6 Essential Tax Saving Strategies to Boost Your 2024 Returns

6 Essential Tax Saving Strategies to Boost Your 2024 Returns

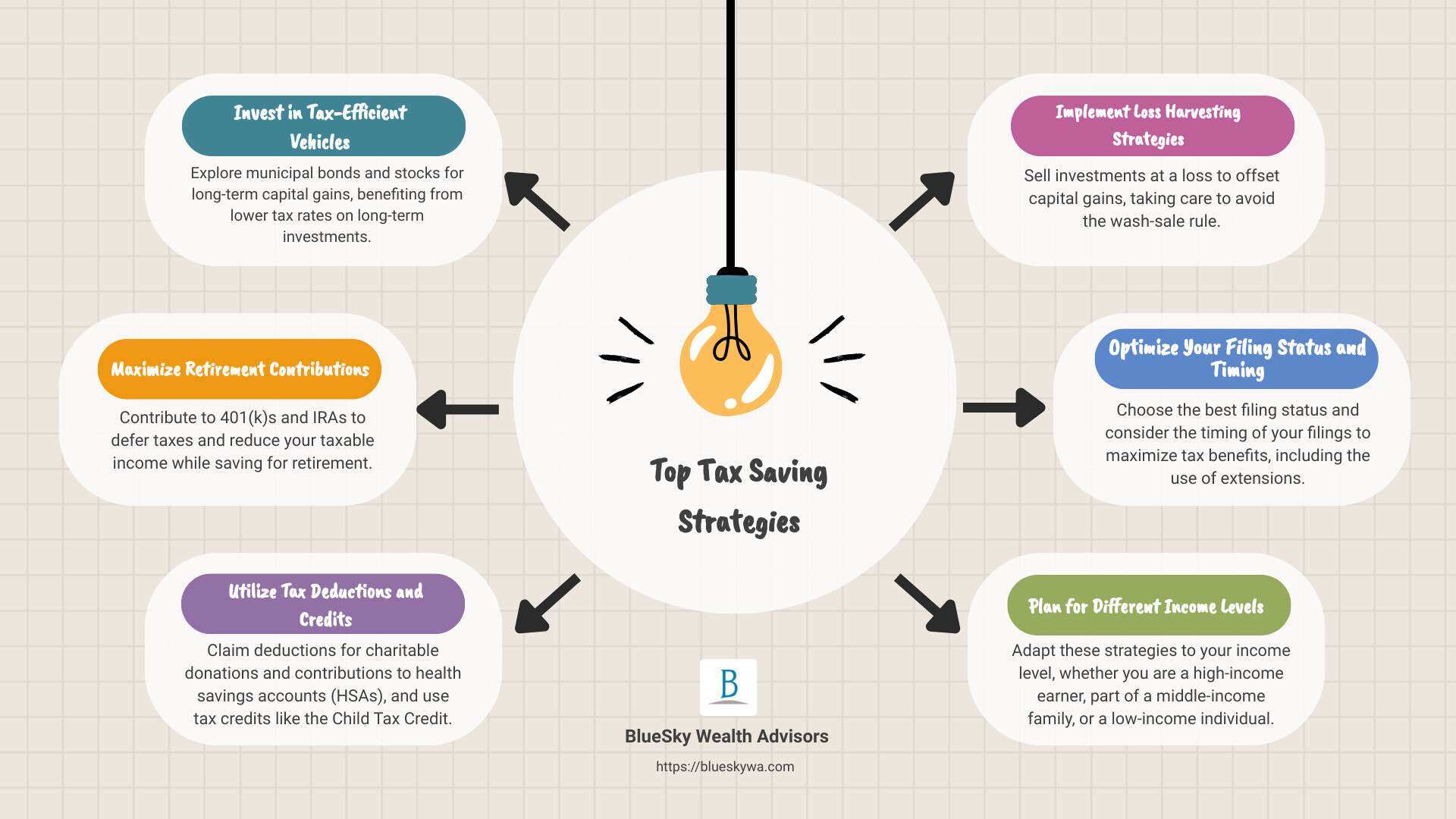

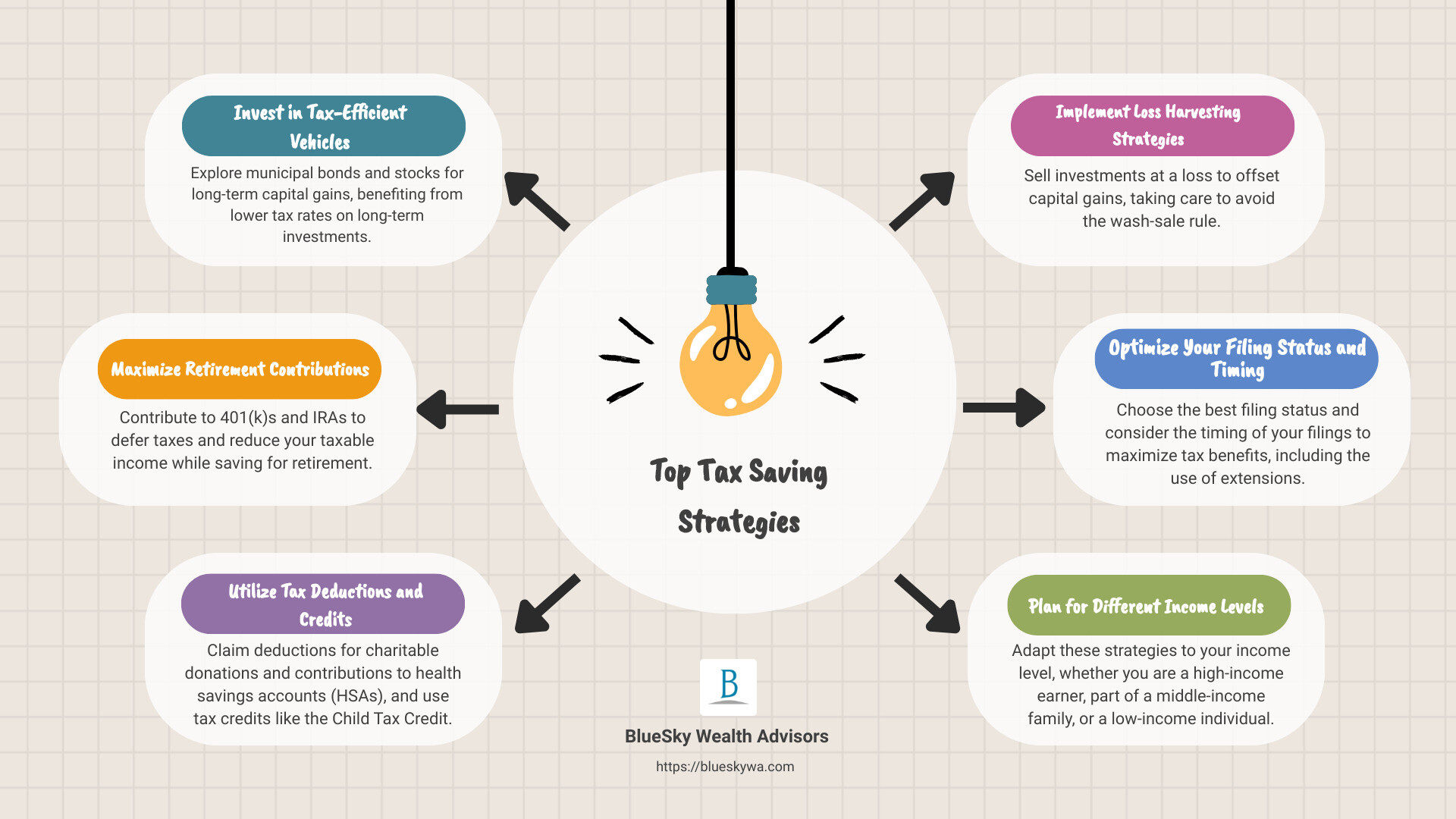

Tax saving strategies are essential for anyone looking to optimize their financial situation and reduce the amount they owe to the government each year. Quickly, here are six effective strategies you can consider:

- Invest in Tax-Efficient Vehicles: such as municipal bonds and stocks for long-term capital gains.

- Maximize Retirement Contributions: take full advantage of 401(k)s and IRAs.

- Utilize Tax Deductions and Credits: such as charitable donations and health savings accounts (HSAs).

- Implement Loss Harvesting Strategies: utilize capital losses to offset gains.

- Optimize Your Filing Status and Timing: make strategic decisions about when and how to file.

- Plan for Different Income Levels: tailor strategies to suit various financial situations.

Tax planning is not just about compliance, but also about maximizing your financial efficiency in a way that aligns with your long-term goals and lifestyle. Engaging in proactive tax planning can lead to substantial savings which can be redirected towards investments, retirement savings, or even creating a financial legacy. By understanding and utilizing the right tax strategies tailored to your specific financial situation, you can not only minimize your tax liability but also enhance your wealth accumulation over time.

Invest in Tax-Efficient Vehicles

When it comes to protecting your income from taxes, investing in tax-efficient vehicles is a smart strategy. Let’s explore three key options: Municipal Bonds, Capital Gains, and Tax-Deferred Accounts. Each of these can help you save on taxes while potentially growing your wealth.

Municipal Bonds

Municipal bonds, often called “munis,” are issued by local or state governments to fund public projects like roads and schools. The interest you earn from these bonds is usually tax-free at the federal level. This can be especially beneficial if you’re in a high tax bracket.

Investing in munis not only lowers your taxable income but also supports community development. However, be cautious as some munis might be subject to taxes if purchased at a significant discount, known as the “de minimis” tax rule. Always check the specific bond’s tax implications before investing.

Capital Gains

Capital gains are the profits you make from selling assets like stocks or real estate. Long-term capital gains, which are gains on assets held for more than a year, are taxed at lower rates than short-term gains (assets held for less than a year). These rates are 0%, 15%, or 20%, depending on your income level.

To benefit from these lower rates, plan the timing of your asset sales carefully. Holding onto investments for over a year can significantly reduce the taxes you owe on gains. Understanding the difference between long-term and short-term capital gains is crucial for effective tax planning.

Tax-Deferred Accounts

Contributing to tax-deferred accounts like 401(k)s or IRAs allows you to postpone paying taxes on the money you invest until you withdraw it, typically during retirement. During your working years, this can lower your taxable income and defer tax liabilities to a period when you might be in a lower tax bracket.

Maximizing contributions to these accounts not only helps in tax deferral but also aids in accumulating wealth over time due to the compound growth of deferred taxes.

By strategically investing in these tax-efficient vehicles, you are not just complying with tax laws but actively leveraging them to your advantage. This approach aligns with proactive financial planning, ensuring that you maximize your returns while minimizing tax liabilities.

Moving forward, let’s look into how you can further enhance your tax savings through maximizing retirement contributions, another pivotal aspect of strategic financial planning.

Maximize Retirement Contributions

When it comes to tax saving strategies, enhancing your retirement contributions is a powerful tool. This not only secures your future but also significantly lowers your current tax bill. Let’s dive into how you can utilize accounts like 401(k)s, Roth IRAs, and SEP IRAs to protect more of your income from taxes.

401(k) Plans

A 401(k) plan allows you to contribute pre-tax income, which reduces your taxable income. For 2023, the contribution limit is $22,500, with an additional $7,500 allowed as a catch-up contribution if you’re aged 50 or older. This means if you maximize your contributions, you can substantially lower the income tax you owe for the year.

Employer matching in 401(k) plans is akin to receiving free money that also grows tax-deferred. By not taking full advantage of this, you’re essentially leaving money on the table.

Roth IRA

Unlike a 401(k), contributions to a Roth IRA are made with after-tax dollars. The beauty of a Roth IRA lies in its withdrawal phase; you pay no taxes on withdrawals during retirement, which includes the gains your investments have earned. In 2023, the contribution limit is $6,500, or $7,500 for those 50 or older. This is particularly advantageous if you anticipate being in a higher tax bracket in retirement.

SEP IRA

For self-employed individuals or small business owners, a Simplified Employee Pension (SEP IRA) offers a way to contribute significantly towards retirement. The contribution limit for 2023 is the lesser of 25% of compensation or $66,000. This type of IRA not only facilitates a higher saving rate due to its higher contribution limits but also reduces taxable income substantially.

Implementing these retirement strategies effectively requires understanding the nuances of each plan. For instance, while a 401(k) offers immediate tax relief by reducing taxable income, a Roth IRA provides tax-free income in retirement, valuable for those expecting higher tax rates in the future. On the other hand, a SEP IRA allows self-employed professionals to save aggressively for retirement while enjoying tax deductions.

By maximizing your contributions to these plans, you not only secure a comfortable retirement but also optimize your current tax situation. We’ll explore how leveraging various deductions and credits can further enhance your tax saving strategies.

Utilize Tax Deductions and Credits

Charitable Donations

Donating to charity isn’t just a noble act; it’s also a smart tax move. When you give to a qualified charity, you can deduct these contributions from your taxable income. For instance, donating appreciated assets like stocks can be particularly advantageous. You avoid capital gains taxes and can deduct the full market value. Consider using a Donor-Advised Fund (DAF) for larger donations. You receive an immediate tax deduction in the year you contribute, and the funds can grow tax-free until you allocate them to your chosen charities.

Health Savings Account (HSA)

If you have a high-deductible health plan, contributing to an HSA is a triple tax-saving strategy. Your contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free. For 2022, you can contribute up to $3,650 for individuals and $7,300 for families, with an additional $1,000 if you’re 55 or older. This makes HSAs an excellent tool for reducing taxable income while saving for future health costs.

Child Tax Credit

The Child Tax Credit (CTC) provides significant relief for families. For the tax year 2022, the credit amounts to $2,000 per qualifying child. The full amount of the CTC is available to single filers earning up to $200,000 and married couples earning up to $400,000. This credit is directly subtracted from the tax you owe, dollar for dollar, making it a powerful component of family-oriented tax saving strategies.

By strategically using these deductions and credits, you can significantly reduce your tax liability, making each dollar you save or spend work harder for you. As we continue to explore tax saving strategies, next we’ll delve into how loss harvesting can further optimize your tax situation.

Implement Loss Harvesting Strategies

Tax-loss harvesting is a technique that can help you manage your investment portfolio more efficiently from a tax perspective. Here’s how you can implement this strategy effectively:

Capital Losses

When you sell investments at a loss, these losses can be used to offset capital gains you might have from other investments. For instance, if you sold one stock at a $5,000 gain and another at a $5,000 loss, these would cancel each other out, meaning you wouldn’t owe taxes on the gain. If your losses exceed your gains, you can use up to $3,000 of the net loss to reduce your ordinary income, which could further lower your tax bill.

Wash-Sale Rule

It’s important to be aware of the wash-sale rule. This IRS rule disallows a tax deduction for a security sold at a loss if a substantially identical security is purchased within 30 days before or after the sale. To benefit from tax-loss harvesting without falling foul of this rule, ensure any repurchased security is not “substantially identical,” or simply wait more than 30 days to repurchase the same security.

Mutual Funds

Mutual funds can also be part of your tax-loss harvesting strategy. If some of the mutual funds in your portfolio have underperformed, selling them at a loss can offset gains from other securities. Just like with stocks, you need to be cautious of the wash-sale rule when dealing with mutual funds.

By implementing these strategies, you can help manage your capital gains and losses more effectively, potentially reducing your overall tax liability. The key to successful tax-loss harvesting is to maintain your overall investment strategy and not let tax implications dictate your investment decisions solely. Always consult with a financial advisor to ensure these strategies align with your long-term financial goals.

Let’s explore how different filing statuses and strategic timing can further enhance your tax saving strategies.

Optimize Your Filing Status and Timing

When it comes to tax saving strategies, the way you file and when you file can have significant impacts on your tax liabilities. Let’s break down how optimizing your marital status, understanding filing deadlines, and leveraging extension benefits can help you save on taxes.

Marital Status

Choosing the right filing status is crucial as it determines your tax bracket and potential deductions. For instance:

- Single: You may have higher tax rates compared to married couples filing jointly.

- Married Filing Jointly: Often results in lower tax rates and higher income thresholds for tax brackets.

- Married Filing Separately: Can be beneficial if one spouse has significant medical expenses or miscellaneous deductions.

- Head of Household: Offers more favorable tax rates and higher deduction amounts than filing as single, particularly if you are supporting dependents.

It’s important to assess your specific situation each year, as changes in your personal life—like marriage or divorce—can alter the most beneficial status for you.

Filing Deadlines

The general deadline for filing your tax return is April 15. However, if this date falls on a weekend or a holiday, the deadline is extended to the next business day. For example, for the year 2024, the deadline is April 15. Missing this deadline can lead to penalties and interest charges.

Extension Benefits

If you find yourself unable to file by the April 15 deadline, you can request an extension, which typically gives you until October 15 to file your taxes. Here’s why considering an extension might be part of your tax strategy:

More Time to Gather Information: An extension provides additional months to ensure you have all the necessary documentation, especially if you are waiting on missing information or correcting discrepancies.

Avoid Errors: Rushing to meet the filing deadline can lead to mistakes. Having extra time helps ensure accuracy.

Planning Opportunities: Use the extra time to better plan around deductions, credits, and contributions, potentially reducing your taxable income.

An extension to file is not an extension to pay. If you expect to owe taxes, you should estimate and pay the amount by the original April 15 deadline to avoid possible penalties and interest.

By understanding and strategically planning your filing status and timing, you can enhance your tax saving strategies. Next, we’ll delve into how different income levels can apply various tax-saving tactics to optimize their financial outcomes.

Tax Saving Strategies for Various Income Levels

High-Income Earners

High-income earners often face higher tax rates and complex financial situations. For these individuals, tax saving strategies such as maximizing retirement contributions and investing in tax-efficient vehicles are crucial. Municipal bonds are a prime choice, providing tax-exempt income, particularly beneficial for those in higher tax brackets. Additionally, high-income earners should consider strategic asset placement. Placing income-producing investments in tax-deferred accounts can minimize the taxes on returns and optimize asset growth over time.

Middle-Income Families

Middle-income families can benefit significantly from utilizing tax credits and deductions to reduce their taxable income. The Child Tax Credit and Earned Income Tax Credit (EITC) are powerful tools that can lower tax burdens substantially. Contributing to retirement accounts like a 401(k) or IRA can also reduce taxable income while building savings for the future. Health Savings Accounts (HSAs) offer another tax-efficient saving option, with contributions being tax-deductible and withdrawals for medical expenses tax-free.

Low-Income Individuals

For low-income individuals, the Earned Income Tax Credit (EITC) is particularly impactful. It’s designed to aid those with lower earnings by providing a refundable tax credit, which can even result in a refund if the credit exceeds the amount of taxes owed. Additionally, low-income earners should ensure they are not missing out on any available tax credits or deductions, such as those for education or health care expenses. Even small contributions to a retirement account can yield tax benefits and help build longer-term security.

By tailoring tax saving strategies to their specific income levels, taxpayers can effectively reduce their tax liabilities and enhance their financial well-being. We’ll address some of the most frequently asked questions about tax saving strategies to help clarify further and ensure you are fully prepared to make informed decisions.

Frequently Asked Questions about Tax Saving Strategies

What is the best way to reduce taxable income?

Reducing your taxable income can significantly lower your tax bill. Here are a few effective methods:

- Maximize Retirement Contributions: Contributing to retirement accounts like a 401(k) or an IRA can reduce your gross income. For example, in 2023, you can contribute up to $20,500 to a 401(k) and $6,500 to an IRA, potentially lowering your taxable income by the sum of these contributions.

- Health Savings Accounts (HSA): If you’re eligible, contributing to an HSA is a smart choice. For 2023, individuals can contribute up to $3,850 and families up to $7,750. These contributions are pre-tax, reducing your taxable income.

- Itemized Deductions: For those with significant expenses in areas like medical costs, state taxes, or charitable donations, itemizing deductions can be more beneficial than taking the standard deduction.

How can I maximize my tax return without increasing my income?

To maximize your tax return without boosting your income, focus on fully utilizing tax credits and deductions:

- Utilize Tax Credits: Credits like the Child Tax Credit or the Earned Income Tax Credit directly reduce the tax you owe, dollar for dollar. For instance, the Child Tax Credit offers up to $2,000 per qualifying child.

- Education Credits: Take advantage of credits like the American Opportunity Tax Credit, which can provide up to $2,500 per student for the first four years of college.

- Maximize Deductions: Ensure you’re not overlooking potential deductions, such as those for student loan interest or out-of-pocket charitable contributions.

Are there new tax credits or deductions I should be aware of for this year?

For 2023, it’s important to stay updated with the latest tax changes, which include:

- Increased Standard Deductions: For 2023, the standard deduction is $13,850 for singles and $27,700 for married couples filing jointly, which might affect your decision to itemize.

- Adjustments in Tax Brackets: Tax brackets have been adjusted upward to account for inflation, which could potentially lower your tax rate.

- SECURE Act 2.0: This new legislation introduces changes that could affect retirement savings strategies, such as increased catch-up contributions for those aged 50 and above.

By keeping informed about these updates and planning accordingly, you can optimize your tax situation and potentially increase your tax refund. As you navigate through these strategies, consider consulting with a tax professional to tailor these approaches to your personal financial situation.

Conclusion

As we wrap up our discussion on tax saving strategies, emphasize the importance of long-term planning. Effective tax planning is not just about minimizing your current year’s tax liabilities but also about setting a foundation for future financial stability and growth.

At BlueSky Wealth Advisors, we understand that each individual’s financial situation is unique. That’s why our approach to tax planning is highly personalized. We strive to understand your long-term goals and financial aspirations, aligning our strategies to not only meet but exceed your expectations.

Long-term planning involves more than just annual tax preparation; it encompasses a comprehensive strategy that considers future tax law changes, retirement planning, and your evolving financial needs. Our team of experts is dedicated to ensuring that every aspect of your financial plan works in harmony to create a robust financial future.

Whether you’re looking to optimize your investment portfolio, plan for retirement, or ensure your estate is managed according to your wishes, our advisors are here to guide you through every step. By leveraging our expertise, you can make informed decisions that not only address your immediate tax concerns but also set the stage for lasting wealth accumulation and preservation.

Explore our tax planning services to see how we can assist you in developing a comprehensive tax strategy that reflects your aspirations and financial goals. Together, let’s build a financial plan that not only meets your current needs but secures your legacy for the future.

Good investors are good tax planners. By integrating sophisticated tax planning into your overall financial strategy, you can enhance your wealth and ensure that you are prepared for whatever the future holds. Let BlueSky Wealth Advisors be your partner in navigating the complex world of taxes and investments.