Market Performance and Economic Stability Give Investors Reason to Celebrate

Market Performance and Economic Stability Give Investors Reason to Celebrate

As we approach the end of 2024, the investment landscape presents numerous positive developments worth celebrating. Markets have shown remarkable resilience, with the S&P 500 advancing 26.7% including dividends, while the Dow and Nasdaq have gained 19.5% and 27.4% respectively. Global markets have also demonstrated strength, with emerging markets rising 9.0% and developed markets up 4.8%. The economy has surpassed expectations, featuring moderating inflation, sustained employment levels, and consistent GDP expansion.

Markets have demonstrated remarkable resilience throughout the year

While investors often concentrate on potential risks, the holiday season provides an opportunity to acknowledge positive developments in financial markets. Despite back-to-back years of strong performance, many continue to express concerns about market fundamentals, economic trajectories, fiscal challenges, and international tensions.

Historical evidence suggests that maintaining a long-term perspective remains the most effective approach to achieving financial objectives. Markets can experience significant fluctuations over shorter periods, as witnessed during April and August, or throughout 2020 and 2022. However, longer timeframes typically show upward trends driven by economic expansion. Let's examine three key developments that warrant recognition this season.

To begin, U.S. equity markets have shown exceptional performance in 2024, supported by solid corporate earnings, favorable economic conditions, and strengthening investor sentiment. As illustrated in the chart, market returns have maintained steady momentum over the past two years, with only one quarterly decline. While technology and artificial intelligence sectors have led gains, market breadth has been notably wide, with eight of eleven S&P 500 sectors delivering double-digit returns.

This bull market has pushed valuations higher, with the S&P 500's price-to-earnings ratio reaching 22.3, approaching both recent peaks and the dot-com era high of 24.5.

These elevated valuations underscore the importance of maintaining a well-balanced investment approach. Risk assets require appropriate counterweights, such as fixed income securities, to achieve portfolio objectives. Year-end presents an ideal opportunity to evaluate asset allocation, particularly following significant market movements.

Price pressures have moderated significantly

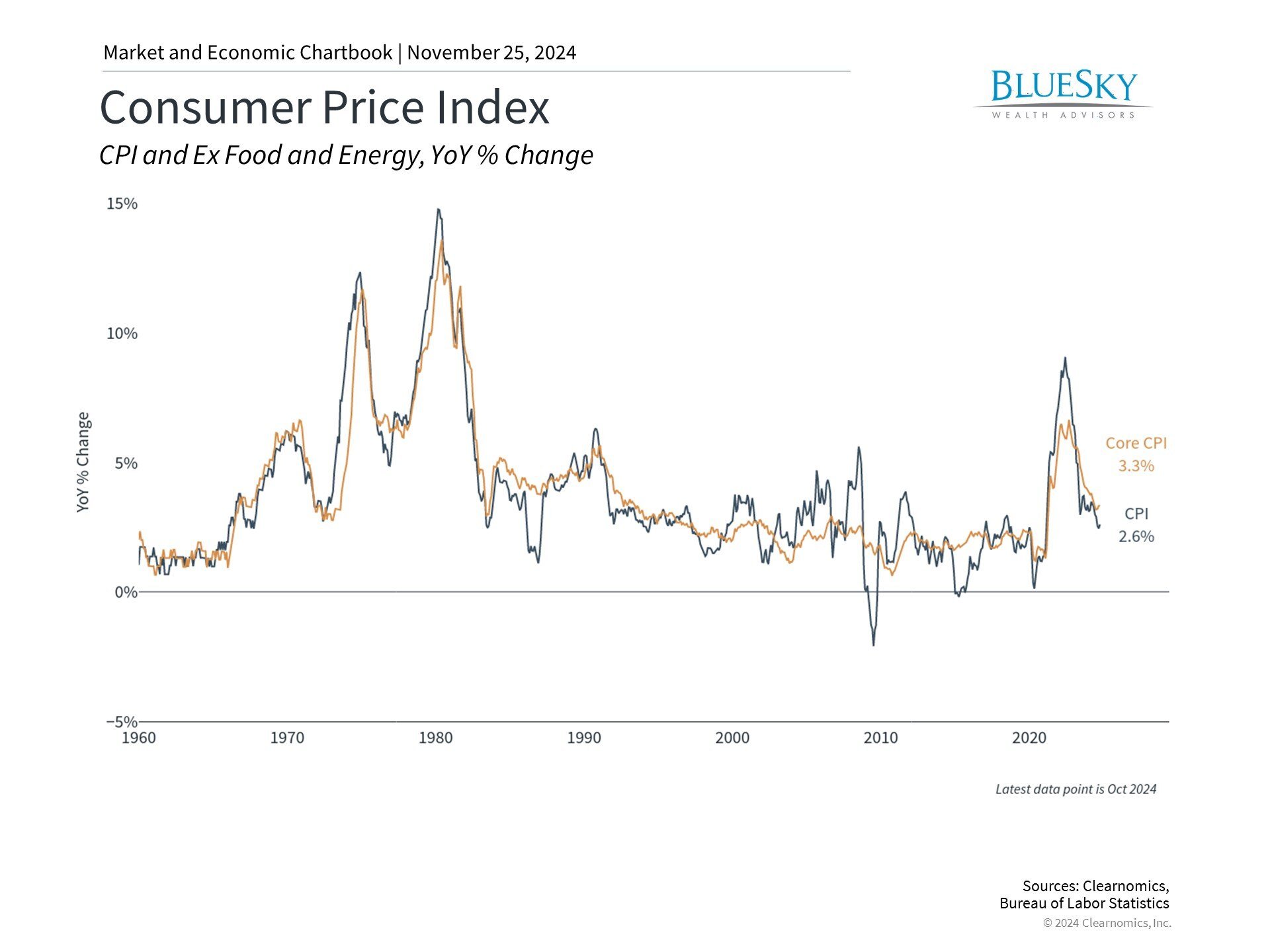

The second positive development is the return of inflation to pre-pandemic levels. While consumers still face elevated prices for essentials like food and housing, the broader trend is encouraging. This moderation particularly benefits investment portfolios, which are sensitive to interest rate movements influenced by inflation expectations.

The improved inflation outlook has enabled the Federal Reserve to consider policy rate reductions for the first time since early 2022. Much of this year's market volatility stemmed from speculation about the timing and magnitude of these potential cuts.

For long-term investors, understanding the general trajectory of interest rates proved more valuable than attempting to predict precise policy changes. Building portfolios based on fundamental factors, rather than recent market trends, remains crucial in the current environment.

Economic growth and employment remain robust

The labor market's resilience represents a third significant achievement. Earlier concerns about a "hard landing" - where inflation reduction efforts might trigger widespread job losses - have not materialized.

Employment levels remain near historic highs with consistent job creation. While wage growth hasn't fully matched inflation, the economy has generated 28.6 million new positions since the pandemic, substantially exceeding previous levels. Despite sector variations, this broad-based employment strength has supported healthy consumer finances.

The broader economy continues to demonstrate impressive durability, with real GDP expanding at a 2.8% annualized rate in the latest quarter. Consumer spending remains a key driver, though pandemic-era savings are diminishing and debt levels are increasing. Looking ahead, lower interest rates, tax policy clarity, and business investment may help sustain economic momentum.

The bottom line? While markets have experienced periodic volatility, 2024 has delivered exceptional returns. Investors should appreciate these positive developments while ensuring their portfolios remain aligned with long-term objectives.

BlueSky Disclosures

Copyright (c) 2024 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.