How Do Mutual Funds Pay Dividends? Top 5 Insights 2024

How Do Mutual Funds Pay Dividends? Top 5 Insights 2024

Introduction

How do mutual funds pay dividends? This common question holds the key to understanding an important aspect of mutual funds that can significantly impact your investment returns.

Here’s the quick version:

– Mutual funds collect dividends from the stocks and interest from the bonds they hold.

– These earnings are then passed to investors in the form of dividends.

– Dividends can be issued monthly, quarterly, semiannually, or annually.

Knowing how mutual funds pay dividends is crucial for anyone looking to secure a steady stream of income and optimize their tax situation. Dividends play a vital role in your overall investment strategy, impacting both your immediate cash flow and long-term returns.

Simply put, dividends are portions of a company’s profits distributed to its shareholders. With mutual funds, these dividends are collected from various investments and then allocated to fund holders. Understanding this process can help investors make better choices, whether they aim for regular income, reinvestment opportunities, or both.

As you read on, we’ll delve into the mechanics of how mutual funds generate, distribute, and manage dividend payments, ensuring you have a clear and comprehensive grasp of this essential investment concept.

How Do Mutual Funds Pay Dividends?

Types of Dividends in Mutual Funds

Mutual funds generate income from their investments in several ways, which they then distribute to their shareholders. Let’s break down the types of dividends you might encounter:

Dividend Income: This comes from the dividends that the stocks within the mutual fund pay to the fund. For example, if a mutual fund holds stocks in companies like IBM or Coca-Cola, which paid dividends of $1.66 and 46 cents per share respectively in 2023, these amounts are collected by the fund and then distributed to its shareholders.

Capital Gains: When the fund sells a security (like a stock or bond) for more than it paid for it, the profit is known as a capital gain. These gains are also distributed to shareholders, often at the end of the year.

Interest Income: If the mutual fund invests in bonds, it will earn interest payments. For example, a bond might pay a fixed interest rate each year, known as a coupon payment. This interest is also collected by the fund and passed on to shareholders.

Timing and Frequency of Dividend Payments

The timing and frequency of dividend payments from mutual funds can vary depending on the fund’s policies and the types of securities it holds. Here are the common schedules:

Monthly: Some mutual funds, particularly those focusing on bonds or high-dividend stocks, may distribute dividends monthly. An example is the Federated Strategic Value Dividend Fund, which offers monthly dividends.

Quarterly: Many mutual funds pay dividends quarterly, aligning with the typical schedule of the companies whose stocks they hold. For instance, the Vanguard Dividend Appreciation Index Admiral Shares (VDADX) has been a consistent payer of quarterly dividends since its inception.

Annually: While less common, some funds distribute dividends annually. This is often the case for funds that focus on capital gains distributions or those that aim to minimize tax liabilities for shareholders.

Dividend Mechanics and Distribution Process

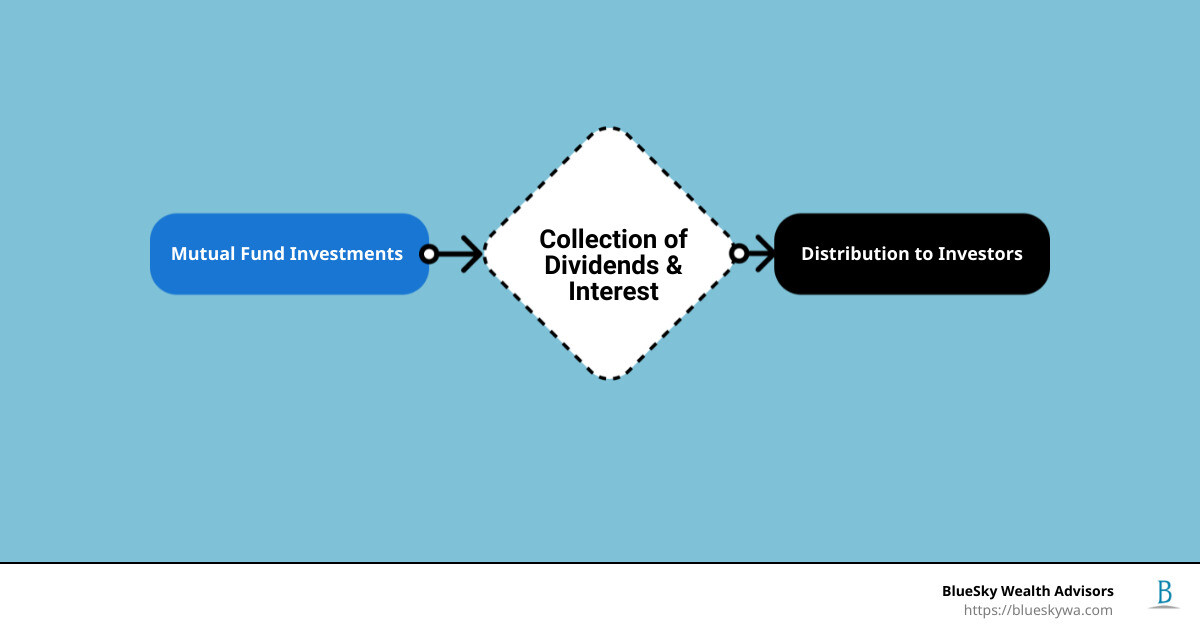

Here’s a simplified look at how mutual funds handle dividends:

Collection: The mutual fund collects dividends from the stocks and interest from the bonds it holds. For example, if the fund holds a variety of dividend-paying stocks and interest-bearing bonds, it accumulates these payments over time.

Aggregation: The fund aggregates all these payments. This includes dividend income, capital gains, and interest income.

Distribution: The fund then distributes this aggregated income to its shareholders. This distribution can take the form of cash payments or reinvested shares. Shareholders can choose to receive the dividends directly as cash or have them automatically reinvested to buy more shares of the fund.

Understanding these mechanics helps investors see the flow of income from the fund’s investments to their own pockets, either as cash or additional shares, enhancing their overall investment strategy.

Next, we’ll explore the factors that influence these dividend payments, such as market conditions and fund performance.

Factors Influencing Dividend Payments in Mutual Funds

Role of Fund Managers

Fund managers play a crucial role in determining how mutual funds pay dividends. Their decisions on which stocks or bonds to include in the fund’s portfolio directly impact the dividends you receive. For example, a manager might focus on high-dividend-yield stocks to ensure a steady income stream for investors.

Decision Making: Fund managers decide which assets to buy, hold, or sell. They look for companies with strong earnings, consistent dividend payments, and growth potential. A good example is Warren Buffett, whose investment strategy focuses on undervalued companies with strong fundamentals.

Strategy Implementation: Managers also decide on the fund’s investment strategy, whether it’s growth-oriented or income-focused. For instance, a high-dividend-yield mutual fund will prioritize stocks and bonds that offer regular income, while a growth fund may invest in companies with rising stock prices but lower dividend yields.

Impact of Economic Changes

Economic factors like interest rates and market volatility also influence dividend payments in mutual funds.

Interest Rates: When interest rates rise, bond yields typically increase, leading to higher income for funds invested in bonds. Conversely, lower interest rates can reduce bond yields, impacting the fund’s income. Balanced funds, which invest in both stocks and bonds, might perform better in high-interest-rate environments due to higher bond returns.

Market Volatility: Market conditions can affect the performance of the stocks and bonds in a mutual fund. For example, during an economic downturn, companies might cut or suspend dividend payments to conserve cash, impacting the fund’s income. On the other hand, stable market conditions can lead to consistent dividend payments.

Company Earnings: The earnings of the companies in a mutual fund’s portfolio also play a significant role. Companies with strong earnings are more likely to pay and increase dividends. For instance, IBM paid a dividend of $1.66 per share on Sept. 9, 2023, based on its financial results. Similarly, Coca-Cola paid 46 cents per share on Oct. 2, 2023.

Fund managers must stay vigilant and adapt to these economic changes to maximize returns and ensure a steady flow of dividends to investors.

Next, we’ll explore the benefits of investing in dividend-paying mutual funds, including steady income and reinvestment opportunities.

Benefits of Investing in Dividend-Paying Mutual Funds

Investing in dividend-paying mutual funds offers several advantages, making them a popular choice for both novice and seasoned investors. Let’s dive into the key benefits.

Steady Income

One of the main attractions of dividend-paying mutual funds is the steady income they provide. These funds aggregate dividends from the stocks within their portfolio and distribute them to shareholders. For example, Vanguard Equity Income Fund regularly pays quarterly dividends, offering a consistent income stream. This steady income can be especially beneficial for retirees or those looking to supplement their current earnings.

Reinvestment Opportunities

Reinvesting dividends can significantly boost long-term returns. When dividends are reinvested, they buy additional shares of the mutual fund, which in turn generate more dividends. This creates a compounding effect, often referred to as the “snowball effect.” Over time, this can lead to substantial growth in your investment.

Comparing DRIP and Direct Payout Options

Dividend Reinvestment Plans (DRIPs) allow investors to automatically reinvest their dividends to purchase additional shares of the mutual fund. This is a hands-off approach that maximizes the benefits of compounding.

On the other hand, direct payout options provide dividends as cash payments, offering immediate liquidity. This can be useful for investors who rely on dividend income for living expenses. However, it does not take advantage of the compounding benefits that DRIPs offer.

Tax Implications of Dividend Payments

Understanding the tax implications of dividend payments is crucial for effective financial planning.

Ordinary Income: Most dividends from mutual funds are treated as ordinary income and are taxable in the year they are received. This means they are subject to your regular income tax rate.

Qualified Dividends: Some dividends qualify for a lower tax rate if they meet certain criteria set by the IRS. These are known as qualified dividends and are taxed at the capital gains tax rate, which is generally lower than the regular income tax rate.

The tax treatment can significantly impact your net returns, so consider this when choosing between reinvestment and direct payout options.

Next, we’ll discuss how to choose the right dividend-paying mutual fund, including yield comparison and expense ratios.

Choosing the Right Dividend-Paying Mutual Fund

High-Dividend Mutual Funds

When it comes to investing in high-dividend mutual funds, two names often come up: Vanguard High Dividend Yield Index Admiral Shares (VHYAX) and Vanguard Dividend Appreciation Index Fund Admiral Shares (VDADX). These funds are popular because they offer consistent dividend payments and have a strong track record.

VHYAX aims to replicate the performance of the FTSE High Dividend Yield Index. This index includes stocks that typically pay higher-than-average dividends. As of July 31, 2023, VHYAX had an SEC yield of 3.06%. One of its standout features is its low expense ratio of 0.08%, making it a cost-effective option for investors. The minimum investment for VHYAX is $3,000, but Vanguard also offers an ETF version called Vanguard High Dividend Yield ETF (VYM) for those looking for a lower minimum investment.

On the other hand, VDADX focuses on companies with a history of increasing their dividends over time. This fund is designed to provide not just high dividends but also potential for capital appreciation. Both VHYAX and VDADX offer a blend of steady income and growth potential, making them attractive choices for dividend-focused investors.

Criteria for Selecting Dividend Funds

Choosing the right dividend-paying mutual fund involves several key factors: yield comparison, expense ratios, performance metrics, and fund history.

Yield Comparison

The yield of a fund is a critical metric. It tells you how much income you can expect relative to the price of the fund. For instance, if a fund has a high yield, it means you’re getting more income per dollar invested. However, a very high yield can sometimes be a red flag, indicating potential issues like a declining stock price.

Expense Ratios

Expense ratios are another essential factor. They represent the annual cost of owning the fund, expressed as a percentage of your investment. Lower expense ratios mean more of your money stays invested, which can significantly impact your returns over time. For example, the average expense ratio among top dividend funds is around 0.53%, but it can range from as low as 0.08% to as high as 1.06%.

Performance Metrics

Past performance can give you an idea of how well a fund has managed to deliver returns. Look at both total returns and dividend consistency. A fund that consistently pays dividends and has a history of good performance is generally a safer bet.

Fund History

Finally, consider the fund’s history. Funds with a long track record of paying dividends and stable performance are usually more reliable. For example, VHYAX has been consistently paying quarterly dividends since its inception in 2019.

By considering these factors—yield, expense ratios, performance metrics, and fund history—you can make a more informed decision about which dividend-paying mutual fund is right for you.

Next, we’ll address some frequently asked questions about how mutual funds pay dividends.

Frequently Asked Questions about How Mutual Funds Pay Dividends

How long must you own a mutual fund to receive dividends?

To receive dividends from a mutual fund, you must own shares before the fund’s ex-dividend date. The ex-dividend date is typically one business day before the record date, which is the cutoff for determining which shareholders are eligible to receive the dividend.

Example: If you purchase shares of a mutual fund on or after the ex-dividend date, you won’t qualify for that dividend distribution. Conversely, if you sell your shares on or after the ex-dividend date, you will still receive the dividend, even though you no longer hold the shares.

What happens to dividends in mutual funds?

When mutual funds receive dividends from their investments, they are legally required to pass these earnings on to their shareholders. This can happen in two ways:

- Direct Payouts: You receive the dividends in cash, which can be deposited into your bank account or reinvested in another asset.

- Reinvestment: You can opt to reinvest the dividends back into the same mutual fund to purchase additional shares. This is often done automatically through a Dividend Reinvestment Plan (DRIP).

Note: Reinvesting dividends can significantly enhance your returns over time due to the power of compounding.

Do mutual funds pay dividends or interest?

Mutual funds can pay both dividends and interest, depending on the types of investments they hold:

- Dividends: These are typically paid from the profits of the companies in which the mutual fund has invested. For example, if IBM pays a dividend of $1.66 per share, the mutual fund will pass this on to its shareholders.

- Interest: This comes from interest-bearing securities like bonds. A bond pays a fixed interest rate each year, known as the coupon payment, which the mutual fund then distributes to its shareholders.

Most mutual funds distribute these earnings at least once a year, but the exact timing can vary. Some funds distribute dividends monthly, quarterly, or semiannually.

By understanding these basics, you’ll be better equipped to make informed decisions about investing in dividend-paying mutual funds. Next, let’s delve into the benefits of investing in these funds.

Conclusion

Investing in dividend-paying mutual funds offers numerous long-term benefits. These funds can provide a steady income stream, making them a popular choice for income-focused investors. By reinvesting dividends, you can also take advantage of compounding, which can significantly boost your returns over time.

BlueSky Wealth Advisors is here to guide you through the complexities of dividend-paying mutual funds. We help you understand the mechanics, evaluate your options, and make informed decisions tailored to your financial goals. Whether you’re looking to supplement your income or grow your wealth, our expert advisors are ready to assist you every step of the way.

For more information on how we can help you manage your investments, visit our Investment Management page.

Investing in dividend-paying mutual funds is not just about receiving periodic payments. It’s about building a robust financial future through informed choices and strategic planning. With the right guidance, you can leverage these funds to achieve your long-term financial objectives.