Top 5 Self-Employed Tax Reduction Strategies for 2024

Top 5 Self-Employed Tax Reduction Strategies for 2024

Self-employed tax reduction strategies are crucial for anyone operating their own business, be it large or small scale. When you’re self-employed, every dollar saved in taxes enhances your ability to invest back into your business or secure your financial independence. However, many self-employed individuals face unique challenges, such as fluctuating incomes and complex tax filing requirements, making efficient tax planning essential.

In the realm of solo entrepreneurship, you shoulder more responsibility, from accounting to ensuring compliance with tax laws. These responsibilities, while enhancing your earnings potential, also increase the complexities of your tax situation. Understanding how to navigate these waters is not just about complying with tax laws but strategically reducing your tax liabilities where possible.

Efficiently managing your taxes involves a combination of leveraging deductions, timely and accurate tax filing, and strategic financial planning. Whether it’s deducting home office expenses, understanding the nuances of self-employment taxes, or planning for retirement, there are numerous strategies that can potentially lower your taxable income and increase your profitability.

Understanding Self-Employment Taxes

When you’re self-employed, managing your taxes can seem like navigating a complex maze. Let’s break down the essentials: Tax Basics, Self-Employment Tax, and IRS Rules. This knowledge is crucial for applying effective self employed tax reduction strategies.

Tax Basics

Firstly, as a self-employed individual, your income is taxed through what is known as “pass-through taxation.” This means the income you earn from your business is passed through to your personal tax return. You’re responsible for paying both income tax and self-employment tax on your earnings.

Self-Employment Tax

Self-employment tax consists of two parts: Social Security and Medicare. The total rate is 15.3%, with 12.4% going to Social Security and 2.9% to Medicare. This mirrors the contributions typically split between employers and employees in traditional employment settings, but as a self-employed individual, you cover both portions.

Key Point: You’re not just paying taxes on profit but potentially on your gross income after deductions. This underscores the importance of maximizing deductions to reduce your taxable income.

IRS Rules

The IRS has specific guidelines for self-employed individuals. For instance, you must file a tax return if your net earnings from self-employment were $400 or more. Moreover, you are required to make estimated quarterly tax payments if you expect to owe at least $1,000 in federal taxes for the year. Failing to make these payments can result in penalties.

- Quarterly Payments: These help spread your tax liability over the year, making it more manageable and avoiding a large lump sum due at tax time.

- Deductions and Credits: The IRS allows several deductions for self-employed individuals that can significantly lower tax bills, such as the home office deduction, health insurance premiums, and business expenses.

Navigating these rules effectively can significantly impact your financial health as a self-employed individual. Always ensure your deductions are well-documented, and consider consulting with a tax professional to optimize your tax strategy.

By understanding these tax basics, self-employment tax requirements, and IRS rules, you’re better equipped to manage your business finances and potentially reduce your tax obligations. This foundational knowledge is crucial as you explore deeper tax strategies and deductions in the following sections.

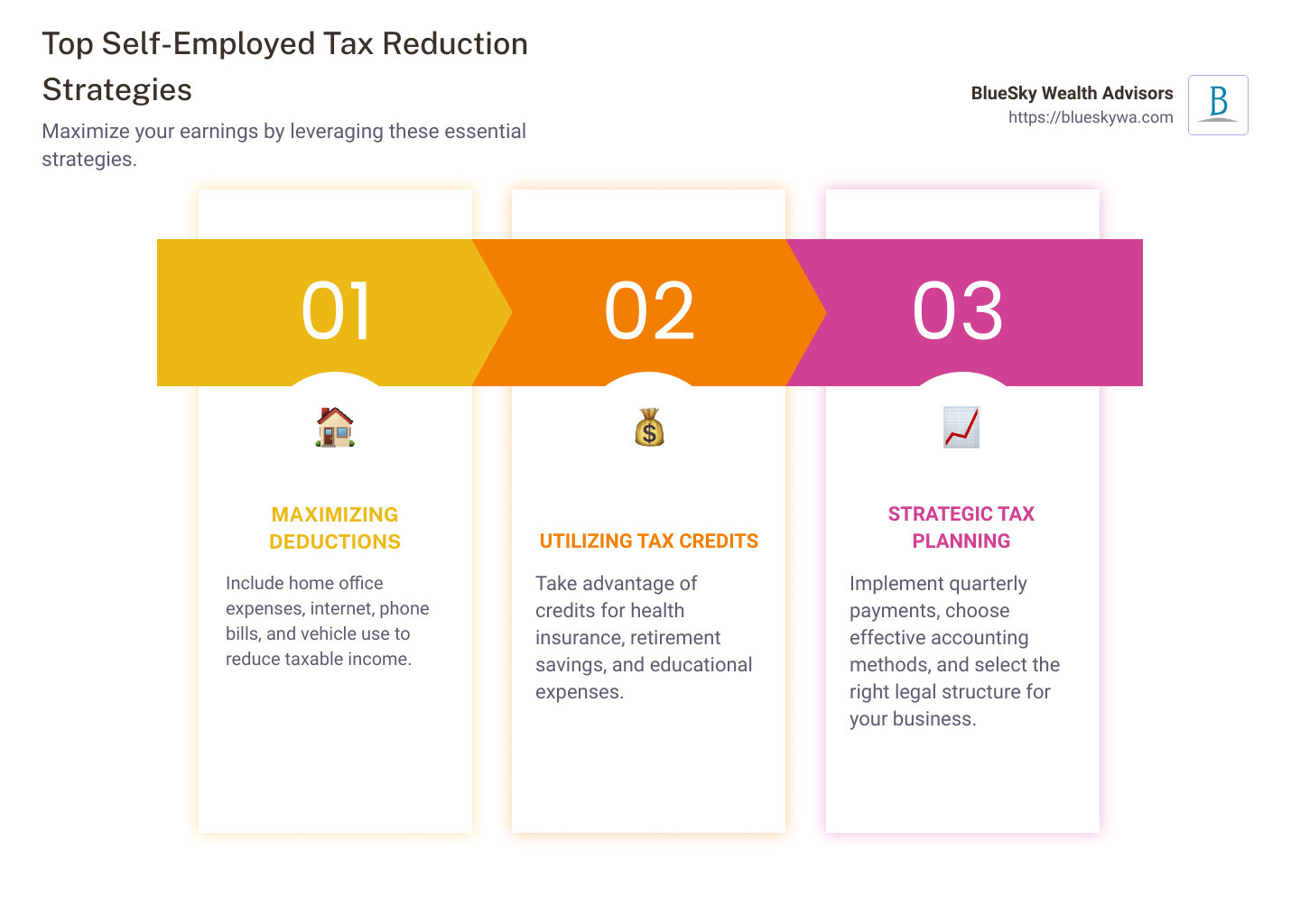

Self Employed Tax Reduction Strategies

Navigating tax strategies as a self-employed individual can significantly impact your financial health. Let’s dive into how you can reduce your tax burden through various methods.

Maximizing Deductions

Home Office: If you use a part of your home exclusively for business, you might qualify for the home office deduction. Two methods are available:

– Simplified Option: Simply multiply the square footage of your office by $5, up to 300 square feet, for a maximum deduction of $1,500.

– Regular Method: Calculate the proportion of your home used for business and apply this percentage to your home expenses, such as mortgage interest or rent, utilities, and insurance.

Internet and Phone Bills: A portion of your internet and phone expenses that directly relate to your business activities is deductible.

Vehicle Use: You have two options:

– Standard Mileage Rate: For 2023, it’s 65.5 cents per mile driven for business use.

– Actual Expenses: Calculate the percentage of vehicle use that is for business and apply that percentage to your total vehicle expenses.

These deductions require meticulous record-keeping. Ensure you maintain detailed logs of home office dimensions, business calls, and miles driven for accurate reporting.

Utilizing Tax Credits

Health Insurance: Premiums paid for health insurance for yourself, your spouse, and dependents can be deducted if you show a net profit from your business.

Retirement Savings: Contributions to plans like a SEP IRA or a solo 401(k) not only prepare you for retirement but also reduce your taxable income. You might also qualify for the Saver’s Credit, which can reduce your tax bill based on your contributions and income level.

Education: Keep enhancing your skills with education that relates to your current business. Expenses for tuition, books, and related items are often deductible if they improve your existing skills but don’t qualify you for a new career.

Strategic Tax Planning

Quarterly Payments: Instead of annual tax payments, you’ll make estimated quarterly tax payments. This helps manage cash flow and avoids underpayment penalties.

Accounting Methods: Choose between the cash method (reporting income when received and expenses when paid) and the accrual method (reporting income when earned and expenses when incurred). The best choice depends on your business structure and cash flow.

Legal Structures: Consider whether operating as a sole proprietorship, partnership, LLC, or S corporation could provide better tax advantages. Each structure offers different implications for liability and tax obligations.

By applying these strategies, you can effectively reduce your taxable income and lower your overall tax liability. Keeping thorough records and possibly consulting with a tax professional can help you navigate the complexities of self-employed taxes more efficiently. Next, we’ll look into specific deductions that are crucial for self-employed individuals.

Key Deductions for the Self-Employed

Navigating taxes as a self-employed individual can be daunting, but leveraging certain key deductions can significantly reduce your tax burden. Here, we’ll explore essential deductions including home office expenses, health insurance premiums, vehicle use, and retirement contributions.

Home Office Deduction

Simplified Option: For those seeking a straightforward approach, the IRS offers a simplified option. Simply multiply the square footage of your home office (up to 300 square feet) by $5. For example, a 300-square-foot office would yield a $1,500 deduction.

Regular Method: If you prefer a detailed calculation, the regular method involves dividing the square footage of your office by the total square footage of your home. Multiply this percentage by your home expenses such as mortgage interest or rent, utilities, and insurance to find your deduction.

Qualifying Criteria: To qualify, the space must be used regularly and exclusively for business. It should also be your principal place of business where you meet clients or manage your business activities.

Health Insurance Premiums Deduction

For self-employed individuals, health insurance premiums are fully deductible. This includes premiums for medical, dental, and qualifying long-term care insurance plans for yourself, your spouse, and dependents. Importantly, if you are eligible for Medicare, premiums for Medicare Part B and Part D are also deductible.

Vehicle Use Deduction

Standard Mileage: The IRS allows you to deduct 65.5 cents per mile for business-related driving in 2023. This method is straightforward as you simply multiply your total business miles by the standard rate.

Actual Expenses: Alternatively, you can deduct the actual expenses of using your vehicle for business. This includes gas, repairs, insurance, and depreciation. It’s crucial to keep a detailed log of your business mileage and expenses to substantiate your deduction.

Retirement Contributions Deduction

SEP IRA & Solo 401(k): These plans are ideal for self-employed individuals looking to save for retirement while reducing taxable income. Contributions to these plans are tax-deductible, potentially lowering your tax bill significantly.

Saver’s Credit: Additionally, lower-income self-employed individuals may qualify for the Saver’s Credit, which can reduce your tax bill beyond the deduction for your retirement plan contributions.

By understanding and applying these deductions, self-employed individuals can effectively reduce their taxable income and enhance their financial well-being. Meticulous record-keeping and potentially consulting with a tax professional can maximize the benefits of these deductions. Next, we will delve into advanced tax strategies that can further optimize your tax situation.

Advanced Tax Strategies for the Self-Employed

Navigating the tax landscape as a self-employed individual can be complex, but with the right strategies, you can significantly reduce your tax obligations. Here we explore three advanced tactics: the Qualified Business Income Deduction, hiring family members, and choosing the optimal business structure.

Qualified Business Income Deduction

The Qualified Business Income (QBI) Deduction offers a substantial benefit, allowing you to deduct up to 20% of your net business income. This deduction was introduced under the Tax Cuts and Jobs Act and is designed to reduce the tax burden on small business owners.

- Eligibility: Most self-employed individuals and small business owners, including those who operate as sole proprietors, partnerships, S corporations, and some LLCs, are eligible.

- Calculation: The deduction is generally 20% of your qualified business income, but it can be limited based on your type of business, total income, and whether you pay wages or own property.

- Limitations: The deduction phases out at higher income levels, especially for specified service trades or businesses such as health, law, and consulting.

For detailed guidance on how to calculate and claim this deduction, it’s wise to consult with a tax professional. This ensures you fully capitalize on this opportunity without running afoul of complex IRS rules.

Hiring Family Members

Incorporating family members into your business can lead to significant tax savings and help manage payroll costs effectively.

- Tax Benefits: Hiring your children or spouse can shift income to a lower tax bracket if they earn less, potentially reducing the family’s overall tax liability. Additionally, wages paid to your children under 18 are exempt from Social Security and Medicare taxes.

- IRS Guidelines: The IRS requires that the work done by family members be legitimate and the compensation must be reasonable for the work performed.

- Wage Requirements: Ensure that the wages are justifiable and consistent with industry standards to avoid scrutiny from the IRS.

Employing family members not only provides potential tax savings but also offers a way to teach younger family members about the business and instill a strong work ethic.

Choosing the Right Business Structure

Selecting the most beneficial legal structure for your business is crucial and can impact your tax obligations and personal liability.

- LLC (Limited Liability Company): Offers liability protection while allowing profits to pass through to your personal tax return, avoiding the double taxation faced by C corporations.

- S Corporation: This structure can save on self-employment taxes by allowing you to pay yourself a reasonable salary while distributing the remaining profits as dividends, which are not subject to self-employment taxes.

- Sole Proprietorship: The simplest structure, but offers no personal liability protection. It’s easy to set up and requires less paperwork.

Each structure has its pros and cons depending on your business size, type, and goals. It’s often beneficial to discuss with a tax advisor to determine which structure aligns best with your business strategies and can offer optimal tax benefits.

By employing these advanced strategies, you can navigate the complexities of self-employment taxes more effectively. Each strategy requires careful consideration and often, guidance from a tax professional to ensure compliance and optimization of tax benefits. Next, we will address some frequently asked questions about self-employed tax reduction strategies to help clarify common concerns and provide additional insights.

Frequently Asked Questions about Self-Employed Tax Reduction

How can I maximize my tax deductions as a self-employed individual?

Maximizing your tax deductions involves a clear understanding of what expenses are deductible and meticulous record-keeping. Here are some effective steps:

- Track all expenses: Keep detailed records of all business-related expenses throughout the year. This includes receipts, invoices, and logs, especially for mixed-use expenses like internet and phone bills.

- Home Office Deduction: If you use a part of your home exclusively for business, calculate the deduction using either the simplified option ($5 per square foot up to 300 square feet) or the regular method (based on the percentage of your home used for business).

- Automobile Expenses: Deduct vehicle expenses if you use your car for business. Choose between the standard mileage rate (65.5 cents per mile in 2023) or actual expenses proportionate to business use.

- Retirement Contributions: Contribute to a SEP IRA, Solo 401(k), or a SIMPLE IRA to reduce taxable income and save for retirement.

Consistent documentation and understanding the nuances of what can be legally deducted will help you maximize your deductions effectively.

What are the best retirement plans for self-employed taxpayers?

For self-employed individuals, several retirement plans offer tax advantages and flexibility:

- SEP IRA: Allows contributions of up to 25% of your compensation or $66,000 for 2023, whichever is less. It’s simple to set up and has low administrative requirements.

- Solo 401(k): Similar to a SEP IRA but includes an employee deferral component, allowing for potentially higher contributions. For 2023, the total contribution limit is $66,000, plus an additional $7,500 if you’re 50 or older.

- SIMPLE IRA: Best for businesses with fewer than 100 employees, allowing you to contribute up to $15,500 in 2023, plus a catch-up of $3,500 for those aged 50 or over.

Each plan has its benefits depending on your income level and business structure, so consider your financial goals and consult with a financial advisor.

How does the home office deduction work for a self-employed person?

The home office deduction allows self-employed individuals to deduct expenses for the business use of their home. To qualify:

- Exclusive and Regular Use: The space must be used regularly and exclusively for business.

- Principal Place of Business: It should be your main place of business, used for administrative activities even if you conduct business elsewhere.

You can choose between:

– Simplified Method: Deduct $5 per square foot of the home used for business, up to a maximum of 300 square feet.

– Regular Method: Calculate the deduction based on the percentage of your home used for business. Deduct a proportional share of all home expenses such as mortgage interest, insurance, utilities, repairs, and depreciation.

Choosing the right method depends on your specific situation, and using the regular method requires more detailed record-keeping but can lead to a larger deduction if your home office expenses are high.

These FAQs aim to address common concerns and provide a starting point for deeper exploration into self-employed tax reduction strategies. Engaging with a tax professional can provide personalized advice tailored to your unique financial situation.

Conclusion

As we wrap up our discussion on self-employed tax reduction strategies, it’s clear that understanding and applying these strategies effectively can significantly lower your tax bill and enhance your financial well-being. From maximizing deductions like the home office and vehicle use, to leveraging tax credits for health insurance and retirement savings, the opportunities for tax savings are substantial.

Action Steps

- Review Your Deductions: Regularly review potential deductions to ensure you’re not missing out on any opportunities. This includes keeping up-to-date records of all business-related expenses.

- Plan for Retirement: Consider setting up or contributing more to a retirement plan like a SEP IRA or Solo 401(k). These not only help in tax reduction but also secure your future financially.

- Consult a Professional: Tax laws are complex and subject to change. Consulting with a tax professional can help navigate these complexities and apply the most beneficial strategies for your situation.

BlueSky Wealth Advisors

At BlueSky Wealth Advisors, we are committed to helping you navigate the maze of self-employed taxes. Our team of experts is well-versed in the latest tax laws and dedicated to optimizing your financial strategies to ensure you keep more of what you earn. Whether you’re just starting out or looking to refine your existing tax strategies, we’re here to provide the guidance and support you need.

In conclusion, while the task of managing taxes as a self-employed individual can seem daunting, with the right strategies and support, it’s possible to significantly reduce your tax liability. We encourage you to take proactive steps towards understanding and implementing these strategies and to reach out for professional advice tailored to your unique circumstances. Let us help you turn tax time into an opportunity for financial growth and stability.