Understanding Consumer Behavior and Economic Health in Today's Market

Understanding Consumer Behavior and Economic Health in Today's Market

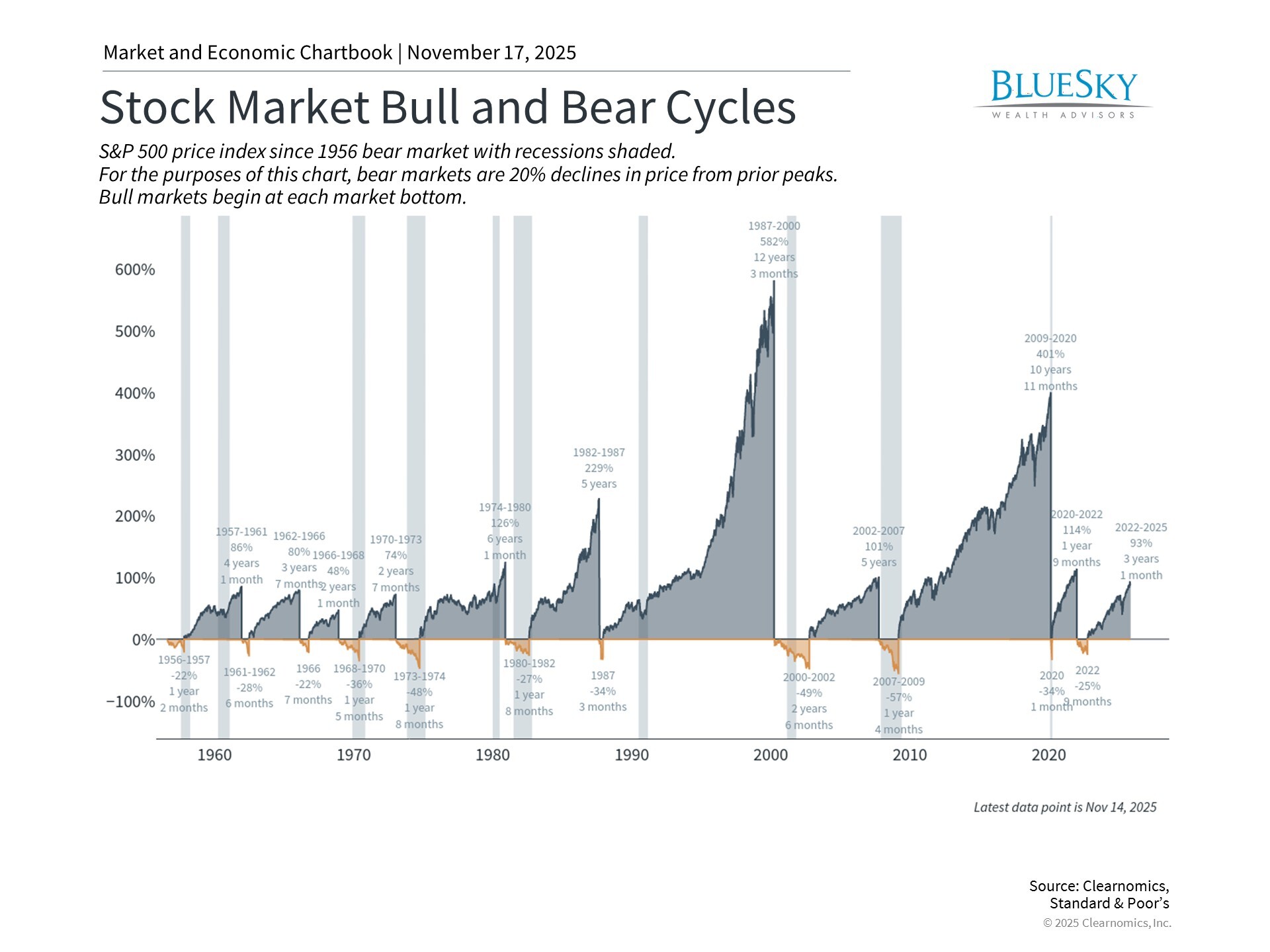

Market volatility has recently intensified, with major indices experiencing significant declines. The S&P 500's recent correction and technology sector weakness have prompted investor unease. However, it's crucial to remember that market fluctuations are an inherent part of the investment journey, and maintaining a long-term perspective typically yields better outcomes.

Economic headwinds are affecting consumer outlook

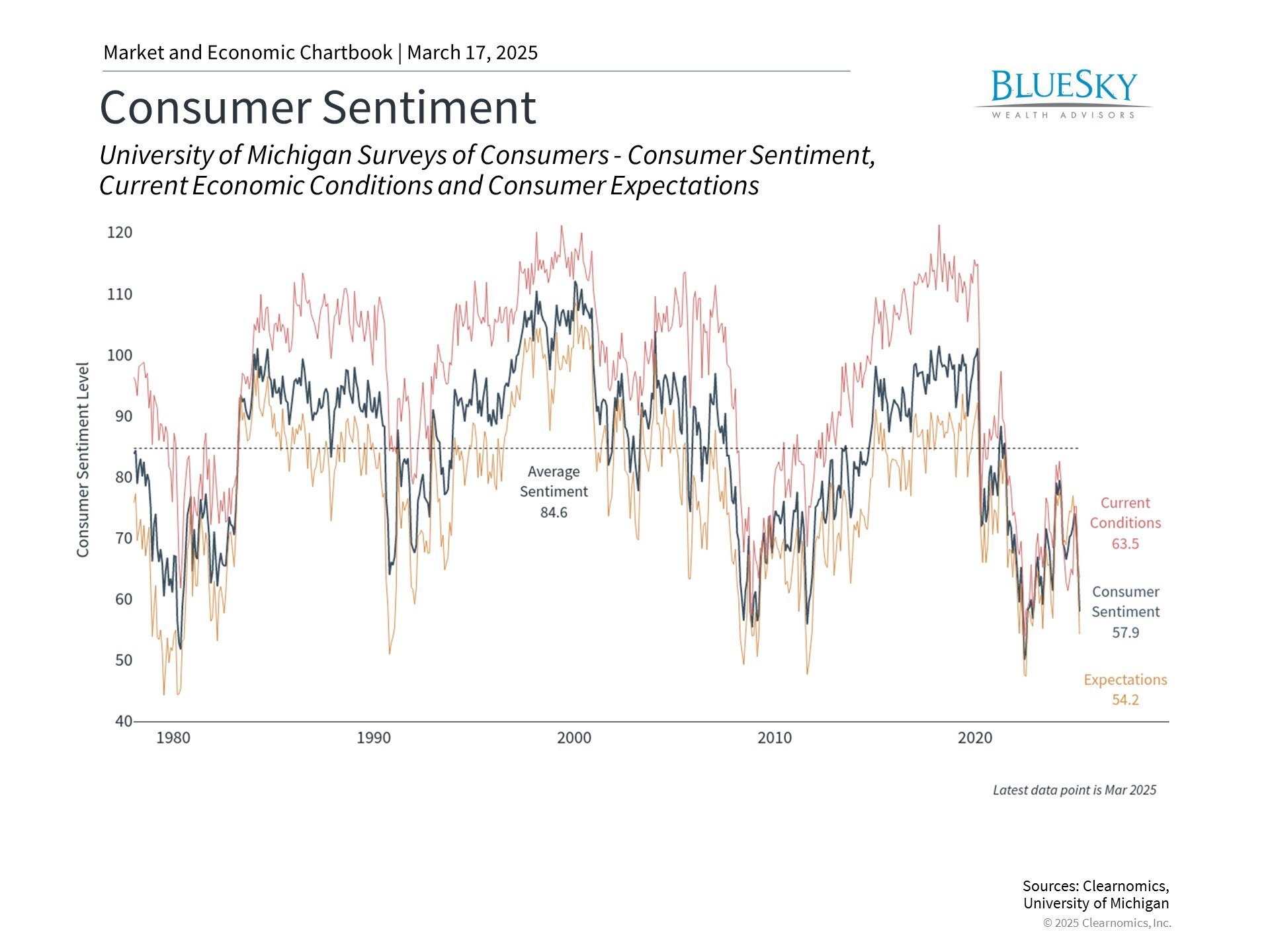

Understanding current market dynamics requires examining consumer behavior, as consumer activity drives approximately two-thirds of U.S. economic output. Economic confidence directly influences spending patterns, which in turn affects business performance and overall economic health.

Recent measurements from the University of Michigan show consumer sentiment has deteriorated to 57.9, down significantly from 79.4 last year, approaching the 50.0 low seen in mid-2022. Consumers are particularly concerned about potential inflation reaching 4.9% in the upcoming year.

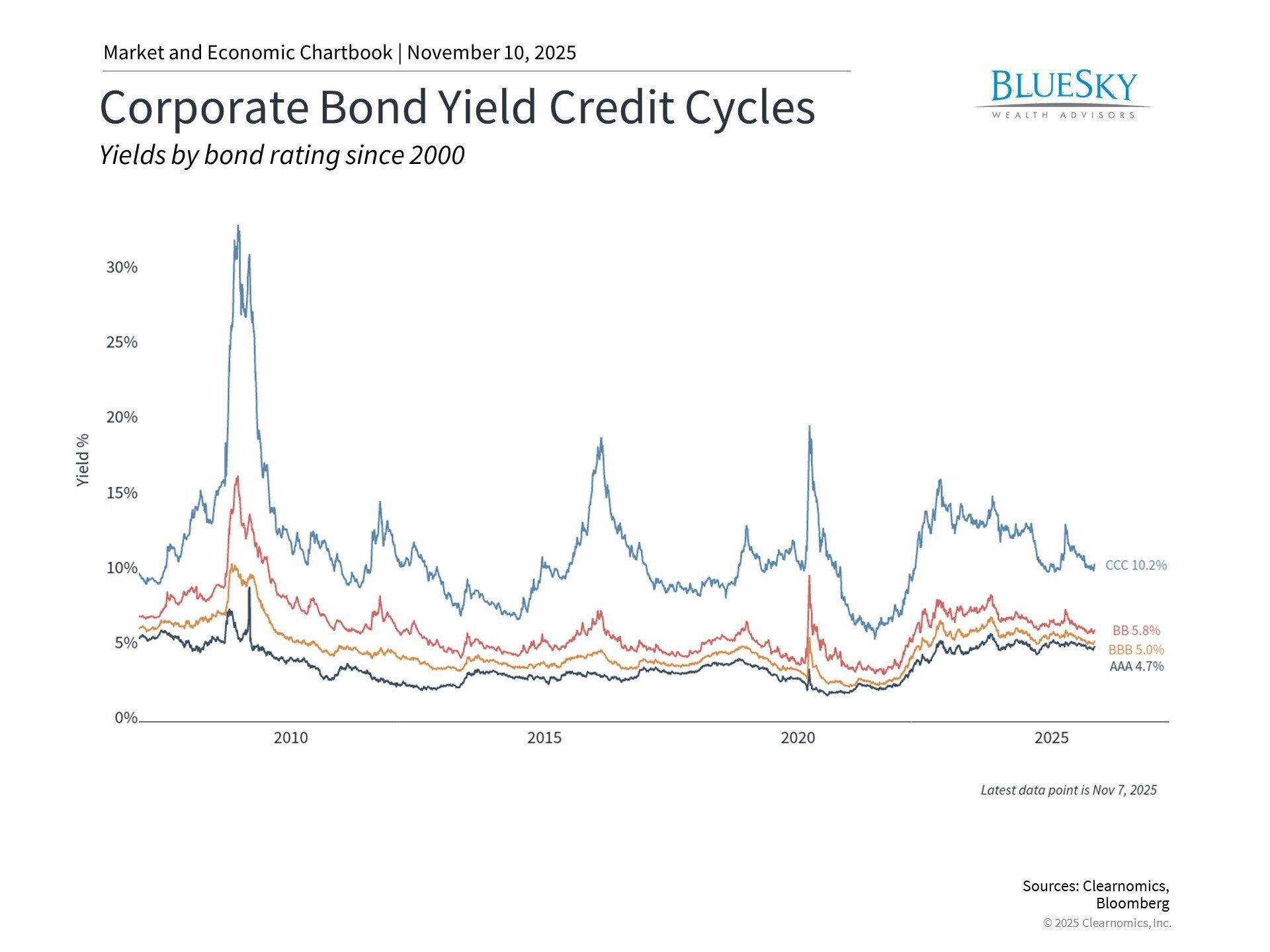

Trade policy uncertainties have emerged as a significant factor impacting consumer confidence and inflation expectations. Historical evidence, such as the price increases following 2018 trade measures, demonstrates how tariffs can affect consumer costs. Companies facing higher import costs must make strategic decisions about cost management.

The relationship between consumer sentiment and actual spending has shown interesting patterns recently. Despite negative sentiment indicators, consumer spending has demonstrated remarkable resilience, creating an unusual divergence in economic signals.

Labor market strength helps explain this phenomenon. With unemployment at 4.1% and 7.7 million job openings available, employment conditions remain favorable. This robust job market supports wage growth potential and helps maintain spending levels despite broader economic concerns.

Consumer spending patterns have shifted notably, with an increasing preference for services over goods. Service sector inflation remains elevated while many goods prices have decreased, reflecting this transformation in consumer preferences.

Consumer financial metrics show mixed signals

Current savings patterns reveal interesting trends. The 4.6% savings rate, while showing improvement, remains below the 6.2% historical average. This indicates consumers are prioritizing spending over building emergency reserves.

Consumer credit has expanded to $1.2 trillion in Q4 2024, raising some concerns. However, this figure requires context - debt typically grows with population and economic expansion. While consumer credit as a percentage of income has increased, it hasn't reached alarming levels.

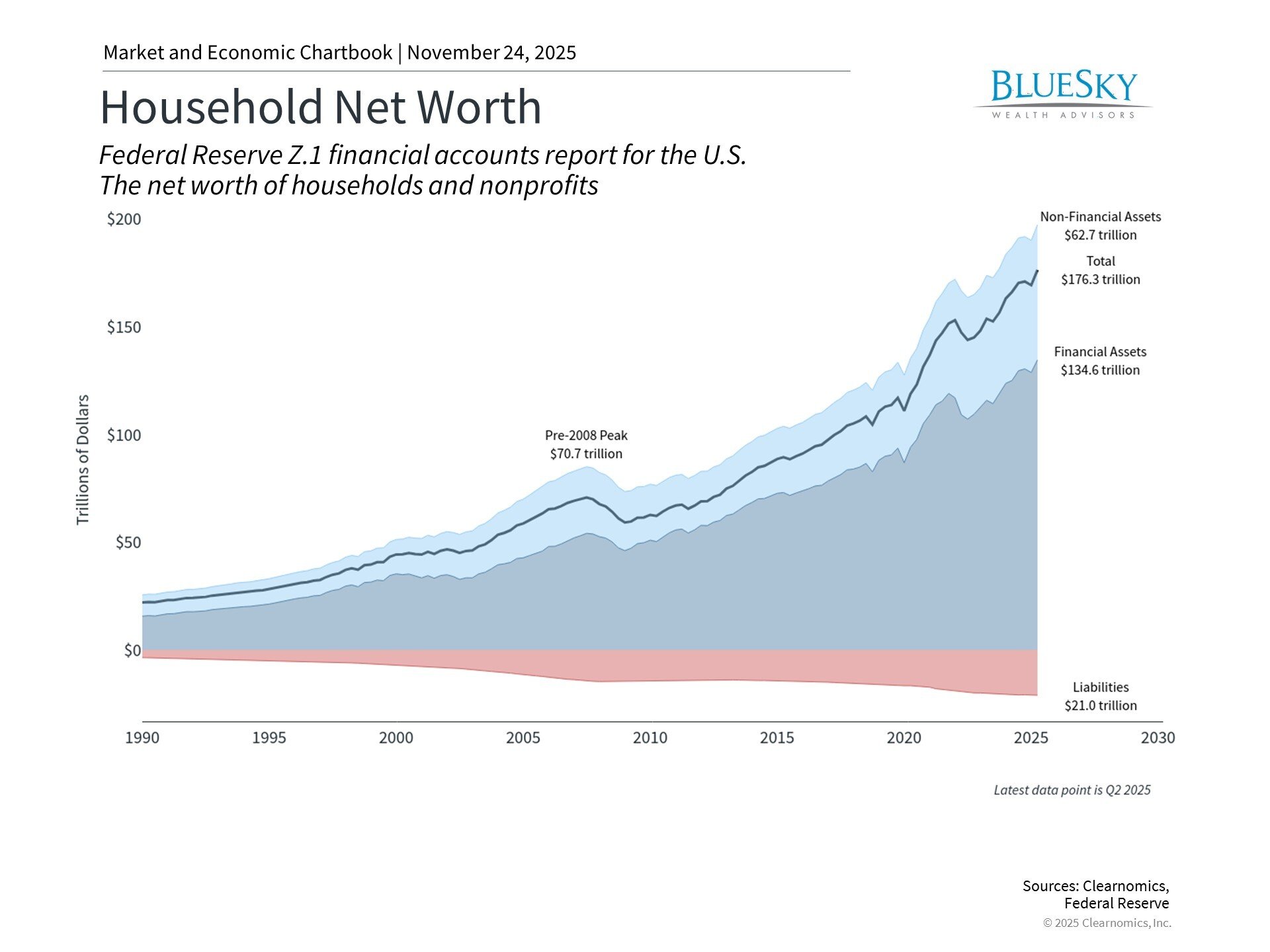

Aggregate household wealth remains strong

U.S. households' net worth has achieved unprecedented levels, supported by strong asset valuations and real estate markets. This wealth effect typically encourages increased consumer spending.

However, it's essential to note that wealth distribution remains uneven across different demographic and economic groups. Some households continue to face financial challenges despite overall positive wealth statistics.

While strong household balance sheets and sustained consumer spending don't guarantee economic stability, they suggest greater economic resilience than some might expect.

The bottom line? Current consumer spending patterns remain resilient despite economic concerns and negative sentiment. This highlights why investors should maintain perspective rather than react to short-term market movements.