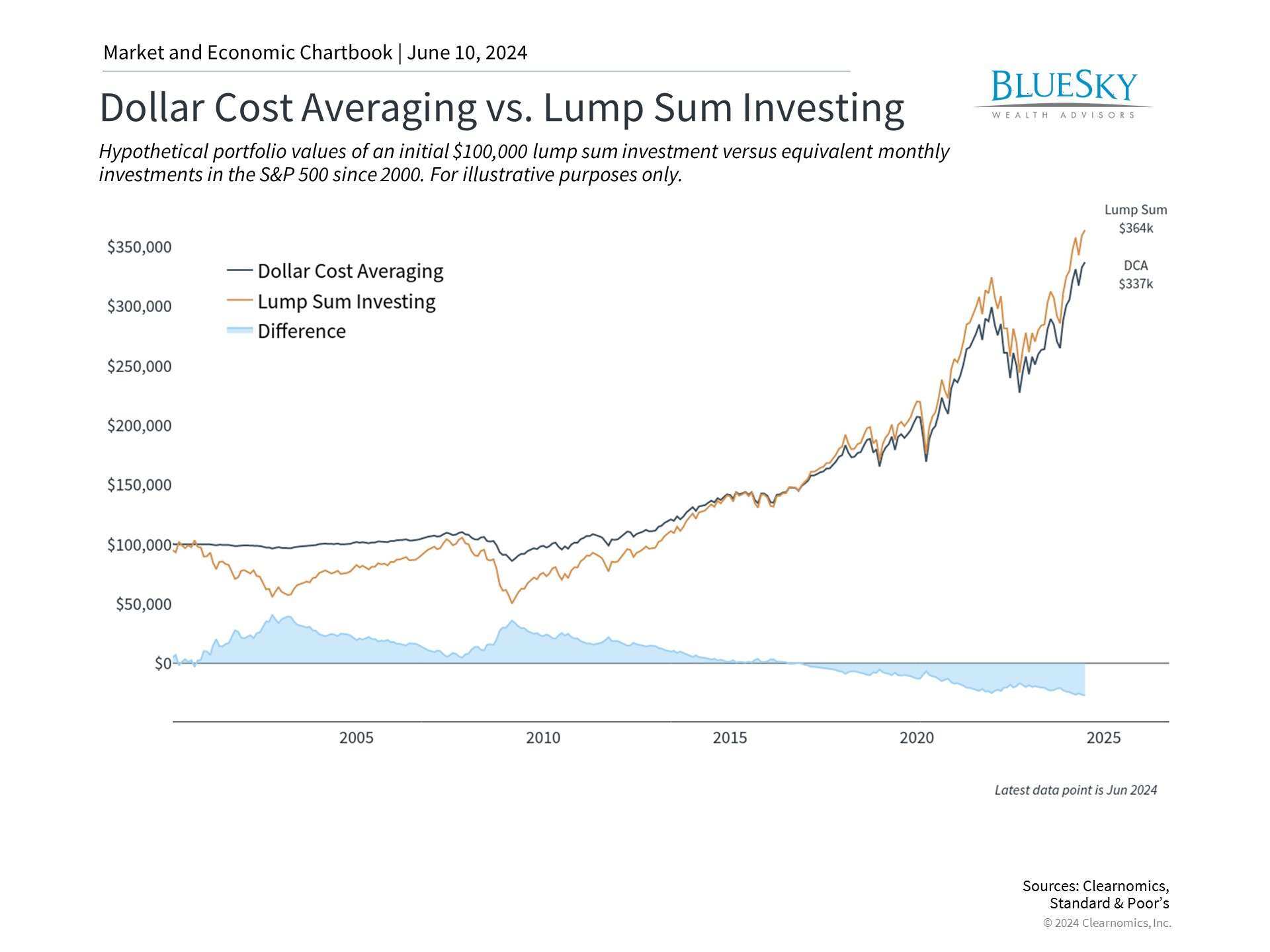

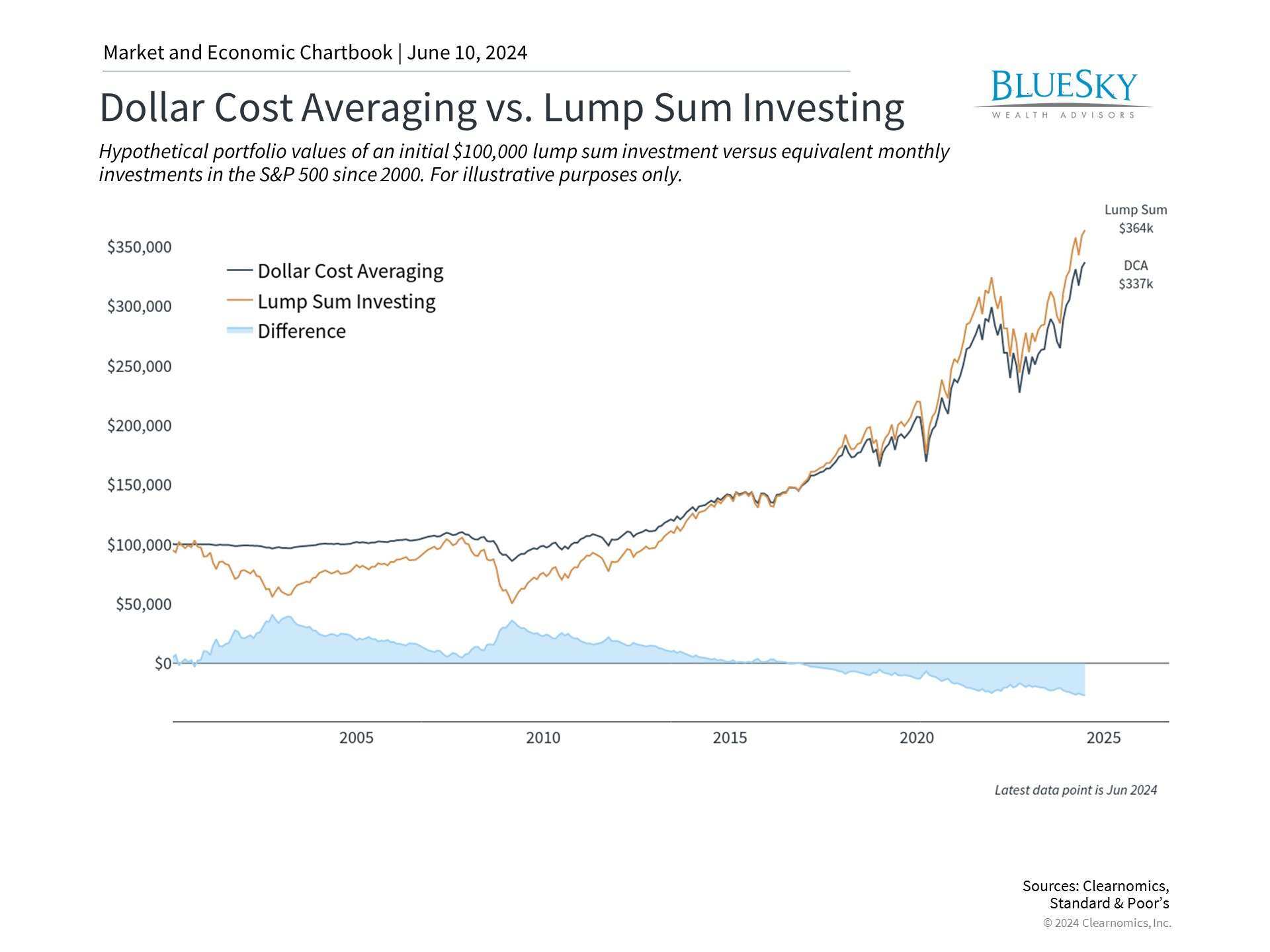

How Dollar-Cost Averaging Can Help Investors Get Into the Market

As with many things in life, knowing what we’re supposed to do and actually doing it are two separate things. This is true for...

Watch Our Latest Webinar: "Who Pays the Tax? Modeling IRA Distributions in a Post-SECURE Act Environment" WATCH NOW

As with many things in life, knowing what we’re supposed to do and actually doing it are two separate things. This is true for...

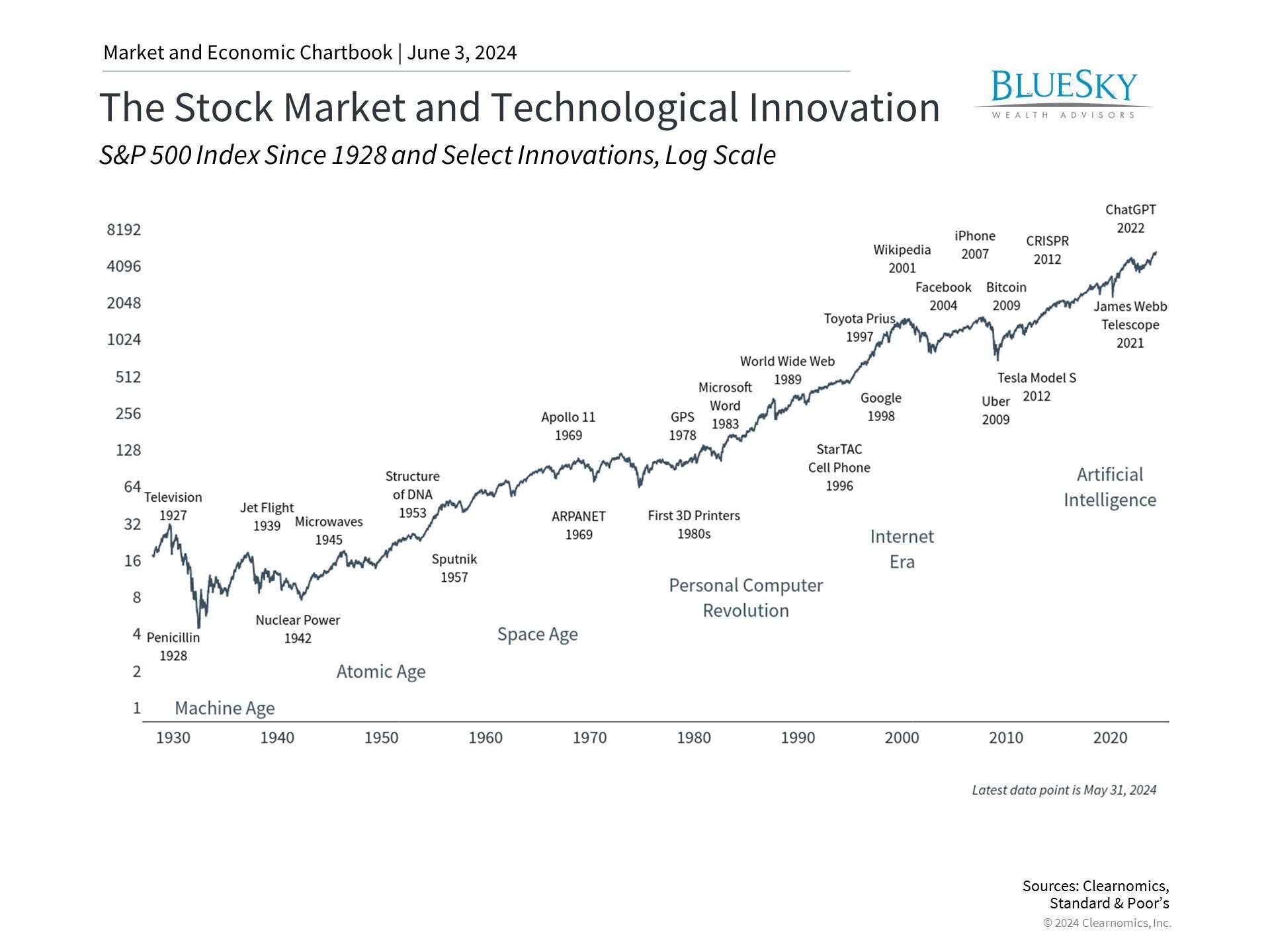

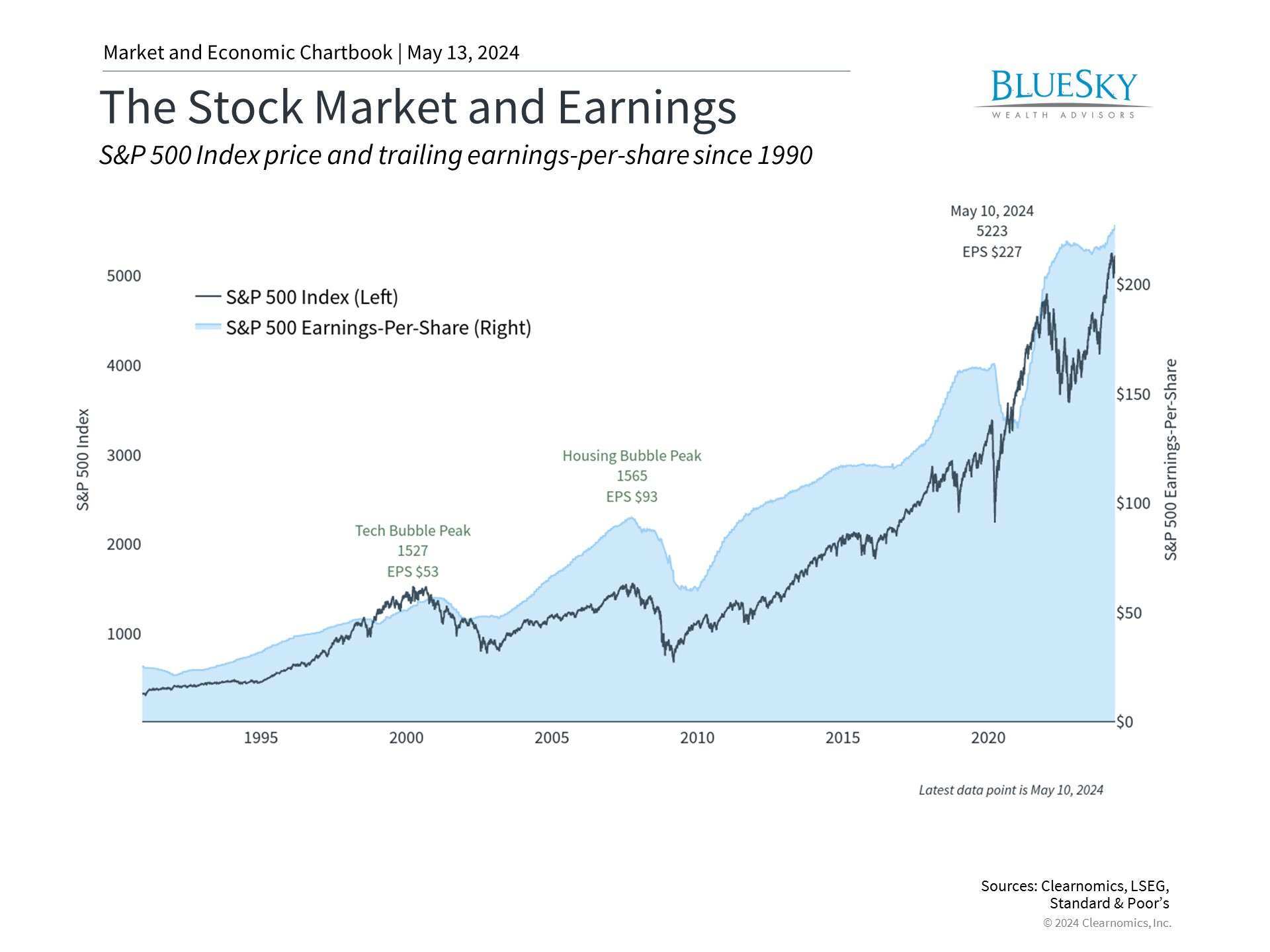

Investors and the financial media tend to focus on macroeconomic concerns such as inflation, labor markets, and the Fed. While...

David Blain, CFA is joined by Ken Gee of KRI Partners to discuss why now is the time to invest in Real Estate, KRI’s unique...

The Dow Jones Industrial Average reached 40,000 for the first time recently as markets continue to rebound from a 5% decline...

Introduction How do mutual funds pay dividends? This common question holds the key to understanding an important aspect of mutual...

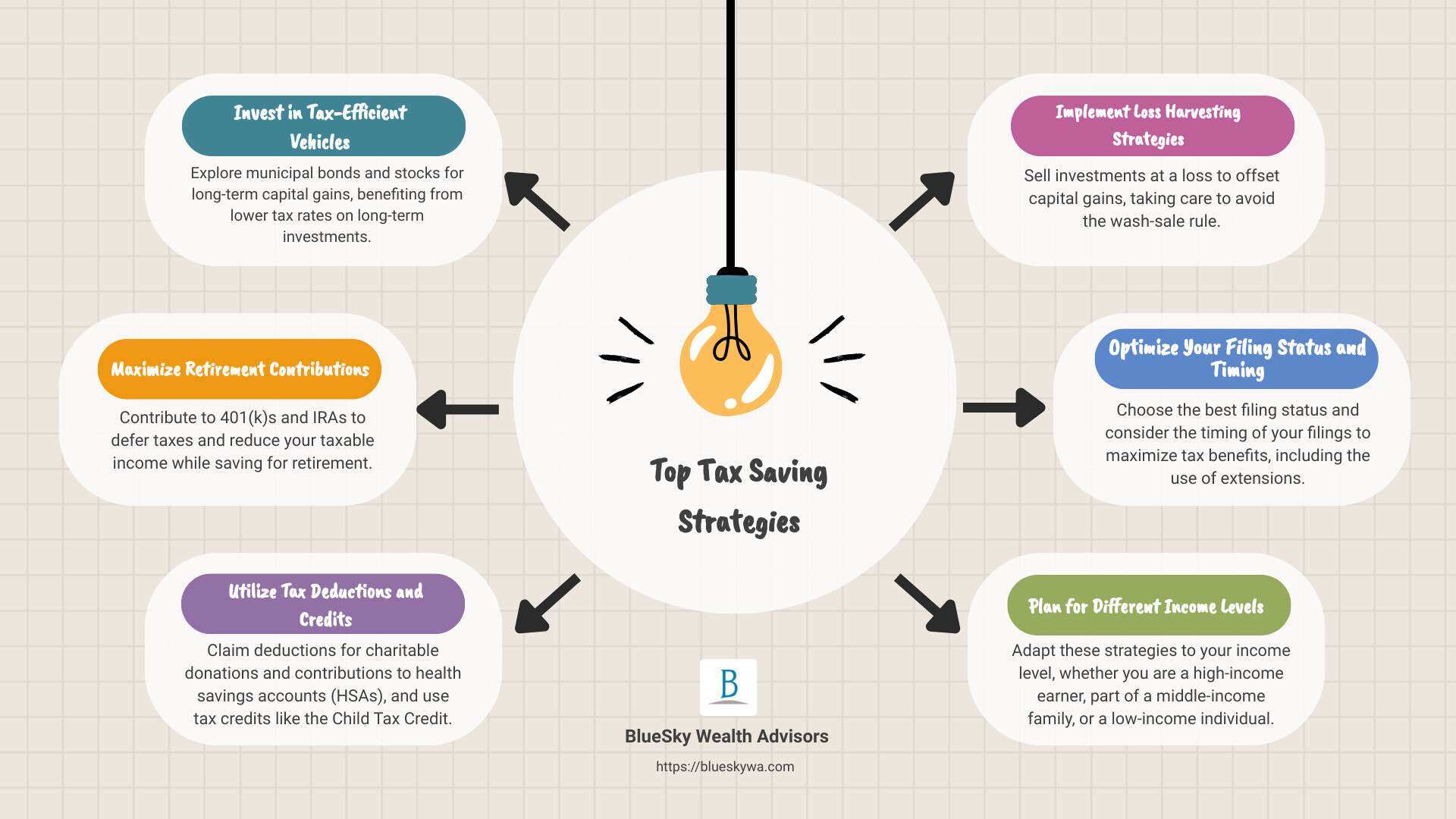

Introduction Looking to save on your taxes? Smart tax reduction strategies can significantly lower your tax bill and enhance your...

If you’re in search of income-producing assets to diversify your portfolio and secure financial independence, you’re in the right...

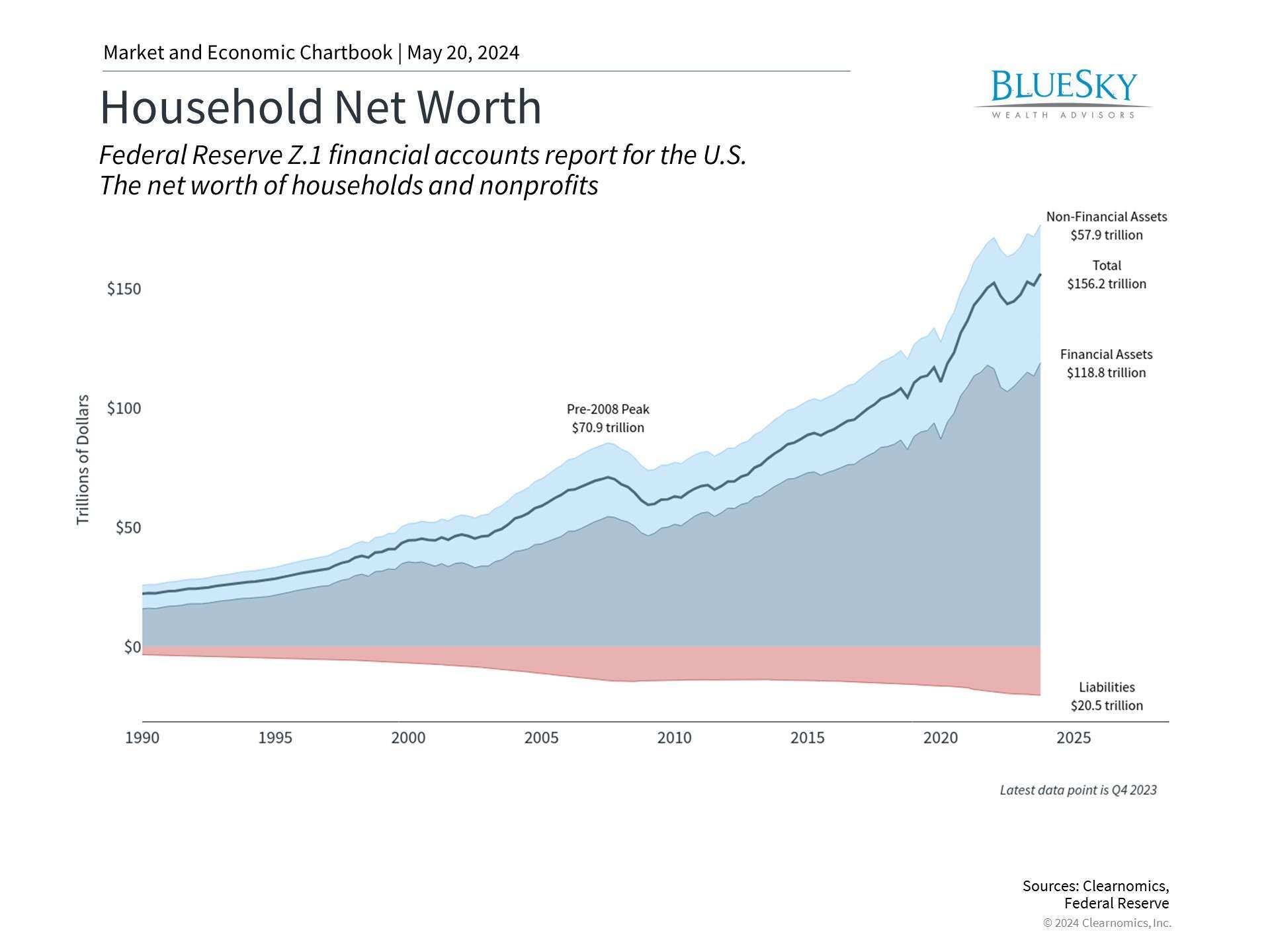

With markets nervous about stubborn inflation, a gradually slowing labor market, and the timing of the first Fed rate cut,...

Tax saving strategies are essential for anyone looking to optimize their financial situation and reduce the amount they owe to...

Introduction If you’re a small business owner looking to navigate through tax season efficiently, understanding and implementing...