Understanding AI Innovation's Market Impact: Lessons from the DeepSeek Development

Understanding AI Innovation's Market Impact: Lessons from the DeepSeek Development

The evolution of computing technology offers valuable historical parallels to today's AI developments. In the 1940s and early 1950s, massive computers relied on power-hungry vacuum tubes, with limited perceived market potential. A notable IBM executive reportedly claimed there would be demand for just "five computers" worldwide. The semiconductor revolution of the mid-1950s changed everything, introducing smaller, more efficient computing solutions that sparked a technological transformation.

Today, we're witnessing a similar paradigm shift in artificial intelligence with DeepSeek's breakthrough. Until now, developing sophisticated AI models like ChatGPT has required enormous resources available to only a select few companies. DeepSeek's reported innovation could fundamentally change this landscape, much like semiconductors revolutionized computing.

Their technical papers indicate a dramatic 95-97% reduction in model development costs, potentially representing as significant a milestone as the "ChatGPT moment" of late 2022. This development has sparked both excitement and concern in financial markets, leading to notable price movements in technology stocks.

Recent market movements highlight AI's growing influence

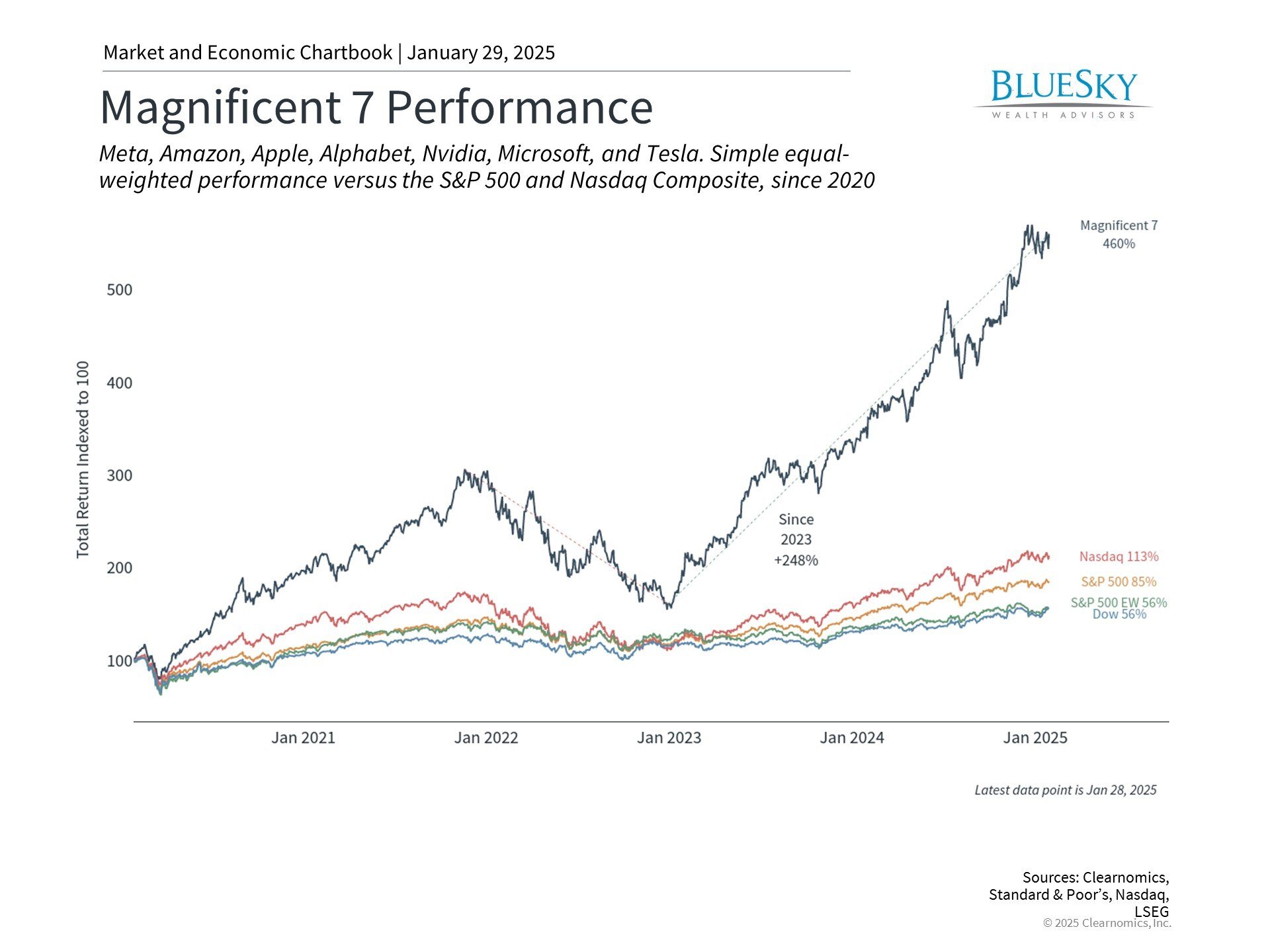

The technology sector, particularly the Magnificent 7 stocks, has been a primary market driver recently. This concentration has raised questions about market breadth and potential technological disruption risks. The S&P 500's market-cap weighting means certain technology stocks can become disproportionately influential in portfolios.

These market dynamics emphasize the importance of proper diversification and alignment with long-term investment goals. Working with financial advisors to maintain appropriate portfolio balance becomes increasingly crucial during periods of rapid technological change.

Innovation's long-term economic impact

Historical patterns show that transformative technologies often take considerable time to realize their full potential. As computer scientist Roy Amara observed, we tend to overstate technology's short-term impact while underestimating its long-term significance.

The Jevons Paradox suggests that increased efficiency often leads to expanded resource usage rather than reduction. Just as semiconductor efficiency led to widespread computing adoption, more efficient AI models could actually increase computing demand through new applications.

Current market valuations deserve attention

Market valuations, especially in AI-related sectors, are approaching levels reminiscent of the dot-com era. While high valuations can persist during bull markets, they warrant consideration when making portfolio decisions.

Though valuations shouldn't be used for market timing, they play a crucial role in asset allocation strategy. A diversified approach across sectors and asset classes can help investors capture long-term growth while managing short-term market fluctuations.

The bottom line? While technological breakthroughs like DeepSeek may cause short-term market volatility, the long-term value creation potential of AI reinforces the importance of maintaining a balanced, strategic investment approach.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.