Market Performance and Policy Changes Following the 2024 Election

Market Performance and Policy Changes Following the 2024 Election

The 2024 presidential election has concluded with Donald Trump securing victory and Republican control of the Senate. This outcome elicits varied reactions across the nation, highlighting the ongoing social and economic divisions in our society that will require time to bridge.

Markets have Historically Succeeded under Both Political Parties

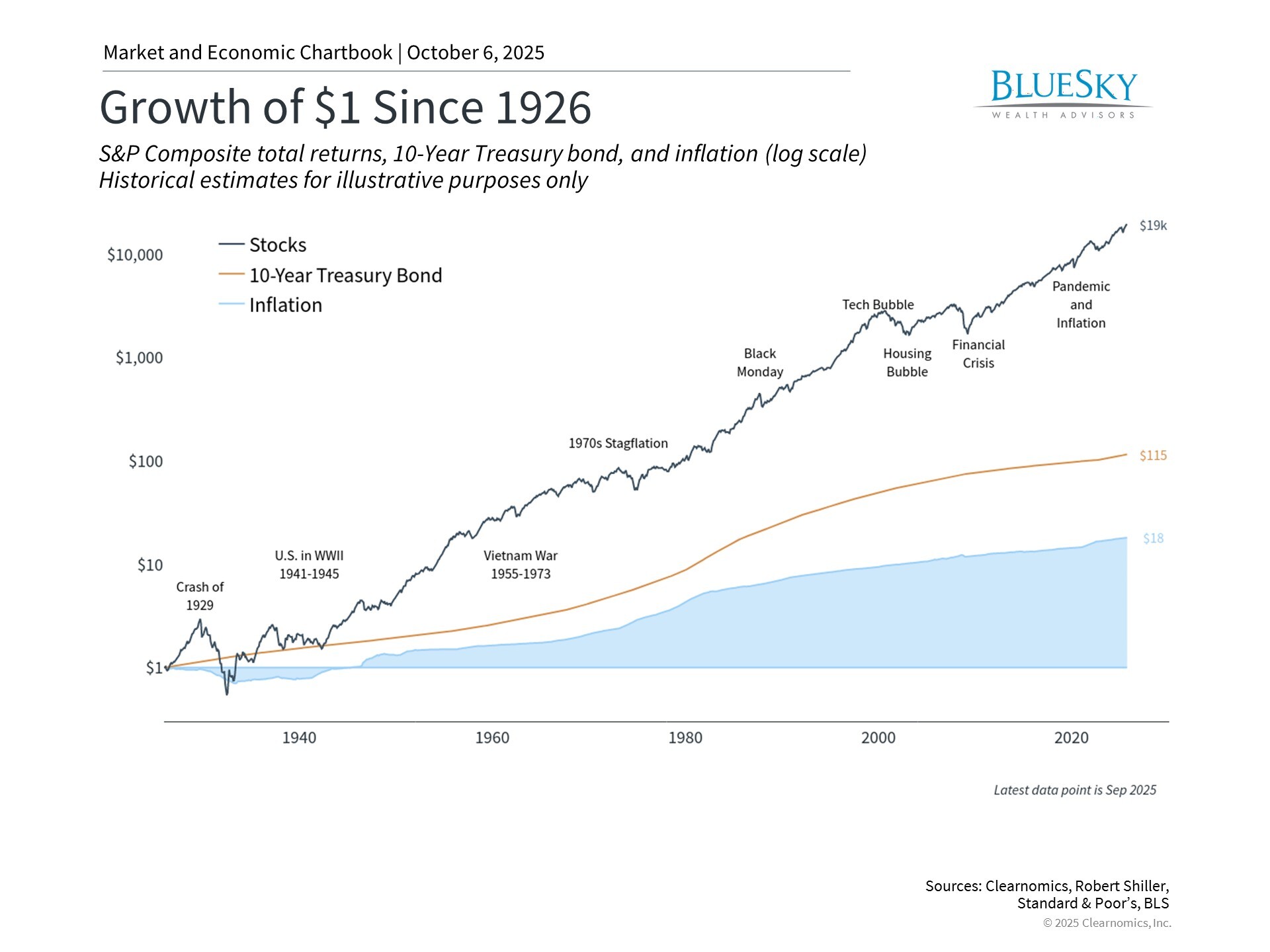

While political outcomes significantly shape our nation’s direction, historical data demonstrates that their impact on investment portfolios is often less significant than many believe. As we navigate the post-election period, maintaining objectivity becomes crucial. Beyond political considerations, what could the next four years mean for economic and market conditions?

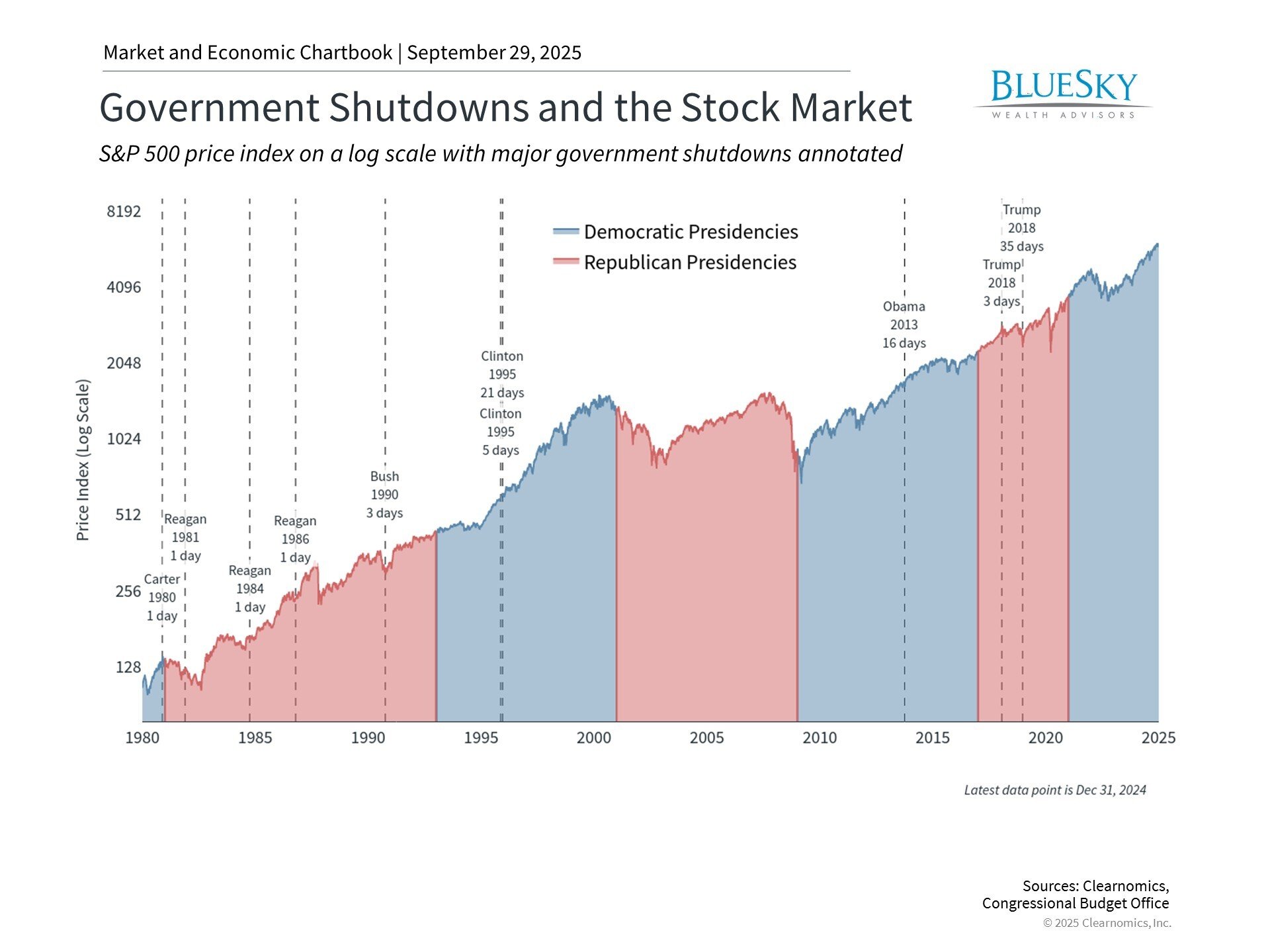

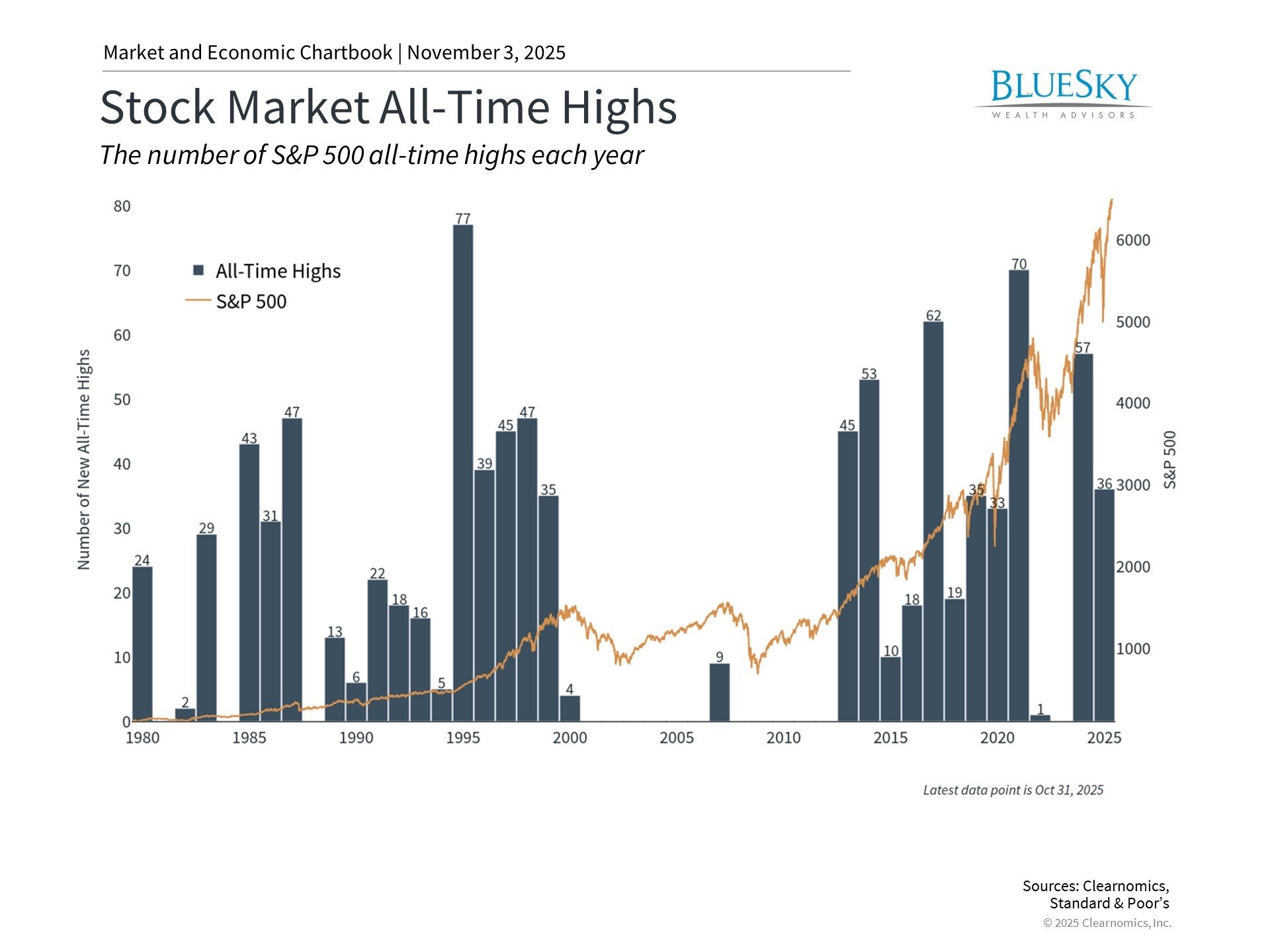

Looking at historical data, both Democratic and Republican administrations have presided over periods of economic and market growth throughout the past century. The coming weeks will likely bring contrasting market predictions, from those anticipating a strong market rally similar to 2016 to others concerned about potential economic headwinds.

For long-term investors, the key remains maintaining a balanced approach through diversification and focus on fundamental factors. Current market valuations exceed historical averages, emphasizing the importance of thoughtful portfolio construction, preferably with professional guidance.

However, excessive pessimism about market prospects should be avoided. Every modern presidency has faced predictions of market collapse, including during the transitions of 2008, 2016, and 2020. This underscores the importance of separating emotional reactions from investment decisions.

While sound policy matters, economic cycles operate beyond political influence. Additionally, policy implementation tends to be gradual, even with unified government control. Historical evidence shows that predicting market reactions to specific policies is challenging, as markets quickly adjust and businesses adapt to new conditions.

Tax Policy Changes on the Horizon

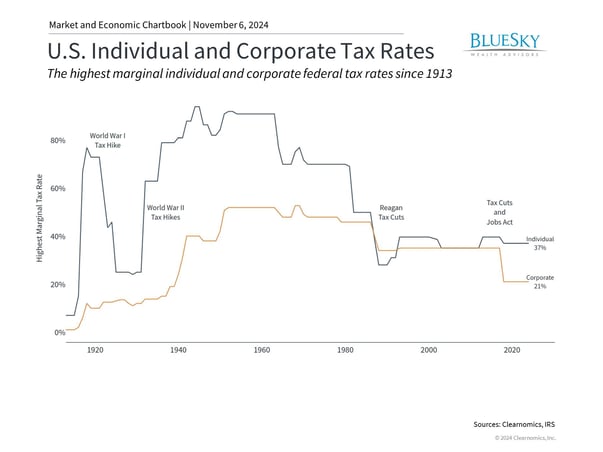

The Republican victory increases the likelihood of extending the Tax Cuts and Jobs Act beyond 2025. This legislation transformed both individual and corporate taxation, implementing a 21% corporate tax rate, reducing individual rates, increasing tax savings for many Americans, and expanding estate tax exemptions.

Pre-election uncertainty around these provisions complicated tax planning decisions. The potential expiration created concerns about a significant tax increase for individuals and businesses. This led to increased activity in areas like Roth IRA conversions as people sought to lock in current rates.

When considering tax policy, maintaining perspective is essential. While taxes directly affect households and businesses, their impact on broader economic and market performance isn’t always straightforward, given various deductions, credits, and planning strategies available.

Markets have prospered under various tax structures, including periods with top marginal rates between 70% and 94% following World War II. Current rates remain low by historical standards. Given growing national debt, prudent planning should account for potential future rate increases.

Trade Policy Implications

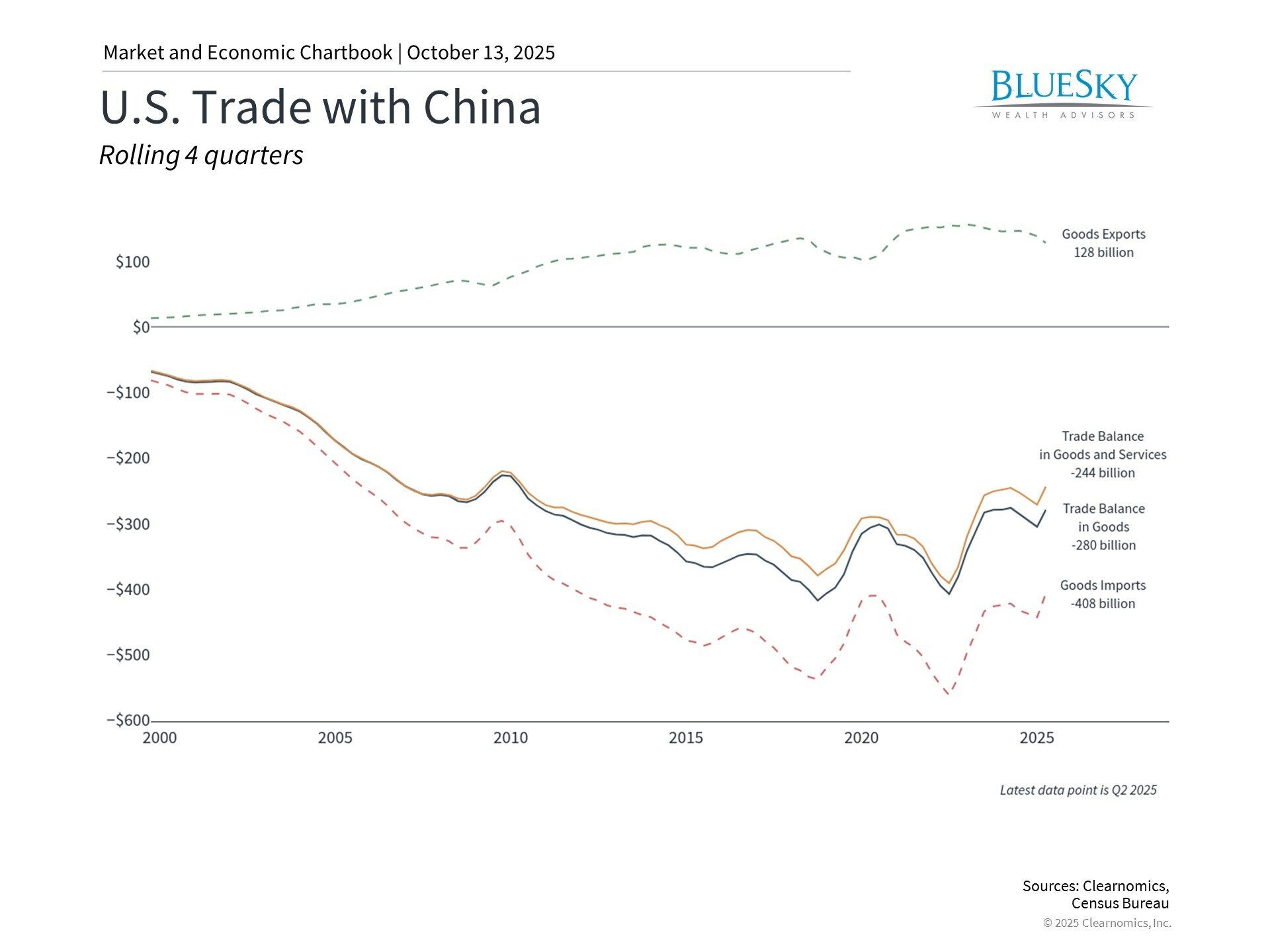

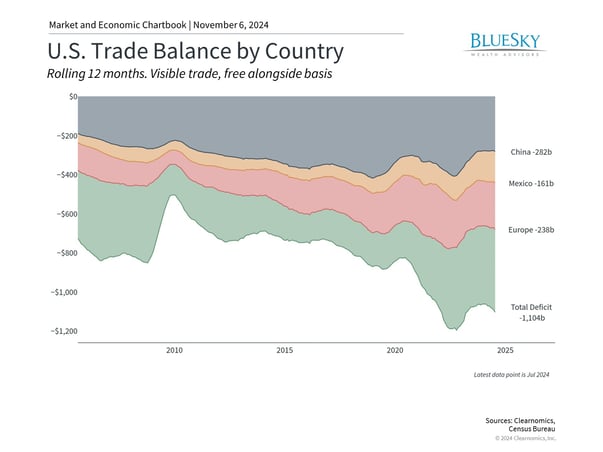

A key concern among investors involves potential new trade restrictions with major partners including China, the European Union, Mexico, and Canada. The previous Trump administration implemented various tariffs on products including steel, aluminum, and consumer goods. Recent campaign proposals suggested potentially higher tariffs, particularly up to 60% on Chinese imports.

Unlike tax legislation, tariff implementation falls under executive authority. While economic impacts concern many, analyzing tariff effects requires nuanced consideration. Previous tariff implementations often served as negotiating tools, leading to agreements like the 2020 China trade deal. Despite initial concerns, worst-case economic scenarios didn’t materialize.

Tariffs can potentially increase consumer prices and challenge traditional free trade principles. However, they may also protect domestic industries and intellectual property. Many Trump-era tariffs continued under the Biden administration, reflecting broader shifts toward protectionist policies over the past decade.

While trade policies may affect specific sectors, maintaining appropriate portfolio diversification remains crucial.

Long-term Perspective Remains Essential

Post-election attention will return to economic fundamentals, including Federal Reserve policy, corporate performance, and consumer behavior. The resolution of election uncertainty could boost market sentiment, as observed in previous cycles.

Long-term business cycles, driven by factors like technological advancement, globalization, and innovation, have historically determined investment returns rather than election cycles. For investors with multi-year horizons, these fundamental trends warrant more attention than daily political developments.

The bottom line? While election outcomes affect policy direction, successful investing requires maintaining diversification and long-term focus regardless of political results. Understanding policy implications helps, but fundamental economic trends ultimately drive long-term financial success.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.