Is There Too Much Cash in Your Portfolio?

Is There Too Much Cash in Your Portfolio?

Long-term investors today face an increasingly important question: how to properly allocate cash holdings as short-term rates decline. While cash may feel secure, it carries hidden expenses that can silently erode the pursuit of long-term financial objectives. This issue has become particularly relevant as investors collectively hold unprecedented amounts in liquid assets, with money market funds now containing a historic $7.3 trillion.

Successful investing is not about choosing between volatile assets and cash reserves, nor is it about market timing – rather, it involves maintaining an appropriate asset allocation that supports long-term financial objectives. Cash certainly serves crucial functions within these plans, particularly for ensuring adequate liquidity to cover expenses and unexpected emergencies.

Yet when investors maintain cash balances beyond what their goals require, sometimes called "excess cash," they may forfeit opportunities for income generation, portfolio growth, risk diversification, and other important objectives. In the current market landscape, what strategies can investors employ to optimize their cash positions and support their long-term financial aspirations?

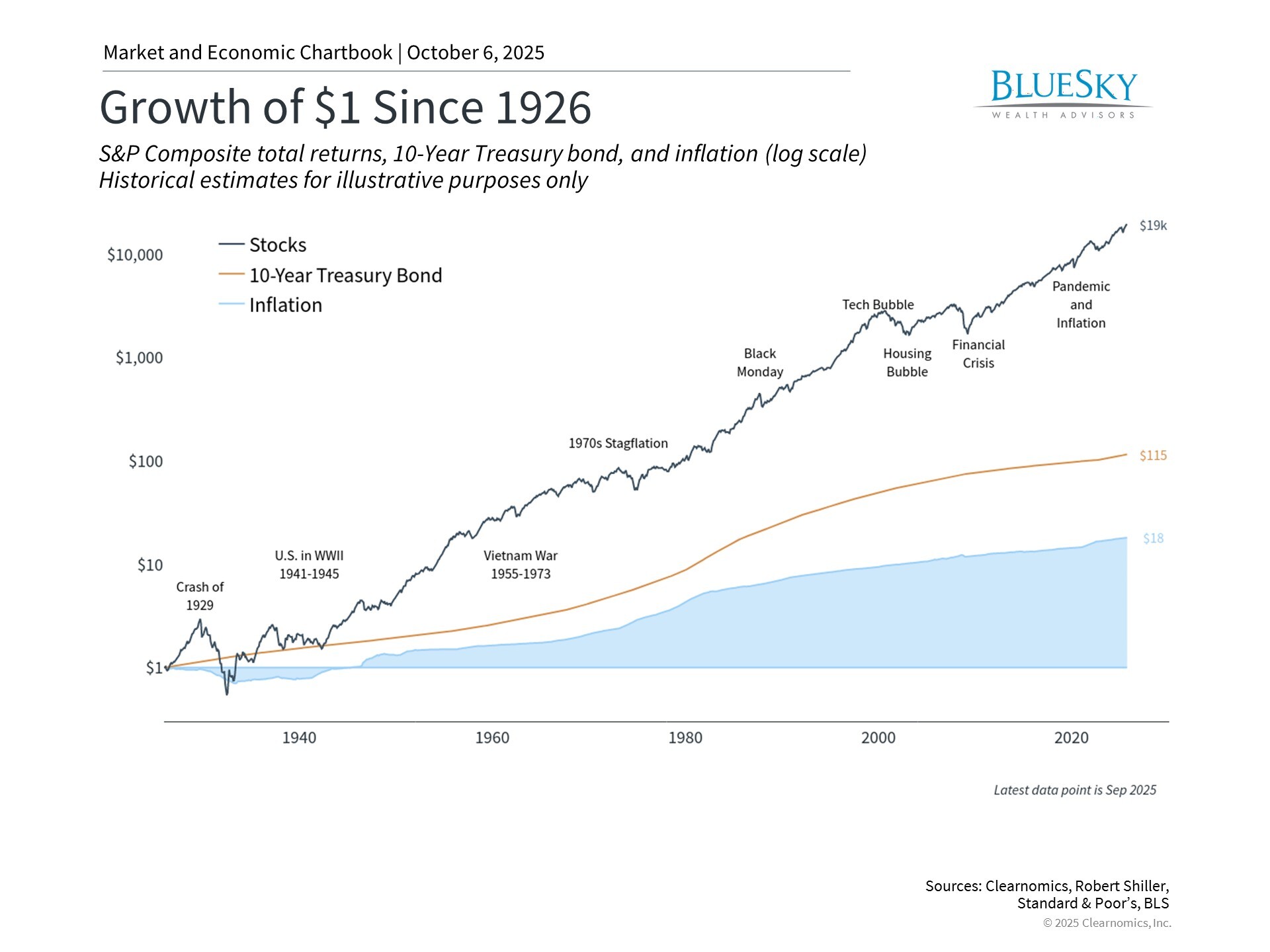

Equities and fixed income have historically exceeded inflation over extended periods

Financial market history demonstrates a clear pattern regarding wealth accumulation and inflation protection. The chart illustrates how equities and fixed income securities have appreciated far beyond inflation rates. While $1 from 1926 requires $18 today due to inflation, stocks and bonds have multiplied substantially more, generating significant wealth for investors positioned to capture these long-term trends. This holds true despite periodic downturns, financial crises, and economic contractions throughout the past century.

Historical performance does not guarantee future outcomes, yet this year's market recovery demonstrates how swiftly pessimism can transition to optimism. Even recent elevated inflation has been modest compared to balanced portfolio returns. Over extended timeframes, the cumulative impact of returns that modestly exceed inflation can build considerable wealth.

Within financial planning frameworks, cash delivers critical liquidity and adaptability for immediate spending requirements and emergency situations. For example, accumulating funds for an imminent home purchase typically involves cash-equivalent instruments, as would tuition obligations and other expenses due within twelve months. Likewise, preserving an emergency reserve offers valuable protection against unforeseen circumstances such as employment disruption or medical expenses.

Excessive cash holdings silently diminish buying power

Challenges arise when investors maintain cash beyond what practical requirements dictate. This behavior has been understandable recently given periodic market volatility and elevated cash yields. When cash interest rates appear competitive relative to bond yields or equity dividends, pursuing income through cash holdings may seem logical given its perception as "risk-free." Nevertheless, this strategy involves at least two concealed expenses.

The first concealed expense of surplus cash is inflation. Even when savings account or money market fund rates appear reasonable, or initially offer appealing yields, they frequently fail to match the increasing costs of goods and services consistently over time. The chart demonstrates that real, inflation-adjusted returns on cash have remained negative throughout most of the previous two decades when examining average certificate of deposit rates.

The second concealed expense concerns the mechanics of short-term interest rates. While money market fund yields, short-term certificates of deposit, and savings account rates may seem appealing, particularly compared to near-zero rates during the post-2008 financial crisis decade, these rates are not guaranteed. Their short-term nature means they fluctuate. While certain promotional rates can be attractive, these rates vary and demand vigilant monitoring upon renewal.

Generally, the requirement to reinvest cash and short-term fixed income instruments at prevailing rates creates "reinvestment risk." For instance, if the Federal Reserve continues reducing rates as widely anticipated, short-term interest rates may continue declining, potentially producing income beneath inflation rates. Investors must then choose between accepting reduced yields at each maturity or transitioning to longer-term investments. Since longer-term investment prices typically increase when rates decrease, investors may sacrifice returns during this period.

This contrasts sharply with longer-term bonds, where yields can be secured for years or decades. An investor purchasing a 10-year Treasury bond today locks in that yield irrespective of subsequent interest rate movements, even as the bond's market price fluctuates. Similarly, although equity markets remain inherently uncertain, investing with extended time horizons has historically enabled investors to capture long-term appreciation while avoiding continuous reinvestment risk.

Cash appears secure because account balances can remain steady, even during market turbulence. However, what our money can purchase ultimately determines financial security, not the nominal dollar figures in our accounts. If inflation operates at 3% annually while cash generates 2%, purchasing power erodes by 1% yearly, even if account statements suggest otherwise. This apparently minor differential can compound substantially and significantly impact planning objectives spanning decades, particularly for those in retirement.

Sidelined cash has reached unprecedented levels

Cash holdings extend beyond individual financial plans and reflect broader market sentiment. The chart reveals money market fund assets have climbed to near-record levels of $7.3 trillion, approximately double pre-pandemic levels. This reflects both investors pursuing elevated short-term interest rates and reluctance to commit to longer-term assets.

However, as rates have begun moderating and are projected to decline further, these surplus cash positions may encounter reinvestment difficulties. Investors who transferred substantial assets to cash during temporarily elevated rates, or amid market stress, may confront challenging decisions. This phenomenon is frequently described as "cash on the sidelines," suggesting some investors may eventually rotate back toward equity and fixed income investments.

The optimal approach for managing surplus cash depends on individual objectives but may incorporate strategies like dollar-cost averaging. This consideration is particularly relevant today as equity markets continue advancing and bond yields remain compelling. Income generated from longer-term Treasury, corporate and high-yield bonds, along with other fixed income securities, remains attractive by historical standards. While interest rates are challenging to forecast, bond market volatility has stabilized. Equity markets have similarly exceeded expectations this year.

The bottom line? While cash fulfills essential functions, excessive holdings generate hidden expenses. For long-term investors, preserving appropriate cash reserves while remaining invested in long-term portfolios continues to represent the most effective path toward achieving financial objectives.

BlueSky Disclosures

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.