was 20 years ago. The second best time is now." This principle applies perfectly to investing, where time in the market amplifies wealth through compound returns. When you reinvest your gains, they generate additional returns, creating a snowball effect that transforms modest savings into substantial wealth over time.

The accompanying visualization demonstrates how delaying investment, even briefly, can significantly impact outcomes. With a 7% average annual return, investing $1,000 at age 35 instead of 30 results in $7,612 rather than $10,677 at retirement. This pattern holds true across various return rates. Throughout an investor's lifetime, these variations can become substantial, and even modest regular contributions can grow remarkably through compounding.

Market volatility, particularly when indices are near peak levels, often deters potential investors. However, the rewards of long-term investment stem from maintaining positions during challenging periods. When nervous investors exit the market, they create opportunities for patient investors to acquire assets at attractive valuations, potentially leading to enhanced future returns.

Evaluate and optimize your retirement planning strategy

The retirement landscape has undergone a significant transformation in recent decades, transitioning from traditional pension plans to defined contribution arrangements. Previously, companies typically provided defined benefit plans with guaranteed retirement payments. The chart illustrates how defined contribution plans like 401(k) and 403(b) accounts have become predominant today.

This shift has transferred retirement planning responsibility to individual employees. Workers must now navigate decisions regarding retirement account selection, tax planning, contribution levels, investment choices, and distribution strategies.

Key retirement planning considerations for 2025 include selecting appropriate account types, maximizing employer matching opportunities, and optimizing investment tax efficiency across accounts. For instance, positioning taxable fixed-income investments within tax-advantaged accounts can help manage tax implications since interest income is typically taxed as ordinary income.

While individual responsibility for retirement funding has increased, it also provides flexibility in customizing financial strategies. Given uncertainty surrounding future social programs, developing a personalized approach, ideally with professional guidance, is essential.

Plan strategically for an extended retirement period

Increasing life expectancy is a positive development, but it introduces the challenge of longevity risk - the possibility of outliving one's financial resources. Successful retirement planning involves ensuring financial security throughout an extended retirement phase.

Current retirees need larger nest eggs and more sustained income growth than previous generations. Many individuals may spend three decades or more in retirement, requiring strategies to maintain and grow savings, particularly during inflationary periods.

According to Social Security Administration data shown in the chart, current 40-year-olds have average life expectancies of 79 for men and 83 for women. However, 10% may live beyond 93 and 96 respectively. For current 65-year-olds, these projections are even higher, suggesting retirement planning should extend well beyond age 80.

Extended retirements require careful consideration of healthcare expenses, inflation impacts, and sustainable withdrawal strategies. Incorporating financial planning into broader lifestyle goals can help ensure both longevity and financial peace of mind.

The bottom line? The new year presents an ideal opportunity to establish strong financial resolutions. Implementing early saving habits, conducting retirement plan reviews, and developing strategies for sustainable income are fundamental to achieving enduring financial success.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.