Lifestyle Changes to Consider in Retirement

Lifestyle Changes to Consider in Retirement

As you approach retirement, it’s essential to re-evaluate your lifestyle and financial strategies to ensure a smooth transition into this new phase of life. From relocating to rethinking your spending habits, these lifestyle changes can help you enjoy a fulfilling retirement.

Changes to Consider as You Enter Retirement

Think About Moving

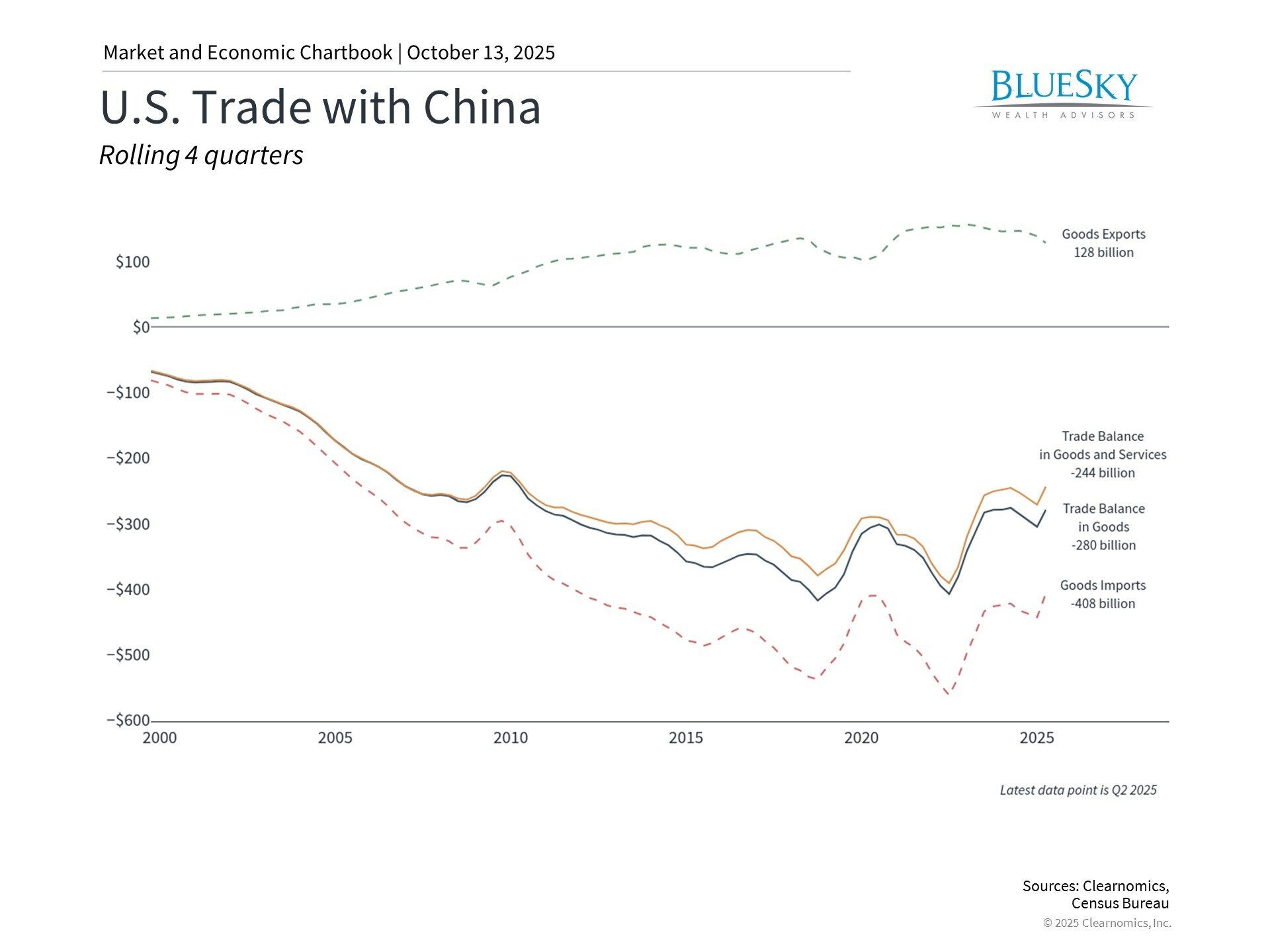

For many retirees, especially those who have built wealth in high-cost regions, such as Silicon Valley, relocating can be a smart move financially. While you may have enjoyed significant financial success during your career, preserving that wealth requires the right strategies, including moving to a lower-cost area.

Choose Your State Wisely

When choosing where to move next, consider the tax implications of that move by identifying states that align with your financial and lifestyle goals. For instance, some states offer exemptions for retirement income or provide favorable options for withdrawing funds from your 401(k). States like Florida and Texas, for example, have no state income tax, making them attractive options for retirees looking to maximize their savings.

Reassess Your Housing Needs

As you enter retirement, it’s important to evaluate your living situation and pinpoint areas where you can make some cuts. Many retirees find they spend less time at home, focusing instead on travel, leisure, or family visits. With this in mind, one consideration many retirees act on is downsizing to a smaller home. Not only do you no longer need the extra space, but downsizing also comes with significant financial savings.

Reevaluate Monthly Spending

In retirement, your financial landscape will shift significantly. While it may have been comfortable to spend $20,000 a month when you were earning a paycheck, your financial reality will change once you stop working and it’s important to take another look at your monthly spending to account for this change.

Understanding Changes in Spending

- Eliminate Work-Related Costs: You’ll no longer have commuting expenses or work-related costs like professional attire.

- Anticipate Higher Healthcare Expenses: Plan for increased healthcare costs, as medical expenses often rise with age.

- Adjust Lifestyle Choices: Be mindful of your spending habits, as the need to stretch your retirement savings will be essential.

Identify Your Income Sources

In your working years, your income was primarily from your salary. In retirement, however, you’ll likely rely on multiple sources of income, which can include:

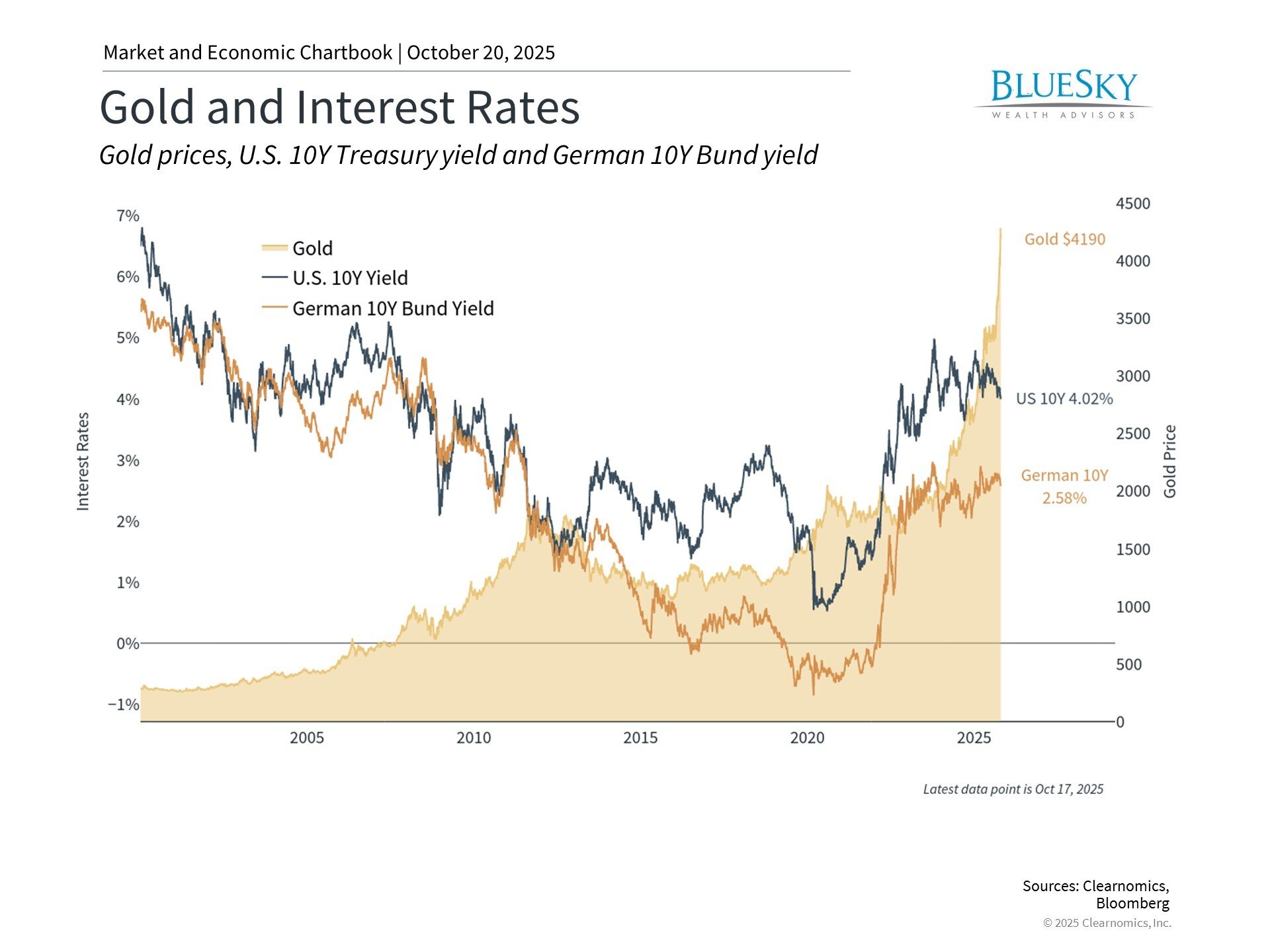

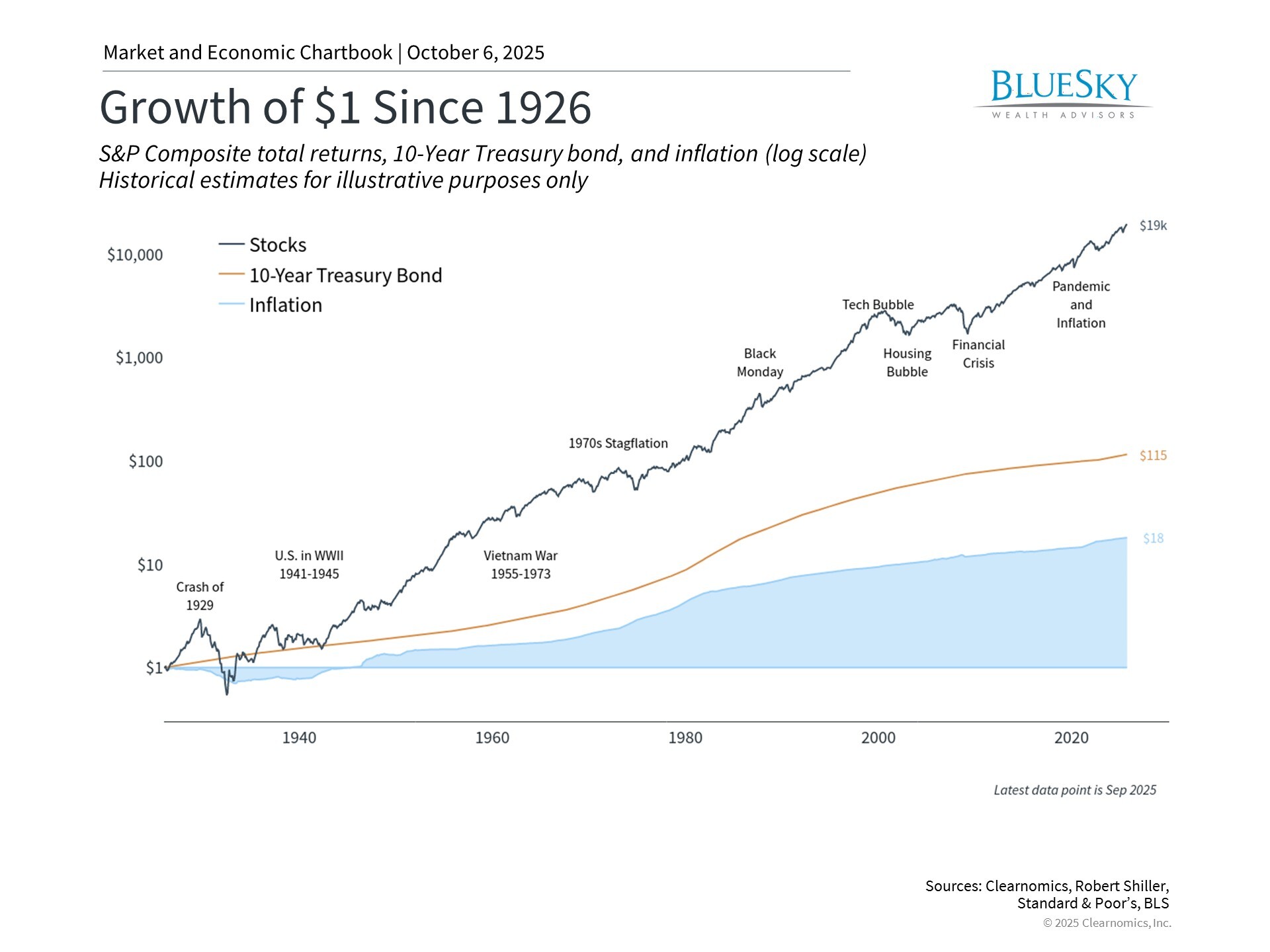

- Investment Portfolio: Returns from stocks, bonds, and other assets.

- Real Estate: Income from rental properties or proceeds from selling your home.

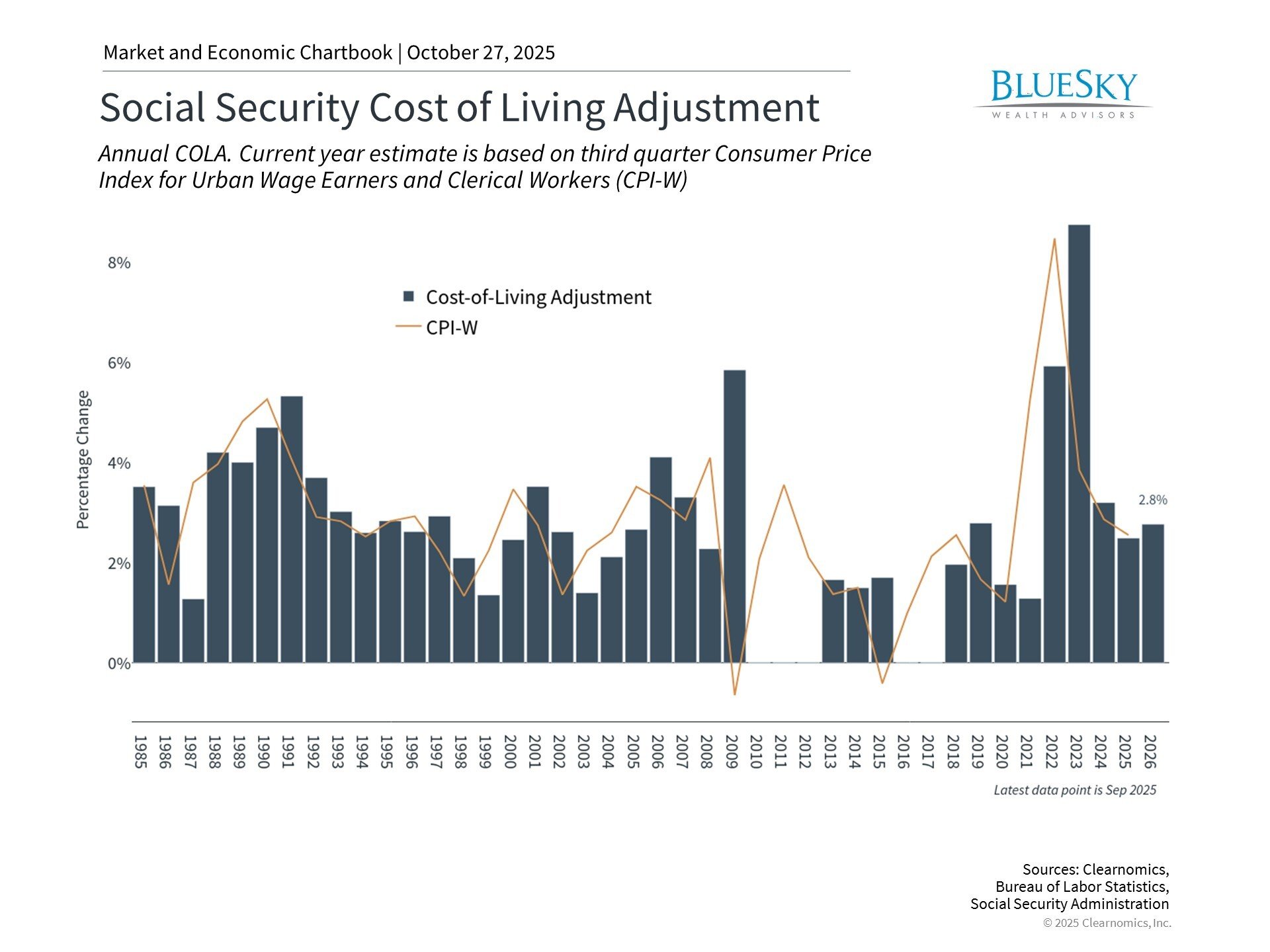

- Social Security: Monthly payments that can significantly contribute to your budget.

- Pensions: If applicable, these can provide a reliable income stream.

- Part-Time Work: Many retirees opt for flexible part-time jobs to stay engaged and supplement their income.

Focus on Key Transition Periods

The years leading up to retirement, as well as the first few years afterward, are critical for planning. The two years prior to retirement, the retirement year itself, and the two years post-retirement are pivotal times for making important decisions.

Speak with an Advisor

Retirement is a time for reflection, adventure, and new beginnings. By re-evaluating your living arrangements, understanding your income sources, and focusing on key transition periods, you can make informed decisions that lead to a fulfilling retirement.

Having a knowledgeable financial advisor during these transition periods can be invaluable. An advisor can assist you in creating a comprehensive plan that includes budgeting, investment strategies, and tax optimization. This proactive approach will give you the confidence to focus on enjoying your retirement rather than worrying about finances.

BlueSky Wealth Advisors is a team of experienced and knowledgeable advisors who can help you with your retirement planning decisions. Contact us today to begin putting your plans in order.