Key Tax Planning Strategies for Your Financial Future

Key Tax Planning Strategies for Your Financial Future

When even a brilliant mind like Albert Einstein found income taxes perplexing, as he reportedly confided to his accountant, it's clear that navigating the tax system requires careful attention. As we approach the April 15 tax deadline, it's worth remembering that effective tax management extends far beyond annual filing requirements - it's a fundamental component of comprehensive financial planning.

Success in tax planning starts with organization. Maintaining detailed records of tax documents - including W-2s, 1099s, and charitable donation receipts - creates a foundation for both compliance and strategic planning. This organizational discipline facilitates collaboration with financial advisors and tax professionals while enabling the exploration of tax optimization opportunities.

Understanding the role of taxes in your broader financial picture can help prevent missed opportunities. While tax strategies can be intricate, their impact on long-term financial outcomes makes them worthy of careful consideration. However, it's essential to recognize that tax planning isn't one-size-fits-all, making professional guidance invaluable.

Let's examine five critical tax considerations that deserve attention throughout the year.

- Strategic Tax Planning for Retirement

Tax-efficient retirement planning requires continuous attention and should be integrated into your overall financial strategy. While retirement accounts offer valuable tax benefits, optimal utilization involves balancing multiple factors including current and projected income levels, life events, and strategic timing of contributions and investments.

Effective retirement tax planning encompasses both contribution and distribution strategies. Understanding the distinctions between retirement vehicles - such as 401(k)s versus IRAs - and their respective deadlines is crucial. For example, while IRA contributions can be made until tax day, potentially reducing your previous year's taxable income, 401(k) contributions must be completed by year-end. Those over 50 should also consider catch-up contribution opportunities.

The retirement phase introduces additional tax considerations, particularly regarding Social Security benefits and Required Minimum Distributions (RMDs). Early planning for RMD obligations helps avoid penalties and optimize withdrawal strategies, especially given recent regulatory updates.

- Leveraging Tax-Advantaged Options

Several powerful tax planning tools merit consideration in your financial strategy.

- Health Savings Accounts offer unique triple tax advantages: deductible contributions, tax-free growth, and tax-free qualified medical expense withdrawals.

- Roth accounts can benefit those anticipating higher future tax rates, offering tax diversification and tax-free inheritance benefits.

- Roth conversion strategies may provide long-term tax advantages by transitioning traditional IRA assets to Roth status.

- Backdoor Roth IRA strategies remain viable for high-income earners, though careful execution is essential.

Professional guidance is crucial in determining which strategies align with your specific circumstances.

- Legacy Planning Considerations

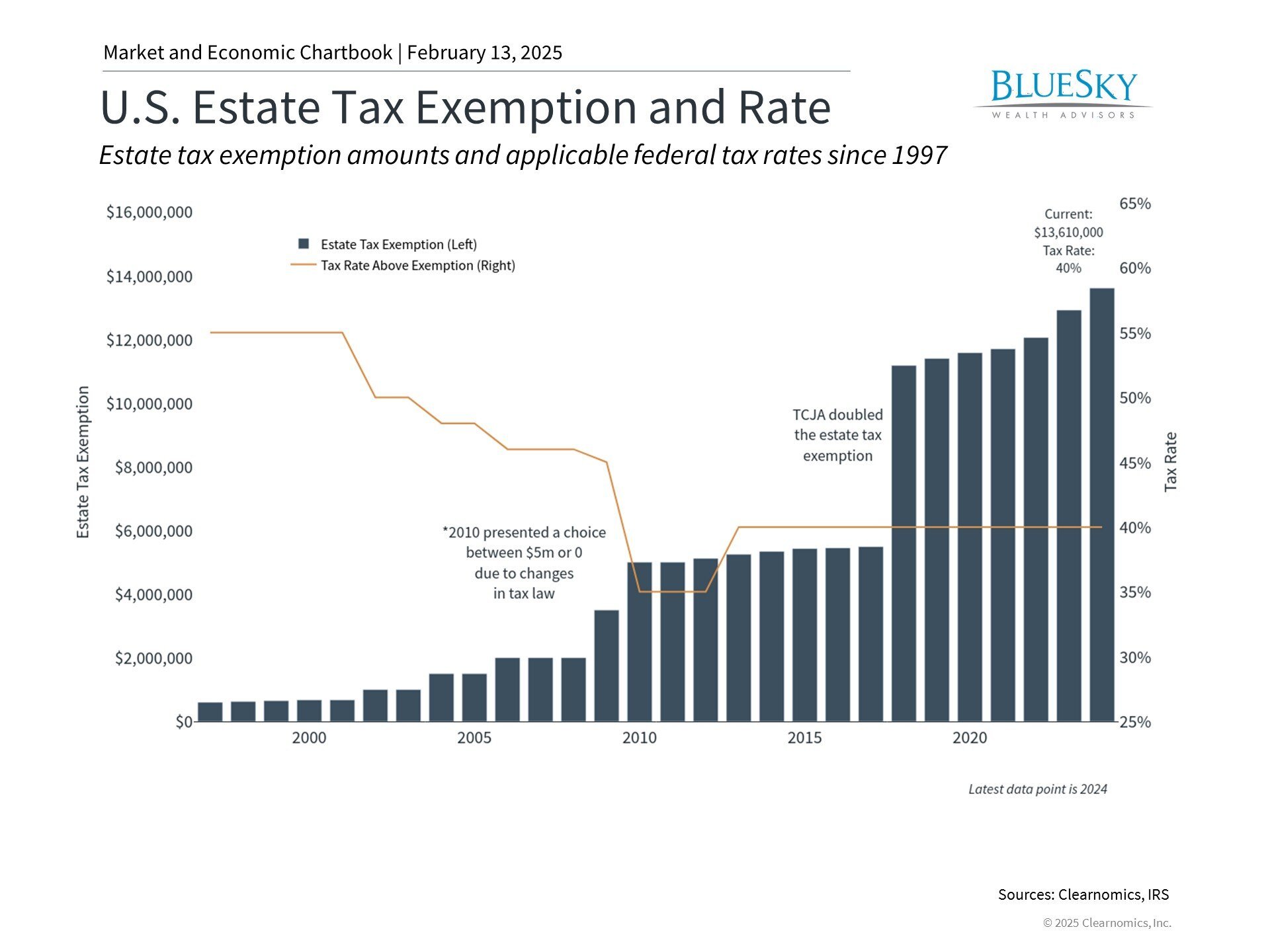

Modern wealth transfer planning has become increasingly sophisticated, particularly given the dynamic nature of tax policy. Current federal estate tax exemptions - $27.22 million for married couples and $13.61 million for individuals - create significant planning opportunities, though these represent just one aspect of comprehensive legacy planning.

A thorough wealth transfer strategy integrates estate planning, tax efficiency, and generational wealth preservation objectives. This may include charitable giving considerations. Proactive planning can help optimize tax outcomes while ensuring your legacy wishes are fulfilled.

The available tools range from basic estate documents to complex trust structures. Given varying state regulations and tax frameworks, professional guidance is essential for developing and maintaining effective strategies.

- Tax-Aware Investment Strategy

While year-end tax management often focuses on capital gains and loss harvesting, early-year planning presents distinct opportunities. A comprehensive approach considers both timing windows to enhance tax efficiency while maintaining portfolio balance.

Various investment vehicles carry unique tax implications. For instance, RSUs become taxable upon vesting, regardless of sale status. Mutual fund distributions, municipal bonds, cryptocurrencies, real estate, and collectibles each present distinct tax considerations requiring professional review.

Forward-looking tax planning should account for anticipated expenses, charitable intentions, and estate planning needs. This includes evaluating tax-efficient funding sources and reviewing portfolio diversification across asset classes and business interests.

- Adapting to Tax Policy Changes

While President Trump's return suggests potential extension of the Tax Cuts and Jobs Act, significant tax reforms require Congressional action. Long-term political shifts can influence tax policy, making flexible planning approaches essential when making extended financial decisions.

The bottom line? Successful financial planning requires ongoing attention to tax considerations throughout the year. By integrating tax strategy into your comprehensive financial plan, you can better position yourself to achieve your financial objectives.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.