Analyzing the Effects of Kamala Harris and Donald Trump’s Tax Plans on Investors

Analyzing the Effects of Kamala Harris and Donald Trump’s Tax Plans on Investors

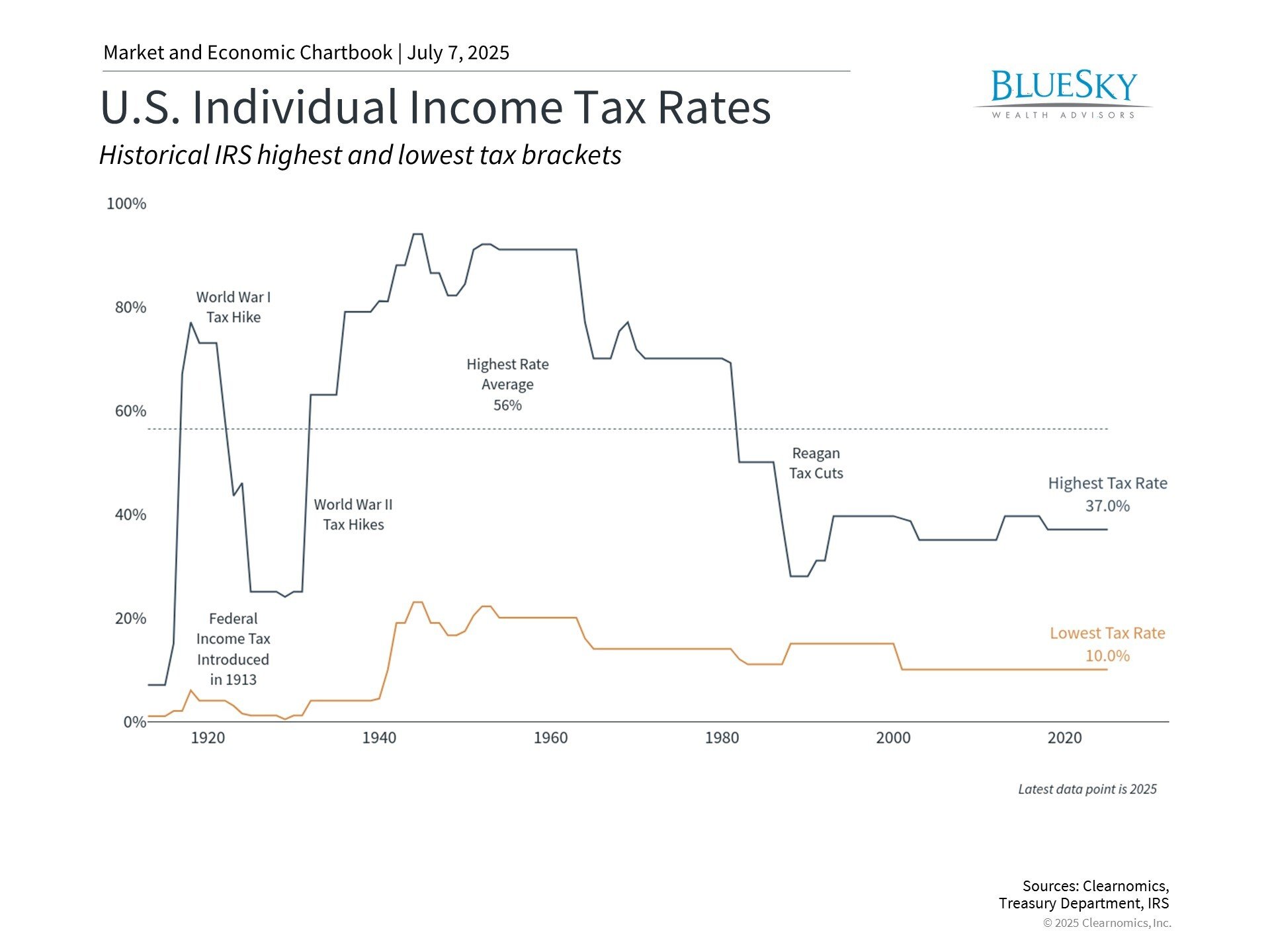

As the 2024 presidential election draws near, the tax plans proposed by candidates Donald Trump and Kamala Harris present distinct approaches that could significantly influence the decisions investors make.

Understanding these differences is crucial for investors looking to navigate the economic landscape effectively, as both plans offer different benefits, risks, and more. Let’s explore how Trump’s tax strategy compares to Harris’ and what the implications are for investors.

Comparing the Differences

Donald Trump’s Tax Plan

Former President Donald Trump’s tax plan primarily focuses on reducing the tax burden for individuals and corporations. Some key features of his tax plan include:

Corporate Tax Rate Reduction: Trump proposes to lower the corporate tax rate from 21% to 15%. This reduction aims to cultivate economic growth by encouraging companies to reinvest their profits.

Capital Gains Tax Stability: Trump’s plan maintains the current capital gains tax rate at 20%, allowing investors to realize profits without facing increased taxation. This stability can create confidence surrounding equity investments and encourage more investors to partake in active trading.

Elimination of the 3.8% Medicare Surtax: Trump has suggested removing this surtax on investment income for high earners, which would enhance after-tax returns for wealthy investors and potentially incentivize them to pursue riskier investments.

Kamala Harris’ Tax Plan

Vice President Kamala Harris’ tax plan takes a different approach, focusing on wealth redistribution and addressing economic inequality. Some of the most important components of her tax plan proposal include:

Increased Tax Rates for High Earners: Harris proposes raising the top marginal income tax rate to 39.6% for individuals earning over $400,000. This change is intended to ensure that high-income earners contribute a bigger share to the economy.

Higher Capital Gains Tax Rates: Harris aims to increase the capital gains tax rate for high-income individuals, creating a similar tax plan to ordinary income tax rates. This change could see capital gains taxed at the same rate as wages, potentially reaching as high as 39.6% for top earners.

3.8% Medicare Surtax: Similar to President Joe Biden’s plan, Harris’ proposal includes maintaining the 3.8% Medicare surtax on investment income for high earners, which could further impact after-tax returns for wealthy investors.

Implications for Investors

These contrasting tax plans have many significant details that can easily get lost in the shuffle, but BlueSky Wealth Advisors is here to help walk you through the implications of each plan! Here is what you should know:

After-Tax Returns

Trump

By maintaining a lower capital gains tax rate and eliminating the Medicare surtax, Trump’s plan would enhance after-tax returns for investors, particularly those in higher income brackets. This could encourage more aggressive investment strategies and a focus on equity markets.

Harris

Conversely, Harris’ proposed increases in capital gains tax rates could lead to reduced after-tax returns for high earners. Investors may reconsider their strategies, opting for longer holding periods to minimize tax burdens or seeking more tax-efficient investment vehicles.

Investment Behavior

Trump

The stability of capital gains tax rates under Trump’s plan may encourage investors to engage more actively in the market, realizing profits without the fear of impending tax hikes. This could lead to increased volatility as more trades occur.

Harris

With higher capital gains taxes, Harris’ plan may encourage a more cautious approach among investors, particularly those in higher income brackets. They might prioritize investments with lower taxable events or seek to defer gains through retirement accounts or other tax-advantaged vehicles.

Corporate Investment and Growth

Trump

The reduction of the corporate tax rate could incentivize businesses to reinvest profits, leading to increased economic growth and potentially higher stock prices. Investors may benefit from improved corporate earnings as companies seek to expand.

Harris

While Harris’ focus on wealth redistribution may promote social equity, the increased tax burden on corporations and high-income individuals could result in lower overall investment in the economy. This may lead to slower growth rates and could impact stock performance negatively.

Get Tax Planning Assistance from BlueSky Wealth Advisors

As the 2024 election nears, the tax plans of Donald Trump and Kamala Harris present vastly different visions for the economy and investors. Trump’s focus on lowering taxes and stimulating growth could create a favorable investment climate, encouraging activity in equity markets. In contrast, Harris’ emphasis on higher taxes for the wealthy aims to address economic inequality, but it could lead to more cautious investment behavior among high earners.

It’s imperative for investors to stay informed about any updates or future potential changes to accurately consider how the plans align with their financial strategies.

Don’t worry; the team at BlueSky Wealth Advisors has you covered. For assistance navigating the complexities of these plans and configuring your tax planning strategies accordingly, give us a call today. We’re more than happy to answer any questions.