Tax Reduction Strategies: 5 Powerful Tips for 2024

Tax Reduction Strategies: 5 Powerful Tips for 2024

Introduction

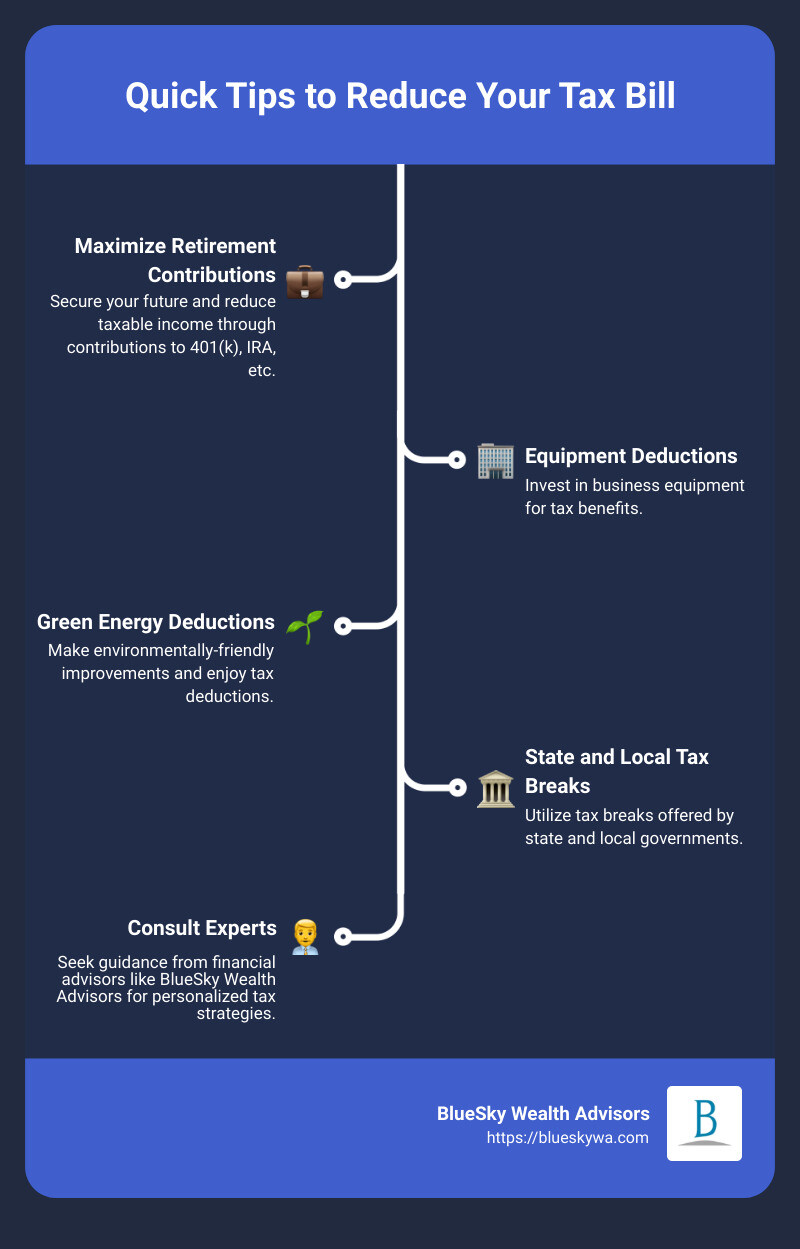

Looking to save on your taxes? Smart tax reduction strategies can significantly lower your tax bill and enhance your financial well-being. Here are some quick tips:

- Maximize retirement account contributions

- Take advantage of equipment and green energy deductions

- Utilize state and local tax breaks

Managing your tax liability is essential for protecting your wealth and achieving financial independence. While paying taxes is inevitable, how much you owe isn’t set in stone. Effective tax planning helps you keep more of what you earn by using legal methods to reduce your taxable income.

For example, setting up or contributing to a retirement savings plan not only secures your future but also reduces your taxable income. Additionally, if you invest in new equipment or green energy improvements for your business, you can benefit from significant deductions.

The goal of tax planning is to be proactive, not reactive. By consulting with experts, like those at BlueSky Wealth Advisors, you can navigate intricate tax laws and leverage strategies tailored to your financial situation. Let’s dive into the details and explore how you can make the most of these opportunities.

Minimize Taxable Income

One of the most effective ways to reduce your tax liability is to minimize your taxable income. Let’s explore some key strategies to achieve this.

Max Out Retirement Accounts

Contributing to retirement accounts is a powerful way to lower your taxable income. Here are some options to consider:

401(k) and 403(b) Plans: These employer-sponsored plans allow you to make pretax contributions, which directly reduce your taxable income. For 2023, you can contribute up to $22,500, or $30,000 if you’re 50 or older. For example, if you earn $100,000 and contribute the maximum amount to your 401(k), your taxable income drops to $77,500.

Individual Retirement Accounts (IRAs): You can also save on taxes by contributing to a traditional IRA. The annual contribution limit is $6,500 for 2023, with an additional $1,000 catch-up contribution if you’re 50 or older. Contributions to a traditional IRA are tax-deductible, reducing your taxable income for the year.

SEP IRA and SIMPLE IRA: If you’re self-employed or own a small business, consider a SEP (Simplified Employee Pension) IRA or SIMPLE (Savings Incentive Match Plan for Employees) IRA. These plans allow for higher contribution limits compared to traditional IRAs. For 2023, you can contribute up to 25% of your net earnings from self-employment, up to a maximum of $66,000 for SEP IRAs.

Contribute to Health Savings Accounts (HSAs)

An HSA is another excellent tool for reducing taxable income, especially if you have a high-deductible health plan (HDHP).

Health Savings Accounts (HSAs): Contributions to an HSA are tax-deductible, and the funds grow tax-free. For 2023, the contribution limits are $3,850 for individual coverage and $7,750 for family coverage. If you’re 55 or older, you can contribute an extra $1,000. Withdrawals for qualified medical expenses are also tax-free, providing a triple-tax advantage.

Flexible Spending Accounts (FSAs): FSAs allow you to set aside pretax dollars for medical expenses. For 2023, you can contribute up to $3,050. However, keep in mind that FSAs have a “use-it-or-lose-it” rule, meaning you must use the funds within the plan year or forfeit them.

Example: Sarah, a 35-year-old employee with an HDHP, contributes $3,850 to her HSA in 2023. This contribution reduces her taxable income by $3,850, and she can use the funds tax-free for medical expenses.

By maximizing contributions to retirement accounts and HSAs, you can significantly lower your taxable income while securing your financial future. Next, let’s explore how to maximize deductions to further reduce your tax liability.

Maximize Deductions

Charitable Donations

Charitable donations can be a powerful way to reduce your tax liability while supporting causes you care about. When you donate to a qualified charity, you can itemize these contributions on your tax return, which may lead to significant tax savings.

One effective strategy is to donate appreciated property, such as stocks or real estate. By doing this, you can deduct the fair market value of the property and avoid paying capital gains tax on the appreciation. For example, if you bought a stock for $1,000 and it’s now worth $5,000, donating it allows you to deduct $5,000 without paying tax on the $4,000 gain.

Another option is to set up a donor-advised fund. This allows you to make a large charitable contribution in one year (and take the deduction) while spreading out the actual donations to charities over several years. This can be particularly beneficial if you have a high-income year and want to maximize your deductions.

Case Study: John, who had a significant income boost in 2023, decides to donate $50,000 to a donor-advised fund. This contribution allows him to itemize his deductions and potentially lower his taxable income for that year. He can then allocate this fund to various charities over the next few years.

Review Interest Expenses

Interest expenses can also impact your tax liability, but not all interest is created equal when it comes to deductions.

Deductible Interest: Certain types of interest are deductible, which can help reduce your taxable income. For example, mortgage interest on your primary residence can be deducted if you itemize your deductions. Similarly, interest on home equity loans may be deductible, provided the loan is used to buy, build, or substantially improve your home.

Non-Deductible Interest: On the other hand, interest on personal loans, credit card debt, and auto loans is generally not deductible. If you have significant non-deductible interest expenses, consider paying off these debts to improve your financial situation and reduce your overall interest burden.

Example: Emily has a $10,000 credit card debt with a high-interest rate. By paying off this debt, she eliminates non-deductible interest expenses, freeing up more of her income for savings or investments.

Home Equity Loans: If you have a home equity loan, make sure the interest is deductible by using the loan for qualified expenses. If not, you might want to explore other financing options that offer tax benefits.

Tip: Keep detailed records of all interest expenses and consult with a tax professional to ensure you’re maximizing your deductions.

By carefully managing your charitable donations and interest expenses, you can make the most of your itemized deductions and reduce your tax liability. Next, let’s explore how investing in tax-advantaged accounts can further benefit you.

Invest in Tax-Advantaged Accounts

Municipal Bonds

Municipal bonds, or “munis,” are a great way to invest while reducing your tax liability. These bonds are issued by local or state governments to fund public projects like schools and roads. The interest you earn from municipal bonds is generally tax-free at the federal level. If you live in the state where the bond is issued, you might also avoid state and local taxes.

Here’s why investing in municipal bonds can be beneficial:

- Tax-Free Interest: The interest you earn is usually exempt from federal taxes, and sometimes state and local taxes.

- Lower Default Rates: Municipal bonds have historically lower default rates compared to corporate bonds. For example, from 1970 to 2022, the default rate for municipal bonds was just 0.08%, compared to 6.9% for global corporate issuers.

- Tax-Equivalent Yield: The higher your tax bracket, the more attractive the tax-equivalent yield of municipal bonds becomes.

However, be aware of exceptions. If you buy a municipal bond at a discount greater than 0.25%, the interest and gains from the discounted amount can be taxed as regular income. Always check the specific bond details to ensure you understand the tax implications.

Long-Term Capital Gains

Investing in assets like stocks, bonds, or real estate can help you grow wealth, especially when you focus on long-term capital gains. If you hold an asset for more than one year before selling, any profit you make is considered a long-term capital gain. These gains are taxed at a preferential rate of 0%, 15%, or 20%, depending on your income level.

Benefits of long-term capital gains:

- Lower Tax Rates: Long-term capital gains are taxed at lower rates than short-term gains, which are taxed as ordinary income.

- Tax-Loss Harvesting: If you sell an investment at a loss, you can use that loss to offset your capital gains. You can deduct up to $3,000 of excess losses from your other income, and any remaining losses can be carried forward to future tax years.

For 2024, the zero-rate bracket for long-term capital gains applies to taxable income up to $94,050 for married couples filing jointly and $47,025 for single individuals. This makes it crucial to plan your asset sales strategically to take full advantage of these lower tax rates.

By investing in municipal bonds and focusing on long-term capital gains, you can significantly reduce your tax liability while growing your wealth. Next, we’ll discuss how starting a business can offer additional tax benefits.

Start a Business

Starting a business can be an effective way to reduce your tax liability. From deducting business expenses to hiring family members, there are several strategies to help you save.

Deduct Business Expenses

Running a business involves many expenses, and many of these can be deducted from your taxable income. Here are some key areas to consider:

Home Office Deduction: If you use a portion of your home exclusively for business, you can deduct related expenses. For example, if your home office is 20% of your home’s total area, you can deduct 20% of your rent or mortgage, utilities, and insurance. Just remember, the space must be used exclusively for business purposes.

Utilities and Internet: Expenses like electricity, water, and internet that are necessary for running your business can also be deducted. If you work from home, calculate the portion of these utilities that are used for business purposes.

Vehicle Costs: If you use your vehicle for business, you can deduct related expenses. This includes gas, maintenance, and even depreciation. You can choose between the actual expense method or the standard mileage rate. For 2023, the standard mileage rate is 65.5 cents per mile.

Self-Employed Health Insurance: Premiums paid for health insurance for yourself, your spouse, and dependents are fully deductible. This includes medical, dental, and qualifying long-term care insurance.

Hire Family Members

Hiring family members can provide significant tax benefits. Here’s how:

Lower Marginal Rate: Paying wages to your children or spouse can shift income to a lower tax bracket. For instance, if your child earns less, their income will be taxed at a lower rate, reducing the overall family tax burden.

FUTA Exemption: Wages paid to your children under 18 are exempt from Social Security and Medicare taxes. Additionally, wages paid to your spouse are not subject to the Federal Unemployment Tax Act (FUTA).

Justifiable Earnings: Ensure that the work done by family members is legitimate and the compensation is reasonable. The IRS requires that wages be justifiable and consistent with industry standards to avoid scrutiny.

By leveraging these tax reduction strategies, you can make significant savings while running your business efficiently. Next, we’ll explore how claiming tax credits can further reduce your tax liability.

Claim Tax Credits

Tax credits are one of the most powerful tax reduction strategies available. Unlike deductions, which lower your taxable income, tax credits reduce the amount of tax you owe dollar-for-dollar. This makes them extremely valuable. Let’s dive into two of the most commonly claimed tax credits: the Child Tax Credit and the Earned Income Tax Credit (EITC).

Child Tax Credit

The Child Tax Credit is a significant benefit for U.S. taxpayers with children. For the tax year 2022, this credit was worth up to $2,000 per qualifying child. To qualify for the full credit, your income must be below $200,000 for single filers or $400,000 for married couples filing jointly. If your income is slightly above these limits, you might still qualify for a partial credit.

Qualifying Child: To be eligible, your child must be younger than 17 at the end of the tax year. They must also have lived with you for more than half the year and should not have provided more than 50% of their own financial support. Stepchildren, siblings, and descendants can also qualify as long as you claim them as dependents on your tax return.

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit (EITC) is designed to assist low- to lower-middle income families. This credit can substantially reduce the tax burden and even result in a refund. The EITC is especially beneficial if you have children, but you can also qualify without them if your income is very low.

For the tax year 2023, the maximum EITC amounts are as follows:

- $7,430 for families with three or more qualifying children.

- $6,604 for families with two qualifying children.

- $3,995 for families with one qualifying child.

- $600 for individuals with no qualifying children.

Income Cap: The EITC has income limits that vary based on your filing status and the number of qualifying children you have. You must have some earned income, and there are also caps on unearned income.

Qualifying Children: A qualifying child must meet specific criteria, including age, relationship, residency, and joint return tests. You must also have a valid Social Security number and be a U.S. citizen or resident alien.

Claiming these tax credits can significantly lower your tax liability. Next, we’ll address frequently asked questions about tax reduction strategies to help you further understand how to minimize your taxes.

Frequently Asked Questions about Tax Reduction Strategies

How can I reduce my taxable income?

Reducing your taxable income can be simpler than you think. Here are some key strategies:

1. Maximize Retirement Contributions

Contributing to retirement accounts like a 401(k) or an IRA can significantly lower your taxable income. These contributions are made pre-tax, meaning they reduce your gross income before taxes are calculated. For instance, if you contribute $19,500 to your 401(k) in 2023, that amount is deducted from your taxable income.

2. Health Savings Accounts (HSAs)

If you have a high-deductible health plan, you can contribute to an HSA. Contributions to HSAs are tax-deductible, and the funds can be used tax-free for qualified medical expenses. For 2023, you can contribute up to $3,850 for individual coverage and $7,750 for family coverage.

3. Flexible Spending Accounts (FSAs)

FSAs allow you to set aside pre-tax dollars for medical and dependent care expenses. Contributions reduce your taxable income, and you can use the funds for a variety of expenses, from medical bills to childcare.

4. Charitable Donations

Donating to qualified charities can also reduce your taxable income. You can deduct the fair market value of donated goods or the cash amount you give. For example, donating appreciated property can allow you to avoid capital gains tax while still getting a deduction for the full market value.

What are the best ways to lower taxable income?

1. Max Out Retirement Accounts

Make the most of your retirement plans. Contribute the maximum allowed to your 401(k), 403(b), IRA, SEP IRA, or SIMPLE IRA. For example, in 2023, you can contribute up to $22,500 to a 401(k), with an additional $7,500 if you’re 50 or older.

2. Contribute to HSAs and FSAs

As mentioned, HSAs and FSAs are powerful tools for reducing taxable income. Use them to cover medical and dependent care costs with pre-tax dollars.

3. Itemize Deductions

If your deductible expenses exceed the standard deduction, itemize them. This includes mortgage interest, state and local taxes, and medical expenses. Timing your expenses to bunch them into a single year can help you exceed the threshold for itemizing.

How do high-income earners reduce taxes?

High-income earners have several strategies to minimize their tax liability effectively:

1. Maximize Contributions to Retirement Plans

High-income earners should take full advantage of tax-deferred accounts like 401(k)s and IRAs. These contributions reduce taxable income now and grow tax-deferred until retirement.

2. Invest in Tax-Efficient Funds

Consider investing in municipal bonds or index funds. Municipal bonds offer tax-free interest income, which can be especially beneficial if you’re in a high tax bracket. Index funds typically generate fewer capital gains due to lower turnover.

3. Charitable Donations

Donating appreciated stock or other assets to charity can provide a double tax benefit: a deduction for the full market value and avoidance of capital gains tax. This strategy is particularly useful for high-income earners with significant investments.

4. Tax Loss Harvesting

Selling investments at a loss to offset gains can help manage taxable income. This strategy can be particularly beneficial in years when you have high capital gains.

5. Roth IRA Conversions

Consider converting traditional IRA funds to a Roth IRA. While you’ll pay taxes now, the funds will grow tax-free and can be withdrawn tax-free in retirement. This can be a smart move if you expect to be in a higher tax bracket in the future.

By implementing these strategies, high-income earners can effectively reduce their taxable income and manage their overall tax burden.

Conclusion

At BlueSky Wealth Advisors, we understand that tax planning can be complex and overwhelming. Our goal is to simplify this process for you with personalized financial solutions and proactive tax strategies designed to meet your unique needs.

Why Choose BlueSky Wealth Advisors?

We believe in building strong partnerships based on trust, transparency, and mutual respect. Our dedicated advisors are committed to understanding your financial vision and working closely with you to achieve it. This personalized attention ensures that our tax reduction strategies are not only comprehensive but also deeply aligned with your personal and business goals.

Proactive Tax Strategies

Tax planning shouldn’t be a last-minute scramble. By being proactive, you can take advantage of various strategies throughout the year to reduce your tax liability. Whether it’s maximizing your retirement contributions, investing in tax-advantaged accounts, or starting a business, our advisors will guide you through every step of the process.

For instance, contributing to a Health Savings Account (HSA) can offer triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses. Similarly, investing in municipal bonds can provide tax-free interest income, which can be particularly beneficial for high-income earners.

Customized Financial Plans

No two financial situations are the same. That’s why we tailor our advice to fit your specific circumstances. From reviewing your financial activities over the past year to planning for future tax liabilities, we ensure that you’re making informed decisions that align with both your short-term needs and long-term goals.

Consult BlueSky Wealth Advisors

Navigating the complexities of tax planning alone can be daunting. Engaging with a trusted advisor ensures that you are making the most informed decisions and taking full advantage of all available strategies to reduce your taxable income and increase your savings.

At BlueSky Wealth Advisors, we are here to help you develop a proactive plan that not only aims to reduce your tax liabilities but also enhances your overall financial well-being.

Ready to take control of your financial future? Contact us today to schedule a consultation and start your journey towards smarter tax planning.

By following these strategies and working with BlueSky Wealth Advisors, you can effectively manage your tax burden and secure a prosperous financial future.