S-Corp Tax Reduction Strategies: Top 5 Essential Tips for 2024

S-Corp Tax Reduction Strategies: Top 5 Essential Tips for 2024

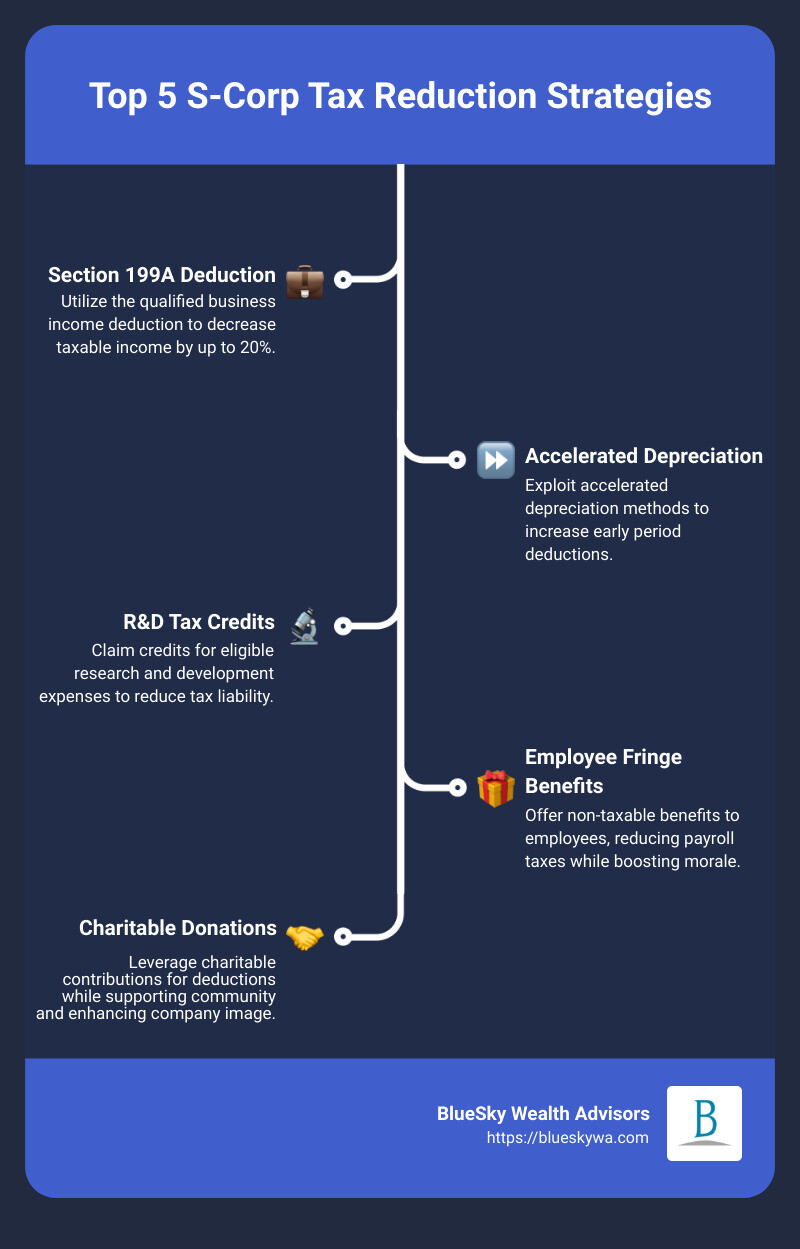

If you’re looking for s-corp tax reduction strategies, the key methods include leveraging Section 199A deductions, employing accelerated depreciation, maximizing research and development tax credits, and optimizing employee fringe benefits. These strategies not only lower your tax bill but also enhance your company’s financial efficiency.

Introduction

Navigating S-corporations can seem overwhelming, especially when it comes to taxes. Yet, understanding how to leverage the entity’s structure can lead to significant tax savings. S-Corporations provide a unique opportunity for business owners to reduce taxable income and avoid the double taxation typically associated with corporate structures. This can be especially beneficial for those looking to reinvest in their business and secure long-term profitability.

Tax planning for S-corporations is not just about compliance; it’s a strategic necessity that can transform your financial landscape. It encapsulates a range of practices from salary adjustments to nuanced deductions—all aimed at minimizing liabilities and bolstering your reinvestment capabilities. The benefits of becoming an S-corporation include pass-through taxation, various tax credits, and deductions, which make it a compelling choice for business owners committed to growing their enterprises while maintaining personal asset protection.

In summary, understanding and implementing strategic tax planning for your S-corporation can lead to substantial savings and more efficient capital management, helping you not only to safeguard but also to maximize your financial assets. As we dive deeper into S-corp taxation, keep in mind that a proactive approach and expert advice are indispensable.

Understanding S-Corp Taxation

Pass-through Taxation

One of the key features of an S Corporation is its status as a pass-through entity. This means that instead of the corporation itself paying income taxes, the profits and losses of the business are passed through to the individual shareholders’ tax returns. Each shareholder then pays taxes at their personal income tax rates. This structure avoids the issue of double taxation, which is more common in traditional C Corporations.

Avoiding Double Taxation

A significant advantage of the S-corp structure is the avoidance of double taxation. Typically, corporations are taxed at the corporate level first, and then shareholders are taxed again on dividends. However, in an S-corp, the income is only taxed once at the shareholder level. This feature makes S-corps a desirable option for many business owners looking to maximize their after-tax income.

IRS Forms: 1120-S and Schedule K-1

To comply with IRS requirements, S-corps must file specific forms:

– IRS Form 1120-S: This form is the U.S. Income Tax Return for an S Corporation. It is used to report the income, losses, deductions, credits, and other financial activities of the corporation.

– Schedule K-1 (Form 1065): This form is provided to each shareholder and shows their share of the corporation’s income, deductions, and credits. It must be filed with the shareholder’s personal tax return, helping to ensure that each shareholder reports the correct amount of income and claims their rightful deductions and credits.

Understanding these forms and the related tax obligations is crucial for maintaining compliance and optimizing your tax strategy. It’s recommended to work with a tax professional who can provide guidance tailored to your specific situation, helping to navigate the complexities of S-corp taxation effectively. Remember that leveraging the benefits of an S-corp requires careful planning and adherence to IRS rules. With the right approach, you can significantly enhance the financial health of your business.

S-Corp Tax Reduction Strategies

Minimizing Taxes Through Salary Adjustments

One of the most effective s-corp tax reduction strategies involves careful management of how you pay yourself. To minimize taxes, it’s crucial to balance your salary and distributions.

Reasonable Compensation: The IRS mandates that S-corp shareholders who work in their business must receive a reasonable salary before taking any non-wage distributions. What’s considered “reasonable” depends on your role, industry standards, and the size of your business.

60/40 Rule: A common strategy is the 60/40 rule, where 60% of your total compensation is taken as salary and 40% as distributions. This isn’t a strict rule, but it’s a starting point for many S-corps to balance payroll taxes against income taxes.

Maximizing Deductible Expenses

Business Deductions: Every dollar your S-corp spends on legitimate business expenses can reduce your taxable income. This includes:

- Vehicle Expenses: If your vehicle is used for business, expenses like gas, repairs, and insurance are deductible. Only the business use portion is deductible.

- Real Estate Taxes: If your S-corp owns property, the real estate taxes paid are fully deductible.

- Marketing Costs: Money spent on advertising and marketing is not only good for business growth but also fully deductible.

- Employee Benefits: Benefits such as health insurance, retirement plans, and education assistance are deductible and can improve employee retention and satisfaction.

Leveraging Home Office Deductions

If you use part of your home regularly and exclusively for business, you can take advantage of the home office deduction. This involves two critical aspects:

Exclusive Use: The space must be used only for business purposes. A home office that doubles as a guest room won’t qualify.

Proportional Expenses: You can deduct expenses such as rent, utilities, and repairs based on the proportion of your home used for business. For instance, if your home office is 10% of your home’s total square footage, then 10% of these expenses can be deducted.

IRS Compliance: To stay clear of IRS scrutiny, keep detailed records of all expenses and use a methodical approach to calculate deductions. It’s advisable to consult with a tax professional to ensure all deductions are legitimate and maximally beneficial.

By implementing these strategies, you can optimize your S-corp’s financial health. Proper salary management, maximizing business deductions, and leveraging home office deductions are foundational elements of a robust tax reduction strategy. As we proceed, we will explore advanced tax-saving techniques that can further enhance your S-corp’s benefits.

Advanced Tax Saving Techniques for S-Corps

Employing Family Members to Reduce Taxes

Hiring your children or other family members can be a smart way to reduce your S-corp’s taxable income. By employing your children, you can pay them a salary up to the tax-free threshold, which is $12,000 per child. This strategy not only provides your children with income but also decreases the business’s taxable income through their salaries, which are deductible business expenses.

Key Points:

– Child employment: Ensure the work is age-appropriate and genuinely contributes to your business.

– Salary benefits: Salaries paid to children are deductible from the business income, lowering overall taxable income.

– Tax-free thresholds: Each child can earn up to $12,000 tax-free, under current IRS rules.

Utilizing State-Specific Tax Benefits

Navigating state taxes can significantly impact your S-corp’s tax liabilities. With the SALT (State and Local Tax) cap set at $10,000, many states have adopted the Pass-Through Entity Tax (PTET) to circumvent this limit. By opting into PTET, S-corps can treat state taxes as a business expense, potentially reducing taxable income at the federal level.

Key Points:

– SALT cap: Understand how the $10,000 cap on state and local tax deductions affects your business.

– PTET strategies: If available in your state, consider opting into PTET to manage tax liabilities better.

– Local credits: Check for any state-specific credits that could reduce your tax burden further.

Exploring Tax Credits and Incentives

Tax credits are a direct way to reduce your tax liability. For S-corps, several credits can be particularly beneficial. Research and Development (R&D) tax credits support businesses investing in innovation, while tax credits for retirement plan startup costs encourage the establishment of employee retirement plans.

Key Points:

– R&D credits: If your S-corp engages in qualifying research activities, you can claim R&D credits to offset income tax.

– Retirement plan costs: Initiating retirement plans like a Solo 401(k) or SEP IRA can not only provide future security for your employees but also offer tax credits to reduce current year liabilities.

– Healthcare premiums: Under certain conditions, S-corps can deduct the cost of health insurance premiums, reducing taxable income.

By integrating these advanced tax-saving techniques, S-corps can leverage both federal and state tax laws to their advantage, potentially saving significant amounts on their tax bills. Each strategy requires careful documentation and adherence to IRS rules, so consulting with a tax professional is recommended to ensure compliance and optimize benefits.

How BlueSky Wealth Advisors Can Enhance Your S-Corp’s Tax Strategy

At BlueSky Wealth Advisors, we understand that every S-Corp’s financial landscape is unique. That’s why we offer personalized financial solutions tailored to meet the specific needs of your business. Our team of experts dives deep into the intricacies of your financial situation to craft strategies that not only comply with the law but also maximize your tax savings.

Personalized Financial Solutions

We start by assessing your current tax strategy and financial statements to identify potential areas for improvement. Whether it’s optimizing your salary structure or reevaluating your deductible expenses, our goal is to ensure that every financial move you make benefits your bottom line. We consider everything from your business goals to your personal financial aspirations to create a holistic plan that aligns with your vision.

Proactive Tax Planning

Tax laws are constantly changing, and staying ahead can be a challenge. BlueSky Wealth Advisors takes a proactive approach to tax planning. We keep our clients informed about the latest tax law changes and how they can affect your business. By anticipating future changes and planning accordingly, we help you avoid surprises at tax time and ensure you are always in the best possible position to save on taxes.

Our proactive strategies include:

– Regular reviews of your business structure to ensure it’s still the best choice for tax purposes.

– Advanced planning for significant business transactions to minimize tax liabilities.

– Utilization of lesser-known deductions and credits that could save you money.

Client Care

At the heart of BlueSky Wealth Advisors is our commitment to client care. We believe in building lasting relationships based on trust, transparency, and mutual respect. Our team is dedicated to understanding not just your business needs but your personal goals as well.

Our client-first approach means we’re always available to answer your questions, help you understand complex tax issues, and provide guidance on financial decisions. We take care of the details, so you can focus on what you do best—running your business.

By choosing BlueSky Wealth Advisors, you’re not just getting a tax advisor; you’re getting a partner who is committed to your success. We go beyond just tax planning; we help you navigate the complexities of financial growth and ensure that your business thrives under our care.

With BlueSky, you can rest assured that your S-Corp’s tax strategy is in capable hands. Let us help you turn your tax challenges into financial opportunities.

Frequently Asked Questions about S-Corp Tax Strategies

How can I ensure my salary meets the IRS’s “reasonable compensation” standard?

Ensuring your salary aligns with the IRS’s “reasonable compensation” standard is crucial to avoid audits and penalties. Here’s how you can stay compliant:

- Research Industry Standards: Look at what others in similar roles and industries are paid. Websites like the Bureau of Labor Statistics can provide this data.

- Reflect on Role and Responsibilities: Consider the scope and impact of your duties within the company. Your salary should reflect your role’s importance.

- Consult with Professionals: A tax advisor or financial consultant can offer personalized guidance based on your specific situation and ensure you meet IRS requirements.

What are the best practices for documenting home office deductions?

To take advantage of home office deductions without risking IRS scrutiny, follow these best practices:

- Exclusive Use: Ensure the space is used only for business purposes. This area must not be used for any personal activities.

- Keep Detailed Records: Maintain receipts and records of all expenses related to your home office, including utilities, insurance, and internet costs.

- Calculate the Proportionate Use: Deduct expenses based on the percentage of your home used for business. Measure your workspace and divide by the total area of your home to get this percentage.

How do specific state tax laws affect my S-Corp’s tax strategy?

State tax laws can significantly impact your S-Corp’s tax strategy due to variations in tax rates, deductions, and credits. Here’s what you need to consider:

- Understand Local SALT Laws: Be aware of state and local tax (SALT) deductions and how they cap at $10,000. This can affect how much you can deduct on your federal tax return.

- Explore State-Specific Credits: Some states offer unique tax credits for small businesses and S-Corps that can reduce your liability.

- Consult State Tax Experts: Since state laws vary widely, it’s wise to work with a tax professional who specializes in your state’s specific tax landscape.

By staying informed and proactive, you can navigate these complexities effectively. At BlueSky Wealth Advisors, we’re here to help optimize your S-Corp’s tax strategy and ensure compliance across all levels of government. Let’s make your business’s financial health our top priority.

Conclusion

As we’ve explored throughout this guide, implementing effective s-corp tax reduction strategies is not just about adhering to tax laws—it’s about strategically planning to make those laws work in your favor. From understanding the nuances of salary adjustments and maximizing deductible expenses to leveraging home office deductions and employing family members, each strategy plays a crucial role in minimizing your tax liability while maximizing your business’s financial potential.

Strategic planning is essential in tax management, particularly for S-Corps, where the benefits of pass-through taxation can significantly enhance your financial outcomes. By carefully planning and executing these strategies, you ensure that every dollar is optimized for both immediate benefits and long-term growth.

At BlueSky Wealth Advisors, we understand that tax planning is a critical component of your overall financial health. We are committed to providing personalized financial solutions that align with your unique business needs and goals. Our approach is always tailored to ensure that your S-Corp not only complies with the complexities of tax laws but thrives under them.

Contact us today to discuss how we can enhance your S-Corp’s tax strategy, helping you to keep more of your hard-earned money and secure the future of your business. Let’s partner together to navigate the intricacies of S-Corp taxation with confidence and ease. Your business deserves no less than a meticulously crafted approach to tax savings, and we are here to deliver just that.