Market Resilience in 2024: Key Insights for Investors

Market Resilience in 2024: Key Insights for Investors

The financial markets demonstrated remarkable strength in 2024, defying widespread skepticism. The S&P 500 delivered a robust 25.0% return including dividends, while the Nasdaq and Dow Jones Industrial Average posted gains of 29.6% and 15.0%, respectively. Global markets also showed vigor, with emerging markets advancing 8.1% and developed markets adding 4.3%, despite persistent worries about economic indicators and political events.

This performance highlights a crucial investment principle: maintaining market exposure during uncertain times often yields better results than attempting to time market movements. As we look toward 2025's inevitable challenges, the value of professional guidance in portfolio construction and financial planning becomes increasingly apparent.

The current bull market showed impressive momentum through its second year

Throughout 2024, the S&P 500 established 57 record highs, concluding near peak levels despite a mild December retreat. The market's trajectory since late 2022 has been particularly noteworthy, marking the strongest two-year performance since the 1990s with a cumulative gain of 57.8%.

Market stability was a defining characteristic of 2024, with only two significant volatility episodes occurring in April and August. These brief periods saw declines exceeding 5%, triggered by various economic concerns, but were quickly followed by strong recoveries.

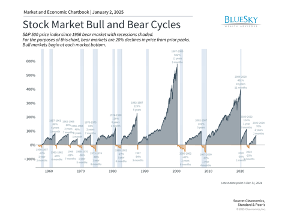

Looking at the broader context, as illustrated in the chart, bear markets historically represent shorter interruptions within longer bull market cycles. While the duration of the current uptrend remains uncertain, investors should maintain a balanced approach that considers both market phases.

The year also saw notable developments in interest rates, with policy rates decreasing by one percentage point following Federal Reserve actions. The 10-year Treasury yield finished near 4.6%, having ranged between 3.9% and 4.7% throughout the year. These rate dynamics contributed to modest bond market gains of 1.3%.

Broad-based gains characterized sector performance

The market's strength in 2024 was broadly distributed, with ten of eleven S&P 500 sectors posting positive returns. Materials was the sole sector recording a minor decline.

While artificial intelligence and technology themes continued to drive market leadership, with Information Technology and Communication Services maintaining strong momentum, numerous other sectors achieved impressive double-digit gains, including Consumer Discretionary, Financials, Utilities, Industrials, and Consumer Staples. Notably, Financials emerged as the leading sector during mid-year.

This pattern reinforces the value of maintaining diverse market exposure. Given the unpredictability of sector leadership, a well-diversified approach across market segments typically offers the most reliable path to long-term success.

Market timing presents significant challenges

As markets reach new highs, investors often contemplate waiting for price corrections before investing. While market fluctuations are inevitable, timing these movements effectively proves challenging.

Bull markets characteristically generate multiple record highs during their progression. Despite experiencing two notable pullbacks in 2024, the market consistently established new peaks throughout the year. Even during corrections, prices typically remained above earlier levels, suggesting that maintaining consistent market exposure would have been more advantageous.

Looking ahead to 2025, various concerns will likely persist, ranging from monetary policy and market valuations to fiscal challenges and geopolitical tensions. However, such uncertainties are a constant feature of financial markets.

The bottom line? The events of 2024 reinforce that maintaining commitment to a properly structured investment portfolio offers the most reliable path to achieving financial objectives. These fundamental principles will remain relevant regardless of what 2025 brings.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.