Strategies for Protecting Your Portfolio Against Inflation

Strategies for Protecting Your Portfolio Against Inflation

Natural disasters require different preparation strategies - while earthquakes demand immediate response plans, erosion calls for long-term protective measures. Financial challenges follow similar patterns. The most significant threats to household and business finances aren't always sudden market crashes but can unfold gradually over extended periods. Today's inflationary pressures exemplify this, presenting both immediate price spikes and the persistent decline of purchasing power that impacts investment markets.

Investors familiar with the inflationary periods of the 1970s and early 1980s, or those who experienced post-pandemic price increases, recognize these dynamics. Current inflation remains more persistent than desired, with ongoing concerns that tariffs could drive consumer prices higher. Simultaneously, this inflation coincides with robust employment levels, strong consumer spending, and solid corporate earnings. This combination creates a challenging landscape for investors and policymakers attempting to balance economic growth with price stability.

Instead of waiting for inflation to become problematic, prudent long-term investors should construct portfolios capable of weathering various economic scenarios while maintaining focus on their financial objectives. What insights do current inflation data provide about economic conditions and investment strategies?

The gradual erosion of purchasing power through inflation

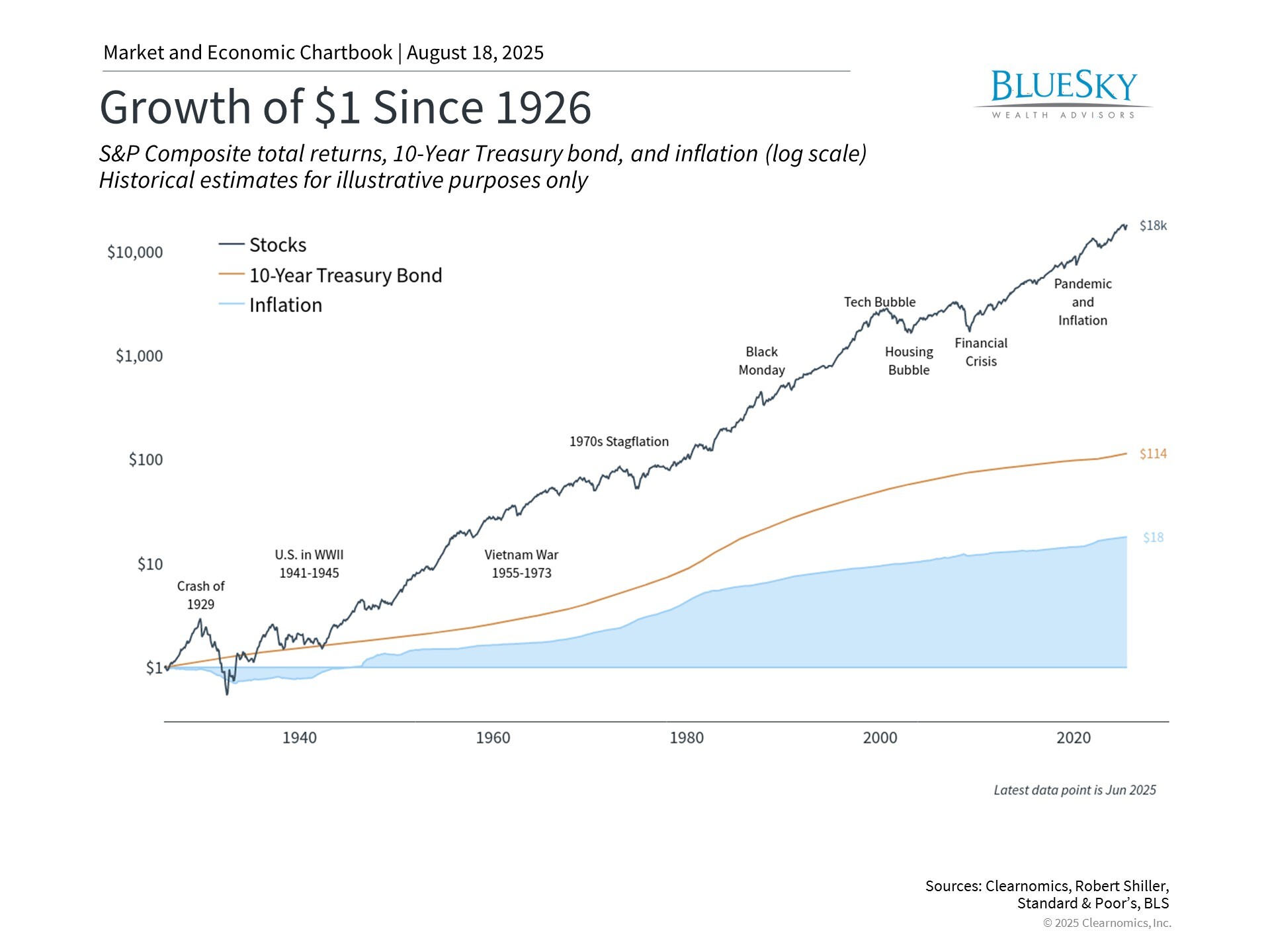

The fundamental purpose of investing for most individuals, savers, and retirees centers on preserving purchasing power against inflation's effects. Whether through equities, fixed income, certificates of deposit, or alternative investments, maintaining the real value of portfolios and bank deposits remains essential for securing future financial comfort. The accompanying chart demonstrates this reality starkly. Items costing $1 one hundred years ago now require $18. The data also reveals acceleration in these price pressures during the 1970s and again in recent years.

This perspective might suggest that zero inflation - or deflation where prices decline - would benefit consumers. However, inflation encompasses more than individual costs; it reflects broader economic health. Contemporary economic theory supports maintaining low but positive inflation rates, typically around 2%, as optimal for both individuals and the overall economy.

Moderate inflation levels provide central banks flexibility in conducting monetary policy, encouraging spending and investment when conditions warrant. Furthermore, modest inflation helps prevent deflationary cycles, where declining prices cause consumers to postpone purchases in anticipation of further price reductions.

Therefore, distinguishing between individual and macroeconomic viewpoints proves crucial. While 2-3% inflation may historically support healthy growth environments, even these moderate levels can harm savers. Though these rates appear manageable compared to 1970s double-digit inflation or recent post-pandemic surges, they still compound significantly over time.

Consider that 3% annual inflation doubles costs approximately every 24 years. This means $100,000 in current purchasing power would require $200,000 in two decades - well within typical retirement spans. This erosion particularly challenges retirees and cash holders. For all investors, inflation establishes a "hurdle rate" that investment returns must exceed to build real wealth.

Persistent inflationary pressures continue

Regarding today's inflationary climate, many worry about the sudden impact tariffs might have on price levels. Recent Producer Price Index data illustrates this concern, showing business-charged prices surged in July. Wholesale prices jumped 0.9%, marking the largest monthly increase since June 2022 and significantly exceeding economist expectations. Goods prices climbed 0.7% during this period, while services surged 1.1% in a single month.1

These figures matter because wholesale price increases typically appear in consumer prices with several months' delay as inflation moves through supply chains. This pattern suggests companies have absorbed some tariff costs thus far but may begin transferring higher prices to customers.

Recent Consumer Price Index data shows less dramatic increases but confirms inflation's persistence beyond desired levels. Latest figures indicate prices rose 2.7% annually for headline inflation, or 3.1% excluding food and energy prices, which remained flat or declined. Much of this increase stemmed from rising shelter costs, particularly housing expenses.2

Beyond abstract economic understanding, these numbers directly affect household budgets. Price increases appear where consumers notice them most: restaurant meals increased 3.9% annually, medical care rose 3.5%, and car insurance jumped 5.3%. Even household items like furniture climbed 3.4%, adding pressure to family budgets already strained by years of elevated prices.

Strategic asset allocation essential for inflation protection

While these increases are significant, inflation remains well below the double-digit rates experienced from 2021 to 2022. Nevertheless, even without tariff-induced price spikes, they may elevate average price levels over time, diminishing cash value. This proves especially problematic when wage growth lags price increases and investors lack long-term allocations capable of exceeding inflation rates.

Understanding inflation's portfolio implications remains vital. The chart above illustrates that average cash interest rates have failed to match inflation levels. Additionally, money market fund holdings remain at record highs of $7.1 trillion, despite declining short-term interest rates.3

While past performance doesn't guarantee future results, historical data shows both stocks and bonds have surpassed inflation over extended periods, as the first chart demonstrates. However, equities can experience volatility during inflationary periods, as seen in 2022. This explains why balanced asset class allocation capable of withstanding both inflation and market volatility helps investors maintain course.

Most importantly, investors should avoid making dramatic portfolio adjustments based on monthly inflation reports or tariff concerns. While ensuring portfolios are positioned for various scenarios remains crucial, overreacting to short-term data frequently results in poor timing decisions that can undermine long-term financial objectives.

The bottom line? Inflation's steady erosion of purchasing power represents a fundamental investment challenge. Maintaining a well-balanced portfolio designed to generate both income and growth provides the optimal path toward achieving financial goals.

- https://www.bls.gov/news.release/ppi.nr0.htm

- https://www.bls.gov/news.release/cpi.t01.htm

- https://www.ici.org/research/stats/mmf

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.