Federal Reserve Policy Changes and Their Impact on Long-Term Investment Strategy

Federal Reserve Policy Changes and Their Impact on Long-Term Investment Strategy

The investment wisdom "don't fight the Fed" emerged during the 1970s and remains increasingly relevant today. This concept emphasizes that Federal Reserve monetary policy choices can significantly influence both markets and economic conditions, making them crucial considerations for investors. However, maintaining proper perspective requires focusing on broader interest rate trends rather than isolated Fed actions. This perspective proves particularly important as the Fed advances its rate reduction cycle within today's intricate economic landscape.

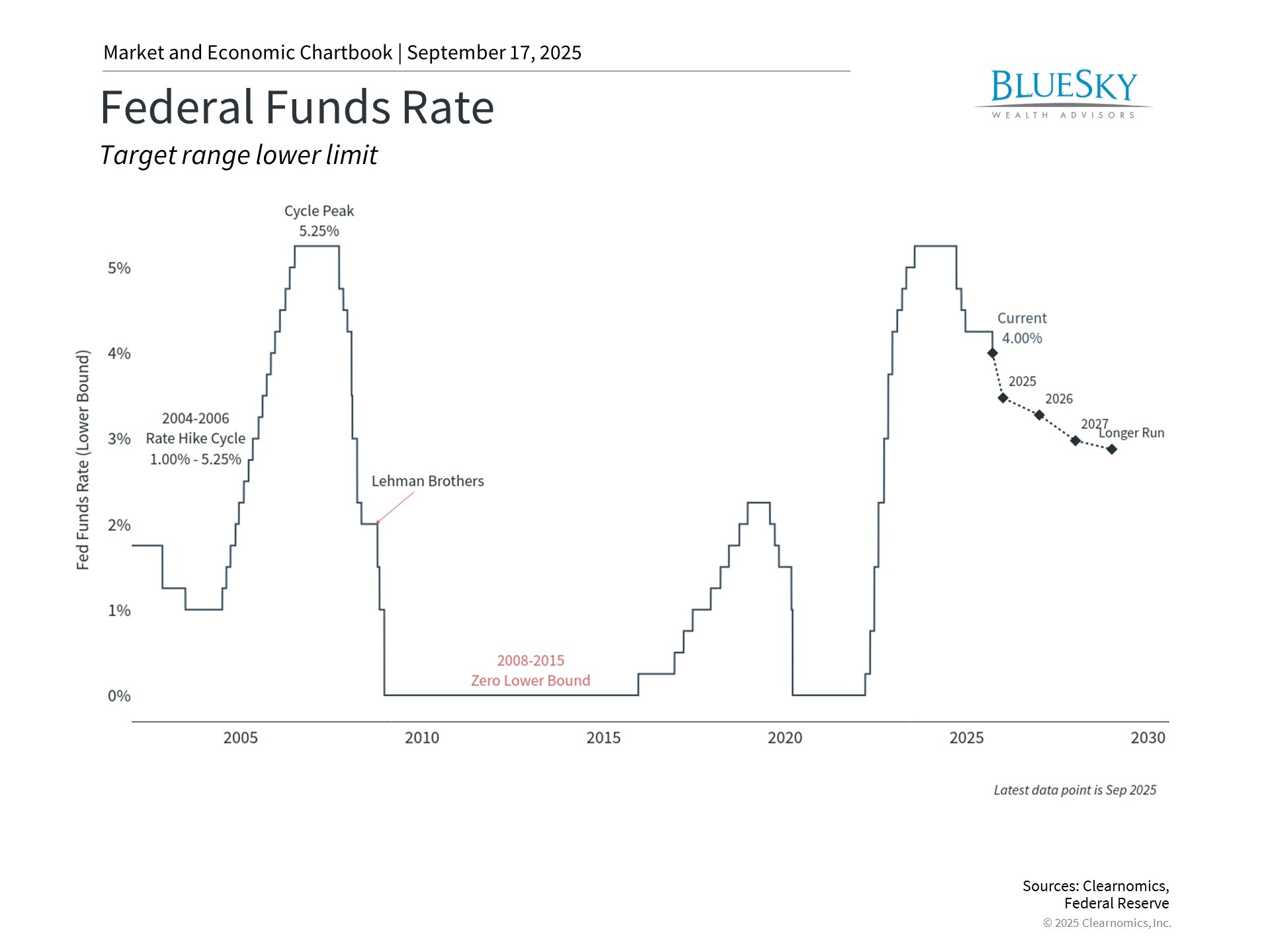

Meeting widespread expectations, the Fed reduced policy rates by 0.25% during its September session, extending the easing phase that commenced in 2024. This action occurred while markets hover near record levels, economic indicators present conflicting signals, and uncertainty persists regarding tariffs and inflation. Unlike emergency rate reductions during the 2008 financial crisis or 2020 pandemic, this current move represents the Fed's effort to calibrate policy for sustained growth rather than crisis response.

Long-term investors benefit from understanding the Fed's rationale for rate cuts and recognizing how this environment differs from previous cycles, providing valuable context for financial planning and portfolio choices. Although rate cuts typically support financial markets, success depends on maintaining perspective and concentrating on long-term financial objectives rather than overreacting to individual policy adjustments.

The Fed's rationale for rate cuts carries more weight than timing or magnitude

Fed officials analyze economic data encompassing growth, employment, and inflation when formulating policy decisions and economic outlooks. When conditions remain unclear, disagreement naturally emerges among Fed officials and economists, creating varying perspectives on future rate cut timing and scale. This situation characterizes today's environment, with substantial variation among officials' rate projections. Although many headlines emphasize political tensions between the Fed and White House, divergent views have existed throughout this period.

Several key facts deserve attention despite this disagreement. The Fed had long anticipated implementing rate cuts, as evidenced by recently published Summary of Economic Projections indicating likely cuts this year, even though specific numbers and timing varied based on tariff developments and market volatility. Current Fed projections suggest two additional cuts may occur this year, accompanied by an enhanced growth forecast.

Additionally, recent rate cuts fundamentally differ from historical cutting cycles primarily driven by emergencies. Current reductions continue reversing the sharp rate increases implemented to combat inflation beginning in 2022. These cuts occur amid softening yet positive economic conditions, despite potentially weakening employment data and more persistent inflation than anticipated. The Fed's quarter-point reduction to guide the economy stands apart from substantial emergency cuts responding to financial system problems or economic crises.

Furthermore, Fed Chair Jerome Powell's term likely concludes in May 2026, with President Trump appointing the next Fed governor, suggesting the federal funds rate will probably trend lower. While short-term interest rates may decline accordingly, long-term rates respond to market and economic forces rather than Fed policy alone. Lower short-term rates potentially driving higher inflation might paradoxically produce elevated long-term rates.

This rate cut represents the Fed's continued 2024 trajectory rather than a directional shift, while signaling commitment to supporting economic expansion.

Economic indicators have shown conflicting signals

Labor market softening primarily motivated the Fed's decision. August job creation totaled just 22,000, falling well short of expectations, with significant downward revisions to previous months. However, the unemployment rate increased only to 4.3% due to fewer job seekers entering the market. This situation differs markedly from previous emergency rate cut periods when unemployment spiked from 5.0% to 10.0% during 2008's financial crisis and jumped from 3.5% to 14.8% in 2020. Current employment figures suggest gradual cooling potentially reflecting softening labor market conditions.

Compounding labor market concerns, recent payroll revisions revealed more subdued job growth than earlier data suggested. The Bureau of Labor Statistics' annual revision process indicated 911,000 fewer jobs created between March 2024 and March 2025, suggesting faster labor market cooling than policymakers recognized when making prior monetary policy decisions. These preliminary estimates await finalization in early 2026.

While weakening employment conditions support rate reductions, Fed inflation concerns favor maintaining steady rates or potentially raising them if tariffs elevate prices. The Fed's preferred inflation measure, the Personal Consumption Expenditures (PCE) Price Index, remains at 2.6%, well above the 2% target. Core PCE hovers at 2.9%, while headline and core CPI persist at 2.9% and 3.1%, respectively. Previous inflation progress has stalled and some trends have reversed in recent months.

The Fed must balance these factors within its "dual mandate." Mixed signals from these indicators explain disagreement within the Fed and with the White House. For investors, understanding these trends likely proves more valuable for comprehending economic and interest rate environments than following daily political headlines.

Rate reductions typically benefit businesses and investors

For investors, the crucial distinction involves whether rate cuts accompany recession or support continued expansion. While economic weakness signs exist, recession indicators remain absent. Under these circumstances, rate cuts typically provide broad financial market benefits. Reduced borrowing costs enable companies to finance growth more affordably and decrease debt service expenses. Consumer spending may increase if mortgage and credit card rates decline, boosting goods and services demand.

One concern regarding current rate cuts involves stock markets already approaching record highs. Although atypical, historical precedents exist. Under Alan Greenspan, the Fed implemented three cuts during 1995 and 1996, characterizing them as "insurance" against economic slowdown. The Fed also reduced rates in 2019 at market peaks to address global growth concerns. At the recent press conference, Powell described this latest policy decision as "a risk management cut" reflecting the Fed's view that "downside risks to employment have risen."

Portfolio effects historically demonstrate generally positive rate cut impacts across asset classes. While past performance doesn't guarantee future results, stocks typically benefit as lower rates reduce future earnings discount rates and improve corporate profitability, particularly for growth-oriented companies. Bonds typically gain value due to higher rates, though this varies across sectors and maturities. Conversely, cash will likely experience reduced yields, making it less attractive compared to investments like stocks and bonds.

Although each economic cycle presents unique characteristics, navigating policy changes represents a normal investing aspect. Rate cuts generally support long-term investors, though balancing risk and reward requires comprehensive market trend understanding.

The bottom line? The Fed's recent rate cut may bolster the economy amid mixed signals. Investors should maintain long-term perspective, emphasizing overall market direction rather than individual Fed decisions.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.