How Market Rallies and Valuations Shape Long-Term Investment Strategy

How Market Rallies and Valuations Shape Long-Term Investment Strategy

Financial markets have quickly shifted their focus beyond recent electoral developments to concentrate on upcoming policy changes, monetary policy adjustments, and broader economic indicators.

The post-election period saw significant market movements, with major indices posting notable gains. The S&P 500 advanced 3.7%, while the Dow moved up 4.2%. Small-cap stocks, as measured by the Russell 2000, demonstrated particular strength with a 6.1% increase. Additionally, Bitcoin reached new heights above $80,000. Despite these positive developments, maintaining investment discipline and a long-term outlook remains crucial.

Market metrics indicate elevated price levels

Setting aside political considerations, economic conditions show considerable momentum. Despite recent inflationary pressures stemming from pandemic-related supply disruptions and government stimulus measures, price increases have moderated toward the 2% target, enabling the Federal Reserve to implement rate reductions that support economic growth.

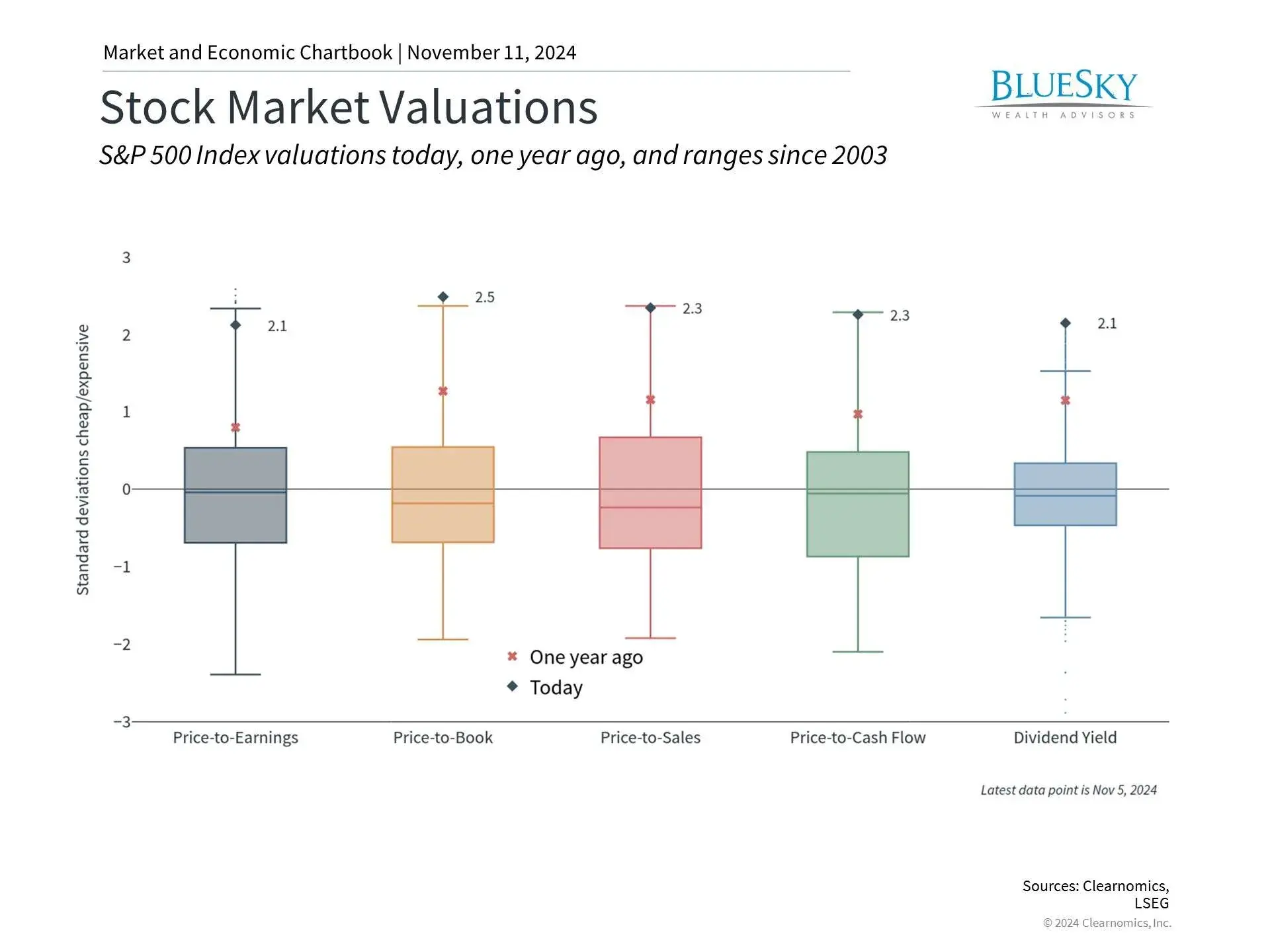

The sustained market advance since late 2022 has pushed valuations across various asset classes significantly above historical norms, suggesting reduced investment appeal. Recent post-election gains have further elevated these metrics. The S&P 500’s price-to-earnings ratio is approaching levels last seen during the pandemic and is within striking distance of dot-com era peaks.

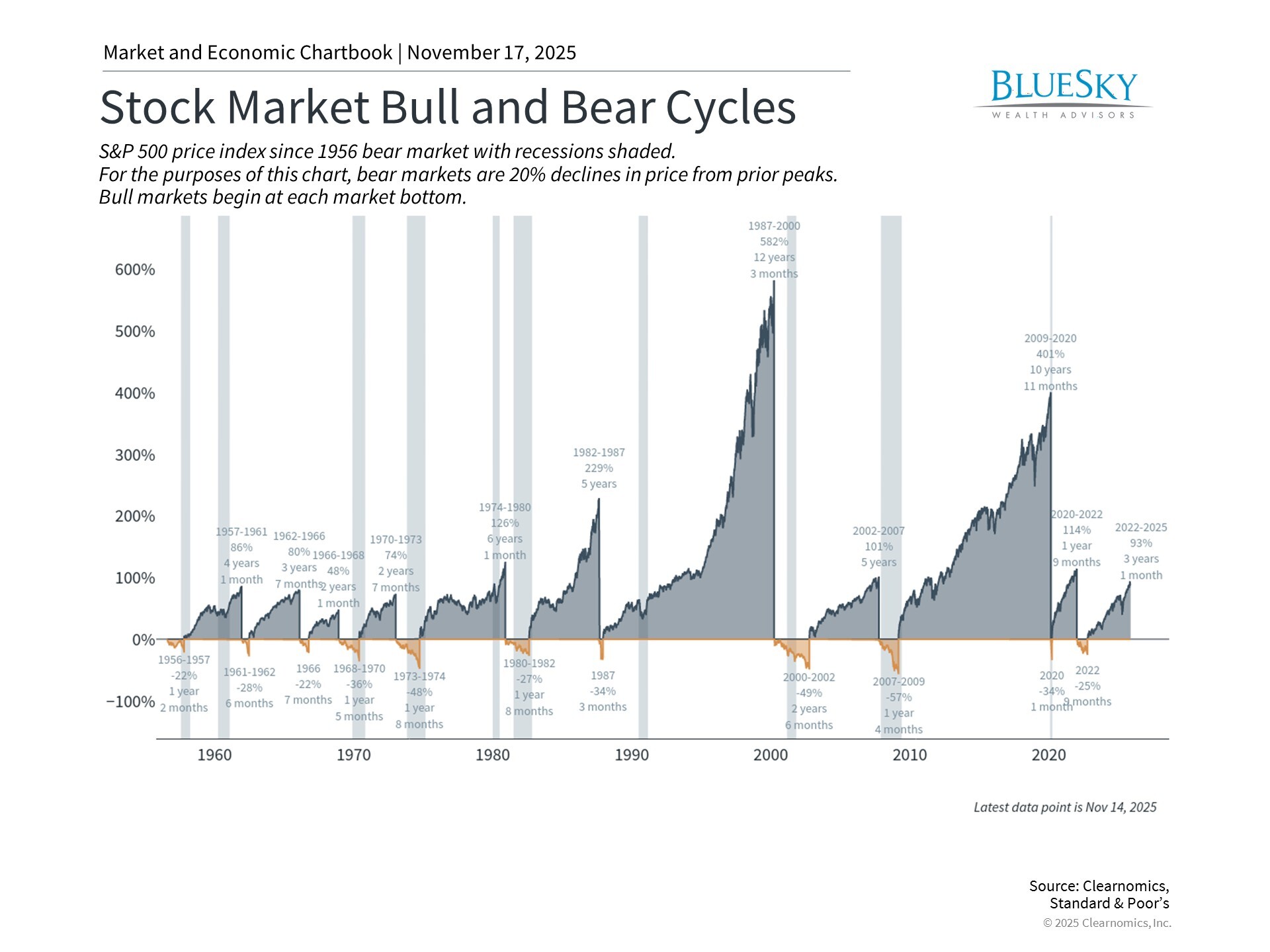

Market history demonstrates how sentiment can swing between optimistic and pessimistic extremes, as evidenced by events following the 2016 election. After a strong 2017, markets experienced volatility in 2018, ending with the first annual decline in ten years. This was followed by robust gains in 2019 until the pandemic disruption of 2020. These patterns illustrate that market progress rarely follows a linear path, regardless of prevailing optimism.

Valuations serve as a reliable compass during uncertain times. Long-term return patterns correlate strongly with whether assets are relatively expensive or inexpensive compared to fundamental measures like earnings. While valuations don’t predict near-term movements, they help establish realistic long-term return expectations.

Elevated market prices typically signal reduced future returns

Current market enthusiasm reflects anticipated policy changes, including potential tax reductions, trade policies, regulatory adjustments, and infrastructure spending. Similar optimism drove markets after the 2016 election, influenced by dollar strength, rising yields, and expectations for growth-oriented policies.

Benjamin Graham’s observation that “in the short run, the market is a voting machine but in the long run, it is a weighing machine” remains particularly relevant. Many high-valuation assets, particularly in technology and cryptocurrency sectors, are susceptible to significant price swings. During upward trends, fundamental analysis may seem overly cautious, but its importance lies in managing uncertainty.

Historical data indicates that high valuations often precede periods of lower or negative returns, particularly when occurring late in economic cycles. While optimism suggests this time could be different, with sustained economic growth, even this scenario might indicate future returns have been “borrowed” from future periods.

Diverse asset classes show positive performance beyond domestic equities

Rather than avoiding equities due to high valuations, investors should focus on thoughtful portfolio construction with appropriate risk management and diversification. Recent market data shows positive returns across multiple asset categories beyond U.S. stocks.

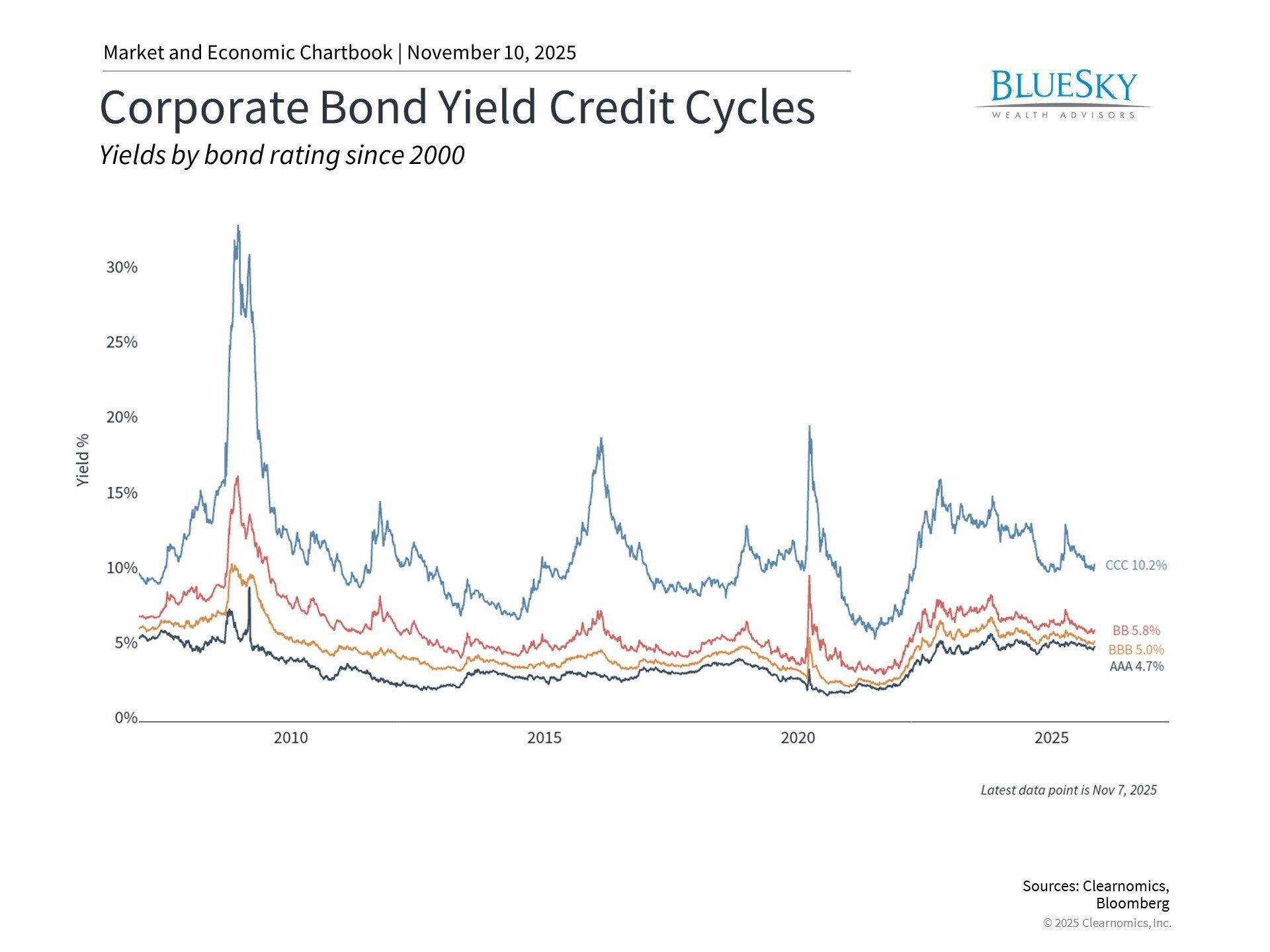

Overseas markets present more attractive valuations compared to domestic equities. Fixed income investments, despite recent challenges from rising rates, continue to offer income potential and portfolio stabilization benefits.

Underlying economic fundamentals remain encouraging. Corporate earnings show consistent growth, and economic output has exceeded expectations. The Federal Reserve’s recent 25 basis point rate reduction to 4.5-4.75% marks its second adjustment in the current cycle.

The Fed’s communications highlight evolving labor market dynamics, noting general easing while unemployment remains historically low. They acknowledge substantial progress on inflation while maintaining economic strength, though labor conditions have normalized from peak levels.

Fed Chair Powell’s balanced perspective on economic conditions emphasizes both progress and continued monitoring. Investment portfolios should similarly balance opportunity with prudence.

The bottom line? Long-term investment success depends more on fundamental economic trends than short-term market fluctuations. The 2016-2020 period demonstrates the importance of maintaining balanced portfolios that can capture upside while providing downside protection.

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.