Market Navigates Policy Changes and Tech Disruption in Early 2025

Market Navigates Policy Changes and Tech Disruption in Early 2025

The financial markets kicked off 2025 with gains despite heightened volatility as investors processed significant policy and technological developments. The transition to the Trump administration, groundbreaking developments in artificial intelligence, and the Federal Reserve's monetary policy stance created a complex market environment. These factors, combined with new trade policies, are shaping economic expectations for the year ahead.

Market Performance and Economic Indicators

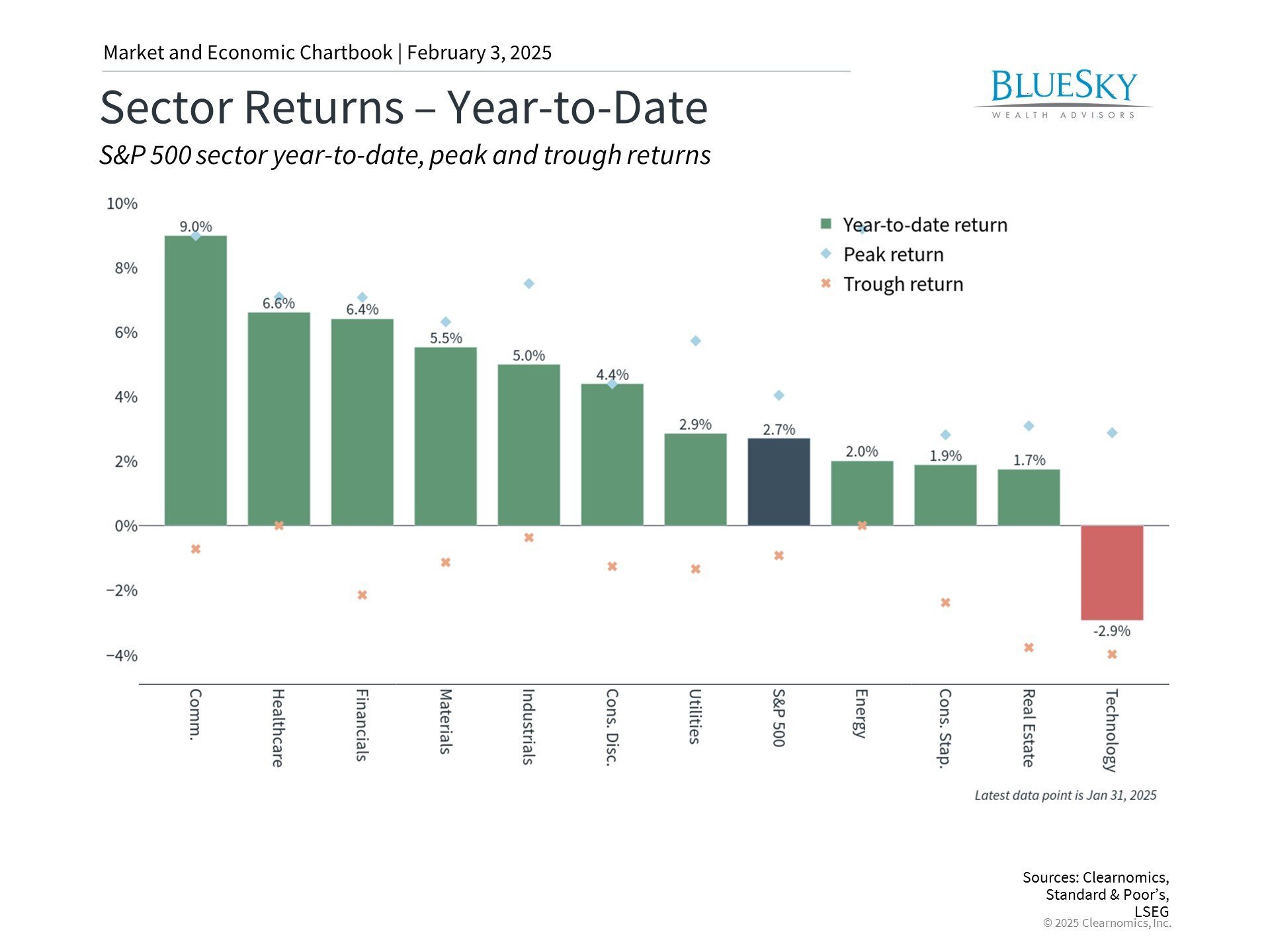

- The Dow Jones Industrial Average led major indices with a 4.7% gain, while the S&P 500 rose 2.7% and the Nasdaq advanced 1.6%.

- Treasury yields fluctuated significantly, with the 10-year reaching 4.8% before settling at 4.5%.

- The Fed maintained its target rate range at 4.25-4.50% after previous rate reductions.

- The economy expanded by 2.3% in the fourth quarter, resulting in 2.8% growth for 2024.

- Annual inflation measures showed persistent price pressures, with CPI at 2.9% and PCE at 2.6%.

Technology Disruption and Policy Developments

A major development in artificial intelligence emerged from China as DeepSeek announced a potential breakthrough in resource-efficient AI model training. The company claims to achieve similar results with dramatically reduced computing requirements compared to industry leaders. This development, while still under scrutiny and facing challenges from competitors, has implications for the entire technology sector and its energy consumption patterns.

Technology sector responds to evolutionary developments in artificial intelligence

The significance of technological advancement extends beyond the tech sector itself. As digital transformation and AI capabilities become increasingly integral to business operations across all industries, these developments have broader market implications that affect diverse investment portfolios.

Policy changes in Washington have introduced new dynamics to international trade relationships. The administration has implemented broad tariffs, including 10% on Chinese imports and 25% on Canadian goods. A proposed 25% tariff on Mexican imports has been temporarily suspended following diplomatic negotiations.

These trade measures have introduced new variables into the economic equation, with potential implications for inflation and growth. The Canadian government has already enacted reciprocal measures, and the full economic impact remains to be determined. The current tariff structure represents a broader approach compared to previous trade policies.

Trade policy adjustments affect major North American trading relationships

Historical context suggests that while markets initially react strongly to trade policy changes, businesses have demonstrated adaptability in managing supply chain challenges. The 2017-2019 period showed that despite similar concerns, markets proved resilient and trade negotiations ultimately led to new agreements.

Economic experts are assessing the potential impact on consumer prices and business operations. Different sectors face unique challenges, from automotive supply chain complexity to agricultural import costs and energy market adjustments. The full effects of these policy changes will emerge gradually over time.

The Federal Reserve's decision to maintain current rates following three consecutive cuts reflects confidence in economic stability while acknowledging persistent inflation concerns. Market projections now indicate expectations for fewer rate reductions in 2025, though such forecasts remain subject to change.

The Fed's stance is supported by robust economic growth, strong employment data, and ongoing inflation pressures. Recent price increases, particularly in energy, have contributed to elevated inflation readings. Bond market behavior suggests investors anticipate an extended period of restrictive monetary policy.

As markets continue to process new administration policies, monetary policy decisions, and technological advancements, maintaining investment discipline becomes increasingly crucial. A long-term perspective remains essential for navigating market fluctuations and achieving investment objectives.

The bottom line? January's market activity demonstrates the importance of maintaining a long-term investment perspective amid policy shifts and technological changes. A well-structured portfolio, combined with professional guidance, remains the most effective approach to managing market uncertainty.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.