How Higher Bond Yields Create New Investment Opportunities

How Higher Bond Yields Create New Investment Opportunities

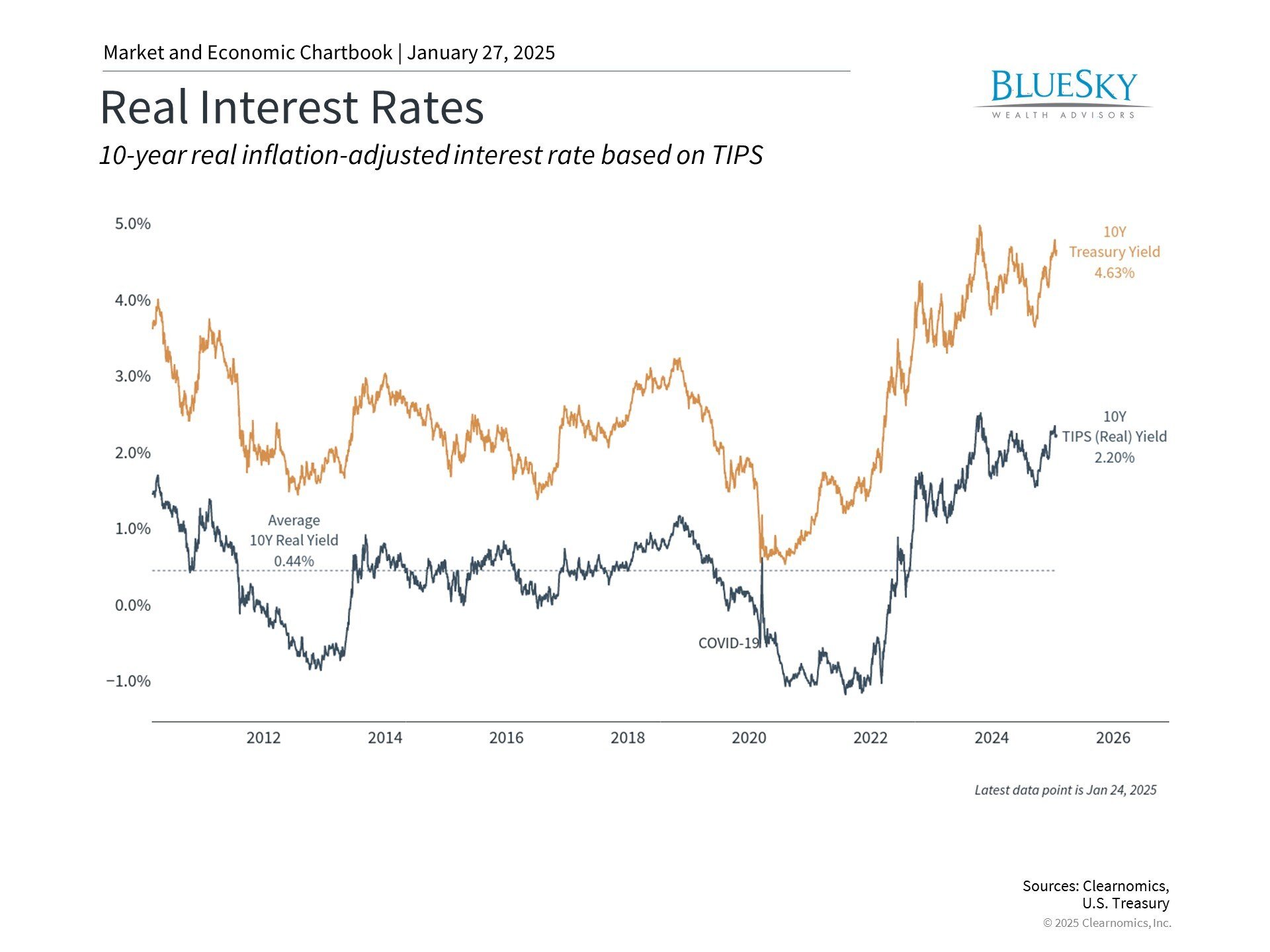

The fixed income landscape has shifted dramatically as market participants digest economic data, Trump administration policy changes, and Federal Reserve positioning. Currently, the 10-year Treasury yield stands below 4.6%, down from recent peaks of 4.8%. Meanwhile, the 2-year Treasury yield hovers around 4.2%, and 30-year mortgage rates persist above 7%.1

Market volatility has been amplified by developments in the artificial intelligence sector, with ripple effects extending into interest rate markets. For instance, fluctuations in prominent AI-related securities have influenced both equity and fixed income markets. These interconnected market dynamics provide important context for investors developing their long-term financial strategies.

Bond yields offer compelling returns after inflation adjustment

The level of interest rates plays a crucial role in determining the relative attractiveness of different asset classes. Higher rates on government bonds can provide more competitive returns from lower-risk investments. This dynamic influences the equity risk premium - the additional return investors require to choose stocks over less risky alternatives. These relationships shift as interest rates move, affecting how investors structure their portfolios.

Currently, real yields - the return on bonds after factoring in inflation - have reached levels not seen in over ten years. Bond yields surged following the presidential election in November, as markets anticipated growth-friendly policies and tax reductions, despite potential inflationary pressures from trade policies.

Understanding the inverse relationship between bond prices and yields is essential - as yields increase, existing bond prices decrease, and vice versa. This relationship affects those who actively trade bonds.

For retirement-focused investors holding bonds to maturity, the current high-yield environment offers enhanced income potential. This increased income can help fund retirement expenses and potentially reduce the need for asset sales. Higher yields may also improve portfolio diversification benefits as bonds become more competitive with other investments. Individual circumstances vary, making professional guidance valuable.

Stock valuations face pressure from rising rates

The equity risk premium can be evaluated through the earnings yield - calculated by dividing corporate earnings per share by stock prices. This metric allows for direct comparison with bond yields by showing how much companies earn relative to their market value.

Looking at the chart, we can observe that the S&P 500's earnings yield has steadily decreased over the past 15 years. Currently, it approximates the 10-year Treasury yield, indicating reduced stock market attractiveness compared to historical levels. This reflects both higher interest rates and strong equity market performance. Historically, investors have sought higher premiums for accepting stock market risk.

A compressed equity risk premium doesn't necessarily signal an imminent market correction. Historical bull markets have sustained periods of low earnings yields, particularly in low-rate environments. However, it does indicate elevated broad market valuations relative to alternatives.

The current market valuation level largely reflects significant technology sector appreciation in recent years. Other market segments maintain more moderate valuations, emphasizing diversification's importance. Success depends on maintaining appropriate asset allocation and risk levels aligned with personal investment goals and timeframes.

Fixed income provides crucial portfolio balance

Current bond yields represent some of the most favorable opportunities in over ten years. This is particularly relevant as short-term cash yields are projected to decline with Fed rate cuts, affecting various cash-equivalent investments. Bonds often appreciate during uncertain periods when interest rates fall, helping offset equity market volatility.

Fixed income remains a cornerstone of portfolio diversification, regardless of interest rate direction. Beyond their historically lower volatility compared to stocks, bonds frequently move counter to equity prices. This negative correlation helps stabilize portfolios during market transitions, reducing overall risk and supporting long-term investment success.

The bottom line? The current interest rate environment presents attractive fixed income opportunities that enhance portfolio yield and diversification potential. Maintaining a long-term perspective while adhering to established investment strategies remains crucial.

1 As of January 24, 2025.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.