How the New Presidential Term Could Impact Markets and the Economy

How the New Presidential Term Could Impact Markets and the Economy

The financial markets are adjusting to President Trump's second term amid a mix of economic signals. Following the November election, markets initially surged 5.3% with dividends, though they subsequently retraced about half those gains early in 2025.1 As the new administration takes office, both institutional and retail investors are analyzing potential policy impacts.

The 2025 investment landscape presents unique challenges, with moderate economic expansion occurring against a backdrop of elevated valuations and potentially fewer interest rate reductions from the Federal Reserve. This environment makes market participants particularly attuned to growth-oriented policies. While numerous executive orders have already been signed, many policy specifics remain undefined. Key focus areas include taxation, government spending, international trade relations, energy policy, and immigration reform - each carrying significant economic implications.

Let's examine seven critical areas that may influence investment decisions:

- Tax policy continuation appears likely

Republican control of both the executive and legislative branches suggests an extension of the Tax Cuts and Jobs Act beyond its scheduled 2025 sunset. While specific legislative details are still emerging, key provisions likely to continue include the 37% top marginal rate for individuals, 21% or lower corporate rates, and enhanced estate tax exemptions.

The relationship between tax policy and economic performance isn't always straightforward. While tax rates influence household and business behavior, various deductions and provisions affect their ultimate economic impact.

Current tax rates remain below historical norms. Given rising federal debt levels, prudent financial planning should account for potential future rate adjustments.

- Federal deficit trends persist

Fiscal experts anticipate continued growth in federal debt levels. The 2024 fiscal year saw $6.75 trillion in spending and a $1.83 trillion deficit, pushing total federal debt beyond $36 trillion.

Recent years have seen limited appetite for deficit reduction from either major party, particularly given various economic challenges. The administration has established the Department of Government Efficiency (DOGE) to identify potential spending reductions.

Though balanced budgets remain popular with voters, their last occurrence in the late 1990s appears increasingly distant.

- Trade policy shifts could reshape commerce

Policy implementation often differs from campaign rhetoric, particularly regarding international trade. The administration has proposed broad tariffs of 10-20% on imports, with higher rates for specific trading partners. Recent announcements include potential 25% tariffs on Canadian and Mexican goods starting February 1, alongside plans for an "External Revenue Service."

The previous Trump administration implemented various tariffs, leading to new trade agreements including USMCA and the China "Phase One" deal. Many of these policies continued under President Biden.

America's trade deficit reached $78.2 billion in November 2024, reflecting robust domestic demand and dollar strength. While this indicates economic vitality, it also represents significant international borrowing.

Tariff revenue contributes minimally to federal income, typically below 2% of receipts. Economic considerations include potential inflationary effects versus intellectual property protection and domestic manufacturing support.

- Energy sector expansion planned

The administration has prioritized energy independence, declaring an emergency and establishing a National Energy Council to expand domestic production.

U.S. energy leadership continues, with record-setting oil production and dominant positions in natural gas and LNG exports.

Recent policy reversals target expanded drilling access, potentially affecting energy prices and inflation levels.

- Labor market implications of immigration policy

Beyond border security measures, immigration policy changes could significantly impact workforce dynamics, particularly regarding skilled labor immigration. Current data shows 1.2 million more job openings than available workers.

Debate continues regarding specialized visa programs, including H1B visas, with potential economic implications for industries facing labor shortages.

- Market response to policy initiatives

Initial market enthusiasm following the election reflected anticipated policy benefits, including tax stability, regulatory changes, and infrastructure investment. Certain sectors, including cryptocurrency and artificial intelligence, have shown particular strength, with Bitcoin exceeding $100,000.

However, market progress rarely follows a linear path, suggesting the importance of maintaining diversified investment approaches.

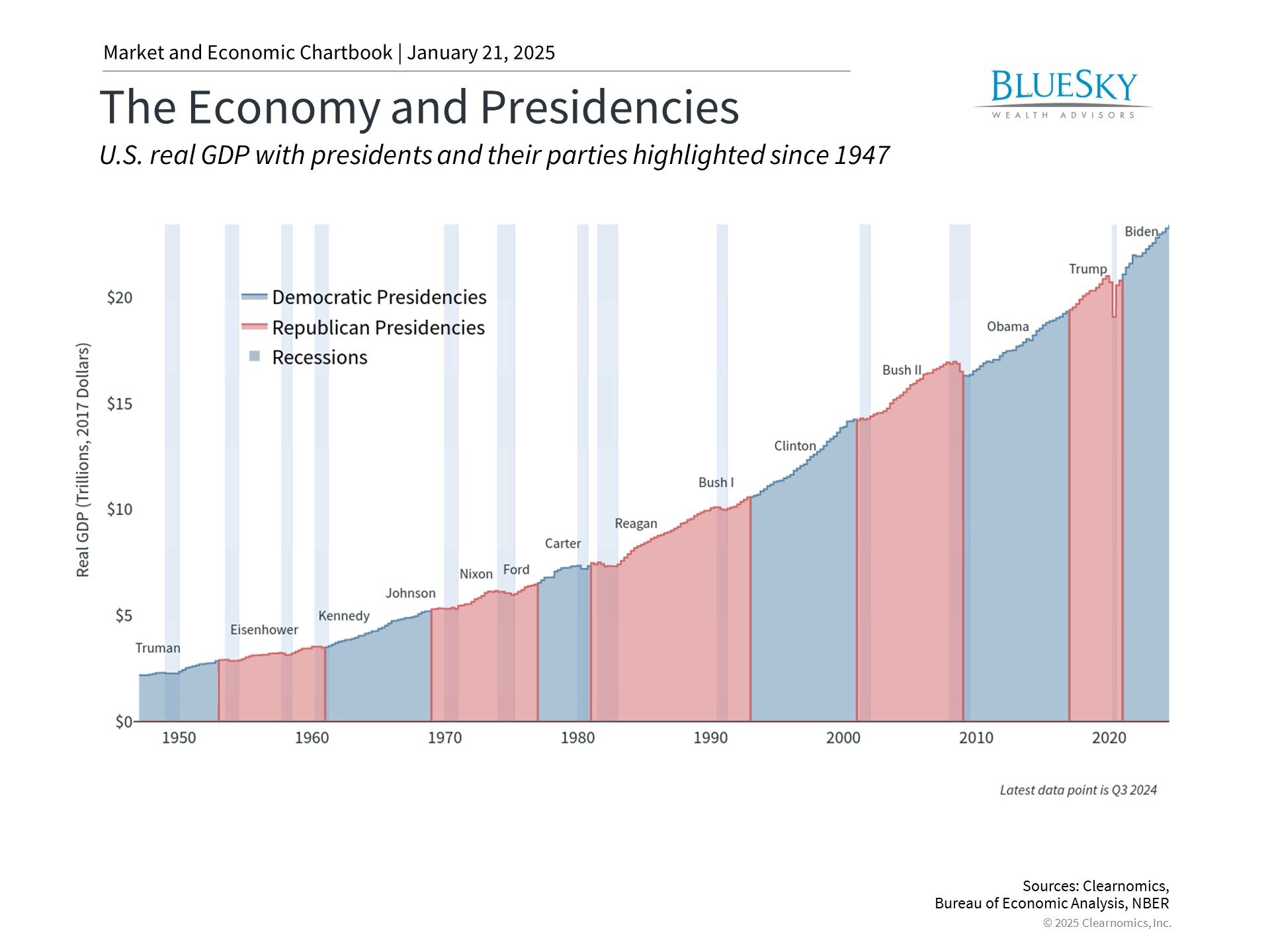

- Economic growth transcends party lines

Presidential influence on economic outcomes often receives disproportionate attention. Historical data demonstrates economic expansion and market appreciation occur under both major parties, driven largely by broader economic cycles.

While policy decisions matter, fundamental economic factors typically exert greater influence than political control.

The bottom line? While presidential policies warrant attention, successful investing requires focusing on long-term objectives rather than political developments. Maintaining a balanced portfolio approach remains crucial for navigating market cycles.

1S&P index total return, as of January 17, 2025.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.