Income Tax Reduction Strategies: 22 Proven Ways for 2024

Income Tax Reduction Strategies: 22 Proven Ways for 2024

Introduction

Income tax reduction strategies are essential tools for financially savvy individuals aiming to optimize their fiscal health and maximize wealth. If you’re looking for effective ways to reduce your income tax legally, several practical methods can help you achieve significant savings. These strategies range from optimizing retirement contributions to making use of various deductions and credits offered under current tax laws.

Reducing your taxable income not only preserves more of your hard-earned money but also enhances your ability to invest in avenues that can potentially increase your financial security and independence. Additionally, understanding the legal implications and methods of implementing these strategies ensures compliance with IRS guidelines, avoiding potential pitfalls.

In our guide, we will unpack various legal strategies that empower you to minimize your tax liability while ensuring adherence to the law. This knowledge is particularly valuable for individuals who are more focused on their professional and personal lives than on the intricate details of tax management. By applying the right techniques, you can enjoy substantial reductions without the hassle of navigating complex tax codes on your own.

Understanding Income Tax Reduction Strategies

Key Components of Tax Reduction

Understanding the Basics

Income tax reduction strategies are methods that legally decrease the amount of income tax you have to pay. These strategies can involve using deductions, credits, and making specific investment choices that are favored by tax laws.

The Importance of Tax Reduction

Reducing your tax liability is crucial because it can significantly increase your disposable income and financial flexibility. This extra money can be reinvested, saved, or spent on immediate needs, providing both immediate and long-term financial benefits.

Long-term Benefits

Implementing effective tax strategies not only provides short-term gains but also enhances your financial health over the long term. For instance, the money saved from tax reductions can grow through investments, compounding the benefits year after year.

Retirement Savings

Contributing to retirement accounts like 401(k)s and IRAs is a powerful tax reduction strategy. These contributions can lower your taxable income now while ensuring that you are building a nest egg for the future. For example, in 2023, you can contribute up to $22,500 to a 401(k), directly reducing your taxable income by the same amount.

Investment Choices

Choosing the right investments can also play a crucial role in reducing your taxes. Long-term investments, such as stocks held for over a year, benefit from lower capital gains tax rates compared to short-term investments. Additionally, investing in municipal bonds can provide tax-free interest income, which is especially beneficial for those in higher tax brackets.

Deductions

Deductions decrease your taxable income. Common deductions include mortgage interest, state and local taxes, and charitable contributions. By carefully itemizing deductions, you can significantly lower the amount of income that is subject to tax.

Credits

Tax credits are even more powerful than deductions because they reduce your tax bill dollar-for-dollar. Credits such as the Child Tax Credit or Education Credits can directly reduce the amount of taxes you owe, sometimes even resulting in a refund.

By understanding and applying these key components of tax reduction, you can ensure that you are not only complying with the law but also maximizing your financial opportunities. Each component requires careful consideration and planning, ideally with the guidance of professionals like those at BlueSky Wealth Advisors, who can tailor these strategies to your specific financial situation. This personalized approach ensures that you are making the most of the opportunities available to reduce your tax liability while securing your financial future.

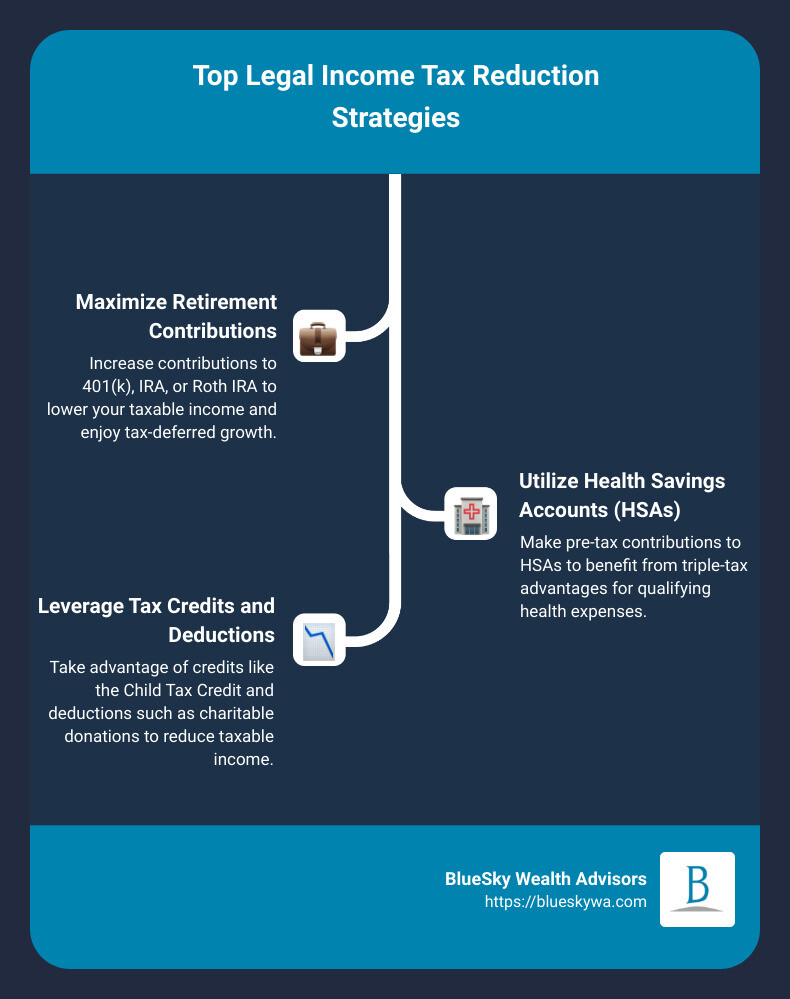

Maximize Your Retirement Contributions

Benefits of Maximizing Contributions

When it comes to income tax reduction strategies, optimally using retirement accounts like the 401(k), IRA, and Roth IRA can significantly lower your taxable income, bolster your savings for the future, and benefit from tax-deferred growth. Here’s how each of these accounts plays a crucial role:

401(k) Plans

By contributing to a 401(k) plan, you’re essentially directing part of your salary into a retirement account before taxes are deducted. For 2023, you can contribute up to $22,500, and if you’re age 50 or older, you can add an extra $7,500 as a catch-up contribution. This reduces your taxable income dollar-for-dollar, lowering your tax bill today while your savings grow without the drag of annual taxes.

Individual Retirement Accounts (IRAs)

Contributing to a traditional IRA offers similar benefits. For 2024, you can contribute up to $7,000 (or $8,000 if you’re 50 or older). Your contributions may be fully or partially deductible, depending on your income and whether you or your spouse has a retirement plan at work. Like the 401(k), the money in your IRA grows tax-deferred, giving your investments the potential to grow faster without the immediate tax burden.

Roth IRAs

While contributions to a Roth IRA are made with after-tax dollars — meaning there’s no immediate tax deduction — the trade-off is that withdrawals in retirement are completely tax-free, as long as certain conditions are met. This can be particularly advantageous if you expect to be in a higher tax bracket in retirement or if tax rates rise across the board.

Lower Taxable Income

Each dollar you contribute to a 401(k) or traditional IRA reduces your taxable income for the year. This not only lowers your immediate tax liability but also might help you qualify for other tax benefits that phase out at higher incomes.

Future Savings

The more you contribute to these accounts, the more potential your money has to grow due to compound interest. Over decades, this can translate into a significant difference in your retirement savings, providing you with a more comfortable and secure retirement.

Tax-deferred Growth

The beauty of tax-deferred growth in these retirement accounts is that you won’t pay taxes on dividends, interest, or capital gains until you withdraw the money. This allows your investments to grow unhindered by taxes, which can significantly increase the amount you will have upon retirement.

By maximizing your retirement contributions, you leverage powerful income tax reduction strategies that benefit you both today and in the future. Planning and maximizing these contributions should ideally be done with the insight of financial professionals at institutions like BlueSky Wealth Advisors, who can provide personalized advice tailored to your unique financial situation. This strategic approach not only ensures compliance with tax laws but also optimizes your financial growth and security.

Continuing on, let’s explore how optimizing Health Savings Accounts (HSAs) can further enhance your tax-saving strategies and support your long-term health planning…

Optimize Health Savings Accounts (HSA)

Strategic Use of HSAs

Health Savings Accounts (HSAs) are a powerful tool in income tax reduction strategies, offering unique benefits that can significantly lower your taxes while providing for your healthcare needs. Understanding how to strategically use HSAs can lead to substantial financial advantages.

Contributions

Each year, you can contribute a specific amount to your HSA pre-tax. For 2023, the contribution limits are $3,850 for individuals and $7,750 for families. If you’re 55 or older, you can add an additional $1,000 to these limits. These contributions reduce your taxable income, lowering your tax bill right from the start.

Triple-tax Advantage

HSAs offer a triple-tax benefit, a rare advantage in the realm of financial accounts:

1. Pre-tax Contributions: Money put into your HSA is not taxed, reducing your gross income.

2. Tax-free Growth: The funds in your HSA grow tax-free, meaning you don’t pay taxes on any interest, dividends, or capital gains.

3. Tax-free Withdrawals: Money taken out for qualified medical expenses is not taxed.

Qualifying Expenses

You can use your HSA funds to pay for a wide range of qualifying medical expenses. These include, but are not limited to, deductibles, copayments, prescriptions, and certain medical procedures not typically covered by health insurance. This flexibility allows you to manage both expected and unexpected healthcare costs more effectively.

Pre-tax Contributions

Contributing to your HSA with pre-tax dollars is straightforward. Typically, these contributions are made through payroll deductions in an employer-sponsored plan, which simplifies the process and ensures your savings are consistent throughout the year.

Tax-free Withdrawals

When you use your HSA funds for qualified medical expenses, the withdrawals are tax-free. This aspect is crucial for planning long-term health expenses, as it allows your savings to stretch further without the burden of taxes.

Long-term Health Planning

An HSA is more than just a way to cover current medical expenses. It’s a long-term health planning tool. Unlike Flexible Spending Accounts (FSAs), HSA funds roll over year to year, allowing you to build a reserve for healthcare costs in retirement. This is particularly beneficial as healthcare expenses tend to increase with age.

In conclusion, HSAs are not just beneficial for immediate tax relief but are a critical component of long-term financial and health planning. They provide a proactive way to manage healthcare expenses while maximizing tax benefits. Engaging with a financial advisor, like those at BlueSky Wealth Advisors, can help you tailor your HSA contributions to fit your overall financial strategy, ensuring you optimize these benefits to their fullest potential.

Moving forward, let’s delve into how you can leverage tax credits and deductions to further reduce your taxable income…

Leverage Tax Credits and Deductions

Maximizing Deductible Expenses

Tax Credits: A Powerful Tool for Reducing Taxes

Tax credits are one of the most effective tools in your income tax reduction strategies toolkit. Unlike deductions, which reduce the amount of income subject to tax, credits reduce your tax bill dollar-for-dollar. Here are some key credits to consider:

Child Tax Credit: For 2022, this credit offers $2,000 per qualifying child. It’s available in full to single filers earning up to $200,000 and married couples earning up to $400,000. The credit begins to phase out above these income levels. Your child must be under 17 at the end of the tax year to qualify.

Earned Income Tax Credit (EITC): This credit is designed for low to middle-income taxpayers. For 2023, the maximum credit ranges from $600 to $7,430, depending on the number of qualifying children. Income thresholds apply, so it’s important to check if you qualify each tax year.

Education Credits: These include the American Opportunity Tax Credit (up to $2,500 per student for the first four years of college) and the Lifetime Learning Credit (up to $2,000 per tax return, not per student). These credits can help offset the costs of higher education.

Deductions: Lowering Your Taxable Income

Deductions reduce your taxable income, which in turn can lower your tax bill. Here are some important deductions to consider:

Charitable Donations: If you itemize deductions, donations to qualified charities can be deducted. This includes both cash and non-cash items like clothing and household goods. Be sure to keep detailed records and receipts.

Medical Expenses: For those who itemize, out-of-pocket medical and dental expenses that exceed 7.5% of your adjusted gross income can be deducted. This includes payments for doctors, surgeries, and some medical devices.

Mortgage Interest: Homeowners who itemize can deduct interest on up to $750,000 of mortgage debt (or $1 million if you bought the home before December 16, 2017). This deduction is a major benefit for homeowners.

Strategic Planning with BlueSky Wealth Advisors

By understanding and utilizing these tax credits and deductions, you can significantly reduce your tax liability. However, the rules can be complex, and the best strategies depend on your individual financial situation. Engaging with a professional advisor at BlueSky Wealth Advisors can help ensure that you’re not only complying with the law but also maximizing your tax benefits.

As we continue to explore income tax reduction strategies, each element of your tax return can interact with others in ways that can either save or cost you money. In the next section, we’ll discuss how personalized planning with BlueSky Wealth Advisors can provide proactive strategies tailored to your unique financial landscape.

Income Tax Reduction Strategies with BlueSky Wealth Advisors

Personalized Planning

At BlueSky Wealth Advisors, we understand that every client’s financial and tax situation is distinct. Personalized planning is the cornerstone of our approach to income tax reduction strategies. We start by thoroughly understanding your current financial status, future goals, and unique challenges. This allows us to craft a tax strategy that aligns perfectly with your personal and business aspirations.

For instance, if you’re an entrepreneur, we’ll look into specific deductions that benefit small business owners. If you’re an individual investor, we focus on optimizing your investment portfolio in a way that minimizes taxes on dividends and capital gains.

Proactive Strategies

Being proactive is key in tax planning. BlueSky Wealth Advisors stays ahead by keeping up-to-date with the latest tax law changes and IRS guidelines. This proactive stance allows us to alert you to new opportunities for tax savings, often before the end of the fiscal year when most adjustments are made.

A great example of our proactive approach is tax-loss harvesting, a strategy that involves selling off investments that are performing poorly to offset the gains from those performing well. This can significantly reduce your capital gains tax. We monitor your portfolio continuously and suggest this strategy at the optimal time, ensuring that your investments are always working in your favor tax-wise.

Client Care

At BlueSky Wealth Advisors, our relationship with clients goes beyond mere financial advisory. We believe in building partnerships based on trust, transparency, and mutual respect. Our dedicated advisors are always ready to answer your questions, clarify the complex world of taxes, and provide reassurances about your financial decisions.

Our client-first approach means that we are committed to understanding your vision and working closely with you to achieve it. This personalized attention ensures that our income tax reduction strategies are not only comprehensive but also deeply aligned with your personal and business goals.

Remember that engaging with a trusted advisor like BlueSky Wealth Advisors not only helps in navigating the complex world of finance but also ensures that your financial plans are well-aligned with your long-term life goals. In the next section, we will delve deeper into specific tax reduction opportunities and how to implement them effectively in your financial strategy.

Conclusion

As we wrap up our discussion on income tax reduction strategies, it’s crucial to take a moment to review the key points we’ve covered. The goal of tax planning isn’t just about reducing taxes for the current year but fostering a strategy that benefits you long-term.

Review

Start by reviewing your financial activities over the past year. Did you maximize your retirement contributions? Did you take advantage of eligible tax credits and deductions? How effective were your investment choices in terms of tax efficiency? Reflecting on these questions will help you identify what worked well and what could be improved.

Plan Ahead

Tax planning is an ongoing process that requires you to think ahead. By starting early, you can make more informed decisions that align with both your short-term needs and long-term financial goals. For instance, if you anticipate a higher income next year, you might consider strategies such as deferring some income or accelerating deductions to manage your tax bracket more effectively.

Consult BlueSky Wealth Advisors

No one should navigate the complexities of tax planning alone. Consulting with professionals like BlueSky Wealth Advisors can provide you with tailored advice that considers your unique financial situation. BlueSky Wealth Advisors stands ready to help you develop a proactive plan that not only aims to reduce your tax liabilities but also enhances your overall financial well-being.

Engaging with a trusted advisor ensures that you are making the most informed decisions and taking advantage of all available strategies to reduce your taxable income and increase your savings. Whether you’re looking to optimize your investments, plan for retirement, or ensure you’re taking full advantage of tax credits and deductions, BlueSky Wealth Advisors can guide you through every step of the process.

As we move into the Frequently Asked Questions section next, think about any additional queries you might have about how to implement these strategies effectively or any specific concerns you might have regarding your personal tax situation. BlueSky Wealth Advisors is here to help clarify these points and assist you in planning a prosperous financial future.

Frequently Asked Questions about Income Tax Reduction

How can I reduce my taxable income?

Reducing your taxable income can be achieved through several legal strategies:

Maximize Retirement Contributions: Contributing to retirement accounts like a 401(k) or an IRA can significantly lower your taxable income. These contributions are made pre-tax, which means they are deducted from your salary before taxes are applied.

Health Savings Accounts (HSA): If you’re eligible, contributing to an HSA not only helps cover medical expenses with pre-tax dollars but also reduces your taxable income.

Itemize Deductions: While the standard deduction works for many, itemizing deductions can be beneficial if you have significant mortgage interest, state and local taxes, or charitable contributions.

Tax Loss Harvesting: This involves selling investments at a loss to offset capital gains in other areas of your portfolio.

For more personalized strategies, consider consulting with professionals who can offer tailored advice based on your specific financial situation. Learn more about how we can assist at BlueSky Wealth Advisors Tax Planning.

What are the basic tax planning strategies?

Basic tax planning strategies involve:

Understanding Your Tax Bracket: Knowing your current tax bracket can help you predict how additional income or deductions affect what you owe.

Making Charitable Contributions: Donations to qualified charities can be deducted if you itemize, potentially lowering your taxable income.

Utilizing Tax Credits: Credits like the Child Tax Credit or the Earned Income Tax Credit can provide dollar-for-dollar reductions in your tax liability, unlike deductions which reduce the amount of income subject to tax.

Deferring Income: If possible, you might defer income to the next year to avoid moving into a higher tax bracket, especially if you expect to have a lower income next year.

How do high income earners reduce taxes?

High income earners have specific strategies to minimize their tax liability:

Advanced Retirement Planning: Beyond standard 401(k) or IRA contributions, high earners might explore options like a backdoor Roth IRA conversion, especially if they exceed the income limits for traditional Roth contributions.

Investment Choices: Capital gains can be managed more effectively by holding investments longer to qualify for long-term capital gains rates, which are lower than short-term rates.

Income Shifting: This involves transferring income to a family member in a lower tax bracket through gifts or by employing them in a family business, ensuring the compensation is reasonable and justified.

Tax-Efficient Investments: Utilizing municipal bonds or certain mutual funds that focus on tax efficiency can also help in reducing taxable income.

Each financial situation is unique, and high earners particularly benefit from customized tax planning. At BlueSky Wealth Advisors, we specialize in creating strategies that align with your financial goals and reduce your tax burden. Visit our tax planning service page to see how we can help you manage and minimize your taxes effectively.

The key to effective tax reduction is a proactive approach and regular consultation with tax professionals. Whether you’re planning for retirement, looking to maximize deductions, or need specialized advice for high income scenarios, BlueSky Wealth Advisors is here to guide you through the complexities of tax planning.