Understanding Trade Policy's Impact on Markets and Investment Strategy

Understanding Trade Policy's Impact on Markets and Investment Strategy

In early 2025, markets face various challenges including concerns over technology sector performance, interest rate movements, and government policies. Trade policy has emerged as a particularly significant factor, with President Trump's administration implementing tariffs targeting Canada, Mexico, China, and the European Union. These developments raise important questions about appropriate investor responses to such policy shifts.

Trade imbalances remain a key economic focus

When evaluating trade-related market developments, long-term investors benefit from maintaining a broader perspective. Trade discussions can shift rapidly, and announced tariffs don't always translate into implemented policies. The administration's tariff strategy serves multiple purposes beyond industrial protection, including border security enhancement, drug trafficking prevention, and revenue generation.

Protectionist trade policies have deep roots in American history, dating back to the Industrial Revolution's support for domestic manufacturing. Notable examples include the McKinley Tariff of 1890, which imposed nearly 50% duties on numerous imports, and the Smoot-Hawley Tariffs of 1930, which contributed to Depression-era economic challenges by restricting global trade.

These experiences led to a prolonged period of trade liberalization and the creation of international trade organizations. Free trade theory suggests that when nations specialize in their comparative advantages, all participants benefit. However, this shift also resulted in domestic manufacturing job losses as production moved to regions with lower labor costs.

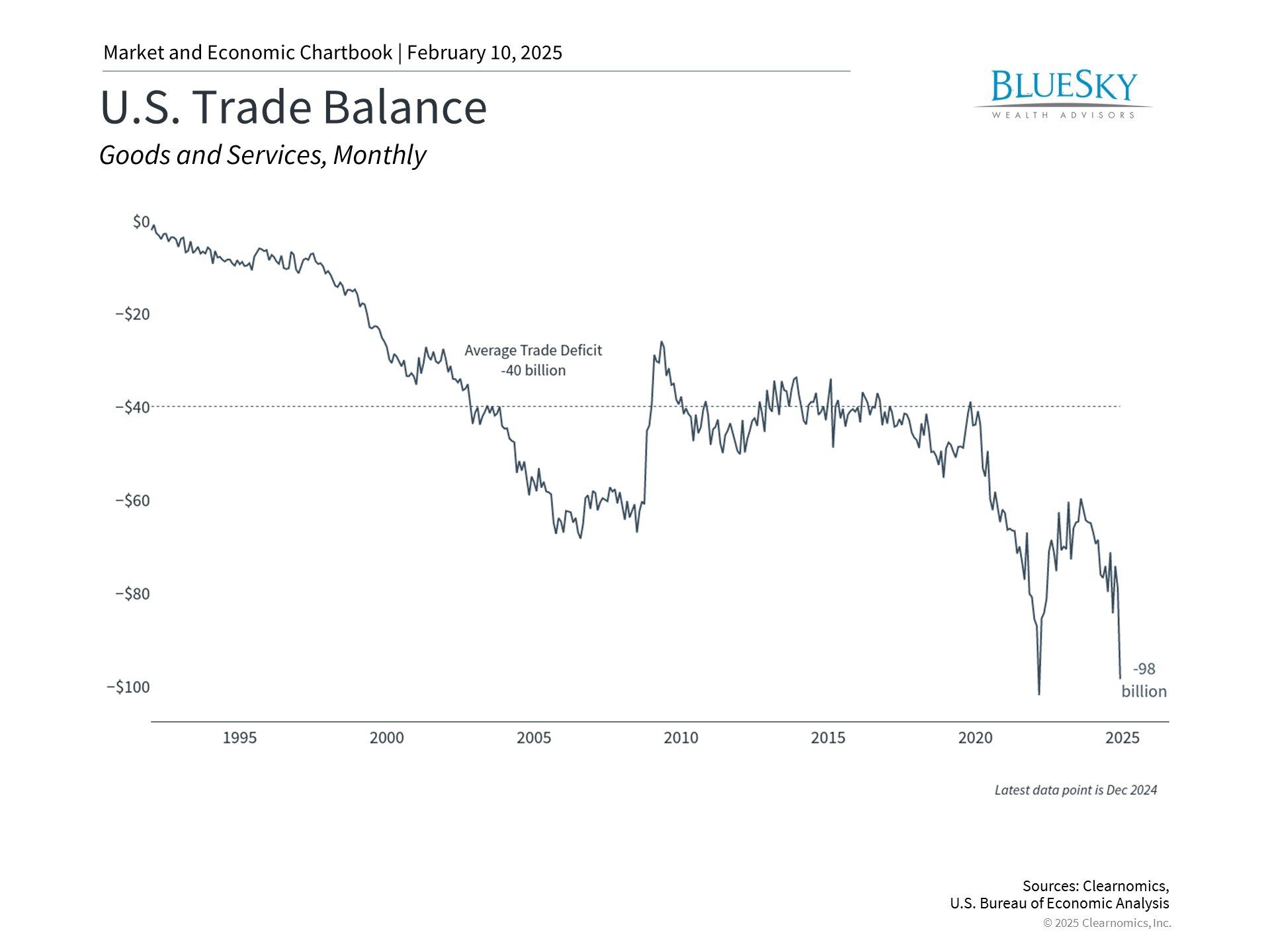

The current administration has reverted to more protective trade policies, similar to approaches taken during President Trump's first term. As illustrated above, the United States maintains a substantial trade deficit, importing significantly more than it exports.

Current trade measures include new 25% tariffs on steel and aluminum potentially affecting all trading partners, reciprocal duties on nations taxing American goods, temporary exemptions for Canada and Mexico, and additional measures targeting China. China's response includes 15% tariffs on energy imports and 10% duties on various American products, reminiscent of the 2018-2019 trade tensions.

Historical perspective shows evolving tariff significance

Market responses to tariff announcements typically exceed their actual economic impact. Despite trade war concerns during Trump's previous administration, markets performed well. The 2018-2019 trade disputes didn't create the severe global disruption many feared, instead serving as negotiating leverage for agreements like USMCA and the China trade deal.

As shown above, tariffs constitute only 1-2% of government revenue under "Other" sources, demonstrating their limited fiscal importance. Nevertheless, many policymakers advocate for trade balance improvements to strengthen domestic manufacturing, boost export-related employment, and reduce foreign borrowing dependence.

The trade deficit also reflects American economic strength and consumer purchasing power. Higher disposable income enables increased imports naturally expanding the deficit. Additionally, foreign capital inflows seeking American investment opportunities partially offset the trade imbalance, supporting domestic innovation and job creation.

Currency markets reflect trade policy shifts

Since the 2024 election, trade concerns have contributed to dollar appreciation. This connection exists because international trade fundamentally influences currency values. Reducing imports decreases dollar selling pressure, supporting currency strength, as demonstrated by recent dollar gains against major currencies.

Tariffs can influence consumer prices and inflation rates. Companies often transfer increased import costs to consumers through higher prices, particularly affecting trade-dependent sectors like electronics, automobiles, and household goods.

These developments warrant measured consideration from investors. While tariffs serve multiple policy objectives, their long-term market impact often proves limited. Despite causing temporary uncertainty, affecting currency markets, and potentially increasing consumer costs, markets have historically demonstrated resilience to trade policy shifts.

The bottom line? Trade policies and tariffs, while significant for global commerce, typically have less market impact than headlines suggest. Investors should maintain focus on long-term financial objectives rather than reacting to short-term trade developments.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.