Beginner's Guide to Understanding Legacy Planning

Beginner's Guide to Understanding Legacy Planning

Quick Answer: Legacy Planning is about deciding and documenting what you want to happen with your assets, values, and final wishes after you’re gone. It’s different from just estate planning because it also includes non-financial things like your values, traditions, and the impact you want to leave behind. Why is it important? Without it, the state decides who gets what, possibly leading to family disputes, and you may also miss the chance to make a positive impact on the future.

Legacy planning is not just preparing for the inevitable; it’s about crafting a story of your life that continues after you’re not here. It’s a thoughtful process that requires considering what financial and non-financial legacies you wish to leave behind. Whether it’s ensuring your children are cared for, a charity receives a donation, or a small business stays in the family, legacy planning allows you to make these important decisions yourself, rather than leaving them up to chance or the state’s laws.

In a world that often emphasizes accumulating wealth, legacy planning shifts the focus towards distributing wealth in a way that reflects your values and wishes. It’s crucial not just for peace of mind, but for the well-being and financial security of your loved ones and the causes you care about. Moreover, it can provide a clear, thoughtful roadmap for your family, minimizing disputes and ensuring they’re taken care of according to your wishes.

Why should this matter to you? Without a clearly articulated legacy plan, your assets might not end up where you intend, potentially leading to family conflict and diminishing the value of your estate through taxes and legal fees. If you’re looking to leave behind more than just assets—if you want your legacy to include the values you lived by and the impact you made—then starting your legacy planning now is essential.

What is Legacy Planning?

When we talk about what is legacy planning, think of it as preparing a meaningful gift for your loved ones and the community that lasts beyond your lifetime. It’s not just about who gets your stuff when you’re gone. It’s about leaving a mark that represents who you were and what you cared about.

Legacy Planning vs. Estate Planning: What’s the Difference?

At first glance, legacy planning might sound a lot like estate planning. While they share similarities, they’re not quite the same.

Estate Planning is about the nuts and bolts: Wills, trusts, and legal documents that dictate how your assets are distributed after you pass away. It’s crucial, but it’s mostly focused on the financial and logistical side of things.

Legacy Planning, on the other hand, goes a step further. It includes the financial strategy and asset bequeathal of estate planning but also involves imparting your values, supporting causes you care about through charitable giving, and ensuring your life’s work and passions are remembered and continued.

The Financial Strategy of Legacy Planning

A key part of legacy planning is deciding how to manage your assets in a way that benefits your loved ones and the causes you care about most. This might mean setting up trusts, choosing the right insurance policies, or making strategic charitable donations to minimize the tax burden on your heirs and maximize the impact of your giving.

For example, using trusts can help avoid the lengthy and public process of probate, ensuring that your assets are distributed smoothly and privately.

Asset Bequeathal: It’s More Than Money

When we think about passing on assets, it’s easy to focus on the tangible—houses, cash, and heirlooms. But legacy planning encourages you to think about the intangible assets you can leave behind as well. This might include your personal values, family history, or a commitment to philanthropy.

For instance, by discussing your values with your financial advisor and integrating them into your plan, you can ensure that your financial legacy reflects what you stood for. Whether it’s funding education for underprivileged kids, supporting research in a field you’re passionate about, or ensuring your business continues to operate in a way that aligns with your ethical beliefs, legacy planning makes it possible.

Why Legacy Planning Matters

In the end, legacy planning is about ensuring that your impact on the world doesn’t end with your passing. It’s a way to make sure that your values live on, that your loved ones are taken care of in the way you wish, and that your contributions to society continue to make a difference.

Whether you’re working with a financial advisor like those at BlueSky Wealth Advisors or starting the conversation with your family, legacy planning is a meaningful step towards leaving a lasting, positive impact. It’s not just about the assets you leave behind but the legacy you create.

Remember that legacy planning is a comprehensive approach that combines the practical aspects of estate planning with a deeper consideration of the values and impact you want to leave behind. Whether it’s through financial gifts, charitable donations, or the lessons and values you impart, your legacy is how you’ll be remembered. It’s never too early to start thinking about the mark you want to leave on the world.

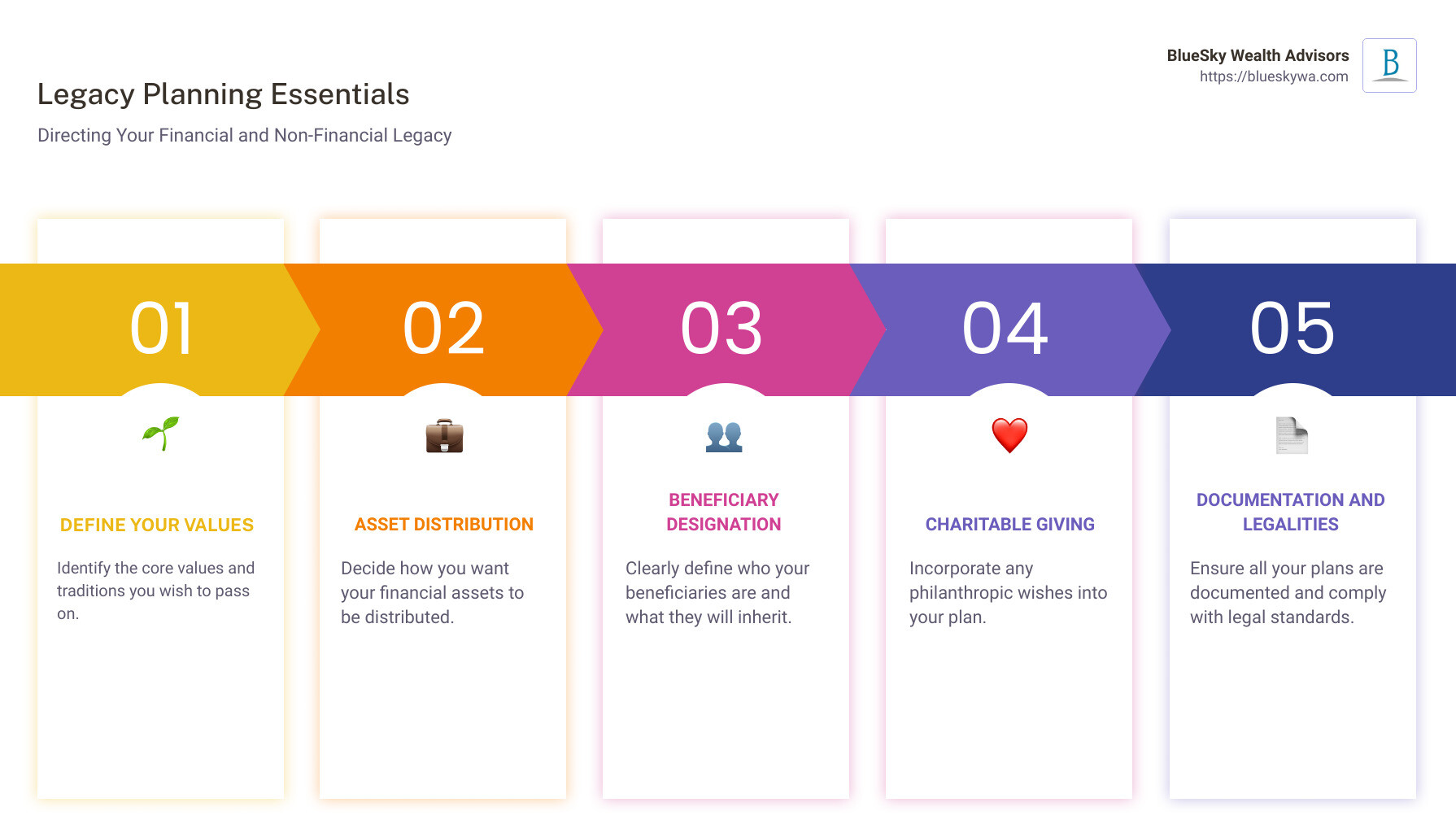

Key Components of Legacy Planning

When we dive into what is legacy planning, it’s not just about the numbers in your bank account or the properties you own. It’s about crafting a story that continues long after you’re gone, touching lives and making a difference. Let’s break down the core components that make up a solid legacy plan.

Assets

The foundation of any legacy plan starts with understanding your assets. These aren’t just your savings and real estate; they also include your investments, life insurance policies, and even your treasured family heirlooms. Knowing what you have is step one. It’s like taking inventory before a big move; you need to know what’s in the box before deciding where it goes.

Beneficiaries

Next up, we have your beneficiaries. These are the people and causes you care about, the ones who will carry forward your legacy. Choosing your beneficiaries isn’t just a matter of listing names; it’s about understanding their needs, dreams, and how what you leave behind can best support them. It’s like casting characters in a play, where each person plays a crucial role in the story you’re telling.

Charitable Giving

Many people see charitable giving as a way to extend their impact and values beyond their immediate circle. Whether it’s supporting a local community center, contributing to medical research, or funding scholarships, your charitable contributions are a powerful way to leave a mark on the world. It’s like planting a tree; you might not be there to sit in its shade, but generations to come will benefit from its presence.

Values and Traditions

Perhaps the most personal aspect of legacy planning is the transmission of values and traditions. This could mean ensuring your grandchildren understand the importance of hard work, passing down family stories, or supporting causes that have been important to you. It’s about weaving your values into the fabric of your legacy, ensuring that the wealth you leave behind is more than just financial.

In Conclusion:

As we transition from understanding what is legacy planning to putting it into action, each of these components is like a thread in a tapestry. Alone, they tell part of a story, but together, they create a legacy that reflects who you are and the impact you want to have on the world. Keep these components in mind, and consider how they fit into the larger picture of your life and legacy.

The Role of Financial Advisors in Legacy Planning

When we talk about what is legacy planning, it’s crucial to understand the pivotal role financial advisors play. Their expertise and guidance can make a significant difference in how effectively you can secure your financial future and ensure your legacy is preserved according to your wishes. Let’s dive into how they help in areas like financial security, asset management, and navigating tax scenarios, with a special focus on BlueSky Wealth Advisors.

Financial Security

First things first, financial security is the bedrock of any successful legacy plan. Without it, aspirations of leaving a lasting impact can quickly crumble. Financial advisors start here, helping you assess your current financial health and making strategic decisions to strengthen it. They ensure you’re not just living comfortably now but are also on track to accumulate the wealth you wish to pass on. This might involve advice on savings, investments, or making the most of your retirement plans.

Asset Management

Next up is asset management. This isn’t just about knowing what you own; it’s about smartly managing those assets to ensure they grow over time and align with your legacy goals. Whether it’s a family business, real estate, or a stock portfolio, financial advisors can provide the insight needed to make informed decisions. They can help you understand which assets are likely to appreciate in value and how to protect them from potential risks, ensuring they’re a blessing, not a burden, to your heirs.

Tax Scenarios

Taxes can quickly complicate any legacy plan. Advisors play a key role in navigating the complex world of tax scenarios. They can forecast the potential tax implications of your current estate plan and suggest strategies to minimize the tax burden on your heirs. This might include setting up trusts, charitable giving, or restructuring your investment portfolio. It’s all about ensuring the wealth you pass on isn’t eroded by taxes more than necessary.

BlueSky Wealth Advisors

When it comes to legacy planning, BlueSky Wealth Advisors stands out for its holistic approach. They don’t just look at your finances in isolation but consider your full financial picture, including your values and the legacy you wish to leave behind. Their team works closely with you to ensure your financial plan aligns with your life goals, offering personalized advice tailored to your unique situation.

Their expertise in areas like tax optimization, asset protection, and charitable giving can be invaluable. By integrating these elements into a cohesive legacy plan, BlueSky Wealth Advisors ensures that your wealth does more than just grow—it supports the causes and people you care about, reflecting your values and aspirations.

In summary, the role of financial advisors in legacy planning cannot be overstated. From ensuring your financial security to managing your assets and navigating complex tax laws, they provide the guidance needed to create a lasting legacy. With a partner like BlueSky Wealth Advisors, you have a team that understands the importance of aligning your financial plan with your life’s values and goals. Remember that legacy planning is a dynamic process, requiring regular reassessment and adjustment.

Common Misconceptions About Legacy Planning

Legacy planning is often misunderstood. Many people hold onto ideas that aren’t quite right, thinking it’s only for the super-rich, or it’s all about money. Let’s clear up some of these misconceptions.

Not Just for the Wealthy

One of the biggest myths is that legacy planning is only for those with significant wealth. This couldn’t be further from the truth. Whether you own a small house, have a modest savings account, or even just personal items of sentimental value, you have a legacy. It’s about ensuring your assets and values are passed on in the way you wish, regardless of their size or monetary value.

More Than Financial Assets

Legacy planning is often equated with financial planning, but it encompasses so much more. It’s about your values, the lessons you’ve learned, and the memories you’ve created. It’s about making sure your loved ones know why you supported certain causes or why family traditions were important to you. It’s not just what you leave behind, but how you leave it behind.

Not a One-Time Task

Another common misconception is thinking of legacy planning as a one-and-done deal. Life changes—so too should your legacy plan. Marriage, the birth of children or grandchildren, changes in financial circumstances, and shifts in personal values can all affect your legacy plan. Regular reviews with a trusted advisor, like BlueSky Wealth Advisors, ensure your plan always aligns with your current wishes and life situation.

In conclusion, legacy planning is for everyone. It’s a comprehensive process that goes beyond just financial assets, embedding your values and wishes into the future. And remember, it’s not static; it evolves as you do. Keeping these points in mind will help set the stage for a meaningful and impactful legacy.

As we delve further into the intricacies of legacy planning, overcoming these misconceptions is the first step towards creating a plan that truly reflects your wishes and values.

Steps to Start Legacy Planning

Legacy planning isn’t just about deciding who gets your vintage guitar or your stock portfolio. It’s about ensuring your loved ones are cared for, your values are passed on, and your financial wishes are honored. Let’s break down the steps to get started on this essential journey.

Gather Information

The first step in legacy planning is like putting together a puzzle. You need all the pieces on the table before you can see the whole picture. This means taking stock of what you have. Make a list of:

- Assets: This includes everything from savings accounts, investments, real estate, to your grandma’s antique brooch.

- Debts and Liabilities: Yes, these need consideration too. Think mortgages, loans, and credit card balances.

Gathering this information gives you a clear starting point. It’s like setting up the base camp before climbing the mountain.

Define Beneficiaries

Now, think about who you want to inherit these assets. Beneficiaries aren’t just family members. They can be friends, charitable organizations, or even your alma mater. Deciding who gets what is a deeply personal decision but think beyond the dollar value. Consider the emotional value of personal items and how they can serve as a reminder of your legacy.

Seek Professional Help

This is where the experts come in. Legacy planning can be complex, and it’s wise to have a guide. Financial advisors, like those at BlueSky Wealth Advisors, can offer personalized advice tailored to your unique situation. They can help navigate the technical aspects, such as:

- Tax implications

- Legal structures

- Trusts and wills

Think of them as the sherpa guiding you up the legacy planning mountain. They know the best paths to take and the pitfalls to avoid.

Regular Reassessment

Legacy planning is not a “set it and forget it” kind of deal. Life changes—marriages, births, divorces, and all the rest—mean your legacy plan will need to evolve too. Regular check-ins with your financial advisor ensure that your plan always reflects your current wishes and life situation.

- Annual Reviews: Mark it on your calendar as a recurring event. A lot can change in a year.

- Life Events: Major life events are a signal to reassess your plan. This ensures your legacy plan is always aligned with your current reality.

Starting your legacy planning journey might seem daunting at first, but breaking it down into these steps can make it more manageable. It’s about more than just assets; it’s about ensuring your legacy lives on exactly as you wish. Engaging with professionals like BlueSky Wealth Advisors not only simplifies the process but ensures that your plan is robust, flexible, and tailored to you.

Frequently Asked Questions about Legacy Planning

Diving into legacy planning can bring up a lot of questions. Let’s tackle some of the most common ones to help clarify what is legacy planning and why it’s so important.

What is an example of legacy planning?

Imagine a family where the parents have spent their lives collecting art. They have two children, one who shares their passion for art and another who does not. In their legacy plan, they decide to leave the art collection to the child who cherishes it, while the other child is designated to inherit the family home. This plan also includes setting up a scholarship fund for aspiring artists in their community, reflecting their values and love for art. This is a classic example of legacy planning, where assets, values, and the family’s unique dynamics are all considered in the distribution of their estate.

Is legacy planning really required?

In short, yes. Without a legacy plan, the state decides how your assets are distributed, which might not align with your wishes or the needs of your family and community. For example, if you have specific intentions for your assets or wishes for charitable giving, only a well-documented legacy plan can ensure these are fulfilled. Moreover, legacy planning can significantly reduce the tax burden on your beneficiaries, ensuring they receive the maximum benefit from your estate. It’s not just about distributing wealth; it’s about making thoughtful decisions that reflect your values and support your loved ones after you’re gone.

What is another word for legacy planning?

Legacy planning is often used interchangeably with terms like “estate planning” and “wealth transfer planning.” However, while estate planning mainly focuses on the legal and financial aspects of your assets, legacy planning encompasses a broader scope. It includes not just your financial assets but also your values, wishes, and the impact you want to leave behind. Think of legacy planning as the heart and soul of estate planning, where your life’s work and values find continuity even after you’re no longer here.

Diving into these steps can make it more manageable. It’s about more than just assets; it’s about ensuring your legacy lives on exactly as you wish. Engaging with professionals like BlueSky Wealth Advisors not only simplifies the process but ensures that your plan is robust, flexible, and tailored to you.

Conclusion

When it comes to legacy planning, the importance of starting early cannot be overstated. It’s about laying a foundation today for a future that reflects your values, wishes, and the impact you want to leave behind. This process isn’t just about ensuring your financial assets are distributed according to your wishes; it’s about creating a lasting legacy that carries on your values and supports the causes and people you care about.

At BlueSky Wealth Advisors, we understand that legacy planning can seem daunting. That’s why our approach is centered around making this process as intuitive and stress-free as possible. We believe in the power of early planning and the peace of mind it brings. Not only does it provide clarity and direction for your financial future, but it also allows you to convey your values, traditions, and the essence of what makes you, you, to the next generation.

Our team of experienced advisors is here to guide you through every step of the legacy planning process. From identifying your assets and defining your beneficiaries to integrating your charitable goals and ensuring your values are passed down, we’re committed to helping you build a legacy that lasts. We’ll work with you to navigate the complex tax scenarios and manage your assets effectively, ensuring that your legacy planning is as efficient and impactful as possible.

Legacy planning is more than a financial strategy; it’s a way to leave a mark on the world and provide for your loved ones in a way that aligns with your dreams and values. BlueSky Wealth Advisors is here to help you achieve that. Whether you’re just starting to think about your legacy or you’re ready to refine your existing plan, we’re here to provide the expertise and support you need.

The best time to start planning your legacy is now. It’s never too early to begin shaping the future you envision for yourself and your loved ones. Let us help you create a plan that not only meets your financial goals but also reflects the legacy you want to leave behind.

Start planning your legacy with BlueSky Wealth Advisors today.

By engaging in early planning and partnering with a trusted advisor like BlueSky Wealth Advisors, you can ensure that your legacy lives on exactly as you wish. Together, we can build a plan that’s not only robust and flexible but also deeply personal and reflective of your unique values and aspirations.