The Ultimate Guide to Creating a Charitable Legacy

The Ultimate Guide to Creating a Charitable Legacy

When you search for “charitable legacy”, you’re possibly looking to find out how to leave a part of your wealth to charitable causes in a way that also benefits you and your family, now and after you’re gone. Here’s what you need to know right away:

– Charitable Legacy involves planning to leave assets or money to charitable organizations as part of your overall estate plan.

– It can offer tax benefits for you and your heirs.

– It’s a way to support causes you care about and leave a lasting impact.

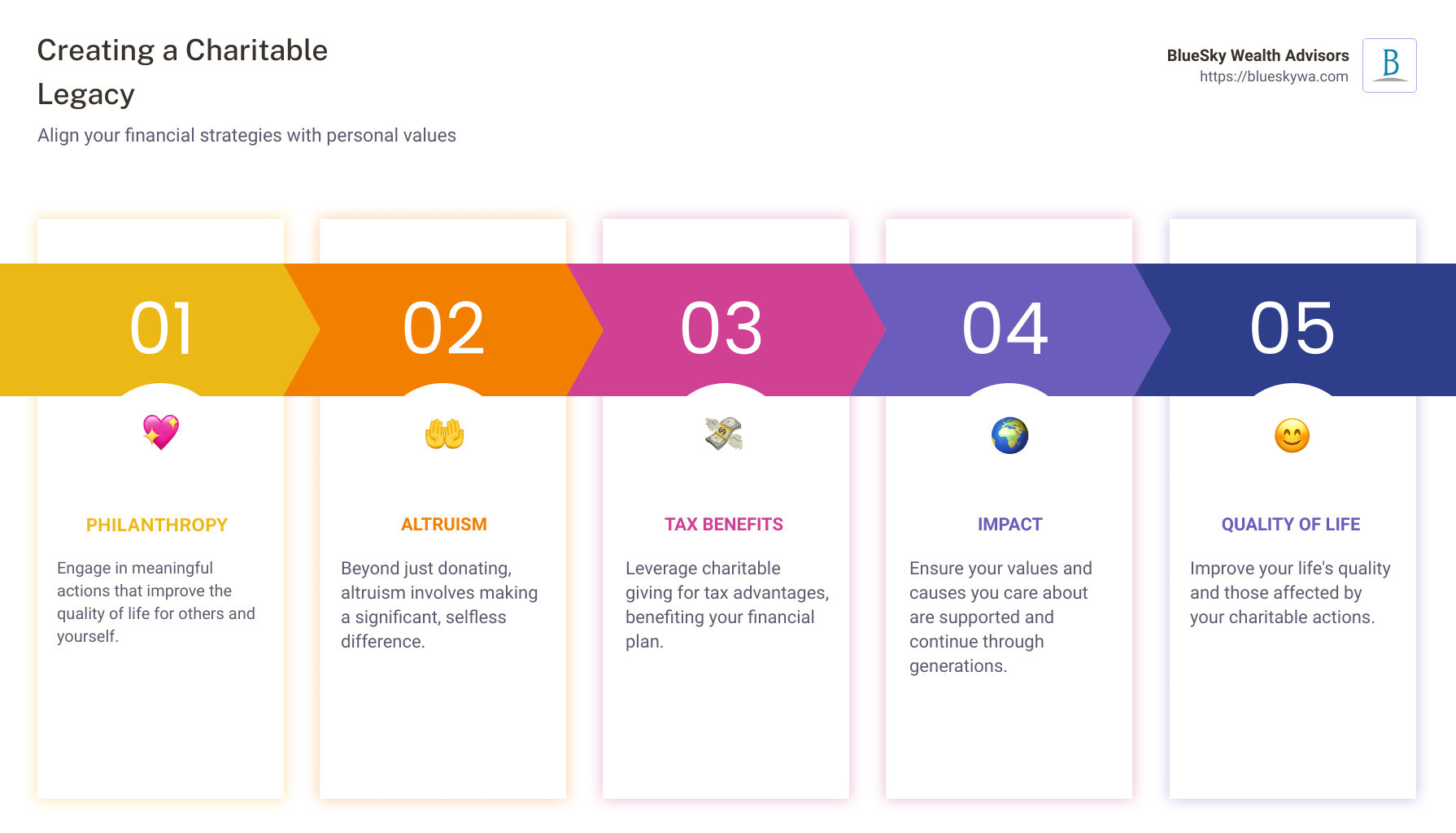

Philanthropy and altruism aren’t just about giving money away. They’re about improving your quality of life and that of others, through meaningful actions. Whether you’re looking to optimize your tax situation, secure financial independence, or establish a legacy, incorporating charitable giving into your financial planning can achieve these goals. It’s not just about making a donation; it’s about making a difference. From simple acts of generosity to structured estate planning, charitable legacy provides a path to fulfill individual aspirations, family goals, and societal needs simultaneously.

For the busy but financially comfortable individual, understanding and leveraging the concept of a charitable legacy can be a powerful way to align financial strategies with personal values. The journey to creating a charitable legacy can bolster your financial plan, offer tax advantages, and ensure your values continue to echo through the generations.

Let’s dig into how this works, and how it can benefit you and the causes you hold dear.

Understanding Charitable Legacies

When we talk about charitable legacies, we’re looking at a way to leave a mark on the world that lasts well beyond our own lifetimes. It’s about making a difference, supporting the causes we care about, and setting an example for future generations. Let’s break down some key concepts:

Charitable Legacy is essentially a blueprint for how you want your generosity to continue after you’re gone. Think of it as a plan that ensures your favorite charities and causes receive support even when you’re not here to make the donations yourself.

Planned Giving is a critical part of crafting your charitable legacy. It involves setting up financial arrangements now that will provide benefits to your chosen charities later. This could mean including a charity in your will, setting up trusts, or using other financial tools designed for future giving.

A Donor-Advised Fund (DAF) is like having a charitable savings account. You put money or assets into it now, get immediate tax benefits, and then recommend grants to charities over time. The beauty of a DAF is its flexibility—you can decide when and how much to give, making it a powerful tool for both current and future philanthropy.

Succession Plan within the context of charitable giving means deciding what happens to your DAF or other charitable instruments after you pass away. You can nominate successors who will continue recommending grants, or you can set up recurring donations to specific charities. This ensures your philanthropic vision carries on.

Here’s why these elements are so important:

- They allow you to maximize tax efficiencies. By planning your charitable contributions, you can often reduce your taxable estate and increase the value of the gifts you leave to both your heirs and charities.

- They ensure that your values and passions are part of your legacy. By supporting causes important to you, you’re teaching future generations about the importance of giving back.

- They provide a sense of peace. Knowing that your philanthropic goals are set and will continue to make an impact can give you a great sense of satisfaction.

Incorporating charitable giving into your financial plan doesn’t have to be complex. Start by reflecting on the causes that matter most to you. Then, consider setting up a DAF as a simple way to manage your giving now and in the future. And don’t forget to talk to your family about your plans and values. Engaging them in your philanthropic efforts can help instill a sense of generosity and responsibility that lasts for generations.

The steps you take today to create a charitable legacy can ripple outwards, touching lives and making a difference far into the future. It’s a powerful way to show that even though we’re not here forever, our actions can be.

Next, we’ll explore the various types of charitable legacies and how each can be tailored to fit your unique philanthropic vision.

Types of Charitable Legacies

When you’re thinking about leaving a mark on the world, considering the type of charitable legacy you want to create is crucial. Let’s break down the options in simple terms.

Bequests under a Will

Imagine writing a letter to the future, telling them you’ve left something special for them. That’s what a bequest under a will is like. You can leave a specific amount of money, a percentage of your estate, or even a particular asset to a charity or cause you care about. It’s a straightforward way to ensure your support for the causes you love continues even when you’re not around. Plus, it can help your estate save on taxes, which is a nice bonus.

Charitable Remainder Trust (CRT)

Think of a CRT like a magic pot that gives twice. First, it pays out a stream of income to you or someone you choose. Then, whatever is left goes to your chosen charity. It’s a win-win. You get to help yourself or a loved one and a cause you care about. Plus, you get a tax break for setting it up.

Private Foundation

Creating a private foundation is like building your own philanthropy fortress. You get to decide which causes to support, how to invest the foundation’s money, and even involve your family in the foundation’s work. It’s a powerful way to create a lasting family legacy of giving, but it comes with more rules and responsibilities.

Charitable Gift Fund

Also known as a Donor-Advised Fund (DAF), this is like having a charitable savings account. You put money or assets in, get a tax deduction, and then recommend grants to charities over time. It’s flexible, easy to set up, and lets you support multiple causes whenever you’re ready.

Each of these options offers a unique way to leave a lasting impact and continue supporting the causes you care about after you’re gone. Whether you want something simple and straightforward, like a bequest, or something more involved, like a private foundation, there’s a way to make your charitable legacy reflect your values and vision.

Talking to a professional can help you navigate these options and decide which is the best fit for your charitable goals and financial situation. We’ll discuss how to incorporate these giving strategies into your overall financial plan.

How to Plan Your Charitable Legacy

When you’re thinking about how to leave a mark on the world, planning your charitable legacy is a powerful way to make a lasting impact. It’s not just about giving money away; it’s about making a strategic plan that aligns with your values, maximizes tax benefits, and ensures your wealth does the most good. Let’s break it down into simple steps.

Estate Planning

First things first, estate planning isn’t just for the rich and famous. It’s for anyone who wants to have a say in what happens to their assets when they’re no longer here. This includes deciding how you want to support the causes close to your heart.

Wills and Trusts: A will is your first step. It’s where you can specify bequests to charities. Trusts can offer more control over how your assets are distributed and can provide tax benefits.

Legal Advice: It’s crucial to work with an attorney or an estate planner. They’ll help you navigate the complex laws and ensure your charitable wishes are honored.

Wealth Transfer

Transferring your wealth isn’t just about handing over a check. It’s about creating a legacy that continues to support your values.

Family Meetings: Talk to your family about your philanthropic goals. This can be a great way to pass on your values and involve them in charitable giving.

Succession Plans: If you own a business, consider how you can use it to support your charitable goals even after you’ve passed on.

Tax Efficiencies

One of the benefits of charitable giving is the potential for tax savings. This can mean more of your wealth goes to the causes you care about.

Donor-Advised Funds (DAFs): These are a tax-efficient way to manage your charitable giving. You can donate cash, stocks, or other assets and receive an immediate tax deduction.

Charitable Remainder Trusts: These allow you to receive income for life or a set number of years, with the remainder going to your chosen charity.

Legacy Goals

Finally, think about what you want your legacy to be. This is a deeply personal decision and one that can have a lasting impact.

Your Values: Choose charities that reflect your personal values and passions. Whether it’s education, health care, or the environment, your legacy can support the causes you’ve cared about during your lifetime.

Long-Term Impact: Consider how your contributions can make a long-term difference. This might mean supporting an endowment, funding a scholarship, or establishing a named fund.

The key to a successful charitable legacy is planning. Start by thinking about your values and how you want to be remembered. Then, work with professionals to ensure your estate and wealth transfer plans are aligned with your charitable goals. Finally, consider the tax implications to make sure your legacy has the greatest impact.

As we explore further, we’ll delve into how you can incorporate these charitable giving strategies into your overall financial plan, ensuring that your philanthropic goals are met while also securing your financial future.

Incorporating Charitable Giving into Your Financial Plan

When you’re thinking about your money, you might not always think about giving some of it away. But, guess what? Including charitable giving in your financial plan can actually be a smart move. Let’s talk about how you can do this with things like a Tax-Free Savings Account (TFSA), Registered Retirement Savings Plan (RRSP), Life Insurance Policy, and Registered Retirement Income Fund (RRIF).

1. Tax-Free Savings Account (TFSA): This is a cool tool because you can put money in it, and it grows tax-free. Imagine it like a plant that keeps growing, but you don’t have to pay any taxes on the “fruits” it bears. Now, if you decide to leave your TFSA to a charity when you’re no longer here, that charity gets everything without the tax headache. It’s a win-win.

2. Registered Retirement Savings Plan (RRSP): This is usually for your retirement, but it can also be a way to help others after you’re gone. You can name a charity as a beneficiary of your RRSP. When you pass away, the charity receives what’s left in the RRSP. This can also help lower the tax bill on your estate, meaning more of your money goes to the causes you care about.

3. Life Insurance Policy: This might be the most straightforward way to leave a charitable legacy. You can simply name a charity as the beneficiary of your policy. When you pass away, the charity receives the payout from your policy. This can be a significant amount, depending on your coverage, and it’s generally tax-free for the charity.

4. Registered Retirement Income Fund (RRIF): Similar to the RRSP, you can name a charity as a beneficiary of your RRIF. This means that whatever funds are left in your RRIF when you pass away go directly to the charity you’ve chosen, helping to reduce the taxes payable by your estate.

Why Consider These Options?

Tax Benefits: Incorporating charitable giving into your financial plan can offer tax advantages. For example, donations can reduce the taxable income on your final return or provide tax-free growth.

Flexibility: You maintain control over your assets during your lifetime, ensuring you have what you need while still planning for a future gift.

Impact: By planning your charitable gifts, you can make a bigger impact on the causes you care about. It’s about leaving a mark and making a difference.

Family Involvement: This can also be a way to involve your family in philanthropy, teaching them about generosity and the importance of giving back.

In conclusion, including charitable giving in your financial plan isn’t just good for your soul; it’s smart for your wallet too. It allows you to support the causes you care about while providing financial benefits to you and your loved ones. As we move into discussing how to engage the next generation in philanthropy, incorporating charitable giving into your financial plan can also be a powerful part of your family’s legacy, passing on values of generosity and impact to future generations.

Engaging the Next Generation in Philanthropy

Family Values

Starting with family values, instilling a sense of philanthropy in the next generation begins at home. Sharing stories about the causes you care about and why they matter to you can be a powerful way to spark interest. For example, a family might share their experiences volunteering at a local food bank or the impact of donating to a scholarship fund that supports education in underprivileged areas. This not only highlights the importance of giving back but also personalizes the concept of philanthropy for younger family members.

Intergenerational Giving

Intergenerational giving is about more than just passing down wealth; it’s about sharing the joy and responsibility of philanthropy across generations. Families can create a tradition of giving by involving children and grandchildren in philanthropic decisions. For instance, allocating a portion of the family’s annual charitable budget for the younger generation to donate to causes of their choice encourages them to research and connect with charities that resonate with their personal values.

Family Legacy with Money

Creating a family legacy with money isn’t solely about the amounts given but the impact those gifts can make. Engaging in discussions about the family’s philanthropic goals and the legacy they hope to leave can be enlightening for all involved. A family might decide to establish a scholarship fund in their name at a local university or support a community project that aligns with their collective values. This creates a tangible representation of the family’s commitment to philanthropy that can inspire future generations.

Philanthropic Activities

Participation in philanthropic activities offers hands-on experiences that can be more impactful than financial contributions alone. Families can volunteer together at local charities, participate in fundraising events, or even travel on mission trips to support international causes. These activities not only provide practical assistance to those in need but also foster a deeper understanding and commitment to philanthropy among younger family members.

Engaging the next generation in philanthropy is about more than just teaching them to give; it’s about inspiring them to care deeply about the welfare of others and to understand the power they have to make a difference. By incorporating these practices into your family’s routine, you’re not just creating a legacy of wealth; you’re building a legacy of compassion and generosity that can last for generations.

As we transition into addressing some of the most Frequently Asked Questions about Charitable Legacies, keep in mind the profound impact your philanthropic actions can have, not only on the causes you support but also on shaping the charitable mindset of the generations that follow.

Frequently Asked Questions about Charitable Legacies

As we delve into the specifics, let’s answer some of the most common questions you might have about creating a charitable legacy. This is crucial in ensuring your generosity leaves a lasting impact.

What is a charitable legacy?

A charitable legacy is a planned future gift, usually made through your will or estate plan, to a nonprofit or charity. It’s a way to support important causes that matter to you, even after you’re gone. Think of it as planting a tree whose shade you know you’ll never sit in, but others will benefit from its presence for years to come.

How does a donor-advised fund work at death?

A donor-advised fund (DAF) is like a charitable investment account for the sole purpose of supporting charitable organizations you care about. When you pass away, you can arrange for the DAF to continue making grants to charities as you’ve directed, or you can name a successor to take over the advisory privileges of the fund. This way, your philanthropic legacy can continue through your family members or loved ones, ensuring your charitable vision lives on.

What are the benefits of a charitable remainder trust?

A charitable remainder trust (CRT) offers a unique blend of benefits. It allows you to receive income for a period of time from assets you place in the trust. After this period, or upon your death, the remainder of the trust goes to the charities you’ve selected. This approach provides immediate tax benefits, potential income for you or your heirs, and ultimately, a significant gift to charity. It’s a powerful way to fulfill both your financial goals and your philanthropic ambitions.

As we’ve explored these frequently asked questions, it’s clear that planning your charitable legacy requires thoughtful consideration of your values, financial goals, and the causes you’re passionate about. Whether through a bequest in your will, a donor-advised fund, or a charitable remainder trust, there are numerous ways to ensure your generosity continues to make a difference.

Conclusion

Creating a charitable legacy is more than just a means of giving back; it’s a way to ensure your values and passions live on, impacting future generations and causes close to your heart. At BlueSky Wealth Advisors, we understand the profound importance of this journey and are committed to partnering with you every step of the way.

From exploring the initial concept of what a charitable legacy means to you, to integrating these plans within your broader financial strategy, our team is here to guide and support you. We believe in making a difference—not just for our clients, but in the world at large. This commitment is reflected in how we approach legacy planning, focusing on creating meaningful, lasting impacts.

We encourage you to think of charitable giving not as a one-time transaction but as a component of your overall life strategy. It’s about creating a story of generosity that echoes through your family’s generations, teaching values of empathy, responsibility, and civic duty. Our strategies are designed to be as unique as you are, tailored to fit your specific goals, financial situation, and charitable aspirations.

At BlueSky Wealth Advisors, we also emphasize the importance of engaging the next generation in philanthropy. It’s crucial to instill in them the values of giving back, ensuring that the legacy of charity and compassion continues through your family line. Through open conversations, shared philanthropic activities, and thoughtful planning, we help you lay the groundwork for a legacy that transcends monetary value, enriching the lives of your loved ones and those your generosity reaches.

The journey towards creating a charitable legacy is a deeply personal one, shaped by your life experiences, values, and vision for the future. Our team at BlueSky Wealth Advisors is here to support you in this noble endeavor, providing expert guidance and personalized strategies to make your charitable dreams a reality.

For more information on how we can help you build a lasting charitable legacy, visit our estate planning services. Together, we can create a plan that not only meets your financial and charitable goals but also leaves a positive mark on the world for generations to come.